Podcasting Market Analysis & Overview:

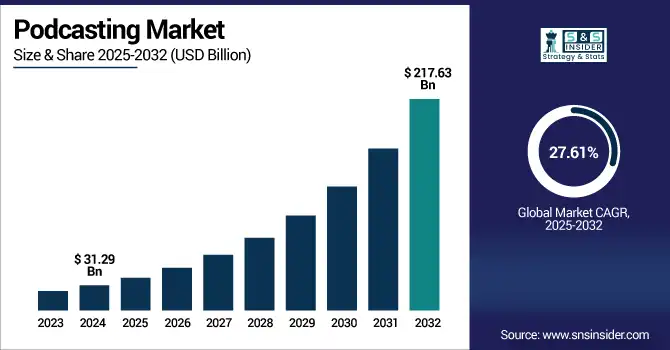

The podcasting market size was valued at USD 31.29 billion in 2024 and is expected to reach USD 217.63 billion by 2032, growing at a CAGR of 27.61% over 2025-2032.

To Get more information on Podcasting Market - Request Free Sample Report

The podcasting market growth is driven by the increasing adoption of smartphones, rising internet penetration, and the growing popularity of on-demand audio content.

-

According to the U.S. National Telecommunications and Information Administration (NTIA), smartphone usage in the U.S. rose from 27% to 70% over the past decade, significantly boosting mobile-friendly content consumption.

Consumers are shifting away from traditional media, favoring personalized, accessible experiences. The proliferation of streaming platforms, such as Spotify, Apple Podcasts, and YouTube has expanded access and monetization opportunities for creators through advertising, subscriptions, and sponsorships.

-

As of early 2025, Spotify reported 675 million monthly active users surpassing expectations driven largely by its expanding podcast ecosystem. Spotify’s Partner Program, now rebranded as Spotify for Creators, has led to a 20% increase in video podcast consumption since launch, with creator payouts in January 2025 up 300% year-over-year.

Additionally, the low cost of content production and rising interest in niche genres from education to entertainment are attracting both independent podcasters and corporate brands. Enhanced analytics, voice tech integration, and multilingual content are also accelerating global podcast consumption and revenue generation.

The U.S. podcasting market size was valued at USD 8.76 billion in 2024 and is expected to reach USD 60.48 billion by 2032, growing at a CAGR of 27.31% over 2025-2032.

The U.S. podcasting market is growing due to the rising consumer demand for on-demand audio, increased advertising spending, widespread smartphone use, and strong platform investments by tech giants, such as Spotify and Apple, fostering content innovation and deeper listener engagement across genres.

Podcasting Market Dynamics:

Drivers:

-

Rising Smartphone Adoption and Internet Penetration Significantly Increase On-Demand Podcast Consumption Across Global Youth and Urban Digital Audiences

The proliferation of smartphones and internet access has changed the way people access podcasts. Mobile devices are the main content source, so that podcasts are being consumed on the go, at work or at home. Emerging markets are catching up fast, owing to cheap data plans and digital literacy. This accessibility expands podcast audiences and drives demand for content that varies. Creators and brands have been aware of this change and are investing much effort into mobile-first strategies. Podcasts are quickly turning into a staple feature of the on-the-go audio experience, particularly among tech-savvy young generations in the U.S. and elsewhere as smartphones become more prevalent.

-

A Pew Research report (Infinite Dial 2023) shows that 42% of Americans aged 12+ listened to a podcast.

-

As of mid‑2024, Spotify hosted over 250,000 video podcast shows, rising from 100,000 in 2023, and 170+ million users have watched at least one video podcast on Spotify.

Restraints:

-

Limited Language Diversity and Content Accessibility Hinder Podcast Market Growth Across Non-English Speaking and Rural Listener Segments

Globalization has expanded the audience for podcasts but, with English-language podcasts dominating, non-English speaking populations are towered over and largely excluded by the medium. Most of the content is local, but it is difficult to access regional dialects for rural or old listeners. There are structural barriers to funding and distribution that exclude content creators from underrepresented regions. Unless a considerable bet is placed on linguistic diversity and culturally relevant storylines, much of the market will face an estrangement of huge potential user bases. Such a language imbalance stifles the global penetration rate, especially in communities with oral traditions and limited access to technology.

-

Over 60% of global podcasts are produced in English, making it the dominant language in podcasting. Spanish is a distant second at roughly 12%, followed by Portuguese (~7%), Indonesian (~5%), German (~2.7%), and Hindi (~0.9%).

-

Apple Podcasts introduced automated searchable transcripts in iOS 17.4 (March 2024), initially supporting only English, Spanish, German, and French, highlighting limited language reach even in transcription features.

Opportunities:

-

Integration of Podcasts into Smart Cars and Home Assistants Boosts Passive Listening and Deepens Platform Stickiness Across User Lifestyles

With the advent of smart homes and connected cars, podcasts are becoming part of the zeitgeist, carving out new listening opportunities. Alexa, Google assistant, and in-car infotainment systems are popular voice-command devices that enable users to access podcasts while performing other tasks, which broadens passive listening on the way to or from work, cooking, or working out. This helps them in increasing user touchpoints on a daily basis, adds to platform stickiness, and increases time spent on content. It also includes ad targeting and interactive podcast formats in these contexts. This alignment of podcasting with smart environments opens doors to immersive and habitual content consumption experiences.

-

The Podcast Consumer 2025 report from Edison Research shows 31% of the U.S. adults who drove or rode in a car in the last month listened to a podcast in their primary vehicle. That percentage jumps to 44% for those using in‑car infotainment systems, such as Android Auto or Apple CarPlay. CarPlay and Android Auto are now available in 40% of vehicles, with 33% of drivers actively using them, further expanding in‑car podcast engagement.

Challenges

-

Content Oversaturation and Discoverability Issues Hinder New Podcasters from Gaining Traction in a Competitive and Noisy Ecosystem

As volumes of podcast content exploded, this made it incredibly challenging for any new podcasters to break through. There are millions of episodes available across innumerable categories, so listener attention is scarce. This tends to leave little room for new or niche creators, as the algorithm favors tried and true shows. In addition, the lack of standard content tagging and poor search functionalities only makes discovering content more difficult. Moreover, there is listener fatigue from choice overload and this affects trial of new content. The oversupply of podcasts will continue to test equitable growth and diversity in the space without advanced discovery tools, curated recommendations, and platform support for underrepresented creators.

Podcasting Market Segmentation Analysis:

By Genre

News & Politics content dominated the podcasting market with the highest revenue share of about 28% in 2024, driven by increasing attention to political happenings, elections, and events taking place globally. Podcasts provide depth beyond what traditional media provides and listeners are turning in droves to them for independent analysis. This category has the highest retention of listeners, is updated more frequently with new content, and has the highest demand for advertising (making it the most monetized) of almost any category on major podcast platforms globally.

Sports segment is expected to grow at the fastest CAGR of about 30.98% over 2025-2032, owing to the growing demand for real-time commentary, interviews with athletes, and game analyses. This global growth of sports leagues and events has led to an increasing popularity for on-demand content. Fans are engaging all year round, even in the off-season with podcasts and selfish brands are seeing the loyalty and targeting opportunity in this rabid, content-starved demographic.

By Format

Interview segment led the podcasting market with the highest revenue share of about 32% in 2024, due to its reach among a large audience and the same content format being maintained. Interviews with celebrities, industry leaders and experts provide high-value shareable content. This format allows for deep advertiser engagement and has consistent repeat listens. The most lucrative of all podcast content categories, thanks to its viral nature, guest association for credibility, and adaptability between genres.

Solo segment is projected to grow at the fastest CAGR of about 29.73% over 2025-2032, due to the growth of content creators and individuals focusing on personal branding. These affordable formats enable creators to tap directly into niche communities. Solo podcasts are rapidly gaining market share due to increasing accessibility of monetization tools, audience loyalty, and due to their flexibility, authenticity, and scalability.

By Platform

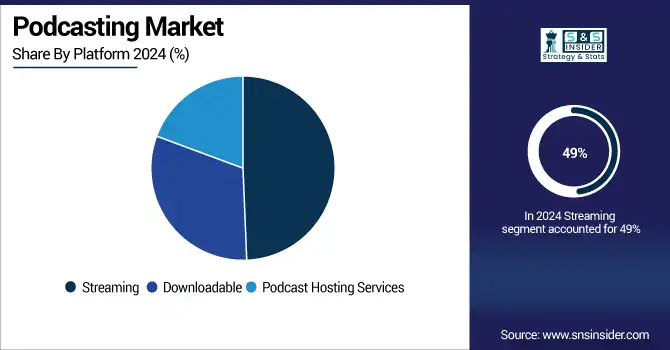

Streaming segment dominated the podcasting market with the highest revenue share of about 49% in 2024, due to their convenience and on-demand functionality along with provision to access these on smartphones and smart devices. User friendly interfaces, personalized recommendations, and seamless content delivery all drive listener retention on platforms, such as Spotify and Apple Podcasts. Platform innovation and proprietary agreements will make streaming not only the method of choice, but the only method.

Podcast Hosting Services segment is expected to grow at the fastest CAGR of about 30.48% over 2025-2032, as the growth is associated with rising independent creators and branded podcasts. Hosting platforms offer the necessary tools for publishing, analytics, monetization, and audience management. As a result, the backend services and enterprise-grade podcasting solutions for them are fast becoming a critical segment of the podcast content ecosystem, with demand for scalable and easy-to-use solution growing by the day.

By Revenue Model

Advertising & Sponsorships segment led the podcasting market with the highest revenue share of about 57% in 2024, since brands are reaching out to podcast’s focused listeners for personalized marketing. Performance and ROI are higher with Host-read ads, dynamic insertion and programmatic buying. Podcast’s intimate, trusted format delivers higher engagement and ad recall, making this global podcast media is the number one revenue stream in podcasting.

Subscription-based segment is projected to grow at the fastest CAGR of about 30.26% over 2025-2032, as listeners are increasingly seeking premium, ad-free, and exclusive content. Platforms are facilitating paid content models, which provide recurring income to creators and more value to fans. The rise of subscriptions as a robust and rapidly growing monetization channel in podcasting stems from increasing consumer readiness to pay for premium, audible-free listening experiences.

Podcasting Market Regional Outlook:

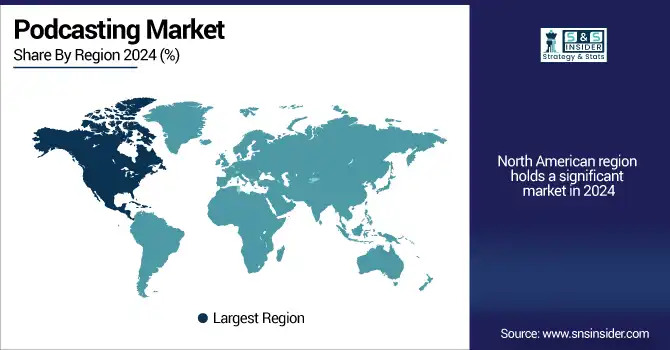

North America dominated the podcasting market share in 2024 owing to a well-established digital ecosystem, high smartphone penetration, and on-demand culture of audio consumption. Monetization models are relatively mature, advertising networks are strong while it has a large number of content providers and platforms. It has taken a leading share of revenue in the world podcasting market, helped by the differential willingness of the U.S. consumers to pay for premium content, and by global tech giants.

The U.S. is dominating the podcasting market in North America due to its vast listener base, advanced monetization, and strong content creator ecosystem.

Asia Pacific is expected to grow at the fastest rate due to the rising internet adoption, proliferation of the smartphone and rising local content development in native languages. A burgeoning middle class and mobile-first populations of young people in countries such as India, Indonesia and China are contributing to increased audio consumption. Efforts by governments to digitize and invest in local creator ecosystems are driving platform adoption and listener engagement, enabling robust podcast market expansion across the region.

China is dominating the podcasting market in Asia Pacific with the high penetration of digital users, platform integration, and the well-established government-backed content ecosystem.

Europe holds a significant share in the podcasting market, supported by widespread digital adoption, high smartphone usage, and growing demand for localized, on-demand audio content. Rising advertiser interest, strong media infrastructure, and increasing listener engagement further fuel market growth across the region.

The U.K. is dominating the podcasting market in Europe, driven by high digital adoption, strong media infrastructure, and growing advertiser investment.

Podcasting market trends in the Middle East & Africa and Latin America show strong growth, fueled by rising internet access, mobile adoption, culturally relevant content demand, expanding local creator ecosystems, and wider platform availability across these emerging regions.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players:

Podcasting market companies are Amazon.com, Inc., Apple Inc., iHeartMedia, Inc., Megaphone LLC, Pandora Media, LLC, TuneIn, Inc., Audacy, Inc., SoundCloud Limited, Spotify AB, Stitcher, Sirius XM Holdings Inc., Audible, Inc., Acast AB, RedCircle, Inc., Podbean LLC, Libsyn (Liberated Syndication Inc.), Buzzsprout (by Higher Pixels, Inc.), Anchor FM Inc., Castbox.fm, and Blubrry Podcasting (by RawVoice Inc.).

Recent Developments:

-

2025: Spotify AB introduced “Plays”, a new in‑app podcast metric showing creators which episodes are resonating most. It enhances analytics within Spotify for Creators and Megaphone dashboards across audio and video formats.

-

2024: SiriusXM & Audio Up Inc. announced a strategic creative partnership to co-develop original scripted podcasts and branded audio entertainment. The alliance spans Stitcher, Pandora, and SiriusXM platforms, expanding multi-format storytelling opportunities.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 31.29 Billion |

| Market Size by 2032 | USD 217.63 Billion |

| CAGR | CAGR of 27.61% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Genre (News & Politics, Society & Culture, Comedy, Sports, Others) • By Format (Interviews, Panels, Solo, Repurposed Content, Conversational) • By Platform (Streaming, Downloadable, Podcast Hosting Services) • By Revenue Model (Advertising & Sponsorships, Subscription-based, Crowdfunding & Donations, Licensing & Syndication, Direct Sales) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Amazon.com, Inc., Apple Inc., iHeartMedia, Inc., Megaphone LLC, Pandora Media, LLC, TuneIn, Inc., Audacy, Inc., SoundCloud Limited, Spotify AB, Stitcher, Sirius XM Holdings Inc., Audible, Inc., Acast AB, RedCircle, Inc., Podbean LLC, Libsyn (Liberated Syndication Inc.), Buzzsprout (by Higher Pixels, Inc.), Anchor FM Inc., Castbox.fm, Blubrry Podcasting (by RawVoice Inc.) |