HVDC Capacitor Market Size

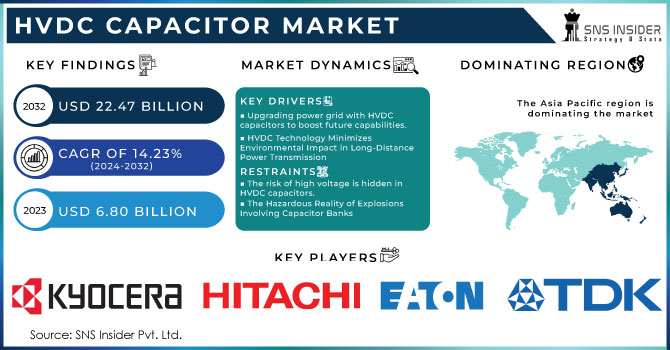

The HVDC Capacitor market size was $ 6.80 Billion in 2023 & expects a good growth by reaching USD 22.47 billion till end of year2032 at CAGR about 14.23 %during forecast period 2023-2032

Get More Information on HVDC Capacitor Market - Request Sample Report

HVDC capacitors are becoming more crucial in updating power grids. These capacitors enhance the security, dependability, and cost efficiency of transmission systems. They assist in detecting possible equipment weaknesses without interrupting operations, guaranteeing a steady and dependable electricity supply.

As the demand for electricity rises in conjunction with the use of solar and wind energy, upgrades are needed for our power grids. HVDC capacitors help power grids by aiding in the regulation of excess energy. An example of this scenario would be a large company revealing their initiative to improve the US power grid by connecting the east and west coasts with advanced HVDC technology.

Another key driver of the market is the positive impact on the environment from HVDC systems. In comparison to conventional AC systems, HVDC needs less transmission lines, decreasing their environmental footprint and space requirements. Furthermore, HVDC also offers greatly reduced transmission losses, which is essential for incorporating renewable energy sources that are frequently situated at a considerable distance from urban areas. Governments in countries such as the US, UK, and Germany are aiding in the widespread adoption of HVDC technology. This indicates that they are simplifying the use of specialized power lines capable of accommodating renewable energy sources such as solar and wind farms. In Europe and Asia, there is an effort to both upgrade aging power grids and incorporate clean energy sources.

Although HVDC capacitors face difficulties with high voltage, the market is projected to thrive as a result of progress in the energy industry and favorable government policies. This development will aid in creating a power grid that is more effective, trustworthy, and eco-friendly.

|

Report Attributes |

Details |

|---|---|

|

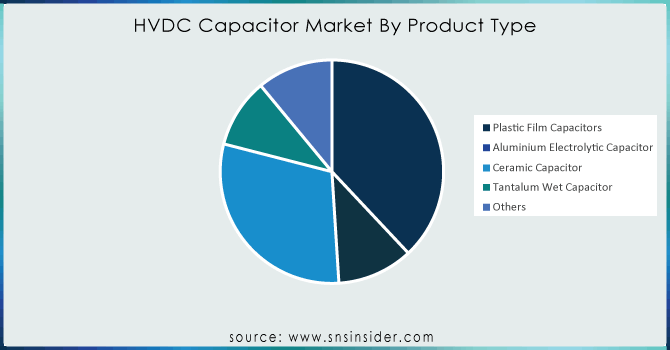

Key Segments |

• By Product Type (Introduction, Plastic Film Capacitors, Aluminium Electrolytic Capacitor, Ceramic Capacitor, Tantalum Wet Capacitor, Others) |

|

Regional Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

Hitachi, Ltd. (Japan), General Electric (US), TDK Corporation (Japan), Eaton (US), KYOCERA Corporation (Japan), YAGEO Corporation (Taiwan), Vishay Intertechnology, Inc. (US), General Atomics (US), International Capacitors, S.A. (Spain), and ELECTRONICON Kondensatoren GmbH (Germany), Sieyuan Electric Co., Ltd. (China), Kunshan GuoLi Electronic Technology Co., Ltd. (China), Condis (Switzerland), samwha Capacitor Group (South Korea), API Capacitors(UK) |

Drivers

Upgrading power grid with HVDC capacitors to boost future capabilities.

There is a growing demand for additional electricity to fuel various needs, leading to an increase in the popularity of solar and wind energy sources. These changes are putting pressure on obsolete electrical grids. Capacitors for HVDC systems are essential for the electricity infrastructure, functioning as superheroes within this critical network. Think of a crowded street filled with cars - that's basically how a congested power grid operates. HVDC capacitors act as traffic controllers, managing the flow of electricity and preventing overload situations. HVDC capacitors serve multiple purposes besides managing traffic; they also improve grid stability and efficiency, guaranteeing a reliable power source for data centers, electric vehicles, and other systems reliant on the grid. Think of them as invisible guardians of our power supply, ensuring a smooth transition to a renewable energy future.

HVDC technology reduces environmental impact when transmitting power over long distances by adopting sustainable practices.

Picture transmitting electricity over large distances without creating a significant impact. The attractiveness of HVDC transmission lines lies in the secret weapon of HVDC capacitors. HVDC, in contrast to traditional AC lines, is comparable to a nature lover because it needs less transmission lines, reducing environmental impact and land use. This revolutionizes the transportation of electricity from remote renewable energy sources such as solar farms in deserts or offshore wind power farms. The advantages do not end there. HVDC has much lower transmission losses, with reductions of up to 50%! This is particularly important for incorporating renewable sources that are frequently situated at a distance from urban areas. Reducing energy wastage results in a smaller environmental footprint.

Restraints

• The risk of high voltage is hidden in HVDC capacitors.

HVDC capacitors, the unsung heroes of transmitting power over long distances, pose a hidden danger of high voltage. These capacitors have voltages that can be fatal, presenting a major safety hazard throughout their entire lifespan. Stringent safety protocols and well-trained personnel are needed for installation, maintenance, and regular operation. This covers specific personal protective gear such as insulated suits, gloves, and face shields. Workspaces are carefully organized and secured to avoid unintentional contact. In addition, thorough training programs make sure that technicians grasp the possible risks and correct handling protocols.

• The Hazardous Reality of Explosions Involving Capacitor Banks

Capacitor banks in HVDC systems act as surge protectors to ensure smooth operation, but they also have the potential to cause harmful explosions. Determining the exact cause of a capacitor bank failure is just as difficult as pinpointing the reason for a flat tire. This difference could lead to voltage spikes exceeding the capacitors' limit, which may cause a destructive explosion. Properly implementing HVDC capacitor banks is crucial because of the emphasized danger. Through careful assembly of components and maintaining safe voltage levels, we can prevent these dangerous high-voltage devices from exploding.

Segment Analysis

By Product Type

By product Type, Plastic Film capacitors are holding the highest share market with 38% of market in HVDC Capacitors in 2023. Plastic film capacitors have a longer lifespan compared to traditional capacitors due to their ability to self-heal minor damage. This results in lower expenses for replacing and less time spent on maintenance. Minimal maintenance requirements are reduced by the self-healing feature, reducing the necessity for continual supervision and repairs. This results in reduced maintenance expenses and increased operational effectiveness. Outstanding Achievement in Challenging HVDC transmission applications entails harsh electrical conditions. Plastic film capacitors perform exceptionally well in these circumstances, guaranteeing dependable and uniform performance even when facing stress.

Get Customized Report as Per Your Business Requirement - Request For Customized Report

By Installation Type

Open Racks hold the largest dominant segment in installation Type in hvdc capacitors market with 45 % share in 2023. Maintenance costs have gone up because of the effects of weather and wildlife, as well as the implementation of more rigorous safety measures for the high voltage parts. Despite being cheaper at first, these open installations could result in increased expenses and safety worries in the future, ultimately prompting individuals to switch to enclosed rack systems. Enclosed racks function similar to protective gear, requiring less upkeep and potentially easier safety protocols, though they come with a greater upfront price.

Regional Analysis

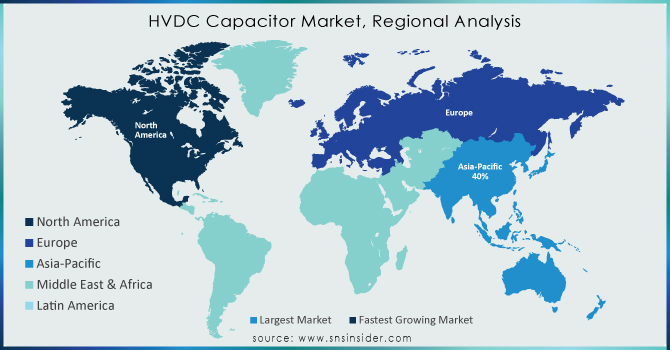

Asia Pacific is dominating in hvdc capacitor market with 40% of share in 2023. Asia is at the forefront in the use of specific devices (HVDC capacitors) to ensure a steady flow of electricity. This is happening due to the increasing demand for electricity in factories, homes, and businesses, particularly in countries experiencing population and economic growth. These capacitors act as overseers on a massive highway, guaranteeing electricity reaches its destination for cars, computers, solar panels, and wind farms. Currently, numerous Asian countries are focused on enhancing and enlarging their electricity networks to accommodate an increasing amount of power. These unique capacitors also assist in linking new sources of renewable energy from solar and wind to the electricity grid HVDC capacitors assist in managing increased loads by stabilizing and improving power transmission. Due to these factors, Asia-Pacific is set to continue dominating the HVDC capacitor market in the future. This emphasis on dependable and environmentally friendly power distribution sets the stage for a more promising future in the area.

In 2023 North America is leading the HVDC capacitor market with the highest growth rate, accounting for 35% of the market. Older electricity networks are having trouble keeping up with the needs of more people and moving towards using more wind and solar power. The key players are HVDC capacitors, facilitating grid improvements and growth to guarantee effective and dependable power delivery. The United States and Canada are effectively incorporating clean energy sources, with HVDC capacitors playing a crucial part in seamlessly linking them to the grid. Governments are playing a role by offering substantial assistance for renewable energy projects and updates to the grid, which frequently involve funding for HVDC technology, boosting the HVDC capacitor market. The increase in data centers and electric vehicle creates additional need for a constant supply of electricity.

KEY PLAYERS

Some of key players are listed in a HVDC Capacitor Market are Hitachi, Ltd. (Japan), General Electric (US), TDK Corporation (Japan), Eaton (US), KYOCERA Corporation (Japan), YAGEO Corporation (Taiwan), Vishay Intertechnology, Inc. (US), General Atomics (US), International Capacitors, S.A. (Spain), and ELECTRONICON Kondensatoren GmbH (Germany), Sieyuan Electric Co., Ltd. (China), Kunshan GuoLi Electronic Technology Co., Ltd. (China), Condis (Switzerland), samwha Capacitor Group (South Korea), API Capacitors(UK) and other players are listed in a final report.

RECENT DEVELOPMENT

-

In April 2023, Kyocera Corporation declared the development of a new capacitor (MLCC) with EIA 0201 dimensions (0.6 mm x 0.3 mm). As smartphones and wearable gadgets become more complex, electronic circuits require more MLCC devices with larger capacitance values.

-

In March 2023, GE Renewable Energy’s Grid Solutions business announced that it had been awarded three High-Voltage Direct Current (HVDC) contracts totaling roughly 6 billion euros as part of a specially formed consortium with Sembcorp Marine for TenneT’s innovative 2GW Program in the Netherlands.

-

In February 2023, Vishay Intertechnology, Inc. released a new series of low-impedance, Automotive Grade micro aluminum electrolytic capacitors that perform better in smaller case sizes than previous-generation alternatives.

-

In February 2023, TDK Corporation introduced its new EPCOS B43652 series of snap-in aluminum electrolytic capacitors with particularly small dimensions and strong ripple current carrying capacity. The DC link circuitry of onboard chargers in xEVs is a common application for these capacitors with high CV products.

-

HVDC Capacitor Market Report Scope:

Report Attributes Details Market Size in 2023

US$ 6.80 billion

Market Size by 2032

US$ 22.47 billion

CAGR

CAGR of 14.23 % From 2024 to 2032

Base Year

2022

Forecast Period

2024-2032

Historical Data

2020-2022

Report Scope & Coverage

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook

Key Drivers • Upgrading power grid with HVDC capacitors to boost future capabilities.

• HVDC technology reduces environmental impact when transmitting power over long distances by adopting sustainable practices.RESTRAINTS • The risk of high voltage is hidden in HVDC capacitors.

• The Hazardous Reality of Explosions Involving Capacitor Banks