Industrial Vacuum Cleaner Market Scope & Overview:

The Industrial Vacuum Cleaner Market size was worth USD 1.12 billion in 2024 and is expected to reach USD 1.78 Billion by 2032 at a CAGR of 5.96% during the forecast period of 2024-2032.

The Industrial Vacuum Cleaner Market is on the rise as the demand for such machines keeps increasing in the manufacturing domain, construction work, food processing, and in other related sectors. Modern systems help maintain cleanliness, and reduce the danger of the work’s associated risks as dust and other hazardous materials are concerned. Recent achievements in technology have allowed devising more efficient and safer measures related to vacuums, which do not harm the environment in any way and improve production. The cleaning services appliances are also beneficial for they facilitate the process of work, contributing to its safe functioning. Another force affecting the improved vacuum cleaning machines are the increasing safety and industry standards, which require that every company provides their workers with the best industrial vacuum cleaners. The increasing emphasis on strict demands makes the industry to further advance.

To get more information on Industrial Vacuum Cleaner Market - Request Free Sample Report

The ultimate trend is, naturally, automation, requiring automatic vacuum machinery capable of functioning within a system, gathering evidence, understanding the issue, and relaying results met. Finally, it is also important to mention the emerging trend of using portable and portable industrial systems. Central industrial systems are good for heavy waste, but their portable replacements display more diversification, for they can remove waste of all types: starting with all kinds of dust and liquids, and up to dirt materials. The new trend is complemented by the improved filtration systems, such as the development of better suction filters or the increased use of HEPA filters, which filter the hazardous particles from the dust, creating a cleaner environment with fewer allergens.

Key Industrial Vacuum Cleaner Market Trends

-

AI-enabled thermal regulation platforms are gaining traction, optimizing dynamic load distribution, reducing energy usage, and enhancing long-term equipment durability.

-

Growing preference for bio-based insulating materials and eco-friendly polymers is strengthening alignment with sustainable construction practices and circular economy mandates.

-

Digital twin integration is advancing real-time system diagnostics, predictive occupancy management, and lifecycle cost optimization.

-

Adoption of modular wireless control units is accelerating, offering seamless retrofitting, faster installation, and scalable applicability across varied facilities.

-

Increasing deployment of autonomous service robots and drone-based monitoring systems is ensuring uninterrupted performance, predictive maintenance precision, and operational continuity.

Industrial Vacuum Cleaner Market Growth Drivers:

-

Stringent regulations on hygiene and workplace safety compel industries to invest in advanced cleaning equipment to ensure compliance, avoid penalties, and maintain operational efficiency.

Stringent regulations regarding hygiene and workplace safety have become crucial drivers for industries to adopt advanced cleaning equipment, such as industrial vacuum cleaners. These regulations are often mandated by governmental bodies and industry standards, emphasizing the need for a clean and safe working environment to protect employees and consumers alike. Non-compliance can lead to significant penalties, including fines and legal repercussions, which can adversely affect a company's financial standing and reputation. As a result, organizations are increasingly prioritizing investments in advanced cleaning technologies that meet or exceed these regulatory requirements.

Advanced cleaning equipment, such as industrial vacuum cleaners, offers superior efficiency and effectiveness in maintaining cleanliness across various sectors, including food processing, pharmaceuticals, and manufacturing. These machines are designed to handle a wide range of contaminants, ensuring that facilities meet the strict hygiene standards set forth by regulatory authorities. Moreover, adopting such equipment not only helps in compliance but also enhances operational efficiency by reducing downtime associated with cleaning processes. By investing in state-of-the-art cleaning solutions, businesses can streamline their operations, minimize health risks, and foster a safer work environment.

-

Innovations in vacuum cleaner technology, including enhanced suction power, automation, and energy efficiency, are improving performance and increasing the attractiveness of industrial vacuum cleaners, driving higher adoption rates.

Innovations in vacuum cleaner technology are transforming industrial cleaning by significantly enhancing performance and efficiency. Key advancements include improved suction power, which allows these machines to effectively remove dust, debris, and contaminants from various surfaces. Automation features, such as smart sensors and programmable settings, enable industrial vacuum cleaners to operate independently, optimizing cleaning schedules and reducing labor costs. Additionally, energy-efficient designs are increasingly prioritized, resulting in lower operational costs and a reduced environmental footprint. These enhancements not only improve the cleaning effectiveness but also make industrial vacuum cleaners more appealing to businesses seeking reliable and cost-effective solutions. As a result, the adoption rates of these advanced vacuum cleaners are rising, as companies recognize the benefits of investing in modern technology that meets their cleaning needs while promoting sustainability and efficiency.

Industrial Vacuum Cleaner Market Restraints:

-

The substantial upfront costs of industrial vacuum cleaners can discourage small and medium-sized enterprises from investing in them, thereby hindering overall market growth.

The significant upfront costs associated with industrial vacuum cleaners often deter small and medium-sized enterprises (SMEs) from making the investment. These high initial expenses can be a major barrier, especially for businesses operating on tight budgets. SMEs may prioritize immediate operational needs over long-term investments, leading to a reliance on less efficient cleaning methods. Consequently, this reluctance to invest in advanced cleaning technology limits the potential for market expansion. Without widespread adoption among SMEs, the industrial vacuum cleaner market may struggle to reach its full growth potential. Additionally, the lack of awareness regarding the efficiency and long-term cost savings offered by industrial vacuum cleaners further exacerbates this issue, preventing businesses from recognizing the value of such investments in enhancing productivity and maintaining workplace hygiene. Ultimately, these financial constraints impede overall market growth and innovation within the sector.

Industrial Vacuum Cleaner Market Segment Analysis

-

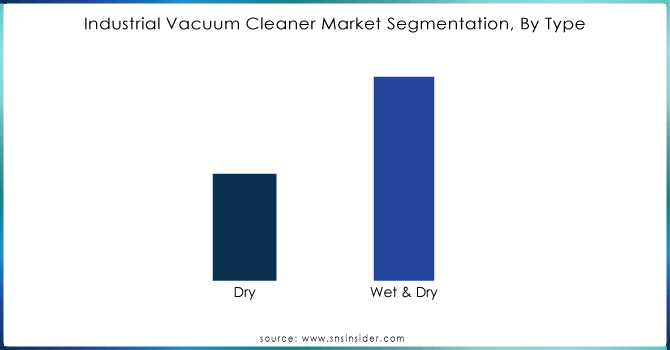

By Type

Wet & Dry segment dominated the market share of over 65.12% in 2024. The major advantage of such vacuum cleaners is their ability to perform with the diverse range of liquid and solid waste. Thus, their applications span over a variety of industries, including manufacturing and construction. It should be noted that this aspect is vital for the facilities exposed to the wide range of cleaning requirements.

Need any customization research on Industrial Vacuum Cleaner Market - Enquiry Now

-

By Power Source

Electric segment dominated the market share of over 42.04% in 2024, this type of cleaners is the most preferred due to their high operational efficiency, reliability, and the general trend towards automation. In particular, industry facilities apply electric models because they operate with consistent suction power and are simple to run, which is important due to the accelerated pace of current cleaning standards.

Industrial Vacuum Cleaner Market Regional Outlook

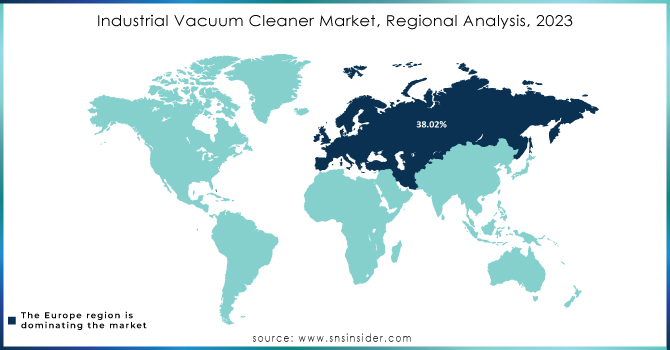

Europe Industrial Vacuum Cleaner Market Insights

Europe's region dominated the market share over 38.02% in 2024, is largely attributed to its well-established industrial base, particularly in sectors such as automotive, chemicals, and food & beverage, all of which demand high levels of cleanliness and sanitation. Strict regulations across the region, including stringent standards for workplace hygiene and safety, further drive demand for industrial cleaning equipment. Leading countries such as Germany, France, and the UK are at the forefront of this demand, with their advanced manufacturing industries and adherence to strict regulatory compliance.

Asia-Pacific Industrial Vacuum Cleaner Market Insights

Asia-Pacific is emerging as the fastest-growing region in the Industrial Vacuum Cleaner Market due to rapid industrialization across key countries like China, India, and Southeast Asian nations. This growth is driven by expanding manufacturing activities in industries such as automotive, electronics, and food processing, which require advanced cleaning solutions for maintaining operational efficiency. The increasing adoption of automation and mechanization in industrial processes is further elevating demand for vacuum cleaners.

North America Industrial Vacuum Cleaner Market Insights

North America holds a significant share of the industrial vacuum cleaner market, supported by advanced manufacturing sectors in the U.S. and Canada. Strong adoption across industries such as pharmaceuticals, aerospace, and food & beverages is driven by strict workplace hygiene regulations and OSHA compliance. Additionally, the region’s focus on sustainable cleaning solutions and the integration of automation technologies fuels market growth.

Middle East & Africa Industrial Vacuum Cleaner Market Insights

The Middle East & Africa region is witnessing steady growth, largely propelled by increasing industrial development in oil & gas, construction, and mining sectors. Rising awareness of workplace safety standards, along with government-driven initiatives for maintaining industrial hygiene, are boosting demand. Countries like the UAE and Saudi Arabia are leading adoption due to rapid infrastructure expansion and industrial diversification.

Latin America Industrial Vacuum Cleaner Market Insights

Latin America shows gradual growth in the industrial vacuum cleaner market, supported by expanding automotive, food processing, and manufacturing industries in countries like Brazil and Mexico. Growing emphasis on workplace safety, along with rising foreign investments in industrial facilities, is contributing to adoption. However, economic fluctuations and uneven regulatory enforcement may pose challenges to consistent growth across the region.

Industrial Vacuum Cleaner Market Companies are:

-

Nilfisk Holding A/S: (VHS120, Attix 33)

-

Tennant Company: (V-BP-7 Backpack, S9 Walk-Behind Sweeper)

-

Comac SpA: (CA30 45E, Comac Innova)

-

Diversey, Inc.: (TASKI AERO 8, TASKI AERO BP)

-

Columbus Cleaning Machines Ltd: (Vacuum 600, RA55)

-

Numatic International Ltd: (Henry HVR160, Numatic WV470)

-

American Vacuum Company: (Hurricane Series, 55-Gallon Industrial Vacuums)

-

Big Brute Industries Pty Ltd: (Big Brute Warehouseman, Big Brute Popular)

-

Alfred Kärcher SE & Co. KG: (NT 40/1 Tact, BV 5/1 Bp)

-

Bosch Professional Power Tools and Accessories: (GAS 35 L AFC, GAS 18V-10 L)

-

Depureco Industrial Vacuums: (Fox 2B, MiniBull)

-

RGS Vacuum Systems: (RGS A327, RGS 220I Series)

-

Delfin Industrial Vacuums: (DM3, Zefiro 75)

-

Vooner FloGard Corporation: (VFD Series Vacuum Cleaners)

-

Hako Group: (Supervac 50, Hamster 600E)

-

IPC Group: (GP 1/16 Wet&Dry, GS 3/78 W&D)

-

Soteco S.p.A.: (PANDA 503, PLANET 22)

-

EXAIR Corporation: (Chip Vac, Heavy Duty HEPA Vac)

-

Goodway Technologies Corporation: (VAC-2, GVC-18000)

-

Tiger-Vac International Inc.: (ATEX Certified Vacuums, HEPA 2V)

Competitive Landscape for Industrial Vacuum Cleaner Market:

Nilfisk, founded in 1906, is a leading global supplier of professional cleaning equipment and solutions, serving industries such as manufacturing, automotive, healthcare, and retail. Headquartered in Brøndby, Denmark, the company is well-known for its innovative vacuum cleaners, floorcare equipment, and high-pressure washers, with a strong focus on sustainability and energy efficiency. Over the years, Nilfisk has consistently pushed boundaries with eco-friendly technologies, including products made from recycled materials, reinforcing its commitment to sustainable industrial practices.

- In April 2024: Nilfisk pushes boundaries in the cleaning industry by introducing its first vacuum made from post-consumer recycled plastic. The vacuum is the first in a series of new products and upgrades in 2024. The new VP300 R consists of 30% PCR (Post-Consumer Recycled) plastic, closing the plastic products loop by diverting consumer waste from landfills.

Guardair Corporation, founded in 1942 and headquartered in Chicopee, Massachusetts, United States, is an American manufacturer specializing in pneumatic tools, safety air guns, and industrial vacuums. The company is widely recognized for developing workplace safety solutions that comply with OSHA standards, particularly in areas of dust control, cleaning, and compressed-air powered equipment. Its PulseAir Vacuum/Dust Extractor line highlights Guardair’s dedication to enhancing both efficiency and operator safety.

- In September 2022: Guardair Corporation announced the PulseAir Vacuum/Dust Extractor Line. The vacuum filter may be cleaned without opening the device thanks to cutting-edge button-activated technology that is powered by pressurized air and strong industrial vacuums.

Numatic International Ltd., headquartered in Chard, Somerset, United Kingdom, is a British manufacturer best known for its iconic “Henry” vacuum cleaner line, recognized globally for its smiling design. The company produces a wide range of cleaning equipment, including commercial floorcare machines and janitorial products, with a strong emphasis on durability, high performance, and user-friendly design, while continually expanding production capacity to meet growing international demand.

- In April 2022: Numatic disclosed that the business may be considering building a new base to produce Henry vacuums that would be around the size of two football fields. Plans for a sizable new Henry Vacuum facility in Somerset have been made public. The business must increase its commercial operations due to changing production techniques. It is looking to invest in brand-new, custom-built production facilities for the Henry Vacuum, its flagship product.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | US$ 1.12 Billion |

| Market Size by 2032 | US$ 1.78 Billion |

| CAGR | CAGR of 5.96% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Power Source (Dry, Wet & Dry) |

| • By Power Source (Electric, Single Phase, Three Phase, Pneumatic) | |

| • By Industry (Food & Beverages, Metalworking, Pharmaceuticals, Manufacturing, Building & Construction, Others) | |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, France, UK, Italy, Spain, Poland, Russsia, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia,ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, Egypt, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia Rest of Latin America) |

| Company Profiles | Nilfisk Holding A/S, Tennant Company, Comac SpA, Diversey, Inc, Columbus Cleaning Machines Ltd, Numatic International Ltd: , American Vacuum Company, Big Brute Industries Pty Ltd, Alfred Kärcher SE & Co. KG, Bosch Professional Power Tools and Accessories, Depureco Industrial Vacuums, RGS Vacuum Systems, Delfin Industrial Vacuums, Vooner FloGard Corporation, Hako Group, IPC Group: , Soteco S.p.A, EXAIR Corporation, Goodway Technologies Corporation, Tiger-Vac International Inc. |