Polyimide Film Market Report Scope & Overview:

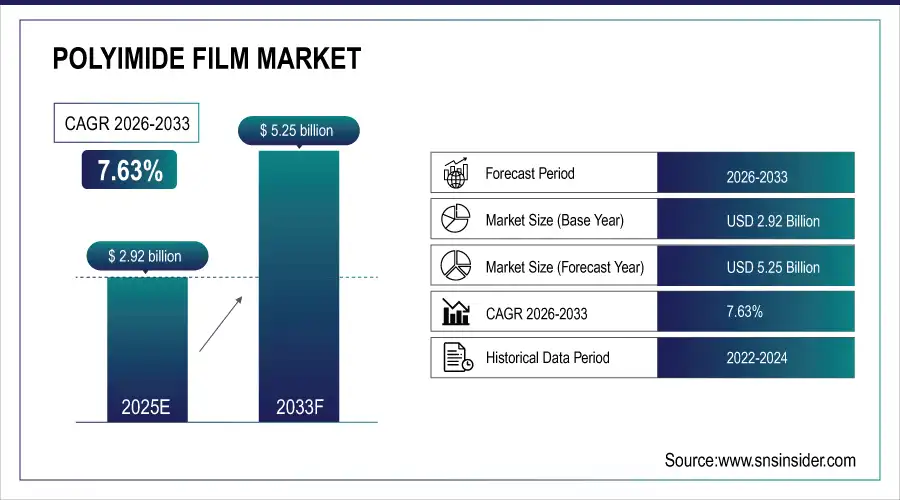

The Polyimide Film Market Size was valued at USD 2.92 billion in 2025E and is expected to reach USD 5.25 billion by 2033, growing at a CAGR of 7.63% over the forecast period of 2026-2033.

The Polyimide Film Market is witnessing significant growth, driven by rising demand for high-performance insulating materials across electronics, automotive, and aerospace industries. Increasing adoption in flexible printed circuits, wires, cables, and pressure-sensitive applications is fueling market expansion. Advanced thermal stability, chemical resistance, and lightweight properties enhance performance, efficiency, and reliability across various industrial applications.

Market Size and Forecast:

-

Polyimide Film Market Size in 2025E: USD 2.92 Billion

-

Polyimide Film Market Size by 2033: USD 5.25 Billion

-

CAGR: 7.63% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information On Polyimide Film Market - Request Free Sample Report

Key Polyimide Film Market Trends

-

Increasing use in automotive and aerospace sectors for insulation and lightweight applications.

-

Growth in demand for pressure-sensitive tapes and specialty fabricated products.

-

Expansion in motors and generator applications due to thermal stability and chemical resistance.

-

Rising focus on environmentally sustainable and high-performance materials.

-

Increasing R&D investment for advanced polyimide formulations and high-temperature resistant films.

-

Growing demand in labelling and packaging applications for durability and flexibility

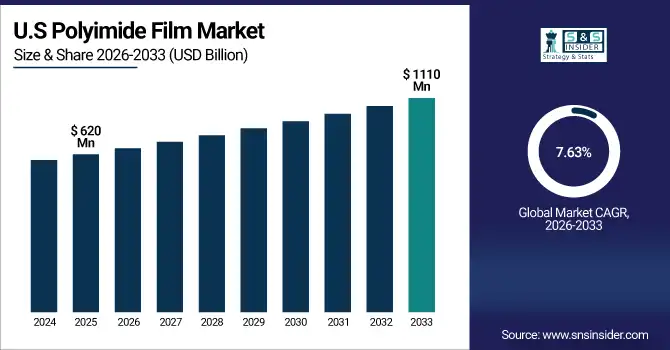

U.S. Polyimide Film Market Insights

The U.S. Polyimide Film Market size was USD 620 million in 2025 and is expected to reach USD 1110 million by 2033 growing at a CAGR of 7.63% over the forecast period of 2026-2033. The growth is driven by increasing adoption in electronics, flexible printed circuits, and automotive insulation applications. High thermal stability and chemical resistance of polyimide films enable their use in aerospace and industrial motors, supporting advanced manufacturing. Rising demand for durable pressure-sensitive tapes, specialty fabricated products, and labeling solutions further boosts market penetration and encourages manufacturers to expand production capacities.

Polyimide Film Market Growth Driver

-

Growing Demand for High-Performance, Eco-Friendly Polyimide Films in Electronics and Automotive Applications Drives Market Expansion

The rising adoption of eco-friendly and high-performance polyimide films across electronics, automotive, and aerospace industries is driving market growth. As industries increasingly demand materials capable of withstanding extreme temperatures, chemical exposure, and mechanical stress, polyimide films offer superior thermal stability, dielectric strength, and chemical resistance. This demand is further accelerated by regulatory pressure for sustainable and recyclable materials in manufacturing processes, encouraging manufacturers to innovate and scale production. Enhanced durability and reliability reduce downtime and maintenance costs, prompting OEMs to replace traditional materials with polyimide solutions. The surge in electric vehicles, flexible printed circuits, and insulation for high-power motors also reinforces the material’s critical role in next-generation applications. Consequently, manufacturers focusing on eco-conscious, high-performance products are capturing significant market share and establishing competitive advantages globally.

For instance, In March 2025, DuPont introduced a new high-temperature, low-emission polyimide film designed for electric vehicle insulation, enabling automakers to meet stringent sustainability and performance standards while reducing energy loss.

Polyimide Film Market Restraint

-

High Production Costs and Limited Availability of Advanced Polyimide Films Restrain Market Growth

The growth of the polyimide film market is constrained by the high production costs and limited global availability of advanced films. Manufacturing polyimide films involves complex chemical synthesis, stringent process controls, and high-purity raw materials, resulting in elevated prices compared to alternative insulation and flexible substrates. Smaller manufacturers and emerging economies face supply chain challenges, limiting adoption despite rising demand. Additionally, the cost-sensitive electronics and automotive sectors often prioritize cheaper substitutes, slowing penetration in certain segments. These economic and logistical factors restrict the scalability of polyimide films, especially in applications requiring bulk consumption. Consequently, market expansion is uneven across regions and end-use industries, necessitating strategic investments to optimize production efficiency and reduce cost pressures.

In June 2024, Kaneka Corporation highlighted supply constraints for its high-performance polyimide films in Asia, resulting in delayed deliveries for flexible printed circuit manufacturers and limiting adoption in cost-sensitive consumer electronics.

Polyimide Film Market Opportunity

-

Integration of Polyimide Films in Advanced Flexible Electronics and Next-Generation EV Components Presents Lucrative Opportunities

The increasing integration of polyimide films into flexible electronics, next-generation electric vehicle components, and aerospace applications provides significant growth opportunities. Their lightweight, thermally stable, and chemically resistant properties make them ideal for high-density, flexible printed circuits, battery insulation, and advanced motor windings. Emerging applications in wearable devices, foldable displays, and EV powertrains create new demand streams and encourage R&D investments in customized film solutions. Manufacturers leveraging advanced production technologies, improved adhesion, and enhanced dielectric properties are poised to capitalize on growing industrial electrification and miniaturization trends. Expansion in regions with high EV adoption, smart devices, and aerospace manufacturing further amplifies market potential, offering sustainable revenue streams.

For instance, In January 2025, Toray Industries launched a flexible polyimide film tailored for foldable displays and electric vehicle battery insulation, enabling OEMs to enhance device durability and thermal efficiency while meeting evolving industry performance standards.

Polyimide Film Market Segment Highlights:

-

By Application: Flexible Printed Circuits – 40% (largest), Wires & Cables – 25%, Pressure-Sensitive Tapes – 15%, Specialty Fabricated Products – 10%, Motors/Generators – 5%, Others – 5%

-

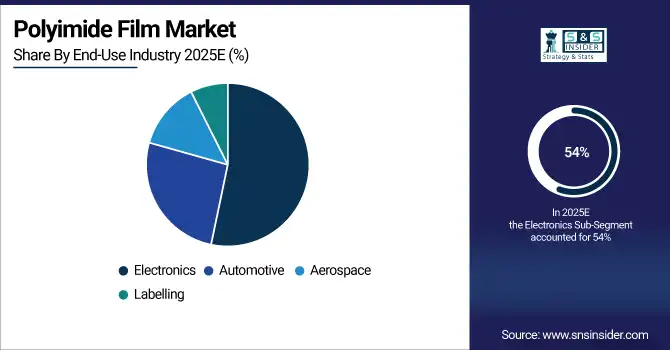

By End-Use Industry: Electronics – 54% (largest), Automotive – 15%, Aerospace – 12%, Labelling – 6%, Others – 13%

Polyimide Film Market Segment Analysis

By Application

The Flexible Printed Circuits segment dominates the market with a 40% share, driven by its extensive use in electronics, consumer devices, and industrial equipment requiring high thermal stability and durability. Wires & Cables, holding 25%, are widely adopted in automotive, aerospace, and energy applications, while Pressure-Sensitive Tapes, at 15%, serve insulation and bonding purposes. Specialty Fabricated Products (10%), Motors/Generators (5%), and Others (5%) contribute to niche applications. Growth is further supported by increasing miniaturization of devices and rising demand for lightweight, high-performance insulating materials across industries.

By End-Use Industry

Electronics holds the largest market share at 54%, owing to rising adoption in smartphones, tablets, and wearable devices. Automotive, accounting for 15%, benefits from polyimide films in electric vehicles and advanced wiring systems. Aerospace, with 12%, leverages films for insulation in high-temperature and lightweight applications. Labelling contributes 6%, primarily in flexible packaging and industrial labels, while Others (13%) cover medical, defense, and industrial sectors. Industry adoption is influenced by stringent performance requirements, environmental compliance, and technological advancements in polyimide-based materials.

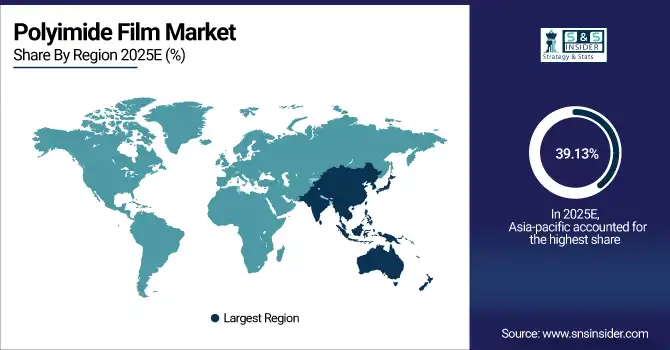

Polyimide Film Market Regional Analysis

Asia-Pacific Polyimide Film Market Insights

Asia-Pacific accounts for 39.13% of the market in 2025 and is the fastest-growing region due to rapid electronics manufacturing, automotive production, and aerospace expansion. China, India, Japan, and South Korea are key contributors, driven by rising demand for flexible printed circuits, electric vehicles, and high-temperature insulation materials. Government support for industrial modernization and investment in advanced materials accelerate adoption. Collaborations between local manufacturers and global suppliers promote technology transfer, quality improvements, and cost-effective production, making Asia-Pacific a dominant hub for polyimide film deployment.

Get Customized Report as per Your Business Requirement - Enquiry Now

North America Polyimide Film Market Insights

North America leads the polyimide film market with a 28% share in 2025, driven by high adoption in electronics manufacturing, automotive applications, and aerospace insulation systems. The U.S. dominates due to advanced R&D infrastructure, stringent quality standards, and growing demand for flexible printed circuits and high-performance insulating materials. Increasing investments in electric vehicles, industrial automation, and aerospace projects accelerate market growth. Collaborations between material suppliers and OEMs enhance product innovation, reliability, and application-specific customization, establishing North America as a key hub for polyimide film technologies.

Europe Polyimide Film Market Insights

Europe holds 22% of the market in 2025, supported by strong electronics, automotive, and aerospace sectors. Germany, France, and the U.K. lead adoption, focusing on lightweight, high-temperature-resistant insulation and flexible circuit materials. Regulatory incentives for energy efficiency and material performance drive manufacturers to innovate. The demand for labelling applications and specialty films also grows. Partnerships between European polyimide suppliers and industrial clients foster advanced product development and compliance with environmental and performance standards, strengthening regional market growth.

Latin America and Middle East & Africa (MEA) Polyimide Film Market Insights

Latin America holds 4.87% and MEA 6% of the market in 2025. Brazil, Mexico, UAE, and Saudi Arabia are investing in electronics, automotive, and aerospace applications, along with insulation and flexible circuit materials. Growing industrial infrastructure and awareness of high-performance polymers drive adoption. Government initiatives, public-private partnerships, and collaborations with international suppliers enhance local production capabilities. Steady growth in niche applications such as labelling and specialty fabricated products is expected across both regions during the forecast period, supported by technology adoption and industrial expansion.

Competitive Landscape for Polyimide Film Market:

DuPont

DuPont is a global leader in materials science, specializing in high-performance polymers, including polyimide films for electronics, aerospace, and automotive applications.

-

In September 2024, DuPont launched a new series of ultra-thin polyimide films designed for next-generation flexible displays and 5G applications, enhancing performance and reliability for advanced electronic devices.

Kaneka Corporation

Kaneka Corporation, headquartered in Japan, develops specialty chemicals and high-performance materials, including polyimide films for electronics, automotive, and industrial applications.

-

In October 2024, Kaneka introduced high-performance polyimide films with improved chemical resistance and thermal stability, targeting electronics and automotive industries requiring robust and durable materials.

PI Advanced Materials (Arkema Affiliate)

PI Advanced Materials focuses on high-quality polyimide films for electronics, aerospace, and industrial sectors, emphasizing thin-film and high-performance applications.

-

In April 2024, PI Advanced Materials produced the world’s first 4-micrometer ultra-thin polyimide film, meeting the growing demand for slimmer, heat-resistant, and durable electronic devices such as smartphones, tablets, and wearables.

Polyimide Film Market Key Players

Some of the POLYIMIDE FILM Companies

-

DuPont

-

Kaneka Corporation

-

Toray Industries

-

UBE Industries

-

SKC Kolon PI

-

Taimide Tech Inc.

-

Saint-Gobain Performance Plastics

-

Mitsubishi Gas Chemical Company

-

Arakawa Chemical Industries

-

Nitto Denko Corporation

-

FLEXcon Company

-

Shenzhen Danbond Technology

-

Yunda Electronic Materials

-

Qinyang Tianyi Chemical

-

PI Advanced Materials Co., Ltd.

-

Goodfellow

-

Anabond Limited

-

Zhuzhou Times New Material Technology

-

Wuxi Shunxuan New Materials

-

Suzhou Kying Industrial Materials

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 2.92 Billion |

| Market Size by 2033 | USD 5.23 Billion |

| CAGR | CAGR of7.63% from 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Application: (Flexible Printed Circuits, Wires & Cables, Pressure-Sensitive Tapes, Specialty Fabricated Products, Motors/Generators, Others) • By End-Use Industry: (Electronics, Automotive, Aerospace, Labelling) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, France, UK, Italy, Spain, Poland, Russsia, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia,ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia Rest of Latin America) |

| Company Profiles | DuPont, Kaneka Corporation, Toray Industries, UBE Industries, SKC Kolon PI, Taimide Tech Inc., Saint-Gobain Performance Plastics, Mitsubishi Gas Chemical Company, Arakawa Chemical Industries, Nitto Denko Corporation, FLEXcon Company, Shenzhen Danbond Technology, Yunda Electronic Materials, Qinyang Tianyi Chemical, PI Advanced Materials Co., Ltd., Goodfellow, Anabond Limited, Zhuzhou Times New Material Technology, Wuxi Shunxuan New Materials, Suzhou Kying Industrial Materials |