Injection Pen Market Size & Overview:

Get More Information on Injection Pen Market - Request Sample Report

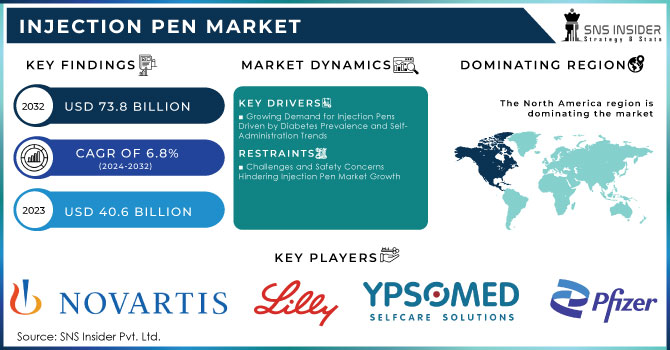

The Injection Pen Market was valued at USD 40.6 billion in 2023 and is projected to reach USD 73.8 billion by 2032, with a growing CAGR of 6.8% over the forecast period 2024-2032.

The growing number of chronic diseases including osteoporosis, diabetes, cardiovascular conditions, and multiple sclerosis fueling some of the most significant demand drivers in the global injection pens market. Injection pens, especially for chronic therapies which typically require daily dosing, are an absolute necessity, for they make therapy easier to take and more convenient. The demand for new reusable and automated injection pens increases market growth. Healthcare workers have preferred automated pens more and more for enhanced safety, convenience, and accuracy in drug delivery.

Diabetes care has gained more attention throughout the world. With its subsequent rise in demand for insulin injections, it has become a major driving factor for the market. According to the Institute for Health Metrics and Evaluation, more than 500 million people worldwide suffer from diabetes; in three decades, this number will be over 1.3 billion. Diabetes is poised to rank as one of the world's top 10 causes of death and disability. Injection pens, particularly for insulin, registered higher sales than vials because the patient prefers a pen due to their ease and simplicity in self-administration.

Other than this, injection pens will enable patients suffering from chronic diseases to regulate their dosing schedules independently. The dosing is not as frequent, therefore patients and hospitals also benefit economically through the transition to homecare. In addition, the general population is aging, which translates to a growing patient population, especially concerning diseases such as diabetes, obesity, and disorders resulting from hormone imbalances.

The market is also based upon the introduction of advanced products along with an increasing trend towards smart medical devices and favorable government policies towards cost-effective healthcare solutions. Supportive reimbursement policies, as well as improved access to injection pens, especially in the home-care setting, will drive market growth in the coming years. Given that this synergy is striking, the global injection pens market is well-positioned to support long-term growth.

Injection Pen Market Dynamics

Drivers

-

Growing Demand for Injection Pens Driven by Diabetes Prevalence and Self-Administration Trends

High prevalence cases of diabetes mainly drive the need for injection pens. Half of all diabetic patients using injection pens for insulin treatment prefer them because they are easier and more comfortable than the traditional methods. A 2019 report by the OECD shows that around one-third of all adults in Britain have a high rate of obesity, the highest in Europe, making the use of injection pens a growing demand. Different formulations of insulin have also been invented to ensure safety in injections and minimize the chances of dosing errors. There is an increased release of new drugs for obesity and diabetes, which has increased demand in the market. Eli Lilly's Mounjaro drug, for instance, was launched in the UK in January 2024 and can be pre-filled in injection pens once approved.

Another vital driver is the growing patient demand for self-administration. Injection pens are made to make self-injection easier and more painless, while with high precision and accuracy, physicians can efficiently fine-tune dosages. Durable and pre-filled pens utilizing interchangeable cartridges of insulin support growth in the market. High technologies that deliver painless injections are in big demand for diabetes treatment and are likely to continue over the forecast period.

In addition, such a high demand for disposable injection pens is driving the market forward. Among them, disposable injection pens available in the market since 2022 account for a larger share and can be easily used without any risk of infection along with the exact dose. Competition among rivals will always be key to the safety use for patients.

Restraints

-

Challenges and Safety Concerns Hindering Injection Pen Market Growth

Injection Pen Market Segmentation

by Product

Reusable products dominated the 56.3% share in injection pens during 2023, with an estimated exponential growth rate during the forecast period as a result of growing emphasis on environmental sustainability in the healthcare sector. Disposable injection pens contribute to major plastic waste and cause a great deal of environmental issues; hence, patients and healthcare professionals are increasingly opting for reusable injection pens, which are sustainable.

In addition to these benefits, more economical methods of treatment are now also available for patients who require injections frequently through reusable pens. Also, switching to reusable pens can help reduce the overall cost for healthcare facilities. Further improvement in user-friendly designs through new technologies ensures proper delivery of the drug and the right dosage. Innovations that address concerns relating to convenience, as well as safety concerns, have also simplified cartridge replacement and sterilization better than before, hence making patient comfort and product dependability even better.

by Application

In 2023, diabetes was considered the largest market 35.6% driver for injection pens because of the numerous benefits that such pens have over the standard approach to insulin injections, mainly syringes and vials. Injection pens benefit users with better accuracy in dosing, ease of use, discretion, and improved mobility by those with diabetes who must deal with it every day. Poverty in eating habits that trigger abundant sugar levels in the blood is also another major factor in the development of type 1 diabetes, hence creating a large demand for the devices.

Anaphylaxis is likely to experience the highest compound annual growth rate during the forecast period. The major drivers behind this high growth rate are an increasing incidence of anaphylaxis among children all around the world and an increased demand for epinephrine auto-injectors, which are crucial to treat severe allergic reactions. Additionally, raised awareness of the life-threatening consequences of anaphylaxis has spurred physicians to prescribe auto-injectors more often.

by End-Use

In 2023, hospitals held the largest share 56.3% in the injection pens market. The growth in this market has been propelled by fast-paced adoption and government projects initiated for the betterment of health infrastructure. The market also experienced support from the growing population suffering from diabetes at this time. Other factors contributing to the growth are enhanced spending on health care by consumers, higher disposable incomes, and improved awareness of the use of injection pens. Factors adding to this need are the elderly population and the increasing incidence of diseases like diabetes. Most of their chronic illness injectable pen patients are treated in hospitals as this accommodates specialized infrastructure and high-end medical equipment, thereby treating a significant number of patients in such setups.

Clinics, however, are likely to be the segment with the highest CAGR over the review period. This can be attributed to the increasing prevalence of chronic disorders, which requires constant patient monitoring and management. Additionally, government programs that encourage patients to maintain the prescribed treatments and ensure better injection practices may enhance the use of injection pens among clinics, thereby contributing to the growth of this segment.

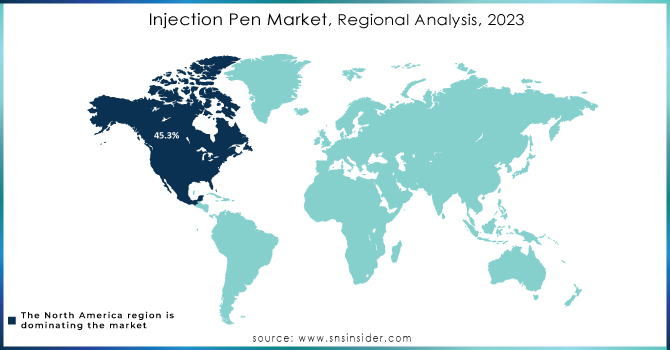

Regional Analysis

North America's injection pen market was the major contributor of 45.3% to the global market in 2023. by revenue share, the North American market is the largest contributor in the global market, and it accounts for almost 43.4%. This can mainly be attributed to the ever-increasing incidence of non-communicable diseases such as diabetes, cancer, cardiovascular diseases, and multiple sclerosis, primarily across the U.S. and Canada. With higher healthcare spending, increased awareness of advanced drug delivery systems, and easy availability of injection pens and cartridges, growth in this region is supported.

The market in Europe injection pens also looks promising enough for 2023, mainly because of the aging population in this continent. Europe is a global leader in the conductance of clinical trials: it features among the five largest clinical trial conductors in the world. The present EU Clinical Trials Register lists more than 43,000 clinical trials with an EudraCT protocol, which speaks well of its commitment to advancing medical research and supporting the injection pen market.

The most promising is the Asia Pacific injection pen market with potentially strong growth for the future. This growth will be fueled by increasingly rapid incidences of chronic diseases like diabetes, largely supported by rapid urbanization, changing lifestyles, and an aging population that is increasing demand for injection pens for self-administration of insulin and other drugs. It commands a large market share in China. Currently, in 2023, changes in demographics and lifestyle continue to fuel demand. However, the main driver remains the elderly population as this increases the prevalence of diseases such as diabetes, which has fueled the growth of the market.

Need any customization research on Injection Pen Market - Enquiry Now

Key Players

-

BD (BD Ultra-Fine Insulin Pen Needles, BD Insulin Pen)

-

Lilly (Mounjaro (Tirzepatide), Humalog KwikPen, Basaglar KwikPen, Trulicity (auto-injector))

-

Ypsomed AG (MyLife YpsoPen, MyLife Clickfine Pen Needles)

-

Biocon (Basalog, Insulin Aspart Pen)

-

AstraZeneca (Fasenra (auto-injector), bydureon Pen)

-

Pfizer Inc. (Enbrel SureClick)

-

Novartis AG (Aimovig, Zolgensma)

-

Novo Nordisk A/S (Ozempic)

-

Sanofi (Admelog SoloSTAR)

-

Owen Mumford Ltd. (AutoJet)

-

Merck KGaA (Bavencio)

-

Hoffman-La Roche (Rituxan Hycela)

-

Medtronic (MiniMed Insulin Pen)

-

Wockhardt Ltd. (Wockhardt Insulin Lispro Injection)

-

Sun Pharmaceutical Industries Ltd. (Sun Insulin Aspart Injection) and others.

Recent Developments

In February 2024, Eli Lilly launched the Mounjaro drug in the UK, marking the fourth European country to introduce this much-anticipated obesity medication. The MHRA approved a four-dose version of Mounjaro (tirzepatide), known as the Mounjaro KwikPen, for managing both diabetes and weight control.

In February 2023, Sanofi partnered with Glooko Inc. to strengthen diabetes care for both individuals and healthcare providers by integrating SoloSmart with the Glooko platform. This collaboration aims to expand access to digital tools for diabetes management in all the markets where SoloSmart will be available.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 40.6 Billion |

| Market Size by 2032 | USD 73.8 Billion |

| CAGR | CAGR of 6.8% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Disposable, Reusable) • By Application (Diabetes, Anaphylaxis, Osteoporosis, Growth Hormone Deficiency, Arthritis, Others) • By End-Use (Hospital, Clinics, Home Care Settings) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia-Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia-Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | BD, Lilly, Ypsomed AG, Biocon, AstraZeneca, Pfizer Inc., Novartis AG, Novo Nordisk A/S, Sanofi, Owen Mumford Ltd., Merck KGaA, Hoffman-La Roche, Medtronic, Wockhardt Ltd., Sun Pharmaceutical Industries Ltd. and Others |

| Key Drivers | • Growing Demand for Injection Pens Driven by Diabetes Prevalence and Self-Administration Trends |

| Restraints | • Challenges and Safety Concerns Hindering Injection Pen Market Growth |