Wafer Processing Equipment Market Report Scope & Overview:

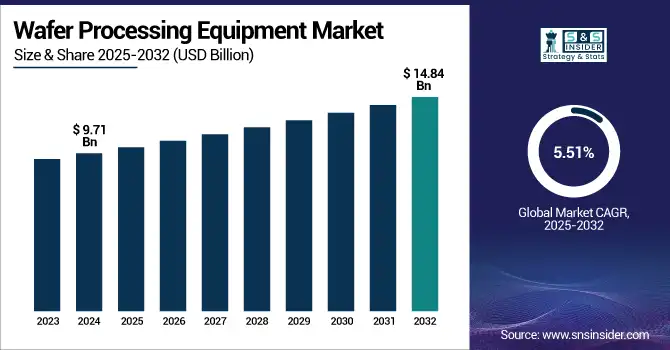

The Wafer Processing Equipment Market size was valued at USD 9.71 billion in 2024 and is expected to reach USD 14.84 billion by 2032, growing at a CAGR of 5.51% over the forecast period of 2025-2032.

To Get more information on Wafer Processing Equipment Market - Request Free Sample Report

The report offers a detailed market analysis with insights into new market trends, such as automation and Artificial Intelligence, and a projected wafer processing equipment market growth prediction represented by semiconductor innovation, increasing demand for consumer electronics, and communication infrastructure development.

April 2025 – ASML launched its high-NA EUV lithography system to enable much higher precision wafer processing under the nodes of 2nm. Chipmakers are getting ready for the next phase of scaling in semiconductors, and this is projected to be a key factor fueling market growth.”

The U.S. wafer processing equipment market size was valued at USD 1.75 billion in 2024 and is expected to reach USD 2.92 billion by 2032, growing at a CAGR of 6.65% over the forecast period of 2025-2032.

This segment of the U.S. wafer processing equipment market report provides readers with insight into the growth and development of wafer processing equipment in a formally coherent manner. Domestic Reach of leading wafer processing equipment Companies is foraying heavy into R&D. Government support across sectors, strong manufacturing ecosystems, and the highest complexities in chip production feeds the U.S. Wafer Fab Equipment Market.

Wafer Processing Equipment Market Dynamics:

Drivers:

-

Rising Demand for Advanced Semiconductor Chips Drives the Wafer Processing Equipment Market Forward Globally

The wafer processing equipment market is driven by the global increase in demand for advanced semiconductor chips, particularly in AI, 5G, and automotive applications. With industries moving to smaller nodes and more advanced architectures, equipment makers are rushing to supply new solutions. Tools, such as wafer bonding equipment are critical to maintaining performance and efficiency guidelines for next-generation devices. New wafer dogs will challenge the competitive landscape as manufacturers ramp production lines and new process integration technologies to meet tight supply deadlines and rapidly escalating customer expectations from the wafer processing equipment market analysis.

“April 2025 – Applied Materials broke ground on a USD 1.5 billion Silicon Valley R&D facility for next-gen etching and deposition tools. Change supports wafer processing equipment market analysis, which shows increased orders for high-end chip fabrication equipment.”

-

Growing Focus on High-Yield Manufacturing Accelerates Investments in the Wafer Fab Equipment Market

High-yield semiconductor manufacturing is a greater priority to the industry today, and as such, is fast-tracking investments in the wafer fab equipment market. High-resolution lithography is a bottleneck for the semiconductor industry, specifically for low-defect processes, thus, manufacturers are opting for process tools with precision to improve wafer yield and minimise rework rates. However, the equipment, such as the wafer cleaning machine, played a major role in keeping the surface contamination free during the fabrication processes. Data analytics, automation, and real-time process monitoring are bolstering manufacturers with increased quality control, reduced costs, and the ability to produce high-performance chips that will eventually be used by numerous technology sectors globally.

Restraints:

-

High Initial Capital Investment and Complexity Restrains Growth of the Global Wafer Processing Equipment Market

The high initial capital investment and operational complexity involved in the operation of wafer processing equipment are one of the major restraints limiting the growth of the market. Establishing modern wafer fabrication facilities needs billions, technologically-advanced cleanroom facilities, along with specialised skilled labour, which makes it hard to compete for newcomers and smaller players. It also had many equipment to be used in the company, which can easily become outdated in this fast technology cycle, increasing monetary threat. In addition to this, manufacturers have to constantly update or renew wafer processing equipment to remain in sync with changing technology specifications, placing even more pressure on already limited capital and operational expenditure budgets.

Wafer Processing Equipment Market Segmentation Outlook:

By Product

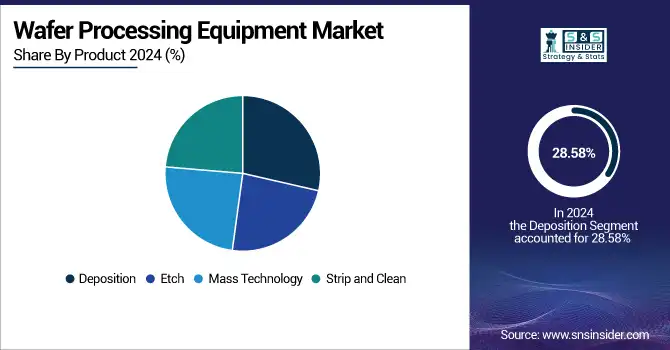

The deposition segment dominated the market with the highest revenue share of about 28.58% in 2024 due to its critical role in forming precise thin films on semiconductor wafers, which are essential for device performance. As the size and complexity of semiconductor devices continue to scale down, the increased requirement for high-quality depositing capabilities in semiconductor production techniques, such as atomic layer deposition, results in the increased demand for high-precision deposition techniques. The market size is further bolstered by this unprecedented demand, and it continues to dominate its category across the semiconductor manufacturing industry.

The etch segment is likely to expand at the fastest CAGR of nearly 6.99% over 2025–2032 timeline, owing to the rise in demand for sophisticated patterning and etching with fine features as device architectures shrink. As designs become tighter and 3D geometries complicated, etching must be highly selective and incredibly critical, requiring new etching machines that promise new levels of selectivity. Coupled with wafer processing equipment market trends toward dry and plasma etching innovations offering new production capabilities in semiconductor fabs, and this has been a key element of focus.

By Application

The sensors segment held the majority revenue share of the wafer processing equipment market, approximately 40%, in 2024, owing to the surging demand for sensors, particularly from automotive, healthcare, consumer electronics, and IoT application sectors. Advanced wafer processing techniques are used in more than 80% of today`s sensor manufacturing to provide precision and reliability. This upturn has particularly augmented the wafer processing equipment market share, driven by sensor output lines being prioritized by fabs to cater to the rising demand owing to increased proliferation of smart devices, autonomous systems, and environmental monitoring solutions globally.

The memory devices segment is projected to grow at a very high CAGR during the forecast period of 2025–2032 due to the increasing developments in data-driven applications, AI, and demand for cloud computing. New wafer processing tools are required to continue scaling and improving the performance of next-generation DRAM, NAND, and emerging non-volatile memory technologies. The further wafer processing equipment market growth can be attributed to the increasing demand worldwide for smartphones, servers, and edge computing devices leveraging advanced memory technologies.

By End Users

The computer segment accounted for more than 35% share. In 2024, the wafer processing equipment market revenue was led by ongoing innovation in computing hardware, including CPUs, GPUs, and high-performance chips for personal computers, servers, and data centers. As performance, efficiency, and miniaturization demands continue to grow, these devices necessitate advanced wafer processing technologies. This has resulted in computer manufacturers turning out to be one of the key drivers in the market, which in turn adds to the high demand for equipment and shapes the wafer processing equipment market.

The communication segment is projected to grow at a vibrant CAGR during 2025–2032 as 5G connectivity expands rapidly across next-generation mobile devices and IoT connectivity. To meet the demands for higher data speeds and lower latency, along with higher performance and more integrated devices, communication equipment manufacturers are relying more heavily on advanced semiconductor components grown using advanced wafer processing tools. The transformation in this growth fits right along the challenges the digital communication industry is facing, and as a result, semiconductor fabs are heavily investing in improving their CHIPS production capabilities.

Wafer Processing Equipment Market Regional Analysis:

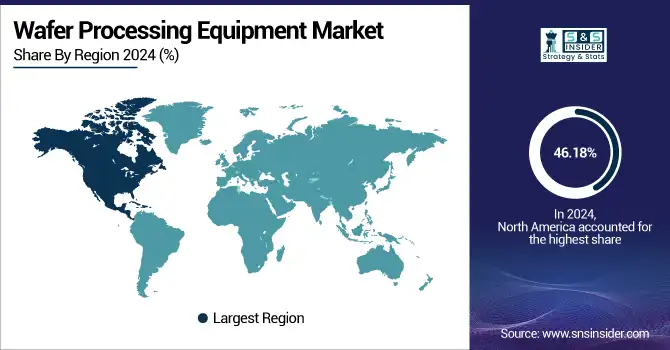

Asia Pacific held the largest revenue share of nearly 46.18% in 2024 and is expected to remain a leading region for the market over the forecast period, with a strong semiconductor manufacturing hub in Taiwan, South Korea, China, and Japan. Home to the largest semiconductor firms and foundries globally, these countries have an avid demand for chip manufacturing equipment year in, year out. The rising market strengths of the region also owe their backing to government initiatives supporting the domestic semiconductor growth and rising investments in R&D, which make the region stand as a backbone for the global wafer processing activities.

North America will witness significant growth in the semiconductor manufacturing equipment market, recording a CAGR of approximately 6.89% from 2025–2032 due to the increasing domestic semiconductor production initiatives and rising reshoring of chip production to minimize supply chain dependencies. Driven by strong investment programs, such as the U.S. CHIPS Act, companies are growing local fabs and moving to next-gen wafer processing technologies. Surging end-use demand from defense, automotive, and high-performance computing applications is also propelling regional growth, making North America the fastest-growing regional market.

The growth of this market is driven by the increasing demand for semiconductor-based equipment in the automotive and industrial sectors. The latest inventions relate to wafer bonding equipment and etching systems with reduced power consumption. Due to significant R&D incentives and manufacturing space, Germany is the leader in the region, with cooperation from the U.S. semiconductor equipment firms.

Get Customized Report as per Your Business Requirement - Enquiry Now

Wafer Processing Equipment Market Key Players are:

Applied Materials Inc., ASML Holding, Tokyo Electron Limited, Lam Research Corporation, KLA Corporation, DISCO, Hitachi Kokusai Linear, KLA Corporation, Lam Research Corporation, and Motorola Solutions, Inc.

Recent Trends

-

June 2024 - Applied Materials highlights wafer processing equipment’s pivotal role, anticipating strong growth as semiconductor industry advances toward next-generation technologies.

-

October 2024 - TEL unveils advanced wafer processing equipment, enhancing productivity, precision, and sustainability for next-generation semiconductor manufacturing processes globally.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 9.71 Billion |

| Market Size by 2032 | USD 14.84 Billion |

| CAGR | CAGR of 5.51% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Deposition, Etch, Mass Technology, Strip and Clean) • By Application (Sensors, Memory Devices, Analog Devices, Logic Devices) • By End Users (Computer, Communication, Consumer, Industrial, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Applied Materials Inc, ASML Holding Semiconductor Company, Tokyo Electron Limited, Lam Research Corporation, KLA Corporation, DISCO, Hitachi Kokusai Linear, KLA Corporation, Lam Research Corporation, Motorola Solutions, Inc. |