Insurance Fraud Detection Market Key Insights:

Get More Information on Insurance Fraud Detection Market - Request Sample Report

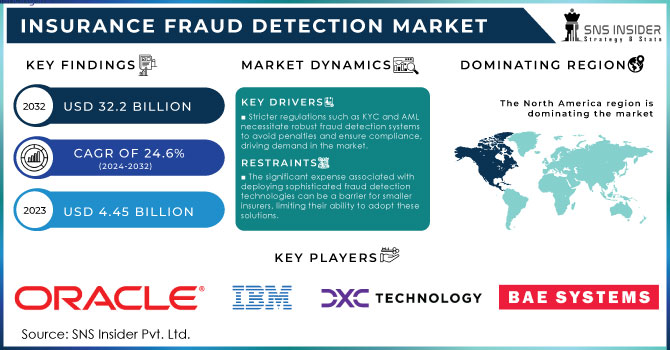

The Insurance Fraud Detection Market Size was valued at USD 4.45 Billion in 2023 and is expected to reach USD 32.2 Billion by 2032, growing at a CAGR of 24.6% over the forecast period 2024-2032.

One of the major drivers of the insurance fraud detection market is the growing prevalence of fraudulent activities in the insurance sector. It causes governmental and private entities to emphasize their efforts to prevent fraud. According to the Coalition Against Insurance Fraud, it costs the insurance sector approximately $308 billion each year in the U.S. alone. As a result, its Department of Justice is highly active in its attempts to combat the issue due to the devastating impact of this phenomenon, including a 15% rise in federal funding for fraud prevention and investigation programs throughout 2023. Moreover, as stated by the National Insurance Crime Bureau, the number of suspicious claims rose by 12% between 2021 and 2022 due to the extensive problems and damages caused by insurance fraud.

Another driver of the insurance fraud detection market is the increased use of technology. Digital technology provides major benefits to the insurance sector; however, it also creates more opportunities for fraud that must be detected. Currently, many insurers are utilizing advanced analytics and artificial intelligence, among other tools, to identify and predict patterns of fraudulent behaviour. The factors of governmental support and the implementation of regulations and requirements will facilitate the growth of the insurance fraud detection market. The rising consumer awareness about fraud risks and their potential financial repercussions further drives demand for effective insurance fraud detection tools, reinforcing the need for continuous advancements in this sector. The Insurance Fraud Department of the U.S., Department of Justice and FBI estimate the annual cost of insurance claims at over $40 billion. As the number of fraud cases grows, these modern solutions will become more popular and effective. Additionally, insurers are increasingly adopting digital platforms and innovative threat detection systems to combat tech-enabled fraud and strengthen customer relations.

Market Dynamics

Drivers

-

The growing prevalence of insurance fraud across sectors like healthcare and motor insurance is prompting insurers to invest in advanced fraud detection solutions to safeguard against significant financial losses.

-

Stricter regulations such as KYC and AML necessitate robust fraud detection systems to avoid penalties and ensure compliance, driving demand in the market.

-

Innovations in AI, machine learning, and big data analytics enable insurers to analyze vast data sets effectively, improving their capability to detect and prevent fraudulent activities.

-

The increase in digital transactions has heightened vulnerabilities, necessitating enhanced fraud detection mechanisms to combat payment and billing fraud.

The main driver of the insurance fraud detection market is the remarkable increase in fraudulent activities. In nations like the U.S., where fraud in sectors such as healthcare and motor insurance is a significant concern, insurance companies pay up to over $80 billion annually. For example, in healthcare, the National Health Care Anti-Fraud Association (NHCAA) reports that around 3% to 10% of total healthcare spending is lost to fraud, amounting to billions of dollars every year. This statistic underscores the critical need for insurance companies to invest in advanced technologies capable of identifying and preventing fraudulent activities. Insurers are increasingly adopting machine learning algorithms and predictive analytics to analyze claims data for patterns indicative of fraud, thereby mitigating losses and improving operational efficiency.

Restraints

-

The significant expense associated with deploying sophisticated fraud detection technologies can be a barrier for smaller insurers, limiting their ability to adopt these solutions.

-

The need to access sensitive personal data raises privacy and security issues, potentially hindering the growth of the fraud detection market due to compliance challenges

-

The rapid evolution of fraudulent tactics poses ongoing challenges for detection systems, requiring continuous updates and adaptations that can strain resources.

One main challenge in the insurance fraud detection market is the evolving fraudulent schemes. Fraudsters are always finding new ways to present more complexities while exploiting new vulnerabilities within the insurance system. For instance, advancements in digital tools and artificial intelligence can both aid fraud detection and enable criminals to bypass traditional security measures. This evolving landscape requires companies to constantly update and adapt their detection systems to remain effective, which can be resource-intensive. The need for constant monitoring and periodic upgrades increases operational complexity for insurers-especially those who may not have the technical know-how or even know how to respond quickly to these emergent threats quickly. Another fact is that dynamic fraud tactics-for example, synthetic identity fraud or staged accidents-will make old fraud detection models static, and hence, companies will have to adopt more agile, real-time analytics systems.

Segmentation Analysis

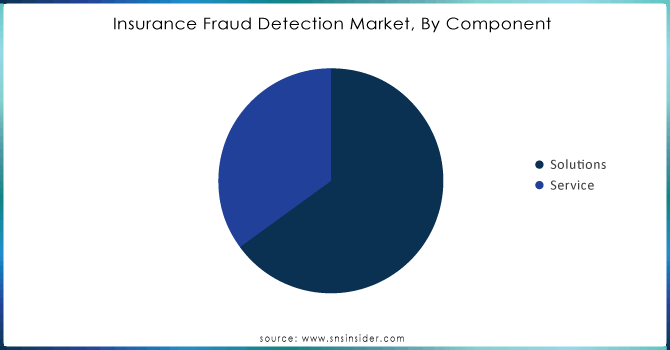

By component

In 2023, the market was dominated by the solutions segment, which accounted for a revenue share of 61%. This dominance is due to the growing adoption of technological solutions, data analytics, machine learning, and AI that empower insurers to manage large data volumes more effectively. According to the Insurance Information Institute (III), more than 70% of insurance companies reported integrating advanced analytics into their fraud detection processes in 2023, showcasing the shift towards data-centric approaches.

The services segment is projected to grow with the highest CAGR during the forecast period. It will be driven by the growing demand for consulting and support services that provide organizations with the necessary information to implement and manage fraud detection systems. Additionally, with the number of regulations pertaining to insurance fraud becoming more rigid and complex, firms need to receive professional and expert support to ensure both the compliance and effectiveness of the operations. The trend is supported by the data about the governmental experience showing that the demand for consulting services aimed at fraud prevention rose by 22% in 2023.

Need Any Customization Research On Insurance Fraud Detection Market - Inquiry Now

By Deployment

The on-premise deployment type held the highest revenue share of the global insurance fraud detection market in 2023. The main driving factor behind this preference for on-premise solutions is the need for better security and more control over sensitive data. Insurance firms are usually hesitant to adopt fully cloud-based solutions as they fear vulnerabilities in data privacy, compliance, and leaks. According to a CISA 2023 report, "85 percent of insurance organizations said they prefer on-premise systems for fraud detection to protect customer information and comply with stringent regulations, especially amid rising rates of cyberattacks targeting the insurance industry". In addition, data protection regulations, for example, the General Data Protection Regulation in Europe and some state-level legislation in the United States, place a necessity on insurers to maintain strict control over their data environments. Cloud-based solutions are flexible and scalable, but the demand for on-premise deployments is ongoing, especially for security and compliance reasons. This trend underscores the absolutely critical importance of data protection and regulatory compliance in shaping preference for deployment in the market for insurance fraud detection.

By organization size

In 2023, the large organization segment held about 65% of the global insurance fraud detection market. The dominance of the segment can be attributed to the high resources and advanced technologies present with large insurers, enabling them to invest in the right insurance fraud detection systems immune to different types of fraud. According to the government statistics of the National Association of Insurance Commissioners, more large organizations are using these advanced applications with 78% of them as of 2023. Large organizations are also prone to fraud due to the amounts of claims they deal with in their business, prompting them to have sufficient fraud detection measures in place. In addition, more small organizations are becoming aware of the benefits of fraud detection, but their low budgets and highly inadequate technologies to leverage on advanced applications make it a challenge for them to invest. Large insurers will supposedly dominate in this trend given the changing regulatory environment, which Favors their status and size in the eventuality of enhancing their fraud detection systems.

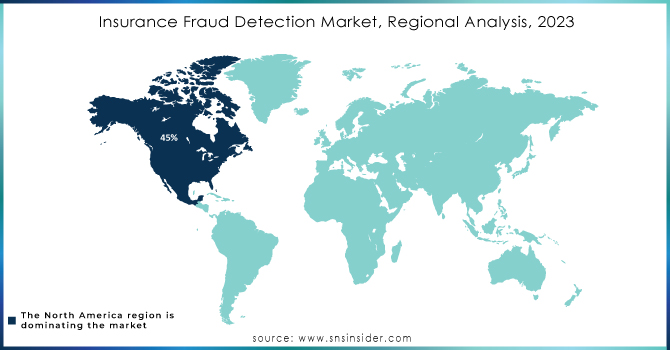

Regional Analysis

North America dominated the insurance fraud detection market in 2023, accounted 45% of the global market share. The dominance is attributed to a strict regulatory environment in the region, an advanced technological infrastructure, and a high awareness of fraud-related concerns among sophistically consumers and organizations. According to the Federal Bureau of Investigation bureau, insurance fraud is a big deal in U.S. America, and the insurers have to spend highly advanced technologies to detect fraud. Additionally, there is a high economic performance of the region, alongside the presence of major players in the insurance sector. The robust economy allows insurance enterprises to innovate on a regular. Furthermore, the region's robust economy and presence of major insurance players facilitate continuous innovation and adoption of fraud detection solutions. The insurance fraud detection market in NA was led by the U.S. in 2023 due to the increase in cases alongside technology upscale hence the introduction of new risks. Service providers are enhancing ease of use for solutions, while partnerships between companies and insurers aim to improve customer experiences. For example, in October 2023, Shippo and Cover Genius launched Shippo Total Protection, a solution offering comprehensive global coverage and streamlined claims processing for merchants.

The Asia-Pacific region is expected to grow with the fastest CAGR during the forecast, the reason being that the insurance sector is going digital as cases are fraud are also on the rise. According to the government data available, insurance fraud cases in India and China have been increasing by over 30% and this has prompted the companies to augment their fraud detection capabilities. The region accounts significant share of the market in 2023 and with growing investments in technology and increasing regulatory scrutiny, its market share is projected to expand significantly in the forecast period.

Recent Developments

-

The new data-sharing initiative for combating insurance frauds through advanced analytics was recently launched by the Insurance Fraud Bureau in the UK in April 2024 in an effort to improve the collaboration of insurance firms with crime prevention teams.

-

In May 2024, Solutis joined forces with FICO to prevent fraud and also reduce losses of medium-sized banks and insurance companies in order to improve financial inclusion.

-

Verisk, in May 2023, teamed up with CCC Intelligent Solutions to merge the fraud detection analytics with CCC's claims platform. This will further intensify fraud prevention in the P&C insurance sector.

Key Players

Service Providers

-

FICO (FICO Falcon Fraud Manager, FICO Insurance Fraud Solution)

-

IBM Corporation (IBM Safer Payments, IBM Counter Fraud Management)

-

SAS Institute Inc. (SAS Fraud Framework, SAS Detection and Investigation for Insurance)

-

Oracle Corporation (Oracle Insurance Fraud Analytics, Oracle Financial Services Analytical Applications)

-

SAP SE (SAP Fraud Management, SAP Business Integrity Screening)

-

DXC Technology (DXC Fraud Detection Solution, DXC Insurance Suite)

-

Experian plc (Experian Fraud Risk Management, Experian Fraud Shield)

-

BAE Systems (NetReveal Fraud Detection, BAE Systems Fraud Detection Platform)

-

Shift Technology (Force Fraud Detection, Shift Claims Fraud Detection)

-

ACI Worldwide (ACI Fraud Management for Insurance, ACI Enterprise Payments Fraud Management)

Users of Services/Products

-

Allianz SE

-

AXA Group

-

State Farm

-

Progressive Corporation

-

GEICO

-

Zurich Insurance Group

-

American International Group (AIG)

-

MetLife, Inc.

-

Chubb Limited

-

Liberty Mutual Insurance

and others in final Report.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 4.45 Billion |

| Market Size by 2032 | USD 32.2 Billion |

| CAGR | CAGR of 24.6% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Solutions {Fraud Analytics, Authentication, Governance, Risk, and Compliance, Others}), Services {Professional Services, Managed Services}) • By Organization (SMB, Large Organization) • By Deployment (Cloud, On-Premise) • By End-user Industry (Automotive, BFSI, Healthcare, Retail, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | IBM Corporation, FICO (Fair Isaac Corporation), SAS Institute Inc.,Oracle Corporation, SAP SE, DXC Technology, Experian Information Solutions, Inc., LexisNexis Risk Solutions, BAE Systems, ACI Worldwide, Shift Technology, Accertify, Inc. |

| Key Drivers | • The growing prevalence of insurance fraud across sectors like healthcare and motor insurance is prompting insurers to invest in advanced fraud detection solutions to safeguard against significant financial losses. • Stricter regulations such as KYC and AML necessitate robust fraud detection systems to avoid penalties and ensure compliance, driving demand in the market. |

| RESTRAINTS | • The significant expense associated with deploying sophisticated fraud detection technologies can be a barrier for smaller insurers, limiting their ability to adopt these solutions. • The need to access sensitive personal data raises privacy and security issues, potentially hindering the growth of the fraud detection market due to compliance challenges |