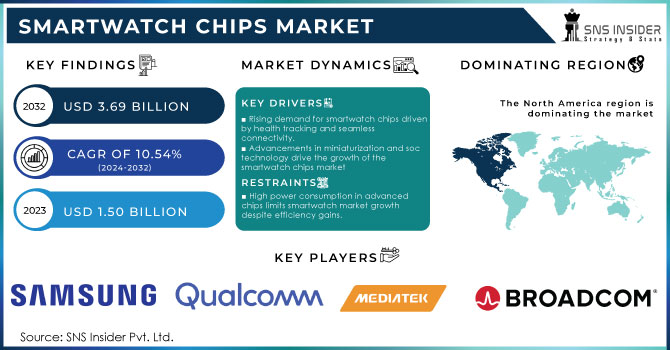

Smartwatch Chips Market Size & Overview:

The Smartwatch Chips Market Size was valued at USD 1.50 Billion in 2023 and is expected to reach USD 3.69 Billion by 2032, growing at a CAGR of 10.54% over the forecast period 2024-2032.

There has been a notable rise in the smartwatch chips market in recent years, fueled by the growing popularity of wearable technology and improvements in semiconductor production. Smartwatches have transformed from simple fitness trackers to advanced devices with features such as health monitoring, communication, and mobile payment functions. The worldwide adoption rate of smartwatches has increased to 21.7% among adults, demonstrating strong interest in wearable tech.

Get More Information on Smartwatch Chips Market - Request Sample Report

Around 38% of smartphone users have accepted smartwatches, with the most significant uptake observed in individuals aged 18-34, at about 31%. In smartwatch ownership, women are ahead of men, with 24% of women owning smartwatch as compared to 19% of men. In terms of region, North America is remarkable, with a 23% ownership rate. Apple's brand loyalty plays a significant role, with approximately 33% of smartphone users opting for Apple smartwatches. 45% of fitness enthusiasts use smartwatches for tracking their physical activities, showing a strong interest in the health and fitness industries. Moreover, 58% of individuals who own smartwatches utilize them for health-related purposes, such as monitoring their heart rate and tracking their sleep.

Smartwatch chips are specialized semiconductors that guarantee efficient performance, extended battery life, and better connectivity. Incorporating features like GPS, Bluetooth, heart rate monitoring, and occasionally even cellular connectivity necessitates advanced chips capable of handling numerous tasks concurrently while preserving battery life. In recent years, there have been notable enhancements in the battery longevity of smartwatches, with contemporary versions lasting an average of 1 to 3 days on a single charge, varying based on usage. Certain high-tech smartwatches, such as the Garmin Fenix 7 series, can last up to 14 days or longer in standard mode. Most of these enhancements result from progress in chipset technology, which aims to enhance power efficiency. Chipsets such as Qualcomm's Snapdragon Wear 4100+ have more efficient processors that provide improved performance with lower power consumption. Moreover, advancements in power management, including low-power modes and intelligent battery-saving features, have prolonged battery life while maintaining functionality. The chips are created to maintain a balance between performance and power usage because smartwatches have restricted battery life and need to endure long periods without recharging.

Smartwatch Chips Market Dynamics

Drivers

-

Rising demand for smartwatch chips driven by health tracking and seamless connectivity.

Growing consumer favor for wearable technology, especially smartwatches, is fueling high demand for smartwatch chips. With modern lifestyles moving towards a focus on health and integrating digital technology, smartwatches are no longer just used for telling time. Customers are looking for devices that can do multiple tasks at once, such as tracking fitness, monitoring heart rate, and connecting to smartphones. The increasing desire, especially among youth, has heightened the demand for efficient chips that allow for these functions. The primary factor driving the popularity of smartwatches is the desire for health and fitness tracking features. Consumers desire to track physical activity, sleep patterns, and overall well-being, leading them to view smartwatches as a crucial tool for personal healthcare. Smartwatch processors need to be compatible with sophisticated sensors and algorithms for real-time analysis of health-related information. This necessitates custom-made chips designed for efficient power usage and fast processing, meeting consumer demands for top performance and extended battery longevity. Additionally, the increasing popularity of working remotely and digital connections has led to a need for smooth coordination among devices. Smartwatches act as an expansion of smartphones, allowing users to receive notifications, make calls, and read texts without needing to always use their phones. Consequently, the smartwatch chip market has grown to incorporate components that enable fast connectivity and data transfer, enhancing the attractiveness of wearable technology to tech-savvy consumers.

-

Advancements in miniaturization and soc technology drive the growth of the smartwatch chips market

The growth of the smartwatch chips market is greatly influenced by advancements in chip design, especially in miniaturization technology. With smartwatches becoming smaller, lighter, and more attractive, the demand for smaller, more efficient chips is increasing. Being able to integrate advanced features such as GPS, heart rate monitoring, and wireless connectivity into smaller chips is essential for the advancement of future smartwatch technology. Miniaturization allows manufacturers to create chips with enhanced performance and reduced power consumption. This is especially crucial when it comes to smartwatches, with battery longevity being a crucial factor for sales. Consumers want their smartwatches to have long battery life, leading to a need for energy-efficient chips that can handle multiple tasks without using up the battery quickly. Another form of technological progress is the combination of various functions into one chip, called System-on-Chip (SoC) designs. This package integrates various processing units, memory, and connectivity modules into a single compact chip, eliminating the necessity for multiple components and allowing for thinner smartwatch designs. SoCs not only enhance speed but also lower production expenses, allowing smartwatches to be more budget-friendly and available to a wider range of consumers.

Restraints

-

High power consumption in advanced chips limits smartwatch market growth despite efficiency gains.

The high power consumption in advanced chips is perceived as one of the important limitations that could hamper the demand of the smartwatch chips market. Normally, smartwatch chips consume 50-200 mW during the active state and between 1-10 when in standby mode. Low-power processors, like ARM Cortex-M chips, use up to 10 mW when idling and may go up to 50 mW throughout active tasks whereas the high-performance chips similar to Qualcomm Snapdragon Wear series cross 200 mW beneath significant load. The chip features of the world continue to grow apace, of course; as smartwatches bulk out their offerings, more oomph is needed. Unfortunately depending on the silicon used these high-performance chips could be power hogs, and consume more energy resulting in shorter battery life. For the ones who are looking to use it for a long duration of time without keeping it off the wrists, this is a major drawback. That chip-design improvements are driving energy efficiency gains is well documented, but manufacturers still have to walk a performance-power consumption tightrope. The need to meet consumers' growing demands for extended battery life, particularly in the context of health monitoring and connectivity functionalities, is driving the development of more power-efficient chips.

Smartwatch Chips Market Segmentation Overview

By Type

The 64-bit segment led the market with a 55% market share in 2023. The rise in popularity of smartwatches is due to the growing need for better performance, energy-saving capabilities, and more advanced functions. Thanks to the 64-bit architecture, chipsets can handle a higher volume of data simultaneously, resulting in enhanced multitasking abilities and quicker application speed. The Apple Watch Series 6 features a powerful S6 chip, which highlights the capabilities of 64-bit architecture by smoothly connecting with multiple health apps and functions, establishing a high standard for competitors in the industry.

The 32-bit segment is growing at a faster CAGR and is expected to become fastest growing during 2024-2032. These chipsets provide enough computational capability for basic activities like time management, alerts, and basic health monitoring. A lot of affordable smartwatches use 32-bit chips because they are cheaper and require less power, which is perfect for people looking for cost-effective choices. Nordic Semiconductor is one of the companies that offer dependable 32-bit solutions, such as the nRF52832 SoC, which enables Bluetooth connectivity and sensor integration.

By Application

The iOS System Smartwatch segment held a major market share of over 60% market led the market in 2023, with the Apple Watch as a prime example of this dominance. Apple's dominant market position is greatly influenced by its loyal customer base and seamless integration within its ecosystem. The Apple Watch is very attractive to consumers because of its special features, such as easy connection to iPhones, unique health and fitness tracking abilities, and a wide variety of third-party apps. Furthermore, the continuous improvements to watchOS and the release of new models, like the Apple Watch Series 9, consistently improve user satisfaction and boost sales.

The Android System Smartwatch is accounted to become the fastest-growing segment during 2024-2032. The main reason for this quick expansion is the rising popularity of wearable technology among customers, especially because of the wide range of Android devices available. The cost-effectiveness and variety of Android smartwatches attract a broad spectrum of users, from those who love fitness to those who are knowledgeable about technology. Samsung and Fossil have taken advantage of this trend by providing a range of models that work seamlessly with Android phones.

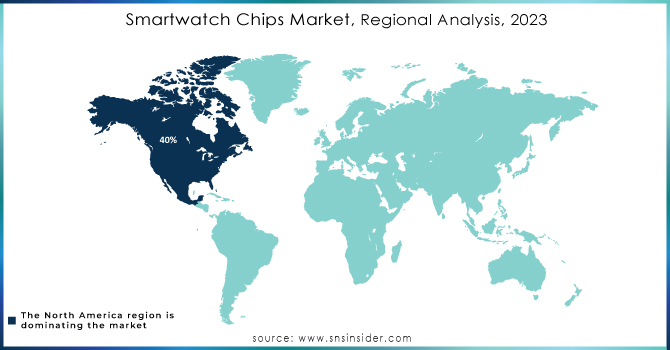

Smartwatch Chips Market Regional Analysis

North America dominated the market with a 40% market share in 2023, due to its advanced technology and strong consumer interest in wearable gadgets. Having tech giants like Apple, Qualcomm, and Intel in the area stimulates innovation and product advancement. Apple and other corporations utilize advanced chips in their smartwatches, improving features like fitness tracking, health monitoring, and connectivity. Moreover, the increasing popularity of being health-conscious among customers drives the need for smartwatches with advanced health-tracking capabilities.

Asia-Pacific (APAC) region is accounted to register the fastest growth rate during 2024-2032, driven by rising smartphone usage and an expanding middle class with disposable money. Nations such as China and India are at the forefront of this expansion, adopting wearable technology for managing health, fitness, and lifestyle. Prominent firms like Samsung and Huawei are making significant investments in the APAC smartwatch market, providing advanced chips that support functionalities such as GPS, heart rate tracking, and mobile transactions. The increase in local producers also leads to competitive prices and a broader selection for customers.

Need Any Customization Research On Smartwatch Chips Market - Inquiry Now

Key Players in Smartwatch Chips Market

The major key players in the Smartwatch Chips Market are:

-

Qualcomm (Snapdragon Wear 4100, Snapdragon Wear 3100)

-

Apple (S6 SiP, S7 SiP)

-

Samsung (Exynos W920, Exynos 9110)

-

MediaTek (MT2601, MT2523G)

-

STMicroelectronics (STM32L4+ series, ST25DV series)

-

Broadcom (BCM4343W, BCM4773)

-

NXP Semiconductors (i.MX RT500, i.MX 7ULP)

-

Texas Instruments (SimpleLink CC2640R2F, TMS320C5515)

-

Intel (Intel Curie, Intel Quark SE C1000)

-

HiSilicon (Huawei) (HiSilicon Kirin A1, HiSilicon LiteOS chip)

-

Rockchip (RK2108, RK3308)

-

Realtek (RTL8762C, RTL8763B)

-

InvenSense (TDK) (ICM-20689, ICM-20948)

-

Ambiq Micro (Apollo3 Blue, Apollo4)

-

Dialog Semiconductor (Renesas) (DA14695, DA14585)

-

Maxim Integrated (MAX77650, MAX86141)

-

Cypress Semiconductor (Infineon) (CYW20719, CY8CMBR3116)

-

Murata Electronics (LBES5PL2EL, LBEH5UE1CX)

-

Synaptics (TD7850, TCM5124)

-

Microchip Technology (SAMD21G18, PIC32MZ)

Recent Development

-

Apple S9 Chip (September 2024): Apple is anticipated to launch the S9 chip with its next Apple Watch model in September 2024. This chip is expected to enhance processing power and energy efficiency, and include more health monitoring features, following Apple's trend of integrating advanced health sensors.

-

Samsung Exynos W930 (February 2024): Samsung unveiled the Exynos W930 chip, aimed at enhancing smartwatch performance with improved AI capabilities and energy efficiency. This chip is expected to power the next generation of Galaxy smartwatches, particularly the upcoming Galaxy Watch 7.

-

Qualcomm Snapdragon X35 (April 2023): Qualcomm introduced the Snapdragon X35, the first 5G modem designed specifically for smartwatches. This chip enables faster connectivity and lower latency while maintaining energy efficiency, allowing for better performance in wearable devices. It is set to feature in smartwatches launching in early 2024.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 1.50 Billion |

| Market Size by 2032 | USD 3.69 Billion |

| CAGR | CAGR of 10.54% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (32-bit, 64-bit, Others) • By Application (Android System Smartwatch, IOS System Smartwatch, Windows System Smartwatch, Others |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Qualcomm, Apple, Samsung, MediaTek, STMicroelectronics, Broadcom, NXP Semiconductors, Texas Instruments, Intel, HiSilicon, Rockchip, Realtek, InvenSense, Ambiq Micro, Dialog Semiconductor, and Others |

| Key Drivers | • Rising demand for smartwatch chips driven by health tracking and seamless connectivity. • Advancements in miniaturization and soc technology drive the growth of the smartwatch chips market |

| RESTRAINTS | • High power consumption in advanced chips limits smartwatch market growth despite efficiency gains. |