Microduct Market Size & Trends:

The Microduct Market Size was valued at USD 5.80 Billion in 2024 and is expected to reach USD 13.66 Billion by 2032 and grow at a CAGR of 11.30% over the forecast period of 2025-2032. The market is experiencing robust growth, driven by the escalating demand for high-speed data transmission and the need for advanced network infrastructure. The global move toward digital transformation, a subject that has become a major concern for 74% of companies in 2024, is mostly driving the market growth. In particular, 77% of businesses have started their digital transformation path; but, only 35% claim success in reaching their objectives. With more than 5.35 billion internet users globally, the expansion of digital technologies by companies, governments, and residential sectors is boosting the demand for fiber-optic networks, so driving a consistent development for the microduct industry.

Microduct Market Size and Forecast:

-

Market Size in 2024: USD 5.80 Billion

-

Market Size by 2032: USD 13.66 Billion

-

CAGR: 11.30% from 2025 to 2032

-

Base Year: 2024

-

Forecast Period: 2025–2032

-

Historical Data: 2021-2023

Get more information on Microduct Market - Request Sample Report

Key Microduct Market Highlights:

-

Microducts enable efficient installation, protection, and maintenance of fiber optic cables.

-

Rising global demand for high-speed broadband, 5G, and IoT drives microduct adoption.

-

Flexible, scalable, and compatible with air-blown fiber systems for rapid network expansion.

-

Cost-effective solution with reduced labor, excavation, and installation time compared to traditional methods.

-

Regulatory challenges, diverse regional standards, and complex approvals may hinder deployment.

-

Infrastructure investments are optimized due to the ease of network expansion and adaptability.

The growing reliance on mobile devices, cloud computing, and video streaming services has significantly driven the demand for high-capacity, low-latency networks, further propelling the microduct market growth. Microducts play a pivotal role in supporting these advanced networks by facilitating the efficient deployment of dense fiber-optic cables in both urban and rural environments. Their flexible design enables optimal use of underground and aerial spaces, making them ideal for a wide range of applications. Moreover, microducts are becoming increasingly essential in supporting the Industrial Internet of Things (IIoT), enabling seamless connectivity for machines, sensors, and systems. This stable communication network enhances operational efficiency, particularly in manufacturing and other industrial sectors, fueling further growth in the microduct market.

Microduct Market Drivers:

-

Microducts Play a Crucial Role in Housing and Protecting Fiber Optic Cables, Enabling Efficient Installation and Maintenance, Driving the Market Growth

Growing demand for high-speed broadband services in urban, suburban, and rural locations drives significant fiber optic infrastructure investment. Globally, governments and businesses are aggressively implementing fiber networks into their national broadband projects. Projects including the European Commission's "Digital Decade" for instance aim to reach ubiquitous gigabit connectivity by 2030, hence creating ongoing need for microduct infrastructure. Moreover, the development of 5G and IoT ecosystems depends on robust back haul support, which also requires the installation of fiber optics with microduct solutions.

Through progressive installations, microduct systems provide flexibility, scalability, and cost-effectiveness, qualities vital in highly crowded metropolitan regions driving market expansion. These systems are not heavy, simple to set up and work well with air-blown fiber deployment to allow for fast and effective network growth. To meet growing data traffic needs, telecommunication companies are set to experience strong growth in the microduct market as they work on enhancing their current infrastructure.

-

Cost-Effectiveness and Reduced Installation Time that Microduct Systems Offer are Key Factors Driving the Market

The increasing need for fiber optic networks has led to the use of microduct technology, offering a more efficient and cost-friendly alternative to traditional fiber optic installation methods. Conventional methods frequently involve a lot of excavation, leading to expensive expenses and time setbacks. On the other hand, microducts are tiny, pliable tubes that can be put in place with little disturbance, leading to notable labor cost savings and quicker deployment. This is particularly advantageous for telecom operators and service providers who require rapid network expansion without incurring high costs.

Furthermore, microduct systems provide excellent adaptability, enabling simple modifications to accommodate current capacity requirements and expand as demand grows, further augmenting the microduct market trends. This flexibility guarantees that infrastructure investments are used efficiently, avoiding unnecessary construction, and reducing initial installation expenses. The capacity to expand fiber optic networks slowly to meet changing technological demands is a crucial benefit in the rapid digital landscape of today.

Microduct Market Restraints:

-

Microduct Market is Subject to a Variety of Regulatory Challenges that can Hinder Growth

Various regions have distinct codes, standards, and regulations for telecommunications infrastructure installation, and microducts may not align with all market requirements. At times, government regulations may support conventional installation methods or place limitations on the use of specific materials, potentially hindering the widespread use of microducts.

Furthermore, obtaining regulatory approvals for fiber optic network installations, such as microducts, may involve a long and complicated procedure. Local authorities might demand thorough planning and environmental evaluations before authorizing permits for such undertakings, potentially leading to delays in implementation and higher expenses. These regulations can impede the fast deployment of microduct systems and the expansion of fiber optic networks for companies.

Microduct Market Segment Analysis:

By Type

The flame retardant segment dominated with a 45% market share in 2024. These microducts are created to withstand fire, guaranteeing safety in settings at high risk, such as data centers, office buildings, and transportation hubs. Their improved insulation and fire-resistant materials are crucial for ensuring continuous network operations in regions prone to fire hazards. Primary uses involve structured cabling for extensive telecom and IT endeavors. Companies including Corning and Hexatronic supply flame retardant microducts for data centers and urban infrastructure projects, where strict safety regulations are enforced.

The direct installation segment is projected to have the fastest CAGR over 2025-2032 due to its easy deployment and cost efficiency. These small ducts are created for quick installation in different landscapes, reducing the need for digging and allowing for faster deployment of fiber-optic cables. The ducts' flexibility and durability lower installation expenses and time, which is why they are favored in fast-developing areas such as Asia-Pacific and Africa. Prysmian Group and Emtelle are examples of companies that offer telecom operators direct installation of microducts to help them expand their fiber networks more efficiently.

By Application

FTTX (Fiber to the X) segment dominated the microduct market in 2024 with a 56% market share, as a result of the increasing globally need for high-speed internet and connectivity. These networks utilize microducts to protect optical fibers that link end-users with core telecommunication infrastructure, improving internet speeds and dependability. The growth of smart homes, IoT devices, and 5G deployments has increased the use of FTTX, especially in cities. For instance, Corning's ClearCurve microducts are commonly utilized in Fiber-to-the-Home (FTTH) setups to guarantee efficient fiber management that saves money and space.

The data centers segment is going to be the fastest-growing segment during the forecast period 2025-2032, due to the increasing need for data centers, which is being fueled by the rising popularity of cloud services, AI applications, and edge computing. Microducts play a vital role in the organization and protection of high-density optical fiber cables in data centers, guaranteeing fast data transfer and minimal latency. Nexans and Emtelle are examples of companies that focus on serving this market by offering specialized products, including high-capacity microduct bundles designed for fiber management in large data centers.

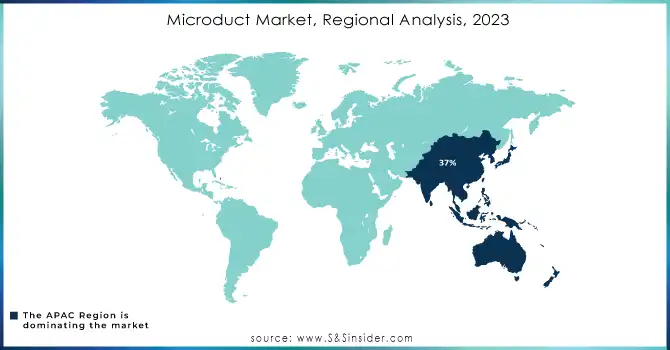

Microduct Market Regional Analysis:

Asia-Pacific Microduct Market Trends

In 2024, APAC led the microduct market with a 37% market share, fueled by fast urban growth and widespread fiber optic network rollouts in nations including China, India, and Japan. Governments in this area have been actively backing digital transformation projects including the 5G rollout in China and the BharatNet project in India, which heavily depend on microduct systems for effective fiber installations. For instance, Emtelle and Hexatronic Group are major players in the APAC region, with their microducts being commonly utilized for telecommunications and broadband purposes.

North America Microduct Market Trends

North America is going to witness the fastest growth rate in the microduct market during 2025-2032 due to advancements in 5G infrastructure and growing investments in rural broadband connectivity. Government efforts in the U.S., including the Rural Digital Opportunity Fund, are speeding up the installation of fiber optics and increasing the need for microduct solutions. The increase in smart home technologies, IoT applications, and data centers in Canada and the U.S. also adds to this expansion. Companies including Prysmian Group and Dura-Line play a crucial role in providing microducts for telecom operators and data centers.

Europe Microduct Market Trends

Europe holds a substantial share in the microduct market, driven by EU-backed fiber-to-the-home (FTTH) initiatives and the widespread adoption of 5G and ultra-broadband services. Countries such as Germany, the UK, and France are leading in fiber deployments, supported by regulations promoting high-speed connectivity. Hexatronic Group AB, Prysmian Group, and Draka Communications are prominent players, offering energy-efficient, fire-retardant, and multiway microduct solutions tailored to European standards.

Latin America Microduct Market Trends

Latin America is experiencing rising demand driven by telecom modernization projects and government initiatives to improve internet penetration in countries like Brazil, Mexico, and Chile. Expanding fiber-to-the-home (FTTH) installations and data center investments are creating strong growth prospects. Clearfield Inc. and GM Plast A/S are key players, supplying scalable and cost-efficient microduct solutions to support regional network expansion.

Middle East & Africa (MEA) Microduct Market Trends

The MEA region is witnessing steady growth due to increasing investments in smart city projects, particularly in the UAE and Saudi Arabia, where fiber-rich networks and 5G deployment are top priorities. Countries in Africa are leveraging microduct systems for cost-effective rural broadband expansion. Egeplast International GmbH and Blue Diamond Industries are emerging suppliers in this region, providing robust and climate-resistant microducts for harsh environments.

Need any customization research on Microduct Market - Enquiry Now

Key Microduct Companies are:

-

Emtelle Holdings Ltd (Emtelle RDB Microducts, Emtelle Blown Fibre Tubing)

-

Primo (Multi-microducts, Customized Microduct Solutions)

-

Hexatronic Group AB (Hexatronic Stingray Microducts, Hexatronic Air Blown Micro Cables)

-

Prysmian Group (Prysmian Multiway Microduct, Prysmian Retractanet Microduct)

-

Datwyler IT Infra. (Datwyler Multi-layer Microducts, Datwyler Fire Retardant Ducts)

-

Egeplast International GmbH (Egeplast Microduct-HDPE, Egeplast Multilayer Pipe Systems)

-

Clearfield Inc. (FieldShield Microduct, Clearview Cassettes with Microduct Technology)

-

Spur AS (Spur Multi-Microducts, Spur Single Microduct Systems)

-

GM Plast A/S (GM Blown Microducts, GM Multi Duct HDPE)

-

Belden Inc. (Belden Microduct Cable, Belden FiberExpress Microducts)

-

Rehau Group (RAU-Therm Microducts, RAU-Microcable Systems)

-

Dura-Line (FuturePath Microducts, Dura-Line Standard HDPE Microducts)

-

KNET (Micro Duct Assemblies, Flexible Mini Microducts)

-

Opterna (Opterna Microduct Cable Solutions, Opterna Single Microducts)

-

Fibrain (Fibrain MICRO-D HDPE Ducts, Fibrain Blowable Fiber Microducts)

-

Exel Composites (Exel Telecom Microducts, Lightweight Microduct Tubes)

-

Blue Diamond Industries (BDI Microduct Bundles, BDI Flame Retardant Microducts)

-

Draka Communications (Draka JetNet Microduct, Draka Blown Fiber Solutions)

-

Acome (Acome Microduct Solutions, Acome Low-friction Microducts)

-

Polieco Group (Polieco HDPE Microducts, Polieco Specialty Ducts)

Suppliers for Raw Materials/Components

-

Borealis AG (Polyethylene for microducts)

-

Sabic (Advanced polymers)

-

LyondellBasell (Polymer solutions for microduct manufacturing)

-

ExxonMobil Chemical (HDPE resins)

-

INEOS Olefins & Polymers (High-performance plastics)

-

DuPont (Specialized additives for durability)

-

Clariant (Color masterbatches for duct markings)

-

Evonik Industries (Flame retardant additives)

-

3M (Cable lubrication solutions)

-

BASF (UV stabilizers and impact modifiers for plastics)

Microduct Market Competitive Landscape:

KEZAD Group Founded in 2020 is a leading industrial and logistics hub in Abu Dhabi, UAE, providing integrated trade, industrial, and infrastructure solutions. It supports diverse sectors, including telecommunications and fiber optic projects, by offering world-class facilities for manufacturing and distribution, fostering regional growth in digital infrastructure and connectivity.

Emtelle Founded in 1981 is a global leader in microducts and blown fiber solutions, specializing in high-performance fiber optic infrastructure for telecommunications and broadband networks. Headquartered in the UK, Emtelle offers innovative microduct systems for 5G, FTTH, and smart city projects, supporting rapid and cost-effective fiber deployment worldwide.

-

In October 2024, KEZAD Group and Emtelle, a producer of fiber-optic and microduct solutions, revealed the inauguration of Emtelle's new USD 50 million global innovation and manufacturing center in KEZAD Area A (KEZAD Al Ma'mourah).

Prysmian Group Founded in 1879 is a global leader in energy and telecom cables, providing advanced fiber optic, copper, and electrical cables for telecommunications, power transmission, and distribution. Headquartered in Italy, Prysmian supports global 5G, FTTH, and broadband deployments with innovative, high-performance microduct and cable solutions.

-

In August 2023, Prysmian announced two events--Fiber Connect 2023 and the ISE EXPO 2023 shows--to unveil a new range of fiber optic cable and connectivity products targeted at major and remote broadband providers.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 5.80 Billion |

| Market Size by 2032 | USD 13.66 Billion |

| CAGR | CAGR of 11.30 % From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Direct Install, Direct Burial, Flame Retardant) • By Application (FTTX Networks, Access Networks, Backbone Networks, Data Center, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Emtelle Holdings Ltd, Primo, Hexatronic Group AB, Prysmian Group, Datwyler IT Infra., Egeplast International GmbH, Clearfield Inc., Spur AS, GM Plast A/S, Belden Inc., Rehau Group, Dura-Line, KNET, Opterna, Fibrain, Exel Composites, Blue Diamond Industries, Draka Communications, Acome, Polieco Group. |