E-Compass Market Size & Growth:

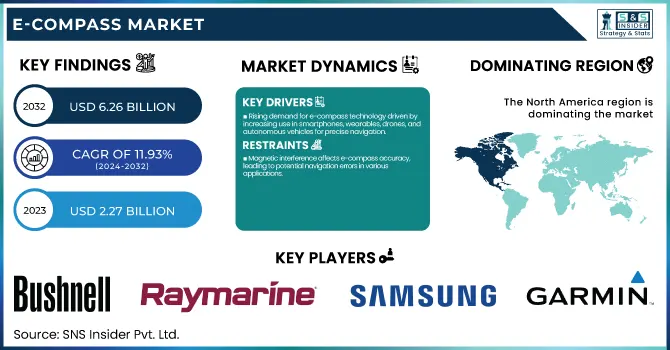

The E-Compass Market Size was valued at USD 2.27 Billion in 2023 and is expected to reach USD 6.26 Billion by 2032, growing at a CAGR of 11.93 % from 2024-2032. fueled by increasing demand for navigation systems in mobile phones, self-driving cars and selective wearables. AI and IoT adoption is also rising for sensor calibration and real-time corrections, making e-compass more accurate and thus leading to higher market growth. MEMS-based magnetometers are miniaturized and consume a small amount of power, making them perfect for IoT applications, smart cities, and industrial automation.

To Get more information on E-Compass Market - Request Free Sample Report

Additionally, sensor fusion, integrating an e-compass with regional navigation systems such as GPS with accelerometers and gyroscopes, is enhancing functionality in automotive advanced driver assistance systems (ADAS), Augmented and Virtual Reality (AR/VR), and marine navigation, which is another key driving element enabling sensor fusion technology. Vendors are working to improve the reliability of their products, reducing failure rates and increasing environmental tolerance, leading to increased use in industries where precise orientation is necessary, such as aerospace, defense, and surveying.

E-Compass Market Dynamics:

Drivers:

-

Rising demand for e-compass technology driven by increasing use in smartphones, wearables, drones, and autonomous vehicles for precise navigation.

The increasing reliance on navigation systems is a key driver of the e-compass market, fueled by the growing adoption of smartphones, wearables, drones, and autonomous vehicles. Modern consumer electronics, such as smartwatches and fitness trackers, utilize e-compass technology for real-time orientation and location-based services. Similarly, drones and UAVs depend on precise positioning for accurate flight control, mapping, and delivery applications. The surge in autonomous vehicles further amplifies demand, as these systems require high-precision sensors for navigation and safety. Additionally, advancements in AI and IoT have enhanced the accuracy and integration of e-compass sensors, making them indispensable across multiple industries. As smart technology adoption accelerates, the market for e-compass solutions is expected to grow significantly.

Restraints:

-

Magnetic interference affects e-compass accuracy, leading to potential navigation errors in various applications.

E-compasses, which are magnetometer-based, can be highly influenced by nearby electronic devices, large metal structures, and the effects of the electromagnetic field. In these urban environments, industrial settings and high-tech vehicles, this interference can distort readings and give rise to inaccuracies in positioning and orientation. The usage of e-compass technology is growing in smartphones, drones, and even autonomous vehicles, resulting in manufacturers incorporating advanced sensor fusion methods (integration of gyroscopes and accelerometers) to nullify the errors. Eliminating interference is still a challenge, and developing effective shielding techniques, software corrections, and AI-driven calibration methods remains crucial. This is a constraint on market growth as it can be especially important in sectors where accurate navigation is a requirement, such as defense, aerospace, and autonomous transport.

Opportunity:

-

Growth of IoT-integrated navigation systems is driving demand for e-compasses across smart devices and automation.

The increasing demand for IoT-integrated navigation systems is a major driver of the e-compass market, as industries seek more accurate and connected positioning solutions. With the proliferation of smart devices, including wearables, autonomous vehicles, and industrial automation systems, e-compasses are being integrated with IoT to enable real-time data exchange and enhanced geolocation accuracy. These sensors provide precise orientation and direction, making them essential for applications in smart cities, logistics, and healthcare. Additionally, advancements in AI and cloud-based computing are enhancing the efficiency of IoT-integrated e-compasses, allowing seamless communication across networks. As IoT adoption accelerates globally, the need for intelligent navigation solutions will continue to fuel the growth of the e-compass market.

Challenges:

-

Optimizing power efficiency in e-compass technology remains a challenge as continuous operation in smart devices drains battery life.

High power consumption is a significant challenge for the E-Compass market, especially for battery-operated devices such as smartphones, wearables, and IoT-based navigation systems. E-Compass sensors need to function continuously in order to provide real-time orientation and positioning data, so they can drain a sizable amount from the battery life, decreasing device efficiency. The addition of multi-axis sensors that enhance measurement accuracy contributes to the energy costs. Manufacturers are responding, already working to low-power designs and more efficient firmware to lower energy consumption. Yet, the demand for performance is in direct conflict with minimizing power because many of these applications need to run for long periods (e.g., autonomous vehicles, drones, military navigation systems).

E-Compass Market Segment Analysis:

By Technology

The magneto-resistive segment held the largest revenue share of approximately 52% in the E-Compass Market in 2023, driven by its high sensitivity, low power consumption, and superior accuracy compared to other technologies. Magneto-resistive sensors are widely adopted in smartphones, wearables, drones, and autonomous vehicles due to their ability to provide precise navigation and orientation even in challenging environments. Their durability and resistance to external disturbances make them ideal for industrial and defense applications. Additionally, advancements in IoT and AI-driven navigation systems have further fueled the demand for magneto-resistive sensors, ensuring their dominance in the market. As industries continue to adopt smart and automated solutions, this segment is expected to witness sustained growth.

The fluxgate segment is projected to be the fastest growing in the E-Compass Market from 2024 to 2032, due to its high precision, stability, and low noise property. These sensors are becoming increasingly prevalent in aerospace, defense and marine applications requiring accurate navigation. Due to their superior performance in detecting weak magnetic fields, and the increasing need for autonomous vehicles and drones, the adoption of fluxgate technology has also witnessed a surge. In addition, the focus on sensor miniaturization and fusion with AI-enabled navigation systems is positively affecting the market development. Fluxgate segment is expected to grow at a high rate due to the accurate and reliable nature of this product.

By Application

The consumer electronics segment dominated the E-Compass Market with a 55% revenue share in 2023 and is projected to be the fastest-growing segment from 2024 to 2032. The need for these sensors has been hyper-accelerated by the explosion in adoption of the similar smartphone, smartwatch, fitness tracker, AR/VR and other forms of wearable electronics that require e-compass sensors to enhance navigation, motion tracking and immersive user experience. The incorporation of AI, IoT, and compact low-power sensors has increased precision and efficiency in electronic compasses, which are now an essential part of contemporary consumer devices. Furthermore, the increasing developments in AR applications, gaming, and smart navigation systems are other factors driving the market growth. With consumers becoming increasingly dependent on accurate positioning, location-based services, and seamless interaction between devices, manufacturers are continuing to develop new, performance- and reliability-focused multi-axis e-compass sensor solutions. With the rapid evolution of consumer electronics, this segment is expected to maintain its dominance while exhibiting the highest growth rate over the forecast period.

By Sensor Type

The 3-axis segment dominated the E-Compass Market with a 40% revenue share in 2023, owing to the increasing use of 3-axis e-compass in smartphones along with tablets, wearables, etc. 3-axis e-compasses are widely incorporated for consumer electronics to navigation systems as they provide a good compromise between accuracy, power consumption, and cost. Their powerful ability to provide reliable orientation and motion sensing makes them critical for GPS enhancement, gaming, and augmented reality applications. The 3-axis segment is poised to continue its market share dominance with advancements in miniaturization and AI-driven sensor fusion continuing to innovate the sensor segments to fulfill the growing need for accurate and low-power navigation solutions.

The 9-axis segment of the E-Compass Market is expected to dominate during the forecast period from 2024 to 2032, driven by its enhanced accuracy and ability to measure all three axes of movement (x, y, and z) along with rotational data. These advantages make 9-axis e-compasses increasingly popular in applications such as automotive navigation, wearable devices, and augmented reality systems, where precise orientation and motion sensing are crucial. As demand for advanced navigation and positioning technologies grows, the 9-axis segment is poised for the fastest growth, providing significant advancements in accuracy and reliability across various industries.

E-Compass Market Regional Overview:

North America dominated the E-Compass Market in 2023, holding a 38% revenue share due to the presence of leading technology providers, widespread adoption of navigation systems, and strong demand in aerospace, defense, automotive, and consumer electronics. The region’s investment in autonomous vehicles, IoT-integrated navigation, and wearable technology has driven market expansion. Additionally, the increasing use of E-Compass sensors in smartphones, AR/VR applications, and military systems has fueled growth. Government initiatives for defense modernization and smart infrastructure development further reinforce North America's leadership in the market.

Asia-Pacific is the fastest-growing region in the E-Compass market over the forecast period 2024–2032, attributed to rapid progress in the use of E-Compass in consumer electronics, automotive and defense sectors. The growing implementation of IoT-enabled navigation systems in smart wearables, smartphones, and autonomous vehicles is boosting demand. For instance, China, Japan, and South Korea are investing significantly in smart technology, leading to an upsurge in the integration of E-Compass sensors in numerous applications. Furthermore, growth in aerospace and defense industries along with increasing government initiatives for smart infrastructure and navigation technology are also anticipated to fuel the market growth in the region.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players:

Some of the major players in E-Compass Market along with their product:

-

Bushnell (USA – Optics & Navigation Devices)

-

Raymarine (UK – Marine Electronics & Navigation Systems)

-

Samsung (South Korea – Smartphones & Consumer Electronics)

-

Garmin (USA – GPS Navigation & Wearable Technology)

-

Leica (Germany – Optical Instruments & Precision Navigation)

-

Apple (USA – Smartphones & Wearable Devices)

-

Airmar (USA – Marine Sensors & Transducers)

-

NAVICO (Norway – Marine Electronics & GPS Systems)

-

Furuno (Japan – Marine Radar & Navigation Systems)

-

Sony (Japan – Consumer Electronics & Imaging Sensors)

-

Magellan (USA – GPS Navigation Devices)

-

Eagle Tree Systems (USA – UAV & RC Electronics)

-

Hawkeye (USA – Marine Depth Sounders & Navigation Instruments)

-

Simrad (Norway – Marine Electronics & Autopilot Systems)

-

TomTom (Netherlands – GPS Navigation & Mapping Solutions)

List of Suppliers Who Provide Raw Material and Component for E-Compass Market:

-

Asahi Kasei Microdevices (Japan)

-

Honeywell Aerospace (USA)

-

Jewell Instruments (USA)

-

Wuxi Bewis Sensing Technology LLC (China)

-

Shenzhen Rion Technology Co., Ltd. (China)

-

MEMSIC Inc. (USA)

-

NXP Semiconductors (Netherlands)

-

TDK Corporation (Japan)

-

Robert Bosch GmbH (Germany)

-

STMicroelectronics (Switzerland)

Recent Development

-

February 13, 2025: Dragonfly 36 Performance Trimaran is presented by Quorning Boats at Düsseldorf Boat Show 2025 We fitted a Raymarine Axiom 12 Pro HybridTouch, which offered improved real-time navigation for high-speed sailing.

-

July 10, 2024: In the 2024 edition of Galaxy Unpacked which was powered up by Snapdragon 8 Gen 3, Samsung introduced to the world Galaxy Z Fold 6 and Z Flip 6 with improved AI performance, 12GB RAM, and seven years of updates for an unbeatable performance.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 2.27 Billion |

| Market Size by 2032 | USD 6.26 Billion |

| CAGR | CAGR of 11.93 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Technology (Fluxgate, Hall-Effect, Magneto resistive, Others) • By Application (Consumer Electronics, Aerospace & Defense, Automotive, Marine, Surveying, Others) • By Sensor Type (1 & 2-axis, 3-axis, 6-axis, 9-axis) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Bushnell (USA), Raymarine (UK), Samsung (South Korea), Garmin (USA), Leica (Germany), Apple (USA), Airmar (USA), NAVICO (Norway), Furuno (Japan), Sony (Japan), Magellan (USA), Eagle Tree Systems (USA), Hawkeye (USA), Simrad (Norway), TomTom (Netherlands). |