Hydrogen Fluoride Gas Detection Market Analysis & Overview:

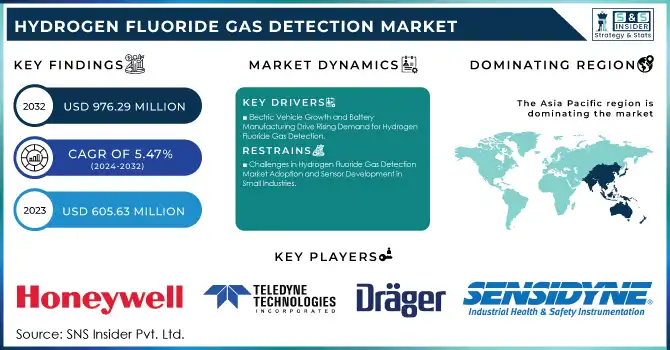

The Hydrogen Fluoride Gas Detection Market Size was valued at USD 605.63 Million in 2023 and is expected to reach USD 976.29 Million by 2032, growing at a CAGR of 5.47% over the forecast period 2024-2032.

Get More Information on Hydrogen Fluoride Gas Detection Market - Request Sample Report

The Hydrogen Fluoride Gas Detection Market is experiencing a boom primarily due to the growing requirement for safety and environmental regulations in the industries that use hydrogen fluoride. Hydrogen fluoride is a toxic and corrosive gas, so, its concentration must be monitored in an industrial setting. With the increasing expansion of industries such as mining, metallurgy, chemical manufacturing, and pharmaceuticals, the demand for systems that detect gas has grown to prevent exposure and fulfill regulatory requirements. With governments worldwide enforcing strict workplace safety regulations, the hydrogen fluoride gas detection system market is gaining traction in multiple sectors. Furthermore, increasing environmental awareness about emissions of toxic gases students to the market growth. In 2023, hydrogen fluoride gas detection system demand from chemical manufacturing and pharmaceuticals accounted for more than 30% of market adoption, as stringent regulations pushed hydrogen fluoride into the spotlight. Adoption in the mining and metallurgical industries increased 20-25% from 2022-2023. Due to their higher sensitivity, advanced detection technologies such as Non-Dispersive Infrared systems now represent 50% of new installations. Industry 4.0 itself will witness a 27% growth for the segment of Digital and remote monitoring solutions between 2023-2024. In areas such as the U.S. and Germany, 70% of HF detection systems were installed due to tougher safety regulations, though in Europe actually, between 10-15% of industrial plants have installed HF detectors just to meet the requirements of new environmental standards.

The development of sensor technology and the increasing demand for stationary and portable gas detection instruments are driving the market

Move towards smart sensors providing instantaneous detection and directly connecting to cloud-based systems are revolutionizing the detection abilities and making it more cost-effective and convenient than ever before. The rise in demand from industries where mobility and portability are crucial such as on-site operations or in remote areas is driving the growth of portable gas detectors. Stricter regulations, advances in HF gas technology, and the increasing focus on safety and environmental responsibility are driving the hydrogen fluoride gas detection market growth. 25% increase in adoption of WIRELESS & IoT-enabled gas detection systems owing to the need for real-time monitoring & remote analysis. In terms of sectors, the use of portable gas detectors is rising at a CAGR of 15-20%, primarily driven by demand from mining, oil & gas, and chemicals sectors. At the same time, MEMS-based sensors and infrared spectroscopy technology are expected to improve detection correctness and decrease false alarms by 20%. Cloud-based platforms for preventive maintenance are expected to share a 10-15% increase as well.

Hydrogen Fluoride Gas Detection Market Dynamics

Key Drivers:

-

Electric Vehicle Growth and Battery Manufacturing Drive Rising Demand for Hydrogen Fluoride Gas Detection

The growing electric vehicle and battery manufacturing industry is one of the principal market drivers for the Hydrogen Fluoride Gas Detection Market. Hydrogen fluoride is crucial for the manufacture of lithium-ion batteries, which are widely used in electric cars. The world is rapidly moving to sustainable energy and electric vehicles and the demand for gas detection systems that are more efficient and reliable is growing. Battery manufacturing plants where HF-based chemicals such as hydrofluoric acid are processed during production need stringent monitoring systems to make sure that workers are safe and to keep industry safety standards. There has also been a marked increase in this activity in Europe, North America, and some areas of Asia-Pacific, where investments in renewable energy and electric vehicle infrastructure are common, which contribute to the higher growth of hydrogen fluoride gas detection market. Worldwide battery manufacturing capacity jumped to 2.5 TWh in 2023, a 25% year-on-year increase in 2022. Already, 70% of worldwide battery production capacity is spoken for by 2030. As a result, the company is witnessing a 25% rise in the adoption of hydrogen fluoride gas detectors in lithium-ion battery production plants owing to increased demand for the safety of personnel when handling these gases.

-

Industrial Growth in Asia Pacific and Latin America Drives Demand for Hydrogen Fluoride Gas Detection

Another important factor contributing to it is the increasing industrialization in developing countries, particularly in Asia-Pacific and Latin America. With the rapid industrialization of countries such as China and India, the chemical manufacturing, glass etching, and mining sectors are growing quickly. Hydrogen fluoride is identified in different production stages and often works with it, and hence these industries have the potential to spill it facilitating gas leaks and gas exposure. Hence, there is an increasing need for gas detection solutions for worker and environmental safety purposes. In these regions, industrial growth along with growing knowledge of environmental regulations and occupational safety are factors that will spur demand for gas detection equipment. This trend is expected to last long due to the modernization of industrial infrastructure in these emerging markets along with synchronization with global safety standards will further drive the market growth of hydrogen fluoride gas detection solutions. The chemical manufacturing and mining sectors in the Asia-Pacific region are buzzing with an 10% growth per year, while for the major industries in Latin America, including mining and chemicals has been 8%. The industrial expansion, reinforced by stricter safety and environment regulations, has driven 15-20% demand for hydrogen fluoride gas detection systems in high-risk industries like glass etching, chemical production, and mining.

Restrain:

-

Challenges in Hydrogen Fluoride Gas Detection Market Adoption and Sensor Development in Small Industries

One of the most important restraints of the Hydrogen Fluoride Gas Detection Market is the limited adoption in smaller industries due to a lack of awareness and fewer availabilities. Although gas detection systems are now being made available for larger industries, small-scale firms, especially in developing markets may not be able to afford these safety technologies as their budgets are lower or they may not be aware of the risks linked with hydrogen fluoride exposure. That failure to penetrate smaller-scale operations can stifle the overall growth of the market as a whole. Further, another major drawback is the technical challenges in sensor development. It uses hydrogen fluoride which is highly corrosive and highly reactive, eventually degrading the sensor over time. Technological difficulties exist in creating sensors that are both robust and reliable in the extreme environments found where HF is known to occur. As a result, market innovation providing ultra-competent reliable long-term detection devices capable of 24/7 performance at industry-critical Intrinsic Zone-level-aged conditions has lagged on the market.

Hydrogen Fluoride Gas Detection Market Segments

By Forms

Gas Hydrogen Fluoride accounted for the largest share of the market with 64% in the year 2023 and is expected to register the fastest CAGR from 2024-2032. Hydrogen fluoride in gaseous form is widely used in chemical manufacturing, mining, glass etching, pharmaceuticals, and accounts for a large share of the market. Much as hydrogen fluoride in the vapor state is more widely dealt with in various industrial processes, gas detection systems are important to ensure employee safety as well as environmental safety. Also, a gas is more difficult to contain, making detection technologies even more necessary in real-time to avoid unsafe leaks or unintentional exposure, which drives gas detection technologies adoption. This growth is leading to additional advancements in sensor technology, enabling an ever-more robust, accurate, and efficient detection of gas hydrogen fluoride. This new age of sensor models additionally consists of clever sensors with now not only fashionable features of thousands and thousands of kinds of gases, explosive, and chemical kind gas but additionally include characteristics like wireless ability, actual time monitoring, statistics analytics, phenomenon examination, which admit primary Gas levels with remote focal point monitoring and integration onto higher stage protection programs. Such improved functionality aids industries in adhering to the rigorous safety and environmental regulations that are enforced today. In addition, increasing awareness about the hazardous nature of hydrogen fluoride gas and the threat it poses to human health and safety, particularly in closed-environment or uncontrolled surroundings, has led many industries to implement detection systems. The surge in efforts taken worldwide in the workplace safety sector coupled with the growing compliance standards will drive the gas hydrogen fluoride detection market growth over the upcoming years.

By Type

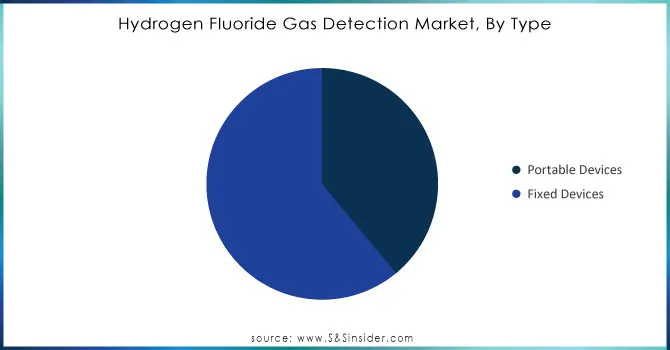

The fixed Device segment accounted for the highest market share of 56.1% in 2023, owing to extensive usage in large-scale industrial applications where real-time hydrogen fluoride gas detection is required for continuous monitoring in hazardous environments. These devices are used in stationary locations inside factories, chemical plants, and other buildings that use hydrogen fluoride gas in large, dangerous amounts. Non-portable or fixed devices stand for dependability, permanence, and continuous monitoring, thus, are recommended for industries that focus on enduring safety and long-run compliance. This is a factor that additionally contributes to their share of the market, as their ability to cover large spots and it can detect gas leaks throughout the facility.

Portable Devices are anticipated to register the fastest Compound Annual Growth Rate during the forecast period (2024-2032) due to increasing demand for flexibility and mobility in the hazardous environment. These portable detection devices enable workers to conduct localized monitoring where the fixed system may not be suitable during inspections and maintenance which makes sense either in prepared areas or in remote places. With industries moving toward dynamic operation spaces, portable devices provide user-friendliness, real-time readings, and rapid response against potential threats in different locations. Ongoing technological developments in sensor accuracy, battery life, and wireless connectivity are further augmenting the demand for portable gas detectors due to their high portability.

Get Customized Report as per Your Business Requirement - Request For Customized Report

By End Use

In 2023, the Mining and Metallurgical sectors dominated the market with a share of 34% as hydrogen fluoride finds large applications in mineral processing, refining, and extraction of metal from ores. Hydrogen fluoride is a toxic and corrosive compound that requires constant monitoring, especially in the mining and metallurgical industries, where it is employed in the extraction of metals and minerals at various production cycles. Hydrogen fluoride detection systems are in high demand in these specific sectors due to the nature of operations, where strict safety regulations are working to ensure no exposure to any hazardous gases. This need for the safety of the workers in such an adverse environment has made the mining and metallurgical vertical the largest revenue-generating segment of the market.

The Chemical industry is projected to witness the fastest CAGR during 2024-2032, due to the growing use of hydrogen fluoride for various chemical products, including refrigerants, pharmaceuticals, and polymers. Hydrogen fluoride is also utilized by the chemical industry for the synthesis of different chemical compounds, and the ubiquitous presence of toxic HF gas requires rigorous detection and control systems for large-scale chemical processes. The chemical industry is generally expanding over the globe, and so also in rising development economic systems, gas discovery systems demand expansion swiftly. Environmental regulations, safety standards, and worker protection are increasingly becoming prominent drivers, which are propelling the chemical sector towards advanced hydrogen fluoride gas detection technologies contributing to fastest fastest-growing segment in the market.

Hydrogen Fluoride Gas Detection Market Regional Analysis

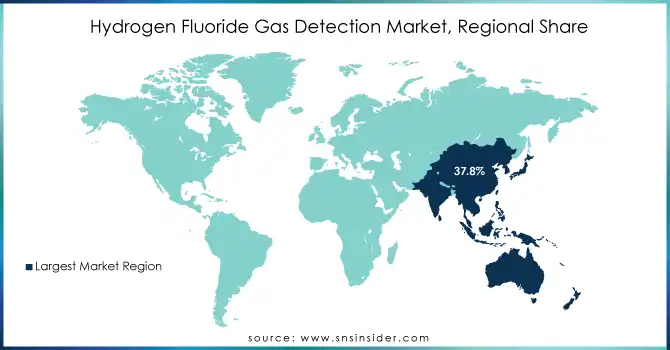

Asia Pacific accounted for the largest share of the hydrogen fluoride gas detection market at 37.8% in 2023. As major industrial sectors like chemical manufacturing, mining, and electronics have grown rapidly in China, the demand for hydrogen fluoride gas detection systems has increased. To illustrate, one of the biggest oil and gas companies, China National Petroleum Corporation (CNPC) works in the atmosphere of hydrogen fluoride applied in refining processes and places an increasing need for gas detection. Furthermore, India's massive chemical production and mineral processing sectors add significantly to this market too, with firms like Reliance Industries pouring money into sophisticated safety technologies to satisfy strict worker safety & environmental regulations.

North America is forecast to maintain the fastest CAGR during the period from 2024-2032 due to the increasing use of hydrogen fluoride gas detection systems in manufacturing sectors such as chemical production, pharmaceuticals, and energy. A leading clamoring for American help especially in territories like semiconductor assembling and lithium-particle battery creation, in which hydrogen fluoride is a base substance used for numerous compound cycles. Sectors such as Intel and Tesla are quite active in these and quite a few others, where they have the technology of gas detection to keep their employees safe and also deal with regulation issues. The demand for hydrogen fluoride gas detection systems is also boosted by the rapid development of the electric vehicle (EV) market, especially in the U.S., where hydrogen fluoride is used in many of the processes related to battery production, particularly etching and refining.

Key Players

Some of the major players in the Hydrogen Fluoride Gas Detection Market are:

-

Honeywell International (Portable Gas Detectors, Fixed Gas Detection Systems)

-

Teledyne Technologies (Multi-Gas Detectors, Personal Gas Monitors)

-

Drägerwerk (Toxic Gas Detectors, Personal Safety Monitors)

-

MSA Safety Incorporated (Portable Gas Detectors, Fixed Gas Detection Systems)

-

GfG Instrumentation (Gas Detection Tubes, Portable Gas Detectors)

-

Sensidyne (Fixed Gas Detectors, Gas Detection Tubes)

-

Crowcon Detection Instruments (Multi-Gas Monitors, Portable Gas Detectors)

-

Analytical Technology (Fixed Gas Monitors, Portable Gas Detectors)

-

RKI Instruments (Personal Gas Monitors, Fixed Detection Systems)

-

R.C. Systems (Industrial Gas Monitors, Area Gas Detection Systems)

-

Industrial Scientific Corporation (Portable Gas Detectors, Fixed Gas Detection Systems)

-

Bruel & Kjaer (Handheld Vibration Meters, Acoustic Analyzers)

-

Inficon (Handheld Leak Detectors, Stationary Gas Detectors)

-

Jerome Instruments (Gold Film Gas Detectors, Mercury Vapor Analyzers)

-

Gas Sensing Solutions (Infrared Gas Sensors, Portable Gas Detectors)

-

Emerson Electric (Fixed Gas Detectors, Portable Gas Detection Monitors)

-

OPSIS System (Continuous Emission Monitoring Systems, Process Control Instruments)

-

Alphasense Ltd (Electrochemical Sensors, Optical Particle Counters)

-

City Technology (Gas Detection Sensors, Electrochemical Cells)

-

LDetek (Online Trace Gas Analyzers, Industrial Gas Detectors)

Some of the Raw Material Suppliers for Hydrogen Fluoride Gas Detection companies:

-

Air Liquide

-

Linde PLC

-

Mitsui Chemicals

-

Honeywell Performance Materials

-

Daikin Industries

-

Sumitomo Chemical

-

Asahi Glass Co. (AGC Inc.)

-

Solvay

-

Shandong Dongyue Chemical Co., Ltd.

-

Fujian Yongjing Technology Co., Ltd.

Recent Trends

-

In September 2023, Teledyne launched the enhanced GS700-Hydrogen detector, capable of detecting both hydrogen and natural gas in one device, supporting key hydrogen transition projects like SGN’s H100 Fife in Scotland.

-

In August 2023, MSA Safety's ALTAIR io 4 portable gas detector Frost & Sullivan New Product Innovation Award, recognizing its excellence in technological innovation and strategic product development in the global gas detection industry.

-

In November 2024, Sensidyne launched the SensAlert IR, a fixed-point infrared gas detector with advanced dual-wavelength NDIR technology, offering precise and reliable gas detection in harsh industrial environments.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 605.63 Million |

| Market Size by 2032 | USD 976.29 Million |

| CAGR | CAGR of 5.47% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Forms (Liquid Hydrogen Fluoride, Gas Hydrogen Fluoride) • By Type (Fixed Devices, Portable Devices) • By End Use (Mining and Metallurgical, Chemical, Glass Etching, Pharmaceutical, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Daikin Industries Ltd., Mitsubishi Corporation, Huntsman Corporation, Arxada, SABIC, Asahi Kasei Corporation, Topas Advanced Polymers, Zeon Corporation, Chemours Company LLC, DIC Corporation, Arkema, Showa Denko Materials Co. Ltd., Shin-Etsu Chemical Co. Ltd., Dow, Olin Corporation, Celanese Corporation, Solvay, Sumitomo Chemical Co. Ltd., Nippon Steel & Sumitomo Metal Corporation, JSR Corporation. |

| Key Drivers | • Electric Vehicle Growth and Battery Manufacturing Drive Rising Demand for Hydrogen Fluoride Gas Detection • Industrial Growth in Asia Pacific and Latin America Drives Demand for Hydrogen Fluoride Gas Detection |

| Restraints | • Challenges in Hydrogen Fluoride Gas Detection Market Adoption and Sensor Development in Small Industries |