Advanced Metering Infrastructure Market Report Scope & Overview:

Get More Information on Advanced Metering Infrastructure Market - Request Sample Report

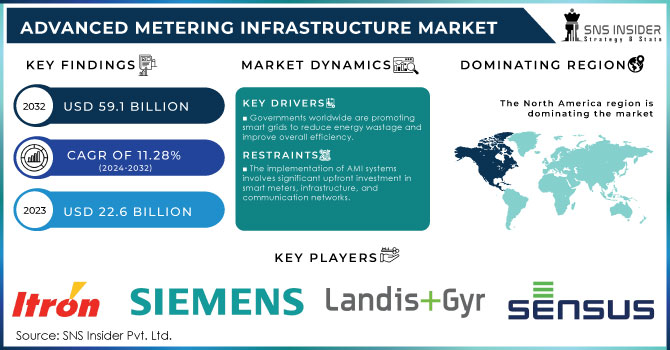

Advanced Metering Infrastructure Market was valued at USD 22.6 billion in 2023 and is expected to reach USD 59.1 Billion by 2032, growing at a CAGR of 11.28% from 2024-2032.

The Advanced Metering Infrastructure (AMI) market is a vital part of the smart grid ecosystem, allowing utilities to remotely monitor electricity consumption, streamline billing, and optimize energy distribution. AMI encompasses smart meters, communication networks, and data management systems that facilitate two-way communication between utilities and consumers, playing a key role in improving energy efficiency, demand response, and grid reliability. One of the main drivers of AMI market growth is the global shift toward energy efficiency and smart grids, especially in regions like North America and Europe. Governments and utilities are increasingly investing in modern grid projects to cut energy waste and lower carbon emissions. For example, in 2023, the U.S. Department of Energy committed $3.5 billion to grid modernization, emphasizing AMI rollouts. Similarly, the European Union aims to install 200 million smart meters by 2024, covering 80% of electricity consumers.

A real-time example of AMI's impact is the 2021 winter storm in Texas, where smart meters were crucial in identifying grid failures and minimizing disruptions. Utilities could quickly determine which areas needed urgent attention, speeding up recovery efforts and reducing downtime. These systems also allowed consumers to monitor and manage their energy use more efficiently during the crisis.

In the United States, the Advanced Metering Infrastructure (AMI) market is experiencing significant growth, bolstered by various initiatives aimed at modernizing the electrical grid. In 2023, the U.S. Department of Energy announced a multi-billion dollar investment plan to support smart grid technologies, including the deployment of smart meters across several states. This initiative aims to enhance grid reliability, improve energy efficiency, and reduce outages, especially in areas prone to extreme weather events.

Advanced Metering Infrastructure Market Dynamics

Drivers

-

Governments worldwide are promoting smart grids to reduce energy wastage and improve overall efficiency.

-

Rising energy consumption necessitates advanced solutions for accurate monitoring and efficient distribution.

-

The need for real-time monitoring and data-driven decision-making drives AMI adoption in utilities.

In the AMI market, real-time monitoring and data-based decisions are vital to the increased operational efficiency and sustainable power grid. AMI system gives utilities immediate information on energy consumption, allowing them to analyze the ongoing usages, identify unlikely patterns, and make decisions. Timely data allows, for example, changing the needed energy amounts to be provided throughout the system whenever demand might spike or fall. The real-time data also facilitates predicting outages before they occur, for example, in case of a sudden drop in consumption. In turn, this method of data-based service ensures that the energy is distributed effectively and there is no unnecessary waste of resources, establishing a grid that is overall more satisfactory for the customer. By analyzing the pattern of consumption, an adequate response can be communicated to the user, who will either stop using as much energy as that or adopt a different strategy during certain time peaks, safely leading the load to an appropriate level and preventing a grid overload.

Tampering with meters or steeling electricity can also be identified rapidly and thus leads to a timely solve of the issue. For the customer, AMI systems allow for a more timely fashion of managing their energy consumption. Real-time data from smart meters allow home owners to see how much energy they consume and manage their consumptions accordingly. Making high-cost energy heavy times prisoners to heavy consumption provides a contribution to the overall efficiency of energy use. Overall, the growing demand for the real-time data and corresponding analytics shows that utilities are getting more invested in enhancing their grid performance and integrating renewable energy, and the modern energy management cannot be done without precise, timely data.

|

Key Features |

Utility Benefit |

Consumer Impact |

|---|---|---|

|

Real-time monitoring |

Immediate grid management decisions |

Real-time consumption tracking |

|

Data-driven analytics |

Demand response optimization |

Cost-saving energy adjustments |

|

Anomaly detection |

Early fault detection |

Reduced power disruptions |

|

Usage pattern insights |

Improved energy distribution |

Enhanced energy savings |

Restraints

-

The implementation of AMI systems involves significant upfront investment in smart meters, infrastructure, and communication networks.

-

Consumers and regulatory bodies may have concerns over the security and privacy of personal usage data collected by smart meters.

-

Integrating AMI with existing grid infrastructure and legacy systems can be complex and require additional resources.

Integrating AMI with the existing grid infrastructure and legacy systems is very challenging for utilities and service providers. For instance, many utility companies have been using traditional metering systems for countless years and have gradually made the transition to the new technology. At the same time, these systems are complex because utilities need to ensure that new smart meters, networks, and data management systems can communicate effectively with old technology. Assessing the existing infrastructure is challenging, as it can be challenging for utilities. Legacy systems may not have the capacity to perform real-time data processing and two-way communication. Likewise, in some situations, these costly systems must be upgraded or replaced. No more, the integration of AMI with existing infrastructure can lead to temporary service shutdowns, and stakeholders are often concerned about this aspect, neglecting systems and technologies that can make migration easier for users. Utilities that must comply with complex requirements and standards of regulatory agencies and industry standards should also follow these measures.

Thus, it can be concluded that although the benefits of AMI in the long run, such as better service, increased energy efficiency and effective grid management, are very promising, it is very challenging to introduce new technology to old systems. It can take years for utilities to adequately plan the necessary assistance, funding, and prepare all necessary staff. When stakeholders reacted to the possibility of temporary service disruptions during migration and ensure that the technology now works as it should, the benefits of the new system would ensure that the migration would gradually take place, and no one would ever consider the old meter.

Security and privacy concerns of the personal usage data collected by smart meters pose substantial threats in the AMI market. As smart meters track extensive data related to consumers’ and/or utilities’ energy consumption patterns, people are hesitant and worry that unauthorized citizens or even malevolent hackers can have access to them. In addition, regulatory bodies are showing an increased intent on the utility companies and try to ensure that the facilities are effectively protecting the information. The information rendered by the smart meter is of delicate nature, and while unauthorized use might not bring substantial losses to the involved parties, they can be used for fraudulent purposes. Identity thefts, privacy implications, and certain financial threats can be noted among the derived negative outcomes in the case of malicious use of the data.

In terms of resolution, the utility firms need to invest in high-end cybersecurity equipment and ensure their compliance with the data protection legislations. The involvement in cybersecurity-related activities could make utilities unpopular, therefore reduced the acceptance of the AMI solutions, which utility providers are interested in promoting. However, the cases of data facts are severely unpleasant and damaging to the trust between the customers and their new am objective to increase potential growth of the AMI market.

Advanced Metering Infrastructure Market Segmentation Overview

By Product

The Smart Metering Devices segment within the Advanced Metering Infrastructure (AMI) market is poised for significant growth due to various driving factors. Increasing energy demand and the necessity for enhanced energy efficiency are motivating utilities to adopt smart meters that provide real-time data and improve grid management. Technological advancements, such as enhanced connectivity options and sophisticated data analytics, are further enhancing the capability of smart meters to optimize energy consumption.

Additionally, government initiatives and regulations promoting smart grid adoption are supporting market expansion. For example, many countries are requiring the installation of smart meters to foster energy conservation and lower carbon emissions. Looking ahead, the smart metering devices market is anticipated to grow, emphasizing the integration of renewable energy sources and the advancement of IoT capabilities to ensure greater operational efficiency.

The Solutions segment of the Advanced Metering Infrastructure (AMI) market is experiencing growth driven by several factors. Increasing investments in smart grid technologies and a growing focus on energy efficiency are propelling the demand for comprehensive AMI solutions. Additionally, the integration of advanced analytics and data management systems enables utilities to optimize energy distribution and improve customer engagement. The future outlook for the Solutions segment is promising, with a significant rise in the adoption of software solutions for real-time data monitoring and decision-making. As utilities continue to modernize their infrastructure and prioritize customer-centric services, the Solutions segment is expected to witness robust growth. This trend will be supported by ongoing advancements in technology and increasing government initiatives aimed at enhancing energy management and sustainability.

By End-Use

The residential segment of the Advanced Metering Infrastructure will experience significant growth. First and foremost, it is related two the increasing demand for smart home technology and the rise of the overall interest in energy efficiency. People are becoming to more well-aware about their energy consumption patterns, seeking ways to lower costs. Using a smart meter, consumers will be able to notice this immediately via real-time updates and adjust their consumption rate. At the same time, the government’s increasing focus on smart grid development and sustainability initiatives can act as a powerful support to this segment. The existing trends in IoT technology and connectivity also fuel optimistic predictions about strong expansion in the segment, especially with integration of renewable energy sources and energy management systems.

The industrial segment of the Advanced Metering Infrastructure (AMI) market is poised for significant growth, driven by the increasing demand for energy efficiency and cost reduction in industrial operations. Industries are adopting AMI solutions to monitor energy consumption in real-time, optimize resource usage, and reduce operational costs. Additionally, regulatory mandates for energy management and sustainability are pushing industries to invest in smart metering technologies. The future forecast for this segment is promising, with more industries implementing smart meters to enhance energy management. By 2025, a notable increase in AMI adoption is expected as industries seek to integrate renewable energy sources and leverage data analytics for improved decision-making, leading to better operational efficiency and reduced carbon footprints.

Advanced Metering Infrastructure Market Regional Analysis

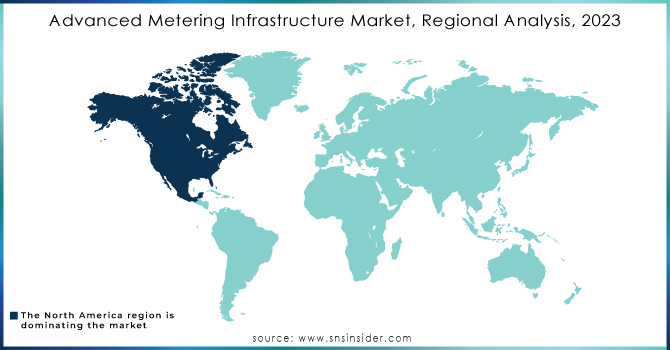

North America dominated the market and represented largest revenue share in 2023. The increasing adoption of smart grid technologies, coupled with the growing population in this area will significantly benefit the market for such new technologies. Moreover, the presence of specified water and energy applications in the North America region will foster the market size for the advanced metering infrastructure AMI.

Europe is anticipated to also contribute substantially towards the global space of the advanced metering infrastructure AMI market. Additionally, the Asia-Pacific region will present the market with substantial growth opportunities during the forecast period. This is resultant of a high consumer demand at the end-user level for smart meters and the strict regulation and policy enforcement by the government to facilitate the use of the same.

In the Asia-Pacific region, AMI is expanding rapidly, driven by large infrastructure projects in countries like China and India. In 2023, India launched a national smart metering program as part of its "Saubhagya" initiative, aiming to install 250 million smart meters. These meters are expected to enhance billing accuracy and curb electricity theft, which is a major challenge in the region. The increasing need for real-time data analytics, growing electricity demand, and governmental carbon reduction mandates are expected to sustain AMI market growth. Additionally, the integration of renewable energy sources is increasing, with AMI systems playing a crucial role in managing grid stability and energy distribution more efficiently.

Need Any Customization Research On Advanced Metering Infrastructure Market - Inquiry Now

Key Players in Advanced Metering Infrastructure Market

The major key players are

Itron, Inc. - Itron

Siemens AG - Siemens

Landis+Gyr - Landis+Gyr

Sensus (Xylem Inc.) - Xylem

Honeywell International Inc. - Honeywell

Schneider Electric - Schneider Electric

Aclara Technologies - Aclara

Elster Group - Elster

Kamstrup A/S - Kamstrup

Oracle Corporation - Oracle

Cisco Systems, Inc. - Cisco

Trilliant Networks, Inc. - Trilliant

GE Digital - General Electric

NEC Corporation - NEC

Tantalus Systems Corp. - Tantalus

Badger Meter, Inc. - Badger Meter

AccuWeather, Inc. - AccuWeather

Echelon Corporation - Echelon

Azbil Corporation - Azbil

ZIV Automation - ZIV

Suppliers in Advanced Metering Infrastructure Market

-

Siemens

-

Mitsubishi Electric

-

Honeywell

-

National Instruments

-

Texas Instruments

-

Rockwell Automation

-

Microchip Technology

-

Maxim Integrated

-

Analog Devices

-

Dell Technologies

-

Hewlett Packard Enterprise

-

Qualcomm

-

IBM

-

Fujitsu

-

Sierra Wireless

-

Honeywell

-

SAP

-

NXP Semiconductors

-

Omron

-

Siemens

Recent Developments

March 2024, Itron announced a partnership with ABB to accelerate the deployment of smart grid solutions.

February 2024, Launched a new AMI solution for water utilities, focusing on improving water loss management and operational efficiency.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 22.65 billion |

| Market Size by 2032 | USD 59.18 billion |

| CAGR | CAGR of 11.28% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Smart Metering Devices,Solutions, Services) • By End-User (Residential, Commercial, Industrial) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | NVIDIA Corporation, Intel Corporation, Google LLC, Amazon Web Services, Inc., Qualcomm Incorporated, IBM Corporation, Microsoft Corporation, AMD (Advanced Micro Devices, Inc.), Graphcore Limited, Apple Inc., Baidu, Inc. |

| Key Drivers | • Governments worldwide are promoting smart grids to reduce energy wastage and improve overall efficiency. • Rising energy consumption necessitates advanced solutions for accurate monitoring and efficient distribution. |

| RESTRAINTS | • The implementation of AMI systems involves significant upfront investment in smart meters, infrastructure, and communication networks. • Consumers and regulatory bodies may have concerns over the security and privacy of personal usage data collected by smart meters. |