Tris Nonylphenyl Phosphite Market Size & Overview:

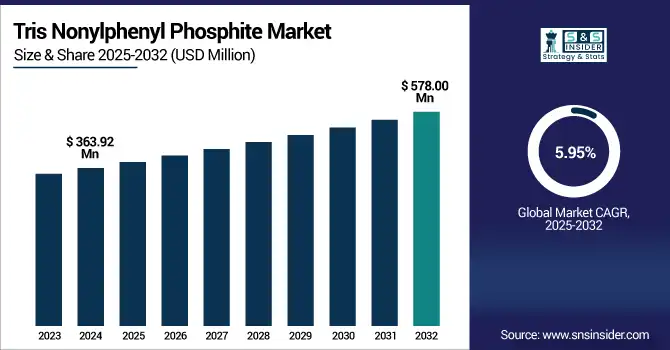

The Tris Nonylphenyl Phosphite Market size was valued at USD 363.92 million in 2024 and is expected to reach USD 578.00 million by 2032, growing at a CAGR of 5.95% over the forecast period of 2025-2032.

To Get more information on Tris Nonylphenyl Phosphite Market - Request Free Sample Report

The tris nonylphenyl phosphite market analysis identifies that increased application in automotive and electrical component manufacturing is one of the main drivers for market expansion. Due to the increasing demand for high-performance, lightweight plastic products in the automotive sector, there is a growing need for stabilizers that enhance thermal and oxidative stability during polymer processing. TNPP is used as a vital secondary antioxidant during the production of automotive parts such as dashboards, under-hood components, and wiring systems to prevent materials from degradation under heat and stress. Similarly, in the electrical and electronics industry, TNPP is used to stabilize polymers used in connectors, housings, and insulation products for safety and durability assurance. Since both industries continue to be concentrated on reliability, durability, and regulation compliance, the market for high-performance additives like TNPP will likely continue to grow, thereby stimulating the tris nonylphenyl phosphite market growth.

The U.S. Department of Energy (DOE) indicates that the removal of 10% of the weight from a vehicle (materials like plastics and composites) can help improve the fuel economy by 6–8%, with projections of the use of lightweight materials on even 25% of the U.S. fleet potentially saving over 5 billion gallons of fuel in 2030.

Tris Nonylphenyl Phosphite Market Dynamics:

Drivers

-

Rising Demand for Polymer Stabilization in the Packaging and Automotive Industries Drives the Market Growth

The growing application of plastics in the packaging and automotive industries is a key driver of the tris nonylphenyl phosphite market growth. As a second antioxidant, tris-nonylphenyl phosphite improves polymer stability at high processing temperatures and product life. In packaging, it keeps films and containers from degrading, providing safety and appearance. In automotive, it aids in the manufacture of long-lasting interior and engine parts. With the increasing demand for light, heat-resistant plastics, the usage of TNPP is increasing. The trend is likely to be sustained through industrial growth and demand for high-quality goods by the consumer.

Restrain

-

Environmental and Health Concerns Over Phenolic Compounds May Hamper the Market Growth

The primary restraint in the tris nonylphenyl phosphite market is the intensifying regulatory attention towards chemicals that are based on nonylphenol. Tris nonylphenyl phosphite, a derivative of nonylphenol, is likely to face restrictions because it is toxic and persistent in the environment. Some geographies, particularly in Europe, are imposing stricter rules on phenolic antioxidants. This may contribute to the decreased usage in sensitive end-use applications, such as food packaging or healthcare plastics. Additionally, companies may need to reformulate or switch to safer alternatives. All these issues can hamper market growth, especially in highly regulated geographies.

Opportunities

-

Development of Halogen-Free and Non-Toxic Polymer Additives Creates an Opportunity in the Market

The current transition towards environmentally friendly and halogen-free polymer additives offers a major opportunity for TNPP market participants. Development of modified TNPP products with reduced toxicity and enhanced biodegradability is becoming increasingly popular. This fits the industry's need for environmentally friendly additives that comply with international environmental regulations. Companies investing in green solutions can access new applications, particularly in sustainable packaging and electronics. Such innovations also sustain brand image and compliance with regulations. As cleaner materials are sought after by industries, producers of safer types of tris nonylphenyl phosphite may gain greater market shares, which drives the tris nonylphenyl phosphite market trends.

For instance, Songwon Industrial Co. made a major R&D commitment in 2025 towards the production of nonylphenol-free TNPP alternatives, which is a strategic move to comply with tougher global environmental regulations. This R&D development is centered on producing environment-friendly and low-toxicity stabilizers for use in the plastic and rubber industries.

Tris Nonylphenyl Phosphite Market Segmentation Analysis:

By Application

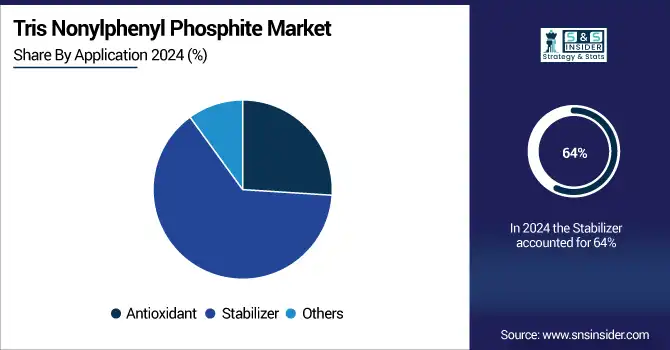

Stabilizer held the largest tris nonylphenyl phosphite market share, around 64%, in 2024. This is mainly because TNPP plays a vital role as a secondary antioxidant and heat stabilizer in the polymer processing of polypropylene (PP), polyethylene (PE), and polyvinyl chloride (PVC). These polymers find extensive application in automobile components, electrical devices, packaging material, and building materials, where thermal and oxidative stability is necessary to ensure product integrity throughout manufacturing and during the life cycle of the product. TNPP improves plastic performance and durability by arresting degradation under heat and stress, particularly when combined with a primary antioxidant.

Antioxidant held a significant tris nonylphenyl phosphite market share. It is due to the vital role of tris nonylphenyl phosphite in maximizing the oxidative stability of industrial materials and polymers. As a secondary antioxidant, TNPP is extensively used to supplement primary antioxidants during the polymer processing stage, particularly under high temperatures, where oxidation is liable to induce discoloration, brittleness, and degradation. It is most effective in stabilizing polyolefins like polyethylene and polypropylene that are employed in packaging, automotive, and consumer goods sectors.

By End Use

The plastics segment held the largest market share, around 39%, in 2024. The reason for this leadership lies in the extensive use of TNPP as a plastic processing stabilizer and antioxidant, more so in polymers such as polypropylene (PP), polyethylene (PE), and polyvinyl chloride (PVC). These plastics are widely used in industries, like packaging, automotive, electrical & electronics, and construction industries, which require high thermal stability and longevity. TNPP inhibits the degradation of polymer chains during production at elevated temperatures, resulting in longer functional service life of finished plastic products by enhancing the heat and oxidation resistance.

Oil & Gas holds a significant market share in the tris nonylphenyl phosphite market. It is because TNPP's superior function as an antioxidant and stabilizer for high-temperature, critical conditions typical of this sector is unmatched. TNPP plays a vital role in safeguarding polymer-based parts, seals, gaskets, hoses, pipelines, and insulation materials against thermal degradation and oxidation, two widespread issues in oil & gas operations. By improving material resistance to high pressure and temperature, TNPP prevents failures, prolongs the life of critical infrastructure, and minimizes maintenance downtime.

Tris Nonylphenyl Phosphite Market Regional Outlook:

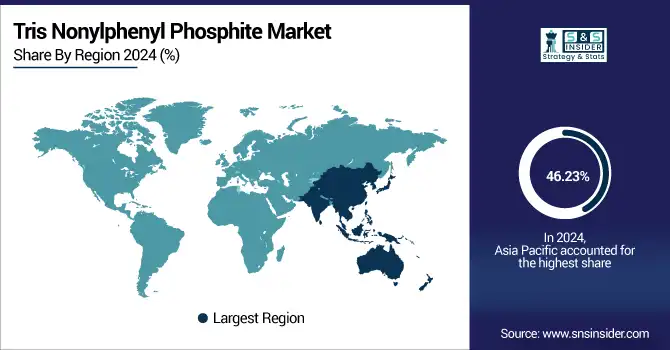

Asia Pacific tris nonylphenyl phosphite market held the largest market share, around 46.23%, in 2024. This is fueled by the pace of industrialization, an increase in the automotive and electrical industries, and an increase in demand for packaging materials across the developing economies, which has considerably driven the consumption of polymer stabilizers such as TNPP. In addition, the availability of cheap raw material and cheap labor, along with huge foreign investment, pushed the market region. Although Asia Pacific continues to capture a high share of high-performance plastics consumption, the requirement for performance-improving additives such as TNPP will remain strong.

In May 2024, Songwon launched SONGNOX binary antioxidant blends optimized for mechanically recycled (PCR) polyolefins, further solidifying its net-zero roadmap and circular economy focus.

The tris nonylphenyl phosphite market in North America has a high market share and is projected to grow at a fast pace during the forecast period. This is due to its mature plastics, automotive, and oil and gas industries. The growing manufacturing base in the region and high demand for heat-resistant, durable polymeric materials, particularly in the U.S., is driving the demand for secondary antioxidants, including TNPP. These stabilizers find extensive application to improve the performance and longevity of plastic parts in automotive interiors, electrical insulation, pipelines, and packaging. North America has also experienced growing investment in polymer innovation and sustainability, and therefore, more efficient adoption of additive technologies.

The U.S. tris nonylphenyl phosphite market size was USD 64.02 million in 2024 and is expected to reach USD 111.37 million by 2032 and grow at a CAGR of 7.17% over the forecast period of 2025-2032. It is because of its robust industrial sector, particularly in the plastic, automotive, and oil & gas industries, where TNPP serves as a secondary antioxidant and stabilizer on a large scale. The U.S. is ahead in the manufacturing and use of high-performance polymers, which need thermal and oxidative protection in processing and application. Moreover, the nation's sophisticated research facilities and increasing emphasis on polymer development have also catalyzed the use of stabilizers such as TNPP to improve product longevity and meet strict environmental and quality regulations. With new investments in production, packaging technologies, and automotive lightweighting, U.S. demand for TNPP remains strong.

Europe held a significant market share in the forecast period. It is largely due to its well-developed polymer production, automotive, and electrical industries, which are heavily reliant on high-performance additives for product longevity and environmental sustainability. Furthermore, Europe's regulatory environmental and chemical safety policies, e.g., REACH, have compelled the use of more effective and cleaner stabilizer systems, including TNPP in regulated uses. The regional focus on product quality, material science innovation, and sustainable manufacturing further underscores its continued dependence on the tris nonylphenyl phosphite industry.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players:

The major tris nonylphenyl phosphites companies are Addivant, Songwon Industrial Group, Dover Chemical Corporation, BASF SE, Everspring Chemical Co., Ltd., Galata Chemicals, Baoxu Chemical Technology Co., Ltd., Akira Chemicals, PCC Group, Nanjing Tiantian Chemical Co., Ltd.

Recent Development:

-

In June 2025, BASF announced plans to expand its Nanjing additives factory, which will include a new line of high-performance dispersants (CFRP technology). By the end of 2025, the line should be operational with reduced CO2 emissions.

-

In April 2024, Songwon will reveal new stabilizers at NPE. Songwon revealed new high-performance polymer additives, SONGNOX 9228 diphosphite antioxidant, and SONGSORB® UV absorbers, featuring ultimate heat, oxidation, and UV protection for plastics, including prospective TNPP replacement.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 363.92 Million |

| Market Size by 2032 | USD 578.00 Million |

| CAGR | CAGR of 5.95% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Application (Antioxidant, Stabilizer, Others) •By End Use (Plastics, Rubber, Oil & Gas, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Addivant, Songwon Industrial Group, Dover Chemical Corporation, BASF SE, Everspring Chemical Co., Ltd., Galata Chemicals, Baoxu Chemical Technology Co., Ltd., Akira Chemicals, PCC Group, Nanjing Tiantian Chemical Co., Ltd. |