White Box Server Market Report Scope & Overview:

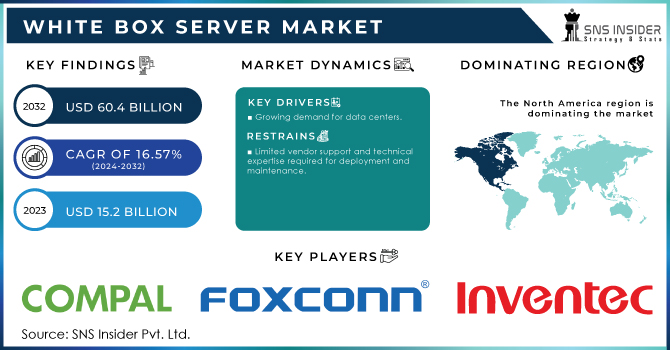

The White Box Server Market Size was valued at USD 5.53 Billion in 2023 and is expected to reach USD 20.35 Billion by 2032 and grow at a CAGR of 15.58% over the forecast period 2024-2032.The research shows increasing demand due to rising data center deployments. It offers flexibility for enterprises seeking customizable server solutions. Open-source architecture adoption and increased demand for hyper-scale data centers drive the market forward. Market trends indicate higher adoption rates in cloud-based sectors, with emerging nations focusing on next-generation server technology deployments.

Get more Information on White Box Server Market - Request Free Sample Report

Market Dynamics

Drivers:

-

The Increasing Adoption Of Cloud Computing And Data Centers Across The World Drives The Market.

The White Box Server Market is growing because of the adoption of cloud computing and the development of data centers. Google, Amazon, and Microsoft are companies that are now looking for more efficient and cost-effective server solutions to manage cloud workloads. White box servers provide customization, scalability, and reduced costs to meet these demands. Governments also focus on developing digital infrastructure; for example, the U.S. government allocated more than $1.7 billion in recent budgets to cloud computing initiatives. China's Digital Infrastructure Plan is also strongly focused on cloud and data centers, further fueling demand for white box servers.

Restrain:

-

The Limited Support And Interoperability With Proprietary Hardware Ecosystems.

White box servers generally come with open-source architectures and can be very challenging to be fully incorporated into traditional IT systems. Most enterprises are afraid to embrace open-source solutions because they fear that incorporation will be incompatible in software-dependent vendor ecosystems. This becomes a problem for banking and healthcare due to the high security and reliable hardware requirements. The European Union's cybersecurity directives emphasize strict compliance, further limiting white box adoption due to perceived risks. Administrators require further special skills to manage such systems, increasing their complexity and operations.

Opportunities:

-

Every data center operator worldwide keeps energy efficiency at the top of their priorities.

Governments and organizations propose sustainable solutions in reaction to growing environmental concerns and stricter regulations. For example, the European Green Deal requires massive reductions in carbon content, and businesses are motivated to implement energy-friendly IT infrastructure. White box servers, with a design that allows for customization, including open source, enable organizations to build their systems optimized to consume less energy. The future of the market is bright with more data centers embracing these green strategies. Secondly, increasing electricity prices worldwide spur demand for efficient alternatives, hence white box servers.

Challenges:

-

White Box Server Market will face consistent quality across a number of different hardware suppliers.

White box servers are often obtained from a number of different manufacturers, which creates the potential for differences in quality and performance. This fragmentation results in higher failure rates, less efficient systems, and higher maintenance costs. The latest U.S. government reports on IT reliability have indicated that hardware inconsistencies account for more than 22% of system downtimes in data centers. Organizations relying on smooth operations, such as e-commerce sites and financial organizations, are exposed to risks if they deploy white box systems without standardized quality controls. Improved vendor certification processes and strict quality benchmarks are necessary to maintain server reliability.

Segment Analysis:

By Server Type

In the year 2023, data center was in the dominant segment, accounting for 63% of the share. This supremacy is because demand for scalable server solutions and its cost-effectiveness is rising up to support extensive cloud services as well as other enterprise data management needs. The need for high-density computing and efficient IT infrastructure in hyper-scale environments also contributes to the data center segment's leadership.

On the other hand, the enterprise custom segment is projected to grow with the fastest CAGR of 4.96% from 2024 to 2032. Enterprises are increasingly adopting custom server solutions to meet specific operational demands, offering better flexibility, enhanced performance, and lower total ownership costs. These solutions are especially helpful for companies which need bespoke workloads including financial analytics, AI applications and sophisticated data storage systems. Growth in this sector is further spurred by the rise in software defined and customizable hardware.

By Business Type

The rack & tower segment dominated the market in 2023 with 45% of the market share. However, they happen to hold such a wide footprint across data centers and enterprises. This is due to scalability provided by these servers while efficiently cooling and offering cable management. These are cost-effective and ideal for general-purpose computing environments.

Meanwhile, the density-optimized segment is anticipated to grow at the fastest CAGR of 5.73% during the forecast period of 2024-2032. This type of server is designed to provide a maximum amount of compute power within a constrained space, so it serves ideal conditions for cloud service providers and hyper-scale data centers. Rising demand for solutions to achieve more efficient use of floor space with lowered operational cost while enhancing energy efficiency is triggering its growth further. As organizations are shifting towards high-performance computing environments, the density-optimized segment will provide a huge opportunity for growth.

By Processor Type

The X86 servers segment dominated the market in 2023 with a share of 64%. The processors are preferred since they are x86, thereby compatible and flexible, supporting several enterprise applications as well as cloud-based services. They are considered efficient for complicated workloads in both data centers and enterprise applications.

However, the segment of non-X86 servers is expected to register the highest growth rate at 5.20% during the forecast period between 2024 and 2032. Such servers based on ARM architecture have been becoming more popular in view of high power efficiency as well as opportunities in high-performance computing. Demand from cloud environments, next-generation IT solutions, and the like in terms of adopting ARM-based processors is promoting such a scenario. Government initiatives with a focus on sustainable IT infrastructure are also contributing to the rapid growth of non-X86 servers.

By Operating System

Linux segment dominated the market with 37% share in 2023. Linux is geared towards flexibility, open-source functionality, and robust security features, which make it ideal for enterprise applications in the cloud computing environment. Linux also supports all applications and virtualization technologies, which is another reason that dictates its adoption in data centers.

Notably, the Linux segment is expected to grow with the fastest CAGR of 4.88% from 2024 to 2032. This growth can be attributed to its increasing deployment in high-performance computing (HPC) environments, along with the rising preference for open-source solutions that reduce licensing costs. As more businesses and cloud service providers embrace software-defined solutions, Linux-based systems will continue to gain traction. The adoption of containerization technologies such as Kubernetes and Docker further supports the expansion of Linux-based server environments in the coming years.

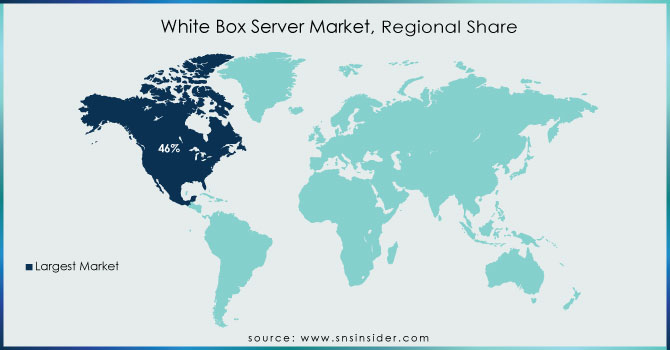

Regional Analysis

In 2023, North America dominated the White Box Server Market, capturing 37% of the total market share. The presence of major cloud service providers such as Amazon Web Services (AWS), Microsoft Azure, and Google Cloud, which require scalable, cost-effective server solutions, is attributed to the region's leadership. Widespread adoption of hyper-converged infrastructure and advancements in software-defined networking (SDN) also contribute to the region's dominance. Increasing focus on energy-efficient data centers and strong investments in AI and big data analytics further boost the North American market.

Meanwhile, the Asia-Pacific region is expected to witness growth at the highest CAGR of 5.18% during the forecast period from 2024 to 2032. Rapid industrialization, a growing IT services sector, and government-backed initiatives for digital infrastructure development are the major factors propelling this growth. Scalable servers are in big demand as most businesses switch from traditional server arrangements to cloud computing and even begin to explore latest technologies such as edge computing and IoT. Notably, governments in China are implementing their Digital Economy Plan and India's campaign for "Digital India," initiatives that have enhanced the demand for modern server infrastructures like the white box server.

Get more information on White Box Server Market - Enquire Now

Key Players

Some of the Major Players in the White Box Server Market Are

-

Quanta Computer (Servers, Networking Solutions)

-

Wistron (Server Platforms, Storage Systems)

-

Inventec (High-Density Servers, Cloud Solutions)

-

Supermicro (Blade Servers, Rack Servers)

-

Hon Hai Precision Industry (Data Center Servers, IoT Solutions)

-

MiTAC Holdings (Cloud Servers, Edge Computing Platforms)

-

Celestica (Enterprise Servers, Data Storage Solutions)

-

Hyve Solutions (Custom Servers, Data Center Hardware)

-

ZT Systems (Rack Servers, Storage Systems)

-

Penguin Computing (HPC Servers, AI Solutions)

-

Inspur (AI Servers, Cloud Platforms)

-

Gigabyte Technology (Server Motherboards, Enterprise Servers)

-

ASRock Rack (Workstation Servers, Data Center Products)

-

Dell Technologies (Server Platforms, Networking Systems)

-

Hewlett Packard Enterprise (HPE) (Data Center Solutions, Edge Servers)

-

Cisco Systems (Server Infrastructure, Networking Devices)

-

Lenovo (Server Platforms, Cloud Solutions)

-

Fujitsu (Mainframe Servers, Enterprise Storage)

-

AMD (Processors, AI Computing Solutions)

-

NVIDIA (GPUs, AI Data Servers)

Major Suppliers (Components, Technologies)

-

Intel (Processors, Chipsets)

-

Broadcom (Networking Chips, Semiconductors)

-

Seagate Technology (HDD Storage, Data Storage Components)

-

Micron Technology (Memory Modules, NAND Flash)

-

Samsung Electronics (Memory Chips, Storage Devices)

-

Western Digital (HDDs, SSDs)

-

Marvell Technology (Network Controllers, Embedded Processors)

-

Texas Instruments (Power Management ICs)

-

Toshiba (Storage Solutions, NAND Flash Memory)

-

NXP Semiconductors (Embedded Processors, Connectivity Chips)

Major Clients

-

Amazon Web Services (AWS)

-

Google Cloud Platform

-

Microsoft Azure

-

Facebook (Meta)

-

IBM Cloud

-

Tencent Cloud

-

Baidu

-

Alibaba Cloud

-

Oracle Cloud

-

Huawei Technologies

Recent Trends

September 2023: Wistron has won significant GPU substrate orders for AI servers and expects its server product shipments to rise month by month for the rest of this year, industry sources said.

October 2024: GPU-enhanced servers can usually fit up to eight of these accelerators, but Supermicro's engineered a box that somehow shoehorns 18 into an air-cooled chassis that'll consume only 3U of rack space. The delightfully named SYS-322GB-NR features 20 PCIe slots, and you're likely to populate those with GPUs.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 5.53 Billion |

| Market Size by 2032 | US$ 20.35 Billion |

| CAGR | CAGR of 15.58% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Server Type (Rack & Tower, Blade, Density-Optimized), • By Business Type (Data centers, Enterprise), • By Processor Type (x86 Server, Non-x86 Server) • By Operating System (Linux, Windows, Unix) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Quanta Computer, Wistron, Inventec, Supermicro, Hon Hai Precision Industry, MiTAC Holdings, Celestica, Hyve Solutions, ZT Systems, Penguin Computing, Inspur, Gigabyte Technology, ASRock Rack, Dell Technologies, Hewlett Packard Enterprise, Cisco Systems, Lenovo, Fujitsu, AMD, NVIDIA. |