IaaS & PaaS Market Report Scope & Overview:

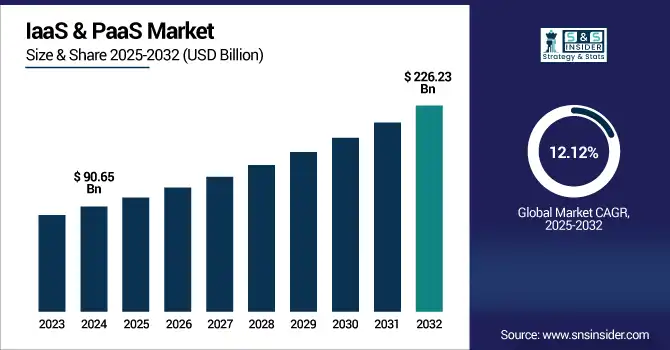

The IaaS & PaaS Market size was valued at USD 90.65 billion in 2024 and is expected to reach USD 226.23 billion by 2032, expanding at a CAGR of 12.12% over the forecast period of 2025-2032.

To Get more information on IaaS & PaaS Market - Request Free Sample Report

The IaaS & PaaS Market is experiencing robust growth as businesses increasingly adopt cloud services to enhance agility, scalability, and cost-efficiency. IaaS offers virtualized resources like storage and servers, while PaaS supports streamlined application development and deployment. IaaS currently holds the dominant market share due to its extensive use across industries, whereas PaaS is the fastest-growing segment, driven by DevOps, microservices, and cloud-native applications. Public cloud leads in deployment, though hybrid models are gaining traction. North America remains the largest regional market, fueled by strong enterprise adoption and major cloud providers. Digital transformation continues to propel demand for cloud-based infrastructure solutions.

According to research, in 2024, over 64% of new applications were developed using cloud-native platforms like PaaS, up from 46% in 2021. Organizations leveraging PaaS also saw a 58% reduction in development time compared to traditional environments.

The U.S IaaS & PaaS Market size reached USD 28 billion in 2024 and is expected to reach USD 65.30 billion in 2032 at a CAGR of 11.17% from 2025 to 2032.

The United States leads the Infrastructure as a Service and Platforms as a Service market through its relatively advanced digital infrastructure and digital structures, early digital adoption of cloud capabilities in its economy, and with leading providers globally such as AWS, Microsoft Azure, Google Cloud, and IBM. Enterprises from all sectors: governments, porcelain plate manufacturing, health systems, and finance, are investing in their IT cloud infrastructure to stimulate innovation, improve circa-40 % of their operational efficiency, and enable remote access to data. Continued increased IT spending, plus the growth of AI, big data, and IoT applications, continues to create a large market for DLC.

IaaS & PaaS Market Dynamics

Drivers:

-

Accelerated Digital Transformation and Enterprise Cloud Adoption Fueled by Remote Work and Scalability Demands.

Organizations across industries are rapidly moving their core operations to the cloud. They are making this investment for remote working flexibility, agility, and cost management. IaaS & PaaS market companies are adopting Infrastructure as a Service (IaaS) and Platform as a Service (PaaS) technology that facilitates DevOps, microservices, and analytics workloads. More recently, we are seeing new trends that include AI-driven provisioning, serverless platforms, and container orchestration (Kubernetes). Leading cloud providers have launched managed PaaS offerings that have a built-in CI/CD pipeline, demonstrating a serious preference for deploying faster, integrating more seamlessly, and working cross-organizationally. Cloud-native development and automated infrastructure remain the primary IaaS & PaaS market growth drivers.

Restraints:

-

Rising Data Sovereignty Regulations and Multi-Cloud Complexity Increase Compliance and Operational Costs.

strict data sovereignty laws like the EU’s GDPR and India’s Data Protection Bill mean companies often have to store data within specific regions, which complicates things and raises costs. Businesses need to comply with region-specific rules while managing multi-cloud setups, which can push up legal, security, and infrastructure expenses. Unfortunately, the complexity of governance frameworks and the need for thorough audits can slow down adoption, acting as major barriers to the broader use of cloud platforms.

Opportunities:

-

Surge in Industry-Specific Cloud Services and Regulatory Mandates Create New Platform Expansion Opportunities.

There is unprecedented pressure to digitalize some sectors across finance, healthcare, and the public sectors, driven by regulatory requirements, leading to increased demand for specialized cloud platforms. Providers are introducing PaaS offerings with compliance certifications tailored to a specific regulated IaaS & PaaS industry, including healthcare clouds compliant with HIPAA and infrastructure approved by FedRAMP. AWS is taking the lead in some recent initiatives by launching specialized government cloud regions and PaaS environments, and helping sectors by supporting FinOps use cases and telehealth use cases. The opportunities for cloud vendors to sell into very regulated verticals using sector-specific, cloud-native solutions are significant.

Challenges:

-

Legacy System Integration and Skills Shortage Impede Seamless Migration and Cloud-First Strategies.

Many businesses are still relying on legacy on-premises systems that require extensive reengineering before moving to IaaS or PaaS environments. This includes refactoring monolithic applications, supporting interoperability, and managing proprietary dependencies. Meanwhile, the lack of trained DevOps engineers and cloud architects slows adoption and cloud transformation. Addressing these concerns requires investing in workforce training, modernization programs, and modernization tooling all adding which create complexity and extend the migration timeline.

IaaS & PaaS Market Segmentation Analysis

By Service Type

IaaS leads with 62.38% revenue share, driven by enterprises seeking flexible, on-demand compute and storage. Amazon Web Services introduced its Graviton3E instances in late 2024 for energy-efficient, high-performance workloads, while Microsoft Azure expanded its Ultra Disk SSD offerings for latency-sensitive apps. Google Cloud launched Titan C5D VM types for enhanced security in hybrid environments. These innovations meet growing demand for scalable infrastructure, driven by rising AI/ML usage and data-intensive operations.

PaaS is growing fastest with a 12.88% CAGR, enabling rapid development and deployment for cloud-native applications. In 2024, IBM Cloud released fully managed Red Hat OpenShift on Kubernetes, targeting hybrid DevOps teams, while Oracle introduced GraalVM support on Oracle Cloud Infrastructure. Google Cloud’s launch of Vertex AI Workbench and AWS’s CodeCatalyst service accelerates developer workflows.

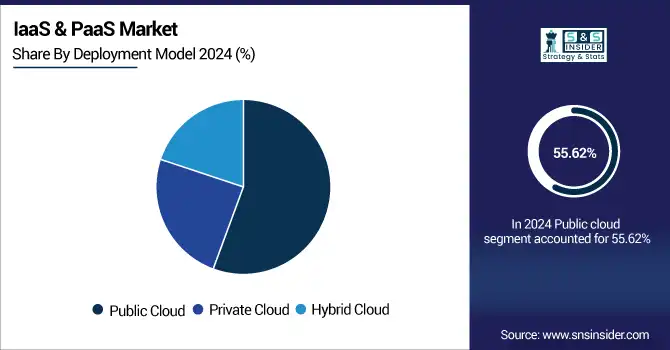

By Deployment Model

Public cloud remains dominant at 55.62%, favored for its elastic scale, low upfront costs, and global infrastructure. AWS expanded its regional presence with new US Gov and Europe zones in 2024, while Azure launched new Confidential VM instances to address enterprise privacy needs. Google Cloud introduced its Assured Workloads for Financial Services to meet regulatory compliance. These developments cater to organizations prioritizing rapid scalability, global reach, and regulatory alignment. In the IaaS & PaaS market, public cloud remains the deployment model of choice, driven by increasing demand for distributed, cost-effective computing.

The hybrid cloud is growing at 13.29% CAGR as businesses balance control with flexibility. VMware and AWS introduced VMware Cloud on AWS Outposts, enabling on-prem consistency with public-scale services. Microsoft expanded Azure Arc to support hybrid Kubernetes and PaaS across private data centers. IBM launched Cloud Satellite extensions for secure connectivity across edge sites. The hybrid model drives adoption in the IaaS & PaaS market by combining the best-of-both worlds, enabling seamless workload portability and governance across on-prem and cloud ecosystems.

By Enterprise Size

Large enterprises account for 68.29% IaaS & PaaS market share, driven by complex IT ecosystems and significant cloud budgets. In 2024, AWS launched Enterprise Support for mainframe migration, while Azure rolled out Tier 1 PaaS services for SAP workloads. Google Cloud debuted Assured Open-Source Support tailored for enterprise apps. These releases assist organizations in modernizing legacy systems at scale. Fueled by digital transformation, security, and compliance demands, large enterprises are the primary adopters within the IaaS & PaaS market.

SMEs are the fastest-growing segment at 12.76% CAGR, drawn to cost-effective, self-service cloud tools. DigitalOcean released App Platform 2.0 for no-code deployments, while AWS LightSail added managed containers. Microsoft introduced Azure Sandbox services for small dev teams. These simplified offerings address limited IT resources and accelerate digital initiatives for SMEs.

By Industry Vertical

The IT & telecom vertical leads with 24.48%, leveraging cloud for software delivery, network services, and infrastructure modernization. In 2024, Cisco launched its Unified Compute System X-series on Azure for telecom workloads, while Verizon extended its Business Cloud NFVI platform with integrated Kubernetes and PaaS. Oracle introduced Telecom Communications Cloud for 5G service orchestration. Within the IaaS & PaaS market, telecom and IT firms drive adoption, integrating cloud-native solutions into core infrastructure and enabling next-gen service architectures.

Healthcare is the fastest-growing vertical at 14.05% CAGR, powered by telehealth, EHR modernization, and AI diagnostics. AWS launched its HealthLake Gen2 to secure healthcare data workflows, and Microsoft introduced Azure Health Data Services with natural language querying. Google Cloud rolled out its PHI-ready Healthcare API Suite. Providers and insurers are adopting compliant, scalable cloud services.

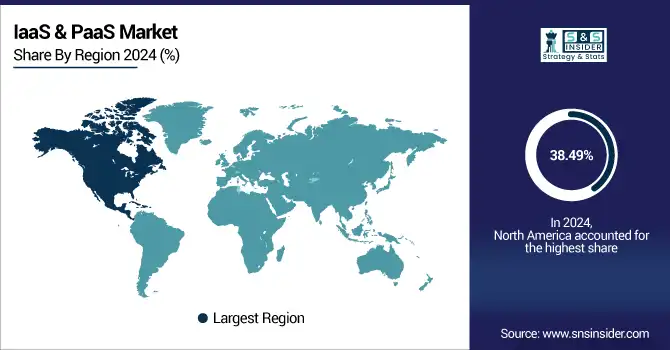

IaaS & PaaS Market Regional Outlook

North America was the IaaS & PaaS leader with a revenue share of 38.49%. North America anchors the IaaS and PaaS market due to high enterprise investments in cloud, broad uptake of infrastructure services, and proximity to established providers such as AWS, Azure, and Google Cloud. The United States continues to dominate the region mainly due to its sizable cloud-native and cloud-first infrastructure, available IT budgets, and being the pioneer of early cloud adoption compared to private enterprises and public institutions.

Europe is a prominent player in the IaaS and PaaS market, driven by various mandatory limitations imposed on data privacy (e.g., GDPR) and enterprise adoption of cloud-native services. The demand is especially prevalent in financial services, telecoms, and manufacturing segments. Cloud providers are investing in super regional compliant solutions, edge and sovereignty-based services, and environmentally friendly data centers. Germany is in the lead within Europe due to digitization programs for industrial-based services, the size of enterprises within the region investing heavily in services and product offerings that meet cloud compliance and regulatory standards.

Asia Pacific is the fastest-growing region with a 22.59% CAGR, driven by digital transformation in emerging economies, growing investments in telecom and fintech, and expanding middle-class business adoption. Rapid deployment of cloud-native applications, edge computing, and AI-driven services in countries such as India, China, and Southeast Asian markets is expanding infrastructure demand. China leads this growth, propelled by aggressive government cloud initiatives, extensive infrastructure investment, and large-scale enterprise digitalization.

The Middle East & Africa and Latin America regions are witnessing steady growth in IaaS & PaaS adoption, driven by digital transformation agendas, rising demand across key sectors, and localized data center investments. The UAE leads MEA with strong cloud-first policies, while Brazil dominates Latin America due to its thriving fintech ecosystem and progressive data privacy regulations.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

The major key players of the IaaS & PaaS market are Amazon Web Services (AWS), Microsoft Azure, Google Cloud Platform (GCP), IBM Cloud, Oracle Cloud, Alibaba Cloud, Salesforce, SAP Cloud Platform, VMware, Huawei Cloud, and others.

Key Developments

-

In May 2025, Amazon Web Services (AWS) launched key innovations, including Aurora DSQL for serverless SQL, Outpost Gen 2 for hybrid deployments, AWS Transform for AI migration, and Ocelot, its next-generation quantum chip, expanding advanced cloud capabilities.

-

In May 2025, Microsoft Azure launched App Service Premium v4 (PV4) in public preview during Microsoft Build, offering enhanced CPU, memory capabilities, and Availability Zone support to boost application scalability, performance, and regional fault tolerance.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 90.65 Billion |

| Market Size by 2032 | USD 226.23 Billion |

| CAGR | CAGR of 12.12% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Service Type (Infrastructure as a Service, Platform as a Service) •By Deployment Model (Public Cloud, Private Cloud, Hybrid Cloud) •By Enterprise Size (Small and Medium Enterprises, Large Enterprises) •By Industry Vertical (BFSI, Healthcare, Retail, IT and Telecommunications, Manufacturing, Government, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Amazon Web Services (AWS), Microsoft Azure, Google Cloud Platform (GCP), IBM Cloud, Oracle Cloud, Alibaba Cloud, Salesforce, SAP Cloud Platform, VMware, Huawei Cloud |