Multi-mode Receiver Market Report Scope & Overview:

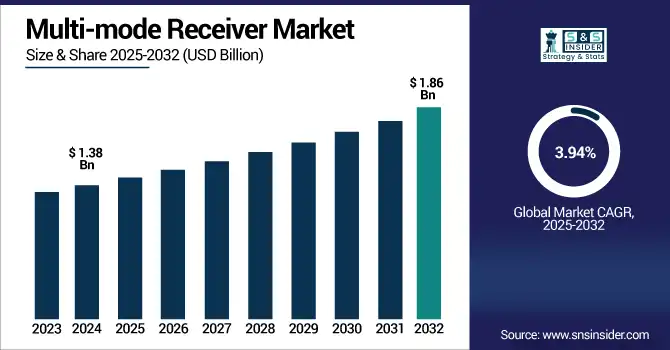

The Multi-mode Receiver Market size was valued at USD 1.38 billion in 2024 and is expected to reach USD 1.86 billion by 2032, growing at a CAGR of 3.94% over the forecast period of 2025-2032.

To Get more information on Multi-mode Receiver Market - Request Free Sample Report

The Multi-mode Receiver Market trends are rising adoption due to GNSS modernization and the growing need for precise navigation across sectors. Integration with autonomous systems and 5G networks is accelerating demand.

With navigational needs in complex environments such as urban canyons, mountainous regions and offshore operations, the requirement for resilient navigation solutions is a key growth driver for the Multi-mode Receiver Market. There is also accelerating adoption driven by the growth in unmanned systems, including drones and autonomous maritime vessels. The global market is also benefiting from regulatory focus on satellite-based augmentation systems (SBAS) and situation awareness at both civil and military levels.

-

Approximately 150,000 SBAS-equipped UAVs were in operation in 2024, mainly in North America, supporting precision agriculture and surveying.

-

North America and Europe allocated over USD 1 billion in 2024 toward SBAS infrastructure, including WAAS and EGNOS upgrades

The U.S. Multi-mode Receiver Market size was valued at USD 0.38 billion in 2024 and is projected to grow at a CAGR of 3.61%, reaching USD 0.50 billion by 2032. U.S. Multi-mode Receiver Market is in its growth stage due to increased defense upgrade programs, effective advancements in integrated avionics, growing need for space exploration, and development of smart transportation infrastructure within urban and inter-city networks.

Multi-mode Receiver Market Dynamics:

Key Drivers:

-

Rising Demand for Precise Navigation Drives Growth in Multi-Mode Receiver Market Across Key Sectors

The Multi-mode Receiver Market growth can be attributed mainly to increasing demand for accurate, dependable navigation across aerospace, automotive, defense, and maritime domains. As GNSS infrastructure continues modernizing and as multi-constellation systems become available to an ever-growing number of users, there is a sharp increase in the market of receivers together with the ability to handle multiple signals. The demand is also reinforced further by the government mandates at ADS-B, SESAR and NextGen in aviation. Secondly, the growing threat of jamming and spoofing of signals require the use of resilient, anti-jamming receiver technologies.

-

As of July 2024, nearly 30% of GNSS chipsets supported all four global constellations (GPS, GLONASS, Galileo, BeiDou), with most mass-market receivers now including SBAS support.

Restraints:

-

Signal Vulnerability and Environmental Interference Challenge Accuracy and Reliability in Multi-Mode Receiver Market Applications

The major restraint is signal vulnerability especially in a high-density urban environment due to GNSS and mixed signals degradation or blocked entirely. Although receiver sensitivity has improved over the years, effects such as multipath and signal attenuation still prevent accurate positioning. Moreover, reliance on external satellite networks carries operational risks in the event of solar storms or satellite outages.

Opportunities:

-

Multi-Mode Receivers Powering Growth in Drones Autonomous Vehicles Smart Farming and Urban Mobility Solutions

Maturation of areas such as drones, driverless cars, and robotic maritime platforms are rapidly developing new market in these zones. Additionally, the fusion of multi-mode receivers with AI, IoT, and 5G infrastructure is expected to support real-time, location-based services, especially in urban mobility, smart farming, and disaster management use cases.

-

BVLOS drones using GNSS-enabled autonomy are deployed in large-scale agricultural monitoring and surveying supported by advanced services such as Spirent’s GNSS Foresight.

Challenges:

-

Overcoming Integration and Security Challenges in AI IoT and Autonomous Systems for Critical Applications

The integration complexity is a key issue with advancing tech advancements AI, IoT and autonomous platforms. It continues to be a challenge to ensure interoperability between different platforms, software ecosystems and communication standards. There are also critical cybersecurity issues such as spoofing, jamming and data space threats for critical applications such as mission-critical defense, aviation and disaster response.

Multi-mode Receiver Market Segmentation Outlook:

By Platform

The Fixed-wing segment accounted for the largest share of 58.4% in the Multi-mode Receiver Market in 2024, as they are widely integrated onto commercial and military aircraft. This demand is driven by the emergence of stricter aviation laws such as FAA's ADS-B and Europe's SESAR targets that necessitate for precise and reliable navigation systems. Without a doubt, fixed-wing aircraft heavily depend on GNSS-enabled navigation for long-haul precision, optimizing routes, and even meeting the demands of global air traffic modernization programs.

During 2025 to 2032, the rotary-wing sector is anticipated to experience fastest growth among all CAGRs. The growth is fueled by rising usage of helicopters in the emergency medical services, search and rescue, and urban air mobility (UAM). To support accelerated adoption of multi-mode receivers and improve navigation performance in challenging mountainous and low-altitude urban environments, the data provided is complimentary to new applications that the rotary platforms are enabling.

By Fit

In 2024, the Line-fit segment held the largest Multi-mode Receiver Market share at 67.3% owing to the ease of integration during the manufacturing process of new aircrafts and vehicles. As more demanding safety, navigation, and connectivity requirements emerge, OEMs throughout aerospace and automotive are emphasizing factory-installed, multi-mode GNSS solutions. This pre-installation compliance with international regulations and less need for post deployment modifications make it the best go to choice of manufacturers.

Retrofit segment is expected to be the fastest-growing segment, with a CAGR of 12.5% from 2025 to 2032, on account of the growing demand for upgrading existing fleets for compatibility with new navigation needs. Airlines, defense agencies, and transport operators are upgrading legacy platforms with newer receivers to improve operational performance, safety, and increase compliance with regulations.

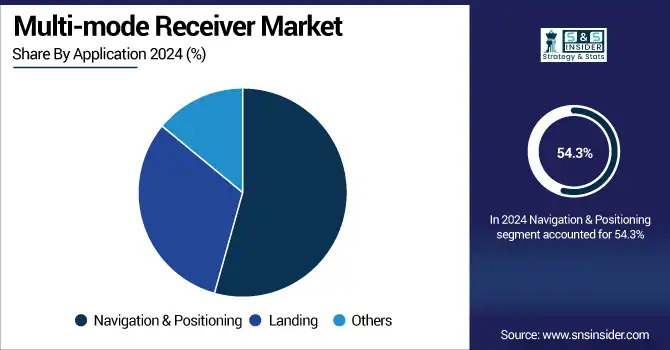

By Application

The Navigation & Positioning segment accounted for 54.3% of the Multi-mode Receiver Market in 2024, as it is an essential component for providing real-time, high-precision geolocation on platforms such as aircraft, drones, ships, and autonomous vehicles. In situations in which GPS is less as reliable, such as urban canyons or in some sparsely populated areas, continuous navigation over all travel phases requires the use of multi-mode receivers.

The Landing segment is expected to be the fastest-growing segment during 2025-2032, owing to the increasing demand for precision approach systems for fixed-wing and rotary-wing aircraft. Driven by regulatory mandates, safety and security considerations, operators are moving toward GNSS-based landing aids in low-visibility conditions and for remote airports.

By End-User

The Aerospace and Defense segment accounted for a 35.2% share in the Multi-mode Receiver Market in 2024, due their high demand for accurate, secure, and resilient navigation systems in both commercial and military aviation. They form part of receivers used for en-route navigation, situational awareness and weapons guidance. Demand has been driven by fleet compliance with international civil aviation mandates such as ADS-B, PBN, and military anti-jamming standards for wide ranging applications in thousands of fixed wing aircraft, UAV and missile platforms.

Telecommunications segment is projected to register the highest CAGR during the forecast period from 2025 to 2032 owing to the rapid growth of 5G network and the rise in demand for ultra-precise timing and synchronization. Telecom infrastructure adopts multi-mode to keep the network stable, overcome latency and enable real-time IoT services.

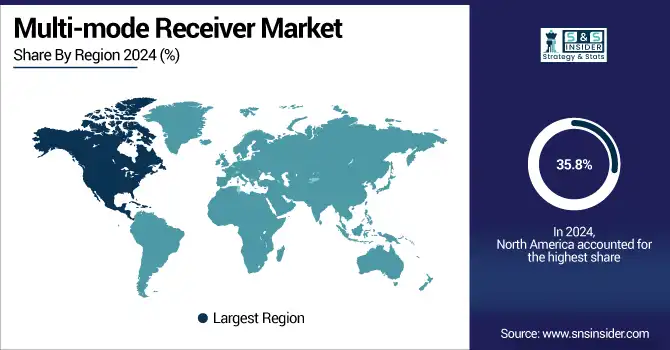

Multi-mode Receiver Market Regional Analysis:

North America accounted for 35.8% of the Multi-mode Receiver Market in 2024, attributed to early adoption of GNSS, substantial defense budget, and the presence of major aerospace and telecom companies. The region enjoys strong regulatory frameworks such as FAA's NextGen program and the widespread deployment of ADS-B mandates. Demand for precise navigation tailored to the needs of autonomous cars, commercial aviation, military applications, and smart infrastructure is accelerating market growth. Continuous development of satellite-based augmentation systems (WAAS) and synergy between IoT and 5G integrated GNSS receivers fortifying regional market across various end-use verticals.

The North American market was dominated by the U.S. as a result of it having a large defense budget, early investment in 5G networks, a strong airframe manufacturing base, and more recently, government-backed GNSS modernization programs such as WAAS and NextGen.

Asia Pacific is projected to grow at the fastest CAGR of 4.73% from 2025 to 2032. Driven by early adoption of satellite navigation systems has been accelerated as a result of government investments in various systems such as BeiDou in China and IRNSS in India. This demand is further strengthened by the growth of autonomous vehicles, smart city initiatives, and commercial UAV deployment. Moreover, countries are rapidly modernising navigation infrastructure as part of a process to bring both regional airlines and the defence sector into compliance with existing and future international safety and efficiency standards.

The market in Asia Pacific was dominated by China owing to large-scale deployment of BeiDou Navigation System, fast pace of military modernization, and heavy investments in smart transportation and autonomous technology ecosystems.

Support from large-scale deployment of the Galileo satellite navigation system across Europe along with regulatory frameworks such as SESAR, is enabling Europe to continue to hold a strong position in the market. High adoption is seen across commercial aviation, defense, maritime and precision agriculture sectors within the region. The integration of advanced GNSS technologies is then driven by rising investments in autonomous mobility, 5G infrastructure, and smart cities.

Middle East & Africa and Latin America also grew steadily during 2024 with increased investments in aviation infrastructure, defense modernization and maritime navigation systems. Nations are improving GNSS-based solutions for local connection, national lines security, and savvy transportation. Moreover, increasing utilization of UAVs in agriculture and surveillance and an encouraging telecom infrastructure is gradually supporting adoption of multi-mode receivers in these regions.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players:

Some of the major Global Multi-mode Receiver companies are Honeywell, Thales, BAE Systems, Collins Aerospace, Garmin, Indra, Saab, Leonardo, Curtiss-Wright, and Cobham.

Recent Developments:

-

In July 2024, At the Farnborough Airshow, Honeywell revealed that United Airlines ordered a suite of cockpit avionics including its Integrated Multi‑Mode Receiver for its new 737 MAX aircraft.

-

In 2024, Collins Aerospace Partnered with EUSPA on the MUGG project, a dual-frequency, multi-constellation GNSS receiver system, enhancing satellite navigation resilience for civil/commercial users.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 1.38 Billion |

| Market Size by 2032 | USD 1.86 Billon |

| CAGR | CAGR of 3.94% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Platform (Fixed-wing, Rotary-wing) • By Fit (Line-fit, Retrofit) • By Application (Navigation & Positioning, Landing, Others) • By End-User (Telecommunications, Automotive, Aerospace and Defense, Marine and Shipping, Agriculture, Construction and Surveying, Transportation and Logistics and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Honeywell, Thales, BAE Systems, Collins Aerospace, Garmin, Indra, Saab, Leonardo, Curtiss-Wright, and Cobham. |