Infrared LED Market Report Scope & Overview:

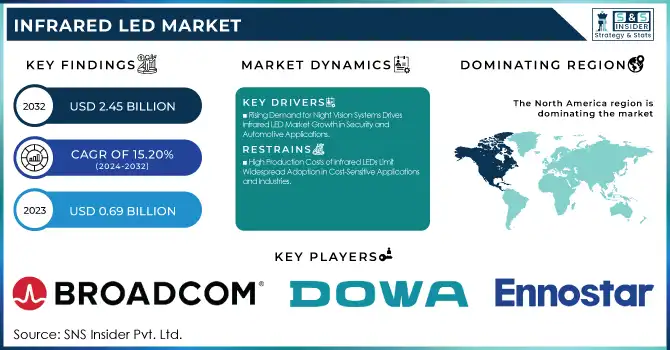

The Infrared LED Market was valued at USD 0.69 billion in 2023 and is expected to reach USD 2.45 billion by 2032, growing at a CAGR of 15.20% from 2024-2032. This report includes insights on key factors such as adoption rate, consumer behaviour, R&D investments, price trends as well as the regulatory backdrop. These factors are a very significant contribution to the future of the market. With the rising applications of infrared LEDs in different industries, technological advancements and changing regulations will continue to usher significant glass into the infrared LED market, opening the door for tremendous innovation and growth.

Get more information on Infrared LED Market - Request Sample Report

Market Dynamics

Drivers

-

Rising Demand for Night Vision Systems Drives Infrared LED Market Growth in Security and Automotive Applications

The escalating need for improved visibility in low-light conditions is propelling the adoption of infrared LEDs in night vision systems. Such LEDs are playing an invaluable role in security cameras, surveillance systems, and automotive applications, providing clear vision in dark spaces. In security and surveillance, IR LEDs support effective monitoring without attracting the notice of the surroundings, which is critical for 24/7 functioning. On the other hand, it is applied in the automotive industry for advanced driver-assistance systems, which would promote driver safety during nighttime travel with the use of infrared sensors and night vision systems. With the rising number of security concerns and advancements in vehicular technology, the demand for infrared LEDs in night vision solutions grows and boosts the market tremendously.

Restraints

-

High Production Costs of Infrared LEDs Limit Widespread Adoption in Cost-Sensitive Applications and Industries

The manufacturing process for infrared LEDs, particularly those designed for high performance and efficiency, requires advanced technology and specialized materials. s. As a result, production costs remain relatively high, which makes large-scale adoption of infrared LEDs difficult to some industries. The higher initial cost of infrared LEDs poses significant challenges for applications where cost saving is important, such as consumer electronics or low-end security systems. Whereas the advantages of infrared LEDs in various fields, such as automotive and surveillance, are well appreciated, the cost side of infrared LED adoption has made companies consider alternatives that are less expensive than pure infrared LED lighting technologies. Therefore, high production costs pose great challenges for wider market penetration and use across the industries.

Opportunities

-

IoT Growth Drives Increased Demand for Infrared LEDs in Smart Devices, Wearables, and Security Systems

The rapid growth of Internet of Things technologies and connected devices is creating new possibilities for infrared LEDs. With the growing usage of smart home systems, wearables, and IoT-based security devices, infrared LEDs are integrated for various functions, including motion detection, communication, and security surveillance. From smart home lighting systems to mobile devices, infrared LEDs improve the caring services provided by infrared LED products. Likewise, in health monitoring wearables, infrared LEDs measure various health parameters, including heart rate and blood blood-oxygen levels. Concurrently, the increasing demand for smart connected security systems positively affects the demand for infrared LEDs, which are crucial for high-performance low-light vision. This way, it is an ever-growing market for infrared LED applications and opens up great opportunities for growth.

Challenges

-

Limited Range and Intensity of Infrared LEDs Hinder Their Use in Long-Range and High-Power Applications

Despite the efficiency of infrared LEDs, their range and intensity can fall short when compared to other light sources, limiting their effectiveness in certain applications. An infrared LED works brilliantly in close-range detection, but in longer-range and higher-powered applications such as outdoor surveillance and long-distance communication systems, it cannot perform optimally. This constraint reverberates in defence, aerospace, and large-scale surveillance tasks requiring potent and long-range lighting solutions. This impending ineffectiveness makes it very difficult for the infrared system to establish its domineering presence over traditional power lights with immense coverage and intensity. Thus, the limited range and intensity of infrared LEDs impede their acceptance and general use in some industries.

Segment Analysis

By Application

The surveillance segment led the infrared LED market, capturing the highest revenue share of about 37% in 2023, due to rising security concerns across the globe. The rising adoption of surveillance cameras in the residential and commercial sectors has increased the demand for infrared LEDs. Today's surveillance systems require such LEDs to ensure good visibility during the night or low-light conditions.

The biometric segment is expected to grow at the fastest rate of around 18.25% CAGR between 2024 and 2032. The retained ardor for secure and contactless identification means would pave the way for this high growth. Infrared LED cannot be omitted when a biometric or contactless identification system such as a facial recognition system or fingerprint scanner is being used, since these IR LEDs allow for accurate readings at low light. Such growth is happening in part due to the fast-growing need for security in finance, health care, and government.

By Technology

The Gallium Arsenide (GaAs) segment dominated the infrared LED market, accounting for the highest revenue share of about 43% in 2023, due to its superior efficiency and performance. GaAs-based infrared LEDs offer high-speed performance, excellent thermal stability, and low power consumption, making them ideal for applications like telecommunications, security systems, and automotive. Their widespread use in a range of sectors, including industrial and consumer electronics, contributes significantly to their market dominance.

The Indium Gallium Arsenide (InGaAs) segment is expected to grow at the fastest CAGR of about 17.22% from 2024 to 2032, driven by its superior properties in infrared detection. InGaAs is highly effective for high-performance applications such as fiber-optic communications, spectroscopy, and environmental monitoring, where precise detection is crucial. The increasing adoption of InGaAs-based systems in emerging technologies, like autonomous vehicles and advanced sensing systems, is fueling its rapid growth and demand in the market.

By Spectral Ranges

The Medium-wave Infrared LED segment held the highest revenue share of about 51% in 2023, due to its broad applications in various industries such as surveillance, automotive, and industrial sensing. Medium-wave IR LEDs provide optimal performance for short to medium-range detection, offering excellent resolution in thermal imaging and night vision. Their versatility and high efficiency make them the preferred choice in many infrared-based systems.

The Long-wave Infrared LED segment is expected to grow at the fastest CAGR of about 16.97% from 2024 to 2032, driven by its growing demand in advanced thermal imaging and sensing applications. Long-wave IR LEDs are crucial for detecting heat signatures and are increasingly used in industries like healthcare, defense, and environmental monitoring. The rising adoption of these LEDs in emerging technologies, like smart buildings and autonomous systems, fuels rapid growth.

By End Use

The Consumer Electronics segment dominated the infrared LED market, holding the highest revenue share of about 34% in 2023, driven by the widespread use of infrared LEDs in devices like remote controls, smart TVs, and wearables. The growing adoption of smart devices and IoT technologies, which rely on infrared LEDs for communication and sensing, significantly contributed to the dominance of this segment in the market.

The Industrial segment is expected to grow at the fastest CAGR of about 17.35% from 2024 to 2032, fueled by the increasing use of infrared LEDs in automation, quality control, and machine vision applications. As industries embrace advanced manufacturing technologies, infrared LEDs are essential for precision sensing, monitoring, and diagnostics. Their ability to enhance operational efficiency and safety in industrial settings drives the rapid growth of this segment.

Regional Analysis

In 2023, North America was predicted to command Infrared LED market, accounting for roughly 40% of revenue with advanced adoption of technology and strong demand for infrared LED-based applications. The region was also in high demand from industries including automotive, defense, healthcare, and consumer electronics. Also, high investments in research and development especially in smart care and autonomous driving continued to bolster the market demand for infrared LEDs.

The Asia Pacific is expected to grow at fastest compound annual growth rate of about 17.46% from 2024 to 2032, marked by speedy industrialization and ever-increasing demand for consumer electronics. With huge investments in the fields of infrastructure, advancements in automotive, and smart technologies in China and India, good opportunities for applications of infrared LEDs arise. Increased manufacturing capacity and the growing adoption of IoT and security systems are also likely to foster market growth in the region.

Get Customized Report as per your Business Requirement - Request For Customized Report

Key Players

-

Boston Electronics Corporation (IR LEDs, LED Assemblies)

-

Broadcom Ltd. (IR Emitters, Photodiodes)

-

DOWA Electronics Materials Co., Ltd. (IR LEDs, Optical Materials)

-

Epileds Technologies (Infrared LEDs, High-Power LED Chips)

-

Ennostar Inc. (Infrared Light Emitting Diodes, LED Components)

-

Everlight Electronics (Infrared LED, IR Sensors)

-

Excelitas Technologies Corp. (IR Emitters, Photodiodes)

-

Infineon Technologies (IR LED, Infrared Sensors)

-

Japan Display Inc. (IR Sensors, IR Modules)

-

Unity Opto Technology (IR LEDs, LED Products)

-

Kingbright Electric (IR LEDs, LED Arrays)

-

Radiant Vision Systems (IR LED Systems, Optical Measurement)

-

TT Electronics (IR LEDs, Photodetectors)

-

Samsung Electronics (Infrared LED, LED Modules)

-

Nichia Corporation (Infrared LEDs, LED Emitters)

-

Mouser Electronics (Infrared LEDs, LED Components)

-

LiteOn Technology (IR LED, Photodiodes)

-

Broadcom (Infrared LED, Photodiodes)

-

OSRAM (IR LEDs, Photodetectors)

-

Epistar Corporation (Infrared LED, LED Chips)

Recent Developments:

-

In 2024, Broadcom introduced the HSM8-C400, a Side View IR ChipLED emitter designed for remote control applications, featuring a narrow viewing angle to enhance on-axis radiant intensity and minimize cross-talk.

-

In January 2024, Samsung Electronics launched its latest Neo QLED, MICRO LED, OLED, and Lifestyle displays, incorporating advanced AI processors and IR LED technology to enhance picture quality and interactive features.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 0.69 Billion |

| Market Size by 2032 | USD 2.45 Billion |

| CAGR | CAGR of 15.20% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Spectral Range (Short-wave Infrared LED, Medium-wave Infrared LED, Long-wave Infrared LED) • By Technology (Gallium Arsenide (GaAs), Aluminum Gallium Arsenide (AlGaAs), Indium Gallium Arsenide (InGaAs), Gallium Antimonide (GaSb), Others) • By Application (Biometric, Imaging, Lighting, Communication, Surveillance, Other Applications) • By End Use (Aerospace & Defense, Automotive, BFSI, Consumer Electronics, Education, Healthcare, Industrial, Retail) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Boston Electronics Corporation, Broadcom Ltd., DOWA Electronics Materials Co., Ltd., Epileds Technologies, Inc., Ennostar Inc., Everlight Electronics Co. Ltd., Excelitas Technologies Corp., Infineon Technologies, Japan Display Inc., Unity Opto Technology, Kingbright Electric, Radiant Vision Systems, TT Electronics, Samsung Electronics, Nichia Corporation, Mouser Electronics, LiteOn Technology, Broadcom, Osram Opto Semiconductors, Epistar Corporation. |