Integration Platform as a Service (IPaaS) Market Key Insights:

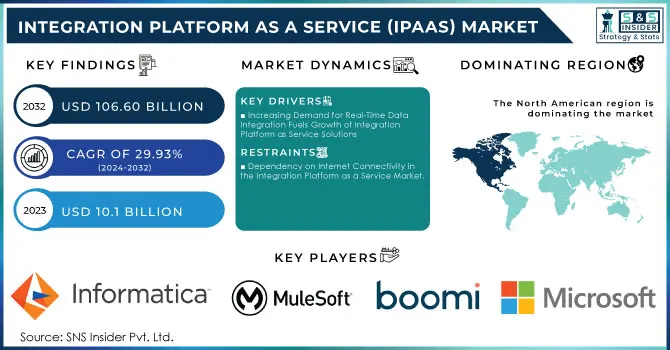

The Integration Platform as a Service (IPaaS) Market Size was valued at USD 10.1 Billion in 2023 and is expected to reach USD 106.60 Billion by 2032 and grow at a CAGR of 29.93% over the forecast period 2024-2032. The Integration Platform as a Service (IPaaS) market is on a trajectory of significant growth, propelled by the accelerating shift towards cloud adoption and the increasing need for seamless integration across diverse IT environments. As organizations migrate to cloud-based infrastructures, the demand for IPaaS solutions is intensifying, particularly in hybrid cloud settings that require robust integration capabilities for real-time data sharing and workflow automation. Notably, 81% of companies utilize multiple clouds, highlighting IPaaS's crucial role in managing these complex ecosystems. The top 12 vendors accounted for 53.2% of this spending, indicating a shift toward integrated solutions that streamline security operations. This reliance on integrated platforms mirrors the demand for IPaaS, as organizations seek to unify cloud applications and services to enhance their security posture.

Get more information on Integration Platform as a Service (IPaaS) Market - Request Sample Report

Sectors such as finance, healthcare, and retail emphasize the necessity of real-time data integration, with 60% of businesses prioritizing integration solutions to improve customer experiences. Key players in the IPaaS market, like Informatica and MuleSoft, are evolving their offerings to meet these demands, incorporating AI and machine learning capabilities. Similarly, companies such as Palo Alto Networks and CrowdStrike are witnessing market share increases due to their integrated cybersecurity solutions, with Palo Alto achieving an 11.2% rise and CrowdStrike an impressive 33.2%. As organizations embrace cloud infrastructures and AI technologies, adopting an “integration-first” strategy becomes essential. This strategy supports a range of independent software vendors (ISVs) and simplifies procurement for multi-vendor systems, ensuring resilience amid growing reliance on integrated platforms. Overall, the IPaaS market presents substantial opportunities for businesses aiming to optimize operations and fortify cybersecurity measures in an increasingly complex digital landscape.

The increasing demand for advanced systems to enhance the development, management, and deployment of enterprise applications globally has been a key driver for the IPaaS market. Recent advancements in big data, cloud computing, and the Internet of Things (IoT) have further propelled the growth of IPaaS solutions. According to the BBC, major cloud providers like Microsoft, Amazon Web Services, Alibaba Cloud, and Google Cloud Platform have reported revenue growth ranging from 25% to 100%, highlighting transformative efficiencies and innovations that drive substantial business changes. Leading players in the market are continuously upgrading their platforms by incorporating next-generation integration technologies, including API management, data hubs, B2B integration, and workflow automation. As enterprises increasingly prioritize data-centric and IoT-focused integrations, the need for real-time synchronization and mobility in cloud-based integration has grown. Many organizations utilize CRM systems to streamline customer service, but gaps remain in integrating these systems with ERP and BI/Analytics. IPaaS solutions offer a comprehensive view of customer data, enabling access to critical information and automating business processes. In November 2022, Qlik launched a new cloud-based data integration platform that allows real-time integration from diverse sources, enhancing data preparation for informed decision-making.

IPaaS Market Dynamics

Drivers

-

Increasing Demand for Real-Time Data Integration Fuels Growth of Integration Platform as Service Solutions

The increasing demand for real-time data integration is a key market driver for Integration Platform as Service (IPaaS) solutions, as organizations increasingly recognize the necessity of timely decision-making and improved operational efficiency. Companies are actively seeking solutions that enable the seamless synchronization of data across various platforms, which is crucial for maintaining a competitive edge in today's rAPIdly evolving digital landscape. According to a report by Menafn, the integration market is projected to experience significant growth from 2024 to 2033, reflecting this escalating demand. Businesses are prioritizing tools that facilitate the integration of diverse data sources, enabling them to establish a comprehensive view that supports informed decision-making. Moreover, with the surge in AI and cloud services, enterprises face an increased need for data processing capabilities. For instance, Twilio's recent integration with OpenAI's real-time API demonstrates the growing reliance on IPaaS for enhancing customer engagement. The market is responding to this demand, as evidenced by Fivetran surpassing USD 300 million in annual recurring revenue, driven by the rising need for AI and data movement solutions. The need for data center capacity has also tripled in the first half of 2024, stressing existing power grids. Furthermore, as companies increasingly adopt CRM systems, a significant gap remains in integrating these with ERP and BI/Analytics tools. IPaaS solutions address this gap by providing enterprises with a holistic view of their customers, enabling effective access to sensitive information and automation of business processes.

Restraints

-

Dependency on Internet Connectivity in the Integration Platform as a Service Market.

Dependency on internet connectivity presents a significant restraint for the Integration Platform as a Service (IPaaS) market, as these solutions heavily rely on stable and consistent internet access for optimal functionality. Disruptions in service can severely hinder data access and integration processes, jeopardizing critical business operations. With the growing adoption of cloud-based solutions, the risks associated with internet outages or slow connectivity have become a pressing concern. For example, a recent initiative aims to invest USD 12 million to enhance internet connectivity in Pierce County by 2026, highlighting ongoing efforts to improve infrastructure. Poor internet connectivity can result in substantial productivity losses, affecting businesses' operational efficiency and their ability to maintain seamless communication between integrated systems. Moreover, organizations located in areas with limited internet infrastructure may struggle to effectively utilize IPaaS solutions. A report indicated that unreliable connections are causing issues for students, demonstrating the broader implications of connectivity challenges. This dependence can deter businesses, particularly smaller firms with limited resources, from investing in IPaaS solutions due to fears of potential downtime and operational disruptions. Therefore, addressing internet reliability is crucial for the sustained growth and adoption of IPaaS solutions. Companies must carefully weigh the benefits of IPaaS against the risks tied to internet dependency, which can lead to hesitation in fully embracing these modern integration solutions. Ensuring robust internet connectivity is essential for businesses to fully leverage the potential of IPaaS and maintain competitive advantages in a rAPIdly evolving digital landscape.

Integration Platform as a Service Market Segmentation Overview

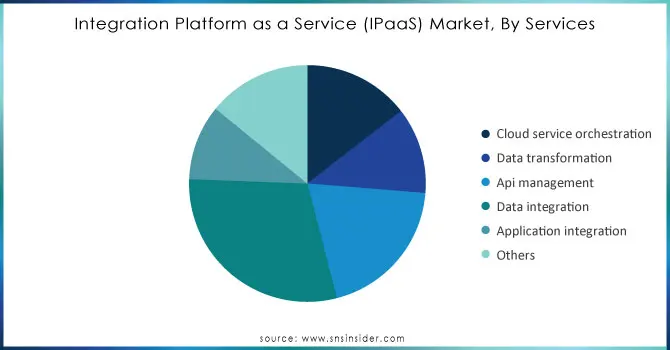

By Services

In 2023, the Integration Platform as a Service (IPaaS) market demonstrated strong growth, with data integration services leading the revenue share at approximately 30%. This segment's prominence is driven by several critical factors. First, the increasing volume and complexity of data generated from diverse sources, such as cloud applications, on-premises systems, and IoT devices, necessitate efficient integration solutions for real-time synchronization. Second, businesses require unified access to their data for informed decision-making, and data integration services facilitate the consolidation of information from various sources, enhancing operational efficiency. The growth of cloud applications has further accelerated this demand, as organizations utilize multiple cloud solutions for different functions, emphasizing the need for seamless interoperability. Additionally, as companies increasingly rely on data analytics for strategic insights, effective data integration becomes essential for extracting, transforming, and loading data into analytics platforms. The emergence of technologies like Artificial Intelligence (AI) and Machine Learning (ML) also drives the need for robust integration solutions, enabling organizations to derive valuable insights from integrated data. In response to this rising demand, companies like MuleSoft have introduced enhanced data integration features in their Anypoint Platform, while Dell Boomi launched its Boomi Flow service to automate processes and improve customer engagement. Furthermore, IBM is integrating AI capabilities into its Cloud Pak for Integration. The expansion of companies like Informatica into the Asia-Pacific region highlights a commitment to addressing localized data integration challenges. Overall, the significant market share of data integration services underscores their vital role in navigating the complexities of data management in an evolving technological landscape.

Do You Need any Customization Research on Integration Platform as a Service (IPaaS) Market - Inquire Now

By Deployment

In 2023, the Integration Platform as a Service (IPaaS) market experienced substantial growth, with the cloud deployment model capturing around 64% of the revenue share. This trend is largely driven by the numerous advantages of cloud-based integration solutions. One significant benefit is scalability and flexibility, allowing organizations to adapt their integration capabilities to meet changing business needs without heavy infrastructure investments. Additionally, cost-effectiveness plays a crucial role; by opting for cloud-based IPaaS, organizations can minimize upfront cAPItal costs associated with traditional on-premises systems, as subscription-based models let them pay only for what they use. Ease of deployment further enhances this model, enabling quicker implementation without the complexities of hardware installation, leading to faster time-to-value. Cloud solutions also promote enhanced collaboration, as teams can access and share data from any location with internet access, which is vital for organizations with remote or hybrid work environments. Moreover, continuous updates from cloud providers ensure that customers benefit from the latest features and security improvements without the need for manual upgrades. To meet the rising demand, companies have been launching innovative products. For example, MuleSoft has enhanced its Anypoint Platform with advanced cloud integration features, while Dell Boomi introduced Boomi Flow to automate workflows and boost customer engagement. Similarly, IBM has upgraded its Cloud Pak for Integration, incorporating AI capabilities to automate data integration processes. Overall, the significant market share of cloud deployment in the IPaaS sector reflects its essential role in helping organizations manage data complexities and maintain competitiveness in a fast-evolving landscape.

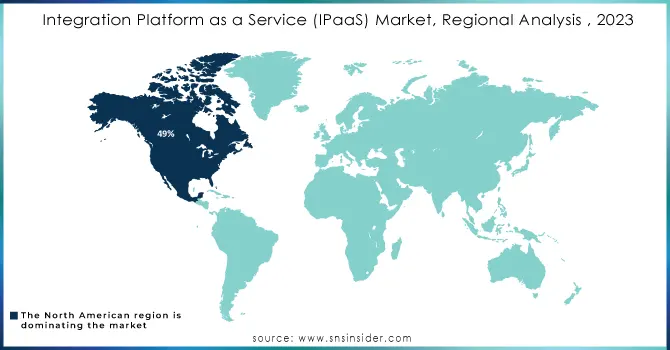

Integration Platform as a Service Market Regional Analysis

In 2023, North America established itself as a leader in the Integration Platform as a Service (IPaaS) market, accounting for approximately 49% of total revenue. This significant market share is a reflection of the region's advanced technological infrastructure and a robust demand for effective integration solutions. The presence of major technology companies such as MuleSoft, Dell Boomi, and IBM creates a vibrant ecosystem that fosters innovation and the development of specialized integration capabilities across various industries. Additionally, organizations in North America are increasingly migrating to cloud-based solutions, which is a critical driver for the IPaaS market. The widespread acceptance of cloud technologies allows businesses to streamline operations and improve data accessibility, thereby necessitating effective integration strategies. Furthermore, a strong emphasis on digital transformation initiatives is prompting companies to integrate diverse data sources and applications to maintain competitiveness, making IPaaS solutions essential for seamless workflows and data synchronization. The growing focus on data analytics and business intelligence also contributes to the rising demand for IPaaS, as organizations strive to leverage integrated data for strategic insights and decision-making. Moreover, government initiatives promoting technological innovation and enhancements in digital infrastructure further support the IPaaS market by fostering an environment conducive to adoption. In summary, North America's substantial revenue share in the IPaaS market highlights its leadership in technological advancements, high cloud adoption rates, and a strong commitment to digital transformation, positioning the region for continued growth in the IPaaS sector.

In 2023, the Asia Pacific region emerged as the fastest-growing IN Integration Platform as a Service (IPaaS) market, driven by several key factors and notable country developments. Rapid digital transformation across various industries is at the forefront of this growth, with businesses in countries like China, India, and Singapore increasingly seeking to modernize their operations and enhance efficiency. The rise of e-commerce, particularly in China, where online retail sales are expected to surpass USD 2 trillion, underscores the growing demand for effective integration solutions to manage complex data streams and customer interactions. The region is witnessing a significant shift towards cloud adoption, with organizations leveraging IPaaS solutions to integrate disparate systems and applications, enabling seamless data flow and improved collaboration. For instance, India's ambitious Digital India initiative aims to transform the country into a digitally empowered society and knowledge economy, fostering demand for cloud-based integration services to connect various government and business applications. Increasing complexity in data generated from multiple sources, such as IoT devices, cloud applications, and on-premises systems, necessitates efficient integration strategies. Countries like Japan and South Korea are investing heavily in IoT technologies, which further fuels the need for robust IPaaS solutions to streamline data management and enhance operational agility. The Asia Pacific region is characterized by a vibrant startup ecosystem and a growing number of technology companies, contributing to innovative IPaaS offerings. Local players are emerging alongside global vendors, creating a competitive landscape that drives advancements in integration technologies. Government initiatives to promote technological innovation and improve digital infrastructure, such as Australia’s National Digital Economy Strategy, are also playing a crucial role in accelerating IPaaS adoption. As countries in the region invest in enhancing connectivity and supporting digital initiatives, the IPaaS market is poised for sustained growth.

Key Players in Integration Platform as a Service Market

Some of the major key players in Integration Platform as a Service (IPaaS) market with Product:

-

Informatica (Informatica Intelligent Cloud Services)

-

MuleSoft (Anypoint Platform)

-

Dell Boomi (Boomi Integration Platform)

-

Microsoft (Azure Logic Apps)

-

IBM (IBM Cloud Pak for Integration)

-

SnapLogic (SnapLogic Integration Platform)

-

SAP (SAP Integration Suite)

-

TIBCO (TIBCO Cloud Integration)

-

Oracle (Oracle Integration Cloud)

-

Jitterbit (Jitterbit Harmony)

-

Workato (Workato Integration and Automation)

-

Celigo (Celigo Integrator.io)

-

Fivetran (Fivetran Data Connector)

-

Talend (Talend Cloud Integration)

-

Anypoint (Anypoint Exchange)

-

ZAPIer (ZAPIer Automation Platform)

-

AWS (Amazon AppFlow)

-

Adeptia (Adeptia Integration Suite)

-

Tray.io (Tray.io Automation Platform)

-

Pipedream (Pipedream Integration Platform)

List of the Potential Customers for Integration Platform as a Service (IPaaS) solutions:

-

JPMorgan Chase

-

Mayo Clinic

-

Amazon

-

General Electric

-

Verizon

-

Delta Airlines

-

University of Phoenix

-

U.S. Department of Health and Human Services

-

FedEx

-

State Farm

-

Pfizer

-

Netflix

-

Duke Energy

-

American Red Cross

-

Ford

-

Zillow

-

Deloitte

-

Procter & Gamble

-

Salesforce

-

Cargill

Recent Development

-

In January 2024, after securing all necessary regulatory approvals, IBM completed its acquisition of Stream Sets and web Methods from Software AG. This strategic move consolidates top-tier expertise in integration, API management, and data ingestion under IBM's umbrella. Stream Sets enhances IBM's AI and data platform with advanced data ingestion features, while web Methods contributes Integration Platform as Service (IPaaS) functionalities to bolster IBM's Automation solutions.

-

On October 24, 2024, Rygen Technologies announced the launch of its X1 Integration Platform. This innovative platform aims to enhance data integration and visibility across supply chain operations, utilizing advanced APIs and automation for real-time data access. This development is set to improve operational efficiency and decision-making for organizations

-

On September 9, 2024, Michael Zuercher highlighted the growing significance of B2B SaaS integrations, noting that a recent G2 report identified integrations as a key factor for software buyers. With the increasing demand for seamless connectivity, B2B companies must choose between developing their own integrations or leveraging an embedded IPaaS solution, weighing the pros and cons to align with their strategic goals

-

In April 2024, Neysa, a start-up specializing in AI cloud and platform-as-a-service solutions, successfully secured USD 20 million in Seed funding. This funding round attracted notable investors, including Matrix Partners India, Nexus Venture Partners, and NTTVC. Neysa's mission is to provide a comprehensive suite of Generative AI platforms and services that empower clients to effectively discover, plan, deploy, and manage their Generative AI initiatives. Additionally, the company emphasizes the security of AI environments in both cloud and edge settings, utilizing a consumption-based model.

-

In February 2024, Advantech, a leader in the global industrial computing sector, unveiled the WISE-PaaS Marketplace. This online platform features exclusive software services from Advantech and its partners, offering a diverse range of WISE-PaaS IoT application software, including WebAccess/SCADA, WebAccess/HMI, WebAccess/IVS, WebAccess/IMM, and WebAccess/NMS, along with various online IoT cloud and security services.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 10.1 Billion |

| Market Size by 2032 | USD 106.60 Billion |

| CAGR | CAGR of 29.23% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Services (Cloud Service Orchestration, Data Transformation, API Management, Data Integration, Deployment Integration, Others) • By Deployment (Cloud, On-premise) • By Organization Size(SME, Large enterprise) • By Industry Vertical(Healthcare, BFSI, Education, Government, Manufacturing, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia-Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia-Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Informatica, MuleSoft, Dell Boomi, Microsoft, IBM, SnapLogic, SAP, TIBCO, Oracle, Jitterbit, Workato, Celigo, Fivetran, Talend, Anypoint, Zapier, AWS, Adeptia, Tray.io, and Pipedream are among the leading companies in the Integration Platform as a Service (iPaaS) market. |

| Key Drivers | • Increasing Demand for Real-Time Data Integration Fuels Growth of Integration Platform as Service Solutions |

| RESTRAINTS | • Dependency on Internet Connectivity in the Integration Platform as a Service Market. |