Smart Appliances Market Size & Trends:

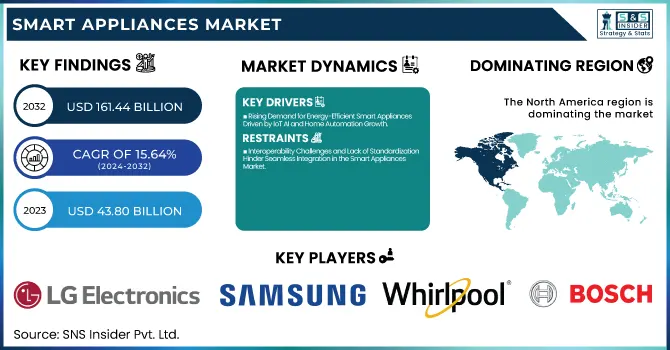

The Smart Appliances Market Size was valued at USD 43.80 billion in 2023 and is expected to reach USD 161.44 billion by 2032, growing at a CAGR of 15.64% over the forecast period 2024-2032. The use performance, AI automation, and ecosystem integration evolution driven by the Smart Appliances Market. Thus, the Smart Appliances sector contributes to growing easiness for users. Real-time energy monitoring, predictive maintenance, and adaptive learning that optimize performance are all prominent features of smart appliances today. Automation powered by AI boosts voice command precision, auto-diagnosis, and customized usage recommendations.

To Get more information on Smart Appliances Market - Request Free Sample Report

Smooth smart ecosystem integration provides compatibility with IoT platforms such as Alexa and Google Home. This solution is also reflected in the consumer dependency on automation, whether in the form of smart kitchens, autonomous HVACs, or AI-driven laundry. The shift toward more connected homes has made us more dependent on hands-free operation, predictive analytics, and personalized automation, which are all qualities of modern living.

Smart Appliances Market Dynamics

Key Drivers:

-

Rising Demand for Energy-Efficient Smart Appliances Driven by IoT AI and Home Automation Growth

High adoption of energy-efficient and connected devices is the major factor driving the growth of the smart appliances market. Smart appliances are one of the major consumer elects desiring the convenience of appliances with reduced energy output and efficient home automation. The spread of Internet of Things (IoT) technology and the development of smart homes have promoted the interconnection of appliances such as refrigerators, washing machines, air conditioners, and more. Furthermore, the increasing use of artificial intelligence (AI) and machine learning is making appliances smarter as they can learn consumer preferences to optimize usage and work more efficiently, which is further pushing the growth of the market.

Restrain:

-

Interoperability Challenges and Lack of Standardization Hinder Seamless Integration in the Smart Appliances Market

The smart appliances market faces a few key challenges, one of which is interoperability and standardization. The problem is that there are too many manufacturers and technologies involved, so a smart appliance from one brand will not work with a smart appliance from another. Depending on compatibility, consumers might not be able to connect many kinds of appliances to its smart home ecosystem which is why people hesitate to adopt it. Decompression in communication protocols such as Wi-Fi, Bluetooth, or NFC, is a barrier to creating the market because many consumers would prefer a relatively simple, reliable solution, and there are no global standards in this aspect.

Opportunity:

-

Rising Commercial Demand and Sustainability Drive Growth Opportunities in the Smart Appliances Market

Unlocking similar market opportunities are growing commercial segment and a strident need for sustainable solutions With improving sustainability and savings on energy bills, commercial demand for smart appliances, like smart fridges or HVAC solutions, is about to surge. In addition, the increasing adoption of voice smart appliances with the integration of platforms such as Amazon Alexa, and Google Assistant is anticipated to create an opportunity for market growth. Developing nations incline smart appliances as well, but have less awareness of smart appliances compared to the smart appliances market news, as a result, that offers a developing ground for manufacturers to convey cheap and innovative products.

Challenges:

-

Security and Privacy Concerns Pose Major Barriers to Mass Adoption of Smart Home Appliances

Connectivity is also linked with security and privacy issues as well. Smart home appliances continuously collect and send data via the Internet, making them a target for cyberattacks, which in turn puts consumer privacy at risk. Consumer trust could erode through data breaches, unauthorized access, or malicious interference which would detrimentally impact adoption. Moreover, manufacturers need to handle regulation issues regarding data protection and privacy legislation areas. This public discontent complicates the development and rollout of smart appliances companies have to satisfy the local legislation, all while ensuring their product remain secure. That means consumers still hesitate about privacy and data security, which is a major barrier to mass market adoption.

Smart Appliances Market Segments Analysis

By Technology

The Wi-Fi segment led the smart appliances market, in 2023, accounting for 48.6% market share. It is expected to grow at the highest CAGR over the forecast period (2024–2032) as it is the predominant technology used in smart home ecosystems. Demand for connected devices, remote control, and real-time monitoring has recently increased, stimulating the acceptance of Wi-Fi-enabled appliances. The ease of integration with smart assistants including Amazon Alexa and Google Assistant has encouraged consumers to buy Wi-Fi-enabled products, making it more user-friendly. At the same time, the market is also being pushed forward by advances in IoT and automation powered by Artificial Intelligence and Machine Learning. In line with this trend are smart appliances refrigerators, washing machines, air conditioners, etc that use Wi-Fi to provide remote operation, energy-saving, and predictive maintenance. The trend will continue to replace Wi-Fi-powered appliances as smart home adoption increases and available network infrastructures improve.

By Sales Channel

In 2023, indirect sales channels accounted for the largest share of 63.7% of the smart appliances market. The availability of various brands and competitive pricing coupled with lucrative promotional offers, propel consumers towards well-established retail chains and online marketplaces for buying smart appliances.

Direct Sales Channel is anticipated to grow fastest over 2024-2032 as manufacturers place an increasing focus on direct-to-consumer (DTC) models. Since consumers have more faith in their websites and exclusive stores, brands are now taking better advantage of them in terms of providing customized experience and improved after-sales service and price competitiveness, thus, accelerating their direct sales transition.

By End User

Residential captured a 68.2% smart appliances market share in 2023 and is estimated to expand at the highest CAGR from 2024 to 2032, owing to the growing adoption of smart homes, along with rising consumer inclination toward convenience, automation, and energy efficiency. This growth is being driven by smart and IoT-enabled home ecosystems and appliances that support homeowners who wish to control and monitor their devices remotely with ease-of-use capabilities through AI and smartphone technology. More and more consumers are buying smart fridges, washing machines, and air conditioners embedded with voice assistants, whether it's Alexa or Google Assistant. With the rising awareness for energy-efficient solutions and the availability of different government incentives for smart home adoption, the demand is also increasing. With increasing urbanization and income levels in the hands of consumers, particularly in many emerging economies, the residential segment will always remain a dominant sector in the overall market with advanced opportunities for IoT innovation & enhanced connectivity.

Smart Appliances Market Regional Outlook

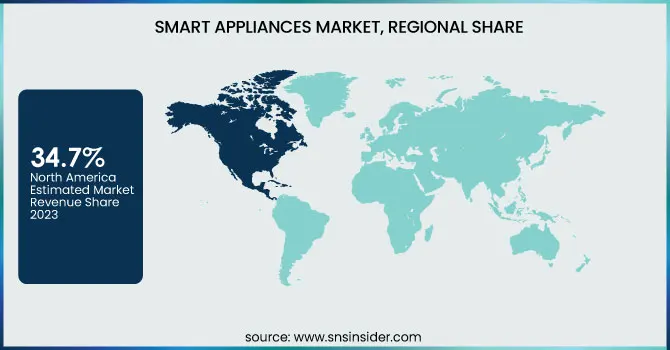

In 2023, North America held the largest 34.7% smart appliances market share, owing to increasing consumer adoption of smart home technologies, developed network infrastructure, and the presence of key industry players. Demand across smart refrigerators, washing machines, and HVAC systems is further supplemented by the presence of a tech-savvy population in the region, along with rising dependency on IoT-powered devices. The leading players include some major companies including Whirlpool Corporation (U.S.), General Electric (U.S.), and Honeywell (U.S.), who are constantly working on innovations in smart appliance connectivity and AI-integrated automation. Also, the increasing initiatives by the government to promote energy-saving devices along with the increasing adoption of voice assistants such as Amazon Alexa and Google Assistant drive the growth of the market.

Asia Pacific is predicted to hold the highest CAGR from 2024-2032 attributable to rapid urbanization, rising disposable income, and a growing middle-class population. Smart homes are gaining traction in some Asian countries like China, Japan, and India, where manufacturers like Samsung (South Korea), LG Electronics (South Korea) and Haier (China) drive market development. There are strong manufacturing capabilities in the region and the government provides smart city incentives which leads to increased demand. Moreover, growing sales through e-commerce platforms such as Alibaba and Flipkart are giving way to accessibility and higher penetration of smart appliances at an economical price to a broad consumer base.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

Some of the major players in the Smart Appliances Market are:

-

Samsung (Family Hub Refrigerator, SmartThings Air Purifier)

-

LG (InstaView ThinQ Refrigerator, AI DD Washing Machine)

-

Whirlpool (Smart Front Load Washer, Smart Over-the-Range Microwave)

-

Bosch (Home Connect Oven, Home Connect Dishwasher)

-

Haier (Smart Refrigerator, Smart Washing Machine)

-

Electrolux (Connected Oven, Pure i9 Robotic Vacuum)

-

Panasonic (Connected Microwave Oven, Smart Washing Machine)

-

Philips (Airfryer Smart Sensing, Hue Smart Lighting)

-

Sony (Bravia Smart TV, Smart Speaker)

-

IFB (Smart Washing Machine, Built-in Oven)

-

Godrej (ChotuKool Refrigerator, Smart Washing Machine)

-

Bajaj (Smart Microwave Oven, Smart Mixer Grinder)

-

Hitachi (Smart Refrigerator, Smart Air Conditioner)

-

Lloyd (Smart LED TV, Smart Air Conditioner)

-

Voltas (Smart Air Conditioner, Smart Air Cooler)

Recent Trends

-

In February 2025, Samsung launched its Bespoke AI Refrigerator series, featuring AI-driven energy optimization, food inventory tracking, and Instacart integration for automated grocery management.

-

In September 2024, Sony launched its 2024 Bravia 4K smart OLED TVs, featuring AI-driven enhancements for superior picture quality and immersive sound. The Bravia 8 OLED model offers deep contrast, vibrant colors, and a screen that doubles as a speaker for a cinematic experience.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 43.80 Billion |

| Market Size by 2032 | USD 161.44 Billion |

| CAGR | CAGR of 15.64% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Technology (Wi-Fi, Bluetooth, Near Field Communication (NFC), Others) • By Sales Channel (Indirect Sales Channel, Direct Sales Channel) • By End User (Residential, Commercial) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Samsung, LG, Whirlpool, Bosch, Haier, Electrolux, Panasonic, Philips, Sony, IFB, Godrej, Bajaj, Hitachi, Lloyd, Voltas. |