Ice Cream Packaging Market Report Scope & Overview:

Get More Information on Ice Cream Packaging Market - Request Sample Report

The Ice Cream Packaging Market Size was valued at USD 1.01 billion in 2023 and is projected to reach USD 1.46 billion by 2032 growing at a CAGR of 4.2% from 2024 to 2032.

The growing popularity of ice cream around the world, fueled by exciting new flavors and varieties, is expected to drive demand for innovative packaging solutions. Industry experts predict the ice cream packaging market will expand significantly. This trend is further fueled by unique product launches like Amul's "Isabcool" ice cream in May 2022.

This innovative flavor, featuring cashew, figs, and the laxative Isabgol, reflects Amul's reputation for experimentation and caters to a specific health-conscious audience. Similar creative launches by leading ice cream and dairy brands are expected to keep the global ice cream packaging market churning.

As consumer preferences evolve rapidly, sustainability takes center stage. Manufacturers are scrambling to develop innovative packaging solutions that are both eye-catching and eco-friendly. This focus on meeting consumer needs and environmental concerns is expected to propel the global ice cream packaging market forward in the coming decade. With businesses seeking to enhance productivity and attract customer attention, this market surge is poised to be significant. Ice cream packaging offers a multitude of benefits, and its demand is steadily rising across both online and brick-and-mortar stores. Recognizing this trend, manufacturers are ramping up production capabilities to meet the growing need for innovative and functional packaging solutions. This ensures a steady supply to keep the ice cream industry thriving.

MARKET DYNAMICS

KEY DRIVERS:

-

Driving Demand Through Constant Industry Innovation

Ice cream makers are adding healthy ingredients to their products to make them more appealing as a healthy treat. This trend of functional foods with added benefits is expected to boost ice cream sales worldwide.

-

A surge in R&D spending is fueling a wave of digital transformation across industries.

RESTRAINTS:

-

Stringent government regulations on the types of materials allowed in ice cream packaging.

Governments around the world are implementing stricter regulations on the materials used in packaging, particularly regarding the use of certain chemicals and heavy metals. This can limit the options available to manufacturers and potentially increase costs to comply.

OPPORTUNITY:

-

Strong, flexible, and cold-resistant plastic packaging could be a key driver of future growth.

The ice cream market is poised for growth due to a surge in demand for plastic containers with lids. These containers offer the ideal combination of strength, flexibility, and resilience to cold temperatures, making them a perfect fit for storing and transporting ice cream.

-

The rise of eco-friendly ice cream packaging presents exciting opportunities for major players in the industry.

CHALLENGES:

-

Products with short shelf lives and high seasonality present unique challenges for businesses.

Ice cream's short shelf life due to spoilage and seasonal demand peaks in summer create a double whammy for the market. The high cost of maintaining proper storage adds another layer of challenge.

-

The absence of international uniformity in ice cream packaging regulations.

It creates challenges for manufacturers, as they need to adapt their packaging to meet the specific requirements of each region they operate in, hindering the streamlining of production processes.

IMPACT OF RUSSIA UKRAINE WAR

Russia might see a temporary boost in ice cream packaging due to production increases, the long-term outlook is uncertain due to sanctions. Ukraine, on the other hand, is likely to experience a decline in ice cream production and packaging demand due to the war's impact on its dairy industry. The ultimate impact depends on the duration and severity of the war. A prolonged conflict could significantly worsen the situation in Ukraine and potentially affect Russia's supply chain more severely. The effectiveness of sanctions and Russia's ability to find alternative suppliers will also play a role. The Russia-Ukraine war has a mixed impact on the ice cream packaging market. While there's a chance for short-term growth in Russia, the long-term outlook for both countries remains uncertain.

IMPACT OF ECONOMIC SLOWDOWN

The initial strong growth of 40% in the first half indicates a high demand for ice cream packaging. However, the slowdown led to a decrease in sales growth to 18-20% for the entire year. This directly translates to a reduced need for ice cream packaging. Economic downturns often lead companies to cut back on new product launches. In the ice cream industry, this could mean fewer unique ice cream flavors or portion sizes being introduced. These new products typically require new or modified packaging, so fewer launches lead to lower demand for innovative packaging solutions. As economic pressures tighten household budgets, consumers may cut back on non-essential purchases like ice cream. This puts pressure on ice cream manufacturers to reduce costs. One way they might achieve this is by opting for more basic or downsized packaging options.

KEY MARKET SEGMENTS

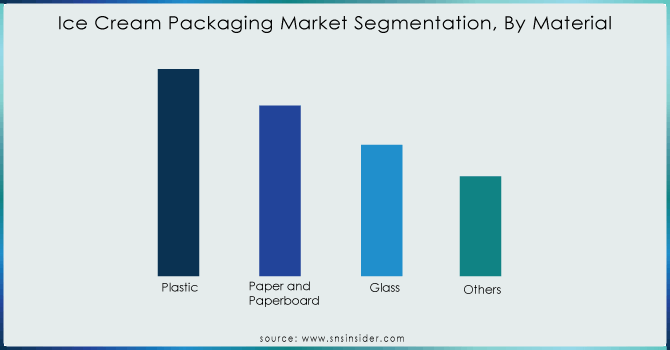

By Material

-

Plastic

-

Paper & Paperboard

-

Glass

-

Others

Plastic dominates in ice cream packaging, holding a 59% market share. Its strength, flexibility, and ability to handle cold temperatures are expected to drive further growth, creating a potential opportunity of US$209.9 million.

Get More Information on Ice Cream Packaging Market - Enquiry Now

By Packaging Type

-

Cup

-

Tub

-

Stick Pack

-

Folding Carton

-

Others

Ice cream cups are expected to be the most popular type of packaging in the world. The market for ice cream cups is expected to grow significantly by 2033. This is likely because people find ice cream cups to be convenient and easy to use.

By Sales Channel

-

Online

-

Offline

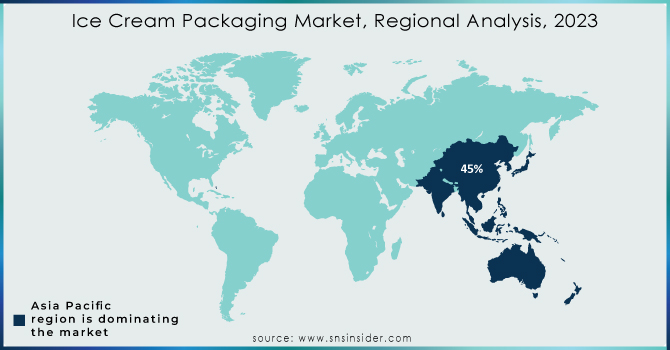

REGIONAL ANALYSIS

Asia Pacific dominated the ice cream packaging industry with market share of 45%. This dominance is attributed to rising living standards and surging ice cream consumption in China, India, Japan, and ASEAN countries. For example, China's ice cream packaging market witnessed a significant 14% growth in retail sales in 2022. Forecasts predict continued growth for the ice cream shop market in this region.

Asia Pacific is followed by North America and Europe in market share.The Ice Cream Alliance reports a strong rebound for ice cream packaging in the United States. This includes a rise in plastic packaging production. Additionally, the booming ice cream market suggests a continued demand for innovative packaging solutions in the coming years. Unique packaging is emerging from US startup ice cream stores, with a focus on meeting strict environmental regulations. A prime example is Sacred Serve, a Chicago-based producer known for their plant-based gelato. In August 2021, they debuted a new ice cream carton design made entirely from eco-friendly materials, 100% virgin, food-safe paperboard with a water-based, food-safe coating.

REGIONAL COVERAGE:

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

Key players

Some of the major players in the Ice Cream Packaging Market are Amcor Plc, ITC Packaging, Huhtamaki Oyj, International Paper Company, Tetra Laval, Berry Global Group, Frapak Packaging b.v., Insta Polypack, Sonoco Products Company, INDEVCO GROUP, Stora Enso Oyj, Sirane Limited., Stanpac Inc. and Others Players.

RECENT DEVELOPMENTS

-

In January 2024, Tetra Laval unveiled a novel ice cream carton that caters to on-the-go consumers. The innovative design incorporates a built-in spoon, enhancing convenience and portability.

-

Eco-Products joins the sustainable scoop movement in December 2023 with plant-based, compostable ice cream cones.

-

Ben & Jerry's teams up with Amcor in November 2023 to create a recyclable ice cream tub made from recycled materials.

-

In October 2023, Huhtamaki targets eco-conscious ice cream makers with a new printable, moisture-resistant paper tub.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 1.01 Bn |

| Market Size by 2032 | US$ 1.46 Bn |

| CAGR | CAGR of 4.2% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Material (Plastic, Paper & Paperboard, Glass, Others) • By Packaging Type (Cup,Tub, Stick Pack, Folding Carton, Others) • By Sales Channel (Online, Offline) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Amcor Plc, ITC Packaging, Huhtamaki Oyj, International Paper Company, Tetra Laval, Berry Global Group, Frapak Packaging b.v., Insta Polypack, Sonoco Products Company, INDEVCO GROUP, Stora Enso Oyj, Sirane Limited., Stanpac Inc |

| Key Drivers | • Driving Demand Through Constant Industry Innovation • A surge in R&D spending is fueling a wave of digital transformation across industries. |

| Key Restraints | • Stringent government regulations on the types of materials allowed in ice cream packaging. |