Household Vacuum Cleaners Market Size & Growth:

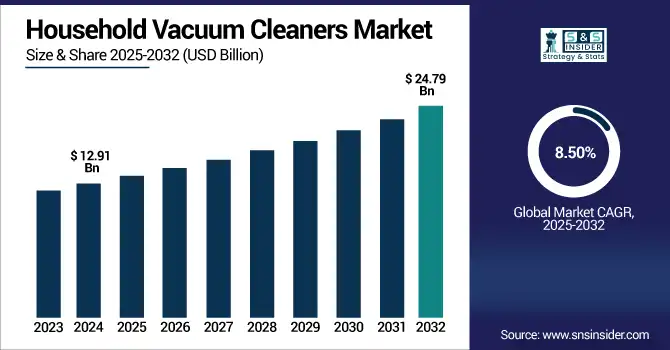

The Household Vacuum Cleaners Market size was valued at USD 12.91 Billion in 2024 and is projected to reach USD 24.79 Billion by 2032, growing at a CAGR of 8.50% during 2025-2032.

To Get more information on Household Vacuum Cleaners Market - Request Free Sample Report

The household vacuum cleaners market is undergoing a rapid transformation, owing to the rise in consumer demand for multi-purpose, smart, and automated cleaning devices. Including AI-powered navigation, real-time obstacle detection and multicategory functionality, is changing the way we think about products. More and more consumers are searching for a small, hands-off water cleaner that can do a good job independently. This transition is being facilitated by increasing disposable incomes, smart home integration and an overall stronger focus on cleanliness and convenience. The cross flow of robotics functionality with traditional vacuuming capabilities to generate new value propositions is compelling manufacturers to think outside of the traditional box. In this increasingly contested space, manufacturers are focusing on improved connectivity, modular design and AI-driven personalization to appeal to today’s tech-savvy households and compete in a rapidly changing market.

SwitchBot Unveils World’s First Multitasking Household Robot K20+ Pro at CES 2025, Showcasing Surprising Features Like Stair-Climbing and 360° Vision.

Household Vacuum Cleaners Market Dynamics:

Drivers:

-

Innovative Cleaning Technologies Drive Consumer Shift Toward Smart Vacuum Solutions

With the rising consumer interest in convenient, hands-free home cleaning, the market for smart vacuum cleaners is expanding at a pace much faster than ever before. This trend is being driven by the inclusion of cutting-edge features, including artificial intelligence (AI)-powered dirt detection and cleaning mechanisms that can flex ultra-strong. These advancements will automatically reduce suction power when vacuuming carpets and making it possible to navigate to even the most hard-to-reach areas without having to move furniture. The result is not only better cleaning, but you'll also save time and physical effort. As smart homes grow in popularity and consumer living requires more automation, such intelligence features are increasingly shaping the way purchases are made and driving the migration to the next-generation, multi-functional cleaning solutions from traditional vacuum models.

Roborock introduces A20 and A20 Pro vacuum cleaners in China featuring FlatReach technology and AI dirt sensing for more thorough and comfortable cleaning. Both have 17kpA of suction power, self-cleaning docks (hello, bidetailer), and are up for pre-order at a fantastic price.

Restraints:

-

Limited Rural Accessibility Restrains Growth of Household Vacuum Cleaners Market

The household vacuum cleaners market is significantly constrained by low adoption in rural or underdeveloped geographies attributed to limited consumer awareness, inadequate electrical infrastructure and low disposable incomes. Such areas largely still depend on conventional cleaning ways and face little to no requirement for automated solutions. Also, many new smart vacuum technologies require reliable internet connectivity and a stable power supply, and these may be lacking on the African continent. Cost is a significant hurdle because customers in these markets focus on lesser-priced products rather than high-end appliances. Together, this leads to a lower penetration of the product, which limits the market growth especially in emerging or remote regions as the global demand for smart and automated cleaning solutions is on the rise.

Opportunities:

-

Advancements in AI Technology Fuel Demand for Next-Generation Smart Vacuum Cleaners

There has been an emergence of integration of AI in household appliances, which is providing significant growth opportunity for the household vacuum cleaners market. With rising interest in vacuum cleaners that boast smart features, such as automated suction adjustment capabilities, maintenance-specific notifications, and smart home ecosystem integration, manufacturers are prioritizing more sophisticated product lines as consumer interests patterns change. AI in the stick vacuums power suckers trailer is yet another sign that power and precision are on the march with a nice techy-efficient theme to appeal to feature-hungry tech-savvy users with less time to clean but a larger appetite for performance. This growing trend creates an opportunity for manufacturers to leverage AI-based functionalities and smart ecosystem compatibility to build a robust position in a competitive environment that is becoming driven by intelligent, efficient, and connected cleaning solutions.

Samsung unveils 2025 Bespoke AI Home Appliances, including AI Jet Ultra cordless vacuum with 400W suction. The series further supports intelligent living with AI-based capabilities, IoT-ready features and home appliance user-centric experience.

Challenges:

-

Rising Consumer Expectations and Technical Limitations Challenge Vacuum Cleaner Market Growth

The household vacuum cleaners market has a few different challenges ahead as it changes and adapts to new technology and customer requirements. The demand for sleek, feature-rich devices that deliver stunning performance at low prices has put great pressure on manufacturers to strike a balance between innovation and costing. Battery operated models are also burdened by short runtimes, charge times and lesser suction over time, having a negative effect on overall user satisfaction. Compatibility across flooring types, noise, and the need for a specialized approach to maintain have also contributed to a less uniform uptake of the system. Additionally, connected devices raise privacy concerns that may discourage consumers from making full use of smart vacuums. Such factors in combination produce friction in the consumer purchase journey, and make it difficult to scale production, adoption and trust in intelligent vacuum cleaning solutions.

Household Vacuum Cleaners Market Segmentation Outlook:

By Product

The Canister segment held a dominant Household Vacuum Cleaners Market share of around 38% in 2024, owing to their high suction capacity, versatile design and high efficiency for cleaning on both carpets and hard floors. The lightweight nature of it, as well as being able to fit under furniture and in small corners make it very utilitarian for thorough home cleaning. These benefits still resonate with consumers, especially in larger sets, keeping it at the head of the market.

The Robotic segment is expected to experience the fastest growth in the Household Vacuum Cleaners Market over 2025-2032 with a CAGR of 14.98%, as the consumers are increasingly demanding convenient, time saving, and Smart home assistant integrated solutions. Tech-savvy users love tech features like automated cleaning schedules, AI-powered navigation, and smart voice assistant integration. The need for space saving also fuels the growth of robotic vacuum cleaners, in addition to rising urbanization.

By Distribution Channel

The Online segment held a dominant Household Vacuum Cleaners Market share of around 64% in 2024, due to the rising preference for digital shopping platforms, as they provide convenience, cheaper rates, and a larger variety of products. Increased consumer trust due to easily accessible customer feedback, thorough information, and promotional discounts. In addition, the growing trend of e-commerce logistics and personal door delivery services has further accelerated the transition from offline purchases to online purchases, thereby strengthening their dominant market position.

The Offline segment is expected to experience the fastest growth in the Household Vacuum Cleaners Market over 2025-2032 with a CAGR of 10.07%, due to the trend of physical experience prior to purchase, meaning consumers want to see and feel the product before purchase, and instant availability. Purchasing through a retail environment helps buyers assess the performance, size, and noise between multiple options, which gives the buyer an overall greater confidence level with their purchase decision. The rising offline sales growth also comes on the account of personal assistance from the sale personnel and presence of after sale support.

By Power Sources

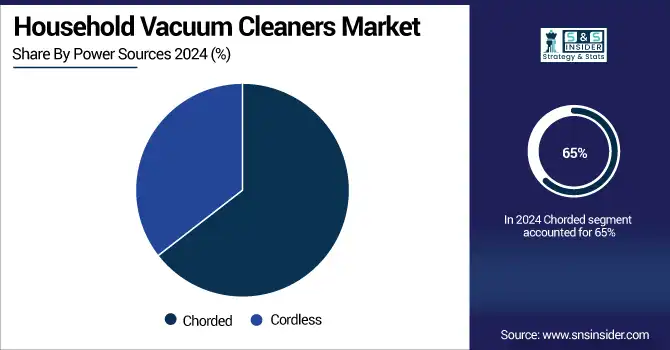

The Chorded segment held a dominant Household Vacuum Cleaners Market share of around 65% in 2024, due to the continuous supply of power resulting in high suction power with cost-effectiveness as compared to cordless vacuum cleaners. Corded types are preferred for full cleansing as well as prolonged performance without absence of facilities time. They are a popular option for larger homes as consumers looking for cost-effective performance tend toward them due to their lower required upkeep and reliability.’

The Cordless segment is expected to experience the fastest growth in the Household Vacuum Cleaners Market over 2025-2032 with a CAGR of 11.56%, owing to rising need for portability, flexibility of operation, and instant cleaning. Developments related to batteries, weight and suction power are pushing consumers to adopt more cordless options to ease home cleaning.

Household Vacuum Cleaners Market Regional Analysis:

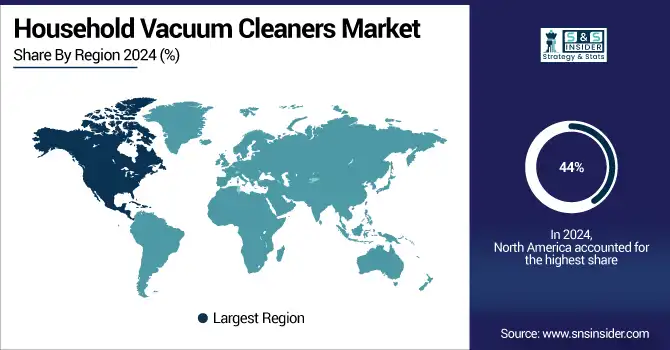

In 2024, North America dominated the Household Vacuum Cleaners market and accounted for 44% of revenue share, driven by high household penetration of cleaning appliances, strong consumer purchasing power, and a preference for technologically advanced solutions. The region’s rapid adoption of smart home devices, growing awareness of hygiene, and availability of a wide range of vacuum models through both online and offline channels further fueled market expansion.

The U.S. dominates the Household Vacuum Cleaners Market due to high adoption of smart appliances, strong spending power, and innovation.

Asia-Pacific is expected to witness the fastest growth in the Household Vacuum Cleaners Market over 2025-2032, with a projected CAGR of 10.19%, due to growing urbanization and disposable incomes coupled with the growing focus on hygiene and home automation. Demand is being driven by a growing middle-class population and better access to affordable smart appliances. Furthermore, the fast expansion of e-commerce and the impact of western culture are significantly boosting the adoption of modern vacuum cleaning solutions in the region.

In 2024, Europe emerged as a promising region in the Household Vacuum Cleaners Market, supported by demand for energy-efficient and eco-friendly appliances. The market is stimulated by the growing adoption of smart and robotic vacuum cleaners, along with the government regulations and incentives. Finally, consumers are increasingly seeking out high-end, time-saving cleaning solutions due these busy lifestyles that are coupled with growing disposable incomes.

LATAM and MEA are experiencing steady growth in the Household Vacuum Cleaners market, driven by improving living standards, urbanization, and growing awareness of hygiene and home automation. Expanding retail infrastructure, increasing availability of affordable models, and rising middle-class populations are supporting demand. Additionally, regional manufacturers are introducing localized products to cater to diverse consumer needs.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players:

The Household Vacuum Cleaners Companies are Dyson Ltd., BISSELL Inc., iRobot Corporation, Samsung Electronics, LG Electronics, Panasonic Corporation, Electrolux AB, Miele & Cie KG, Haier Group, Ecovacs Robotics Inc. and Others.

Recent Developments:

-

In Feb 2025, ECOVACS unveils DEEBOT X8 PRO OMNI with 18,000Pa suction and self-washing OZMO ROLLER mopping, eliminating cross-contamination.

-

In March 2025, iRobot unveils a new Roomba series with LiDAR navigation and rotating discs for improved cleaning precision and smart mapping. The lineup includes four models, but concerns over the company’s future raise uncertainty about their market rollout.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 12.91 Billion |

| Market Size by 2032 | USD 24.79 Billion |

| CAGR | CAGR of 8.50% From 2024 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Canister, Central, Drum, Robotic, Upright, Wet & Dry, Others) • By Distribution Channel (Online, Offline) • By Power Sources (Chorded, Cordless) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | The Household Vacuum Cleaners Market companies are Dyson Ltd., BISSELL Inc., iRobot Corporation, Samsung Electronics, LG Electronics, Panasonic Corporation, Electrolux AB, Miele & Cie KG, Haier Group, Ecovacs Robotics Inc. and Others. |