Metal Foundry Products Market Report Scope & Overview:

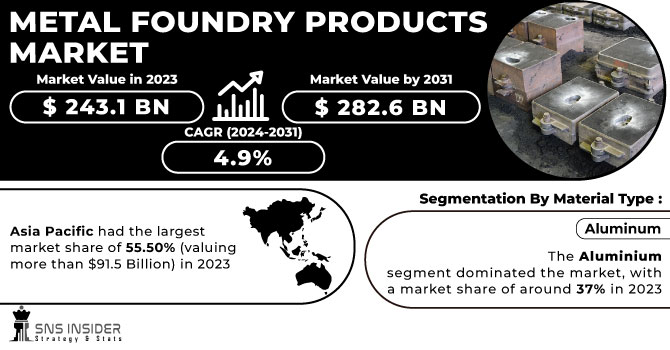

The Metal Foundry Products Market Size was valued at USD 243.1 Billion in 2023 and is now anticipated to grow to USD 282.6 Billion by 2031, displaying a compound annual growth rate (CAGR) of 4.9% during the forecast Period 2024 - 2031.

The Metal foundry products market is growing at a significant rate because of variety of factors. Increasing demand for casting from the automotive sector is expected to drive market growth over the forecast period. The key factors that are driving Metal Casting market are dominantly by automotive and construction industry.

Get More Information on Metal Foundry Products Market - Request Sample Report

Rigid regulations regarding pollution and energy efficiency requirements in vehicles are triggering the growth of the metal casting industry. Regulations have forced automakers to shift to lightweight vehicles to improve fuel efficiency by dominant use of aluminum in their chassis along with sand castings the preferred method. The steel is also growing at a significant rate other than aluminum.

Metal Foundry Products Market Dynamics

Drivers

-

A sudden surge in Development of Infrastructure throughout the globe.

The infrastructure development acts as a catalyst for the surge in demand of market for the metal casting industry. As nations globally embark on bold infrastructure projects, the demand for diverse and specialized metal components grows rapidly. Metal casting plays an important role in providing essential parts for infrastructure projects such as bridges, pipelines, and power plants. The versatility of metal casting processes allows for the production of complex and custom components that meet the stringent requirements of modern infrastructure.

-

Multiple advantages of metal casting technology are pushing towards the market growth.

-

Lack of alternative process for metal casting.

Restraint

-

Global Supply Chain disruptions.

Metal foundry industry heavily relies on suppliers for the raw materials, supply chain disruptions might have difficulty in getting raw material on time leading to backlogs and delay in deliveries. When raw material sources face interruptions, the casting companies face problems in maintaining stable production levels thereby meeting contract obligations.

-

Constant fluctuations in the price of Raw Materials impacting the production cost and overall foundry’s profitability.

Opportunities

-

An increase in the demand of foundry chemicals in automotive components.

-

Use of Additive Manufacturing for more complex and detailed production.

-

Technological improvements in metal casting.

Challenges

-

Shifting from old manufacturing technologies to more advanced automated technologies and to cope up with these technologies.

-

Covering up the breakeven point as almost 70% of total cost are direct materials, labor and energy.

Impact of Russia-Ukraine War

The war pushed the price of aluminum to unprecedented levels. There are multiple factors that have impacted aluminum prices. Price spikes on oil had a huge impact not only on aluminum, but on all commodities. Supply Chain disruptions caused due to the Russian invasion resulting in increased cost of shipping operations. The impact of changing national policies on market dynamics, aluminum is one of the biggest emitting industries, China’s aim to achieve net-zero carbon emissions by 2060 has resulted in a reduction in China’s aluminum output

For example, the price of aluminum on the LME (London Metals Exchange) in three-month contract shoots to a record $4,000 a ton in early March 2022, compared to the $3,200 February monthly average of the same year

Impact of Economic Slowdown

An economic slowdown can disrupt the Metal Foundry industry and there’s been a drop in the demand of metals so the businesses had to cut back on their investments. An increase in the prices of raw materials has also been seen leading to increased cost of manufacturing. Furthermore, manufacturers might have to prioritize cost-cutting steps to overcome tighter budgets leading to shifting towards cheaper raw materials, potentially impacting the product quality. However, the impact of an economic slowdown is likely to be temporary.

Key Market Segmentation

by Material Type

-

Cast Iron

-

Aluminum

-

Stainless Steel

-

Zinc

-

Magnesium

The aluminium segment dominated the market, with a market share of around 37% in 2023 which involves the rising adoption of aluminum castings, particularly in the automotive and aerospace sectors. The preference is driven in order to reduce the weight of vehicle, improving fuel efficiency, and aligning with sustainable practices. The aluminum segment, thus, make it most preferred choice in metal casting, meeting the evolving demands for lightweight, durable, and environmentally friendly components.

by Process

-

Sand Casting

-

Die Casting

-

Shell Mold Casting

-

Gravity Casting

-

Vacuum Casting

The sand casting segment is dominating the market, with a market share of approximately 43.5% in 2024. Sand casting offers versatility, simplicity, and cost-effectiveness and is suitable for producing components of varying sizes, shapes, and complexities. It offers a straightforward process. The simplicity of sand casting reduces the need for complex equipment and tooling, making it available to a wide range of manufacturers. It uses low cost materials and sand moulds can also be reused for multiple production runs. Sand casting offers versatility to design changes or production volume requirements, allowing for modifications to patterns. It has a wide range of applications ranging from automotive, construction, manufacturing industries and aerospace.

Metal Foundry Products Market Regional Analysis

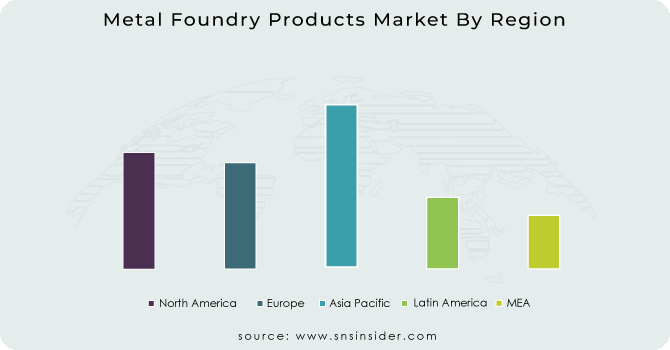

Asia Pacific had the largest market share of 55.50% (valuing more than $91.5 Billion) in 2023 and is maintain its dominant position from 2024 to 2031. the metal casting market due to robust industrialization, substantial automotive production, and rapid infrastructure development. The region's manufacturing prowess, particularly in countries like China and India, has fueled a high demand for metal castings across various sectors. Moreover, the growing emphasis on lightweight materials in automotive manufacturing further amplifies the significance of metal casting processes. The expanding industrial base, coupled with increasing investments in infrastructure, positions Asia-Pacific as a key player in the global metal casting market.

Europe is also assured to have rapid growth in the metal casting market, fueled by advancements in technology and increasing demand for lightweight materials. The European Foundry Industry alone contributes over EUR 40 billion annually. European market has around 4,500 metal casting firms. The European automotive sector, a significant consumer of metal castings, emphasizes fuel efficiency and sustainability, driving the adoption of innovative casting processes. Additionally, initiatives like the European Green Deal promote sustainable practices, creating opportunities for eco-friendly casting methods. With a strong industrial base and a focus on environmental responsibility, Europe is well-positioned for significant expansion in the metal casting market.

Get Customized Report as per your Business Requirement - Request For Customized Report

Regional Outlook

North America

-

US

-

Canada

-

Mexico

Europe

-

Eastern Europe

-

Poland

-

Romania

-

Hungary

-

Turkey

-

Rest of Eastern Europe

-

-

Western Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

Netherlands

-

Switzerland

-

Austria

-

Rest of Western Europe

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Vietnam

-

Singapore

-

Australia

-

Rest of Asia Pacific

Middle East & Africa

-

Middle East

-

UAE

-

Egypt

-

Saudi Arabia

-

Qatar

-

Rest of the Middle East

-

-

Africa

-

Nigeria

-

South Africa

-

Rest of Africa

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

Rest of Latin America

Key Players

The major players are POSCO, Dynacast, Arconic, Ryobi Limited, Endurance Technologies Limited, Alcast Technologies, UNI Abex, MES, Inc., CALMET, Hitachi, Ltd. and others

Arconic-Company Financial Analysis

Recent Trends in the Metal Foundry Industry:

-

Additive manufacturing (3D printing) has rapidly developed and it can now be used to work with plethora of materials including metal. This technology also allows companies to create more precise and high quality components as well as products. It can even be used to build large structures. Additive printers can also build complex components and products which traditional casting methods will struggle with.

-

Automation systems can vastly improve productivity and output while maintaining a high degree of precision and quality. Moreover, besides malfunctioning equipment which can be eliminated by establishing proactive maintenance and care policies automation hardware never grows tired, and it never burns out, unlike human laborers.

Recent Development:

-

In July, 2023: Dynacast introduced A2 thruster machine was developed based on the original A2 but has an increased locking force from 3.3 tons to 5.8 tons. Our A3 SIS is also equipped with a higher locking force but has a new development – the servo hydraulic injection system (SIS). The SIS system has been applied in all of our hydraulic machines since this innovation and it has been very successful.

-

In February, 2024: Alcast Technologies introduced Plastic Injection moulding machine which can produce customised plastic parts to the exact specifications, scale, volumes and budget.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 243.1 Billion |

| Market Size by 2031 | US$ 282.6 Billion |

| CAGR | CAGR of 4.9 % From 2024 to 2031 |

| Base Year | 2023 |

| Forecast Period | 2024-2031 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Material Type (Cast Iron, Aluminum, Stainless Steel, Zinc, Magnesium) • By Process (Sand Casting, Die Casting, Shell Mold Casting, Gravity Casting, Vacuum Casting) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | POSCO; Dynacast; Arconic; Ryobi Limited; Endurance Technologies Limited; Alcast Technologies; UNI Abex; MES, Inc.; CALMET; Hitachi, Ltd. |

| Key Drivers | • A sudden surge in Development of Infrastructure throughout the globe. • Multiple advantages of metal casting technology are pushing towards the market growth. • Lack of alternative process for metal casting. |

| Restraints | • Global Supply Chain disruptions. • Constant fluctuations in the price of Raw Materials impacting the production cost and overall foundry’s profitability. |