Power Sport Vehicle Tire Market Key Insights:

Get More Information on Power Sport Vehicle Tire Market - Request Sample Report

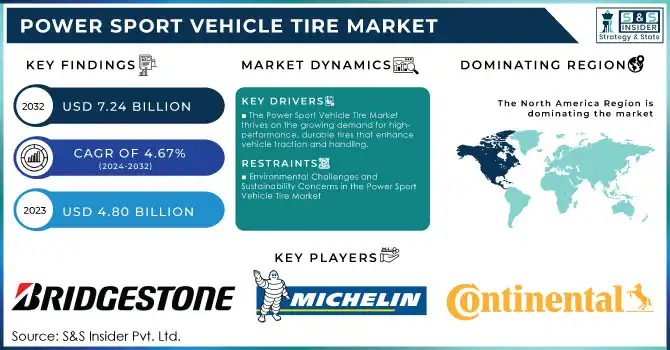

The Power Sport Vehicle Tire Market Size was valued at USD 4.80 billion in 2023 and is expected to reach USD 7.24 billion by 2032, and grow at a CAGR of 4.67% over the forecast period 2024-2032.

The Power Sport Vehicle Tire Market is experiencing significant growth, fueled by rising disposable incomes globally, particularly in emerging economies like India and developed regions such as the U.S. and China. Increased purchasing power is driving investments in power sport vehicles like ATVs, motorcycles, and snowmobiles, which in turn is creating higher demand for durable, high-performance tires. Being replacements, underscoring a sustained demand for tires in both consumer and power sport segments.

The Asia-Pacific region stands out as the fastest-growing market, significantly contributing to global expansion. Economic challenges, such as inflation and rising living costs in regions like South Africa, are exerting pressure on consumer spending, yet the growth in power sports vehicles remains robust. The demand for performance-oriented tires continues to thrive as recreational vehicles gain popularity.

Technological advancements in tire design and a growing trend toward eco-friendly power sports vehicles present new opportunities for innovation, further stimulating market growth. Between 2020 and 2023, global unit sales of tires increased from 56.63 million to 69.72 million, with passenger vehicles contributing to 46.3% of the global tire market’s revenue share as of 2024. The combination of rising disposable incomes, increased leisure vehicle ownership, and a growing global population are key factors driving this expansion. As a result, the market is expected to maintain its upward trajectory in the coming years.

Power Sport Vehicle Tire Market Dynamics

Drivers

-

The Power Sport Vehicle Tire Market thrives on the growing demand for high-performance, durable tires that enhance vehicle traction and handling.

The growing demand for vehicle customization and performance upgrades is a key driver for the Power Sport Vehicle Tire Market. As more enthusiasts seek to personalize their ATVs, motorcycles, and other power sports vehicles, the need for specialized tires designed for high performance, durability, and enhanced handling has surged. This trend is evident as consumers opt for tires that can withstand extreme terrain conditions like mud, snow, and sand. Tire manufacturers are responding to this demand with products that offer superior traction and control. Notably, Michelin’s collaboration with Ford to create custom-engineered tires for performance vehicles illustrates the tire industry’s commitment to meeting the evolving needs of power sports enthusiasts. Additionally, the tire modification trend, once primarily seen in passenger vehicles, is becoming more prevalent in power sports. Enthusiasts are increasingly focused on performance-oriented upgrades to optimize their vehicles for off-road and extreme driving experiences. As this market continues to grow, the demand for high-quality, customized tires designed to enhance overall driving performance is expected to rise steadily, positioning the power sport vehicle tire market for substantial expansion in the coming years.

Restraints

-

Environmental Challenges and Sustainability Concerns in the Power Sport Vehicle Tire Market

Environmental concerns present a key restraint to the Power Sport Vehicle Tire Market, as tire production and disposal contribute significantly to pollution and resource depletion. In 2023, 331.9 million tires were produced for vehicles, with the number expected to rise to 335.7 million in 2024. Tire manufacturing involves carbon-intensive processes, releasing approximately 367 tons of CO2 equivalent per tire, alongside particulate matter and toxic chemicals that contaminate air and water. Additionally, tire wear generates micro plastic particles, further harming ecosystems. The sourcing of natural rubber for tire production also results in deforestation, particularly in tropical regions, disrupting biodiversity. For power sport vehicles tire market, which demand specialized, high-performance tires, these environmental impacts are significant. As tires wear down, they release particulate matter into the environment, contributing to pollution. The production of heavier tires for electric vehicles, such as the Tesla Model Y and Ford F-150 Lightning, further exacerbates the environmental burden, as they generate more wear due to the increased weight. These factors pose challenges for the power sport vehicle tire market. Which must innovate toward more sustainable materials and manufacturing methods. Rising consumer demand for eco-friendly products and stricter regulations on tire waste management will require manufacturers to adapt, thus influencing market growth. Sustainable tire technologies and improved recycling practices will play a critical role in mitigating these environmental issues while supporting the continued growth of the power sport vehicle tire market.

Power Sport Vehicle Tire Market Segment Analysis

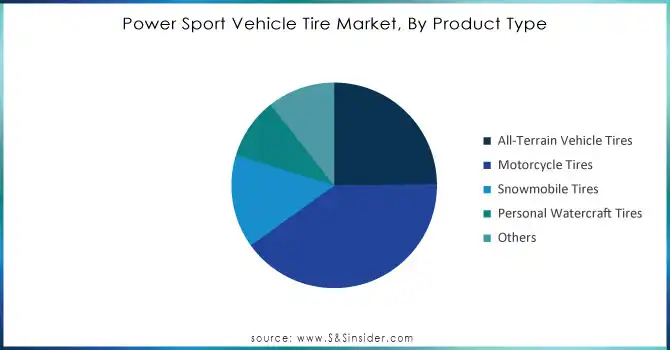

By Product Type

In 2023, motorcycle tires accounted for approximately 41% of the revenue share in the Power Sport Vehicle Tire Market, making them the largest product category. This dominance is driven by the widespread popularity of motorcycles across various regions, including emerging markets like Asia-Pacific and established markets such as North America and Europe. The increasing demand for high-performance tires, designed for both road and off-road conditions, contributes to this growth. As consumer interest in motorcycles for both recreational and commuting purposes rises, tire manufacturers are focused on improving durability, grip, and performance, further boosting the segment's share in the market.

Need Any Customization Research On Power Sport Vehicle Tire Market - Inquiry Now

By Distribution Channel

In 2023, the aftermarket segment captured the largest revenue share of around 52% in the Power Sport Vehicle Tire Market. This dominance is primarily driven by the growing trend of tire replacements and upgrades, as enthusiasts seek to enhance the performance and durability of their vehicles. The aftermarket offers a wide range of specialized tires for various power sports vehicles, including motorcycles and ATVs. As consumers increasingly demand tires that can handle extreme terrains or provide better handling, the aftermarket is well-positioned to meet these needs. Additionally, the rise of online platforms and specialized retailers has further fueled the growth of the aftermarket segment.

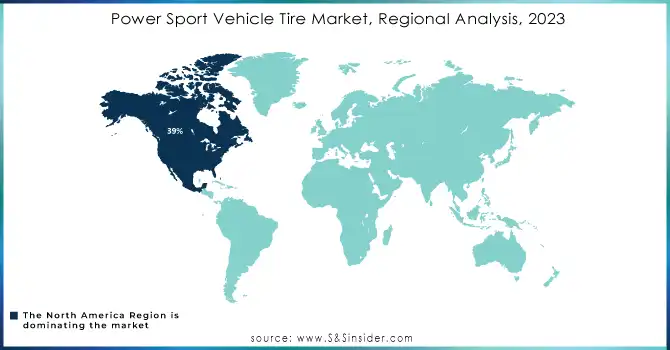

Power Sport Vehicle Tire Market Regional Overview

In 2023, North America held the largest revenue share of around 39% in the Power Sport Vehicle Tire Market, driven by the region's strong demand for motorcycles, ATVs, and other power sports vehicles. The U.S. and Canada are key markets, supported by a large consumer base that values outdoor recreation and sports, including off-roading and racing. The rising trend of vehicle customization and performance upgrades further boosts tire demand. Moreover, the well-established aftermarket distribution channels and increasing focus on high-performance tires contribute to North America's market dominance. The region's commitment to innovation and expanding recreational activities also supports sustained growth.

Asia-Pacific is the fastest-growing region in the Power Sport Vehicle Tire Market in 2023, driven by a surge in demand for power sports vehicles, particularly motorcycles and ATVs. The region benefits from increasing disposable incomes, rising urbanization, and growing interest in recreational activities. Countries like China, India, and Japan are key players, where the popularity of outdoor adventures and motorsports is contributing to higher tire consumption. Additionally, the expanding middle class and improvements in infrastructure further support market growth, making Asia-Pacific a significant driver in the global power sports vehicle tire market.

Key Players in Power Sport Vehicle Tire Market

Some of the major key Players in Power Sport Vehicle Tire Market with product:

-

Bridgestone Corporation (Motorcycle Tires, ATV/UTV Tires)

-

Michelin (Snowmobile Tires, Motorcycle Tires)

-

Dunlop Tires (Performance Motorcycle Tires, Sport ATV Tires)

-

Pirelli (High-Performance Motorcycle Tires, Enduro Tires)

-

Continental AG (Adventure Motorcycle Tires, Touring Motorcycle Tires)

-

Goodyear Tire & Rubber Co. (ATV Tires, UTV Tires)

-

Maxxis International (Off-Road ATV/UTV Tires, Motorcycle Tires)

-

Yokohama Rubber Co., Ltd. (Adventure Motorcycle Tires, Sports Motorcycle Tires)

-

Kenda Tires (ATV Tires, Personal Watercraft Tires)

-

Carlisle Companies Inc. (ATV/UTV Tires, Snowmobile Tires)

-

BFGoodrich (All-Terrain ATV Tires, UTV Tires)

-

Metzeler (Touring Motorcycle Tires, Sports Motorcycle Tires)

-

Shinko Tires (Budget-Friendly Motorcycle Tires, Cruiser Tires)

-

CST Tires (Dirt Bike Tires, ATV/UTV Tires)

-

ITP Tires (Off-Road ATV Tires, Mud Tires for UTVs)

-

Interco Tire Corporation (Specialized Off-Road Tires, ATV/UTV Mud Tires)

-

Vee Rubber Group (Motorcycle Tires, Snowmobile Tires)

-

Hoosier Racing Tire (Racing Tires for Motorcycles, ATV Tires)

-

Avon Tyres (Performance Motorcycle Tires, Touring Tires)

-

Trelleborg AB (ATV/UTV Tires, Personal Watercraft Tires)

-

MRF(Motorcycle Tires, Radial and Bias Ply Tires, Cross Ply Tires)

List of suppliers of raw materials for vehicle tires:

-

Lanxess AG

-

Bridgestone Corporation

-

Goodyear Tire & Rubber Co.

-

Kraton Polymers

-

China National Petroleum Corporation (CNPC)

-

Michelin

-

SABIC (Saudi Basic Industries Corporation)

-

Solvay

-

ExxonMobil Chemical

-

TSRC Corporation

-

Reliance Industries Limited

-

Cabot Corporation

-

Arkema

-

Dow Chemical Company

-

JSR Corporation

-

PolyOne (Now Avient)

-

Bridgestone BSE (Bridgestone Synthetic Elastomer)

-

Indian Oil Corporation

-

Shandong Hitech Rubber Co., Ltd.

-

Nokian Tyres

Recent Development

-

August 22, 2024: Bridgestone has been named the exclusive tire partner for Lamborghini’s hybrid supercar, the Temerario, set to launch in 2025. The company has engineered three custom tires—Potenza Sport, Potenza Race, and Blizzak LM005—using its Virtual Tire Development technology to ensure high performance across summer, track, and winter conditions, while improving sustainability.

-

March 25, 2024: Michelin has surpassed 100 J.D. Power Awards, marking a historic milestone as the first tire company to achieve this. The brand received top rankings in the 2024 U.S. Original Equipment Tire Customer Satisfaction Study for Luxury, Passenger Car, and Performance Sport Vehicles, earning 102 awards in total.

-

August 9, 2024: The Continental Extreme Contact DWS06 Plus tires have been tested extensively on a Honda Civic Si, showcasing their performance across various road types and weather conditions. While not the most aggressive tire for high-performance handling, they proved to be a versatile, reliable choice for everyday and track use, providing solid value despite being on the pricier side.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 4.80 Billion |

| Market Size by 2032 | USD 7.24 Billion |

| CAGR | CAGR of 4.67% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (All-Terrain Vehicle Tires, Motorcycle Tires, Personal Watercraft Tires, Personal Watercraft Tires, Others) • By Application (Racing, Recreational, Others) • By Distribution Channel (OEM, Aftermarket) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Bridgestone Corporation, Michelin, Dunlop Tires, Pirelli, Continental AG, Goodyear Tire & Rubber Co., Maxxis International, Yokohama Rubber Co., Ltd., Kenda Tires, Carlisle Companies Inc., BFGoodrich, Metzeler, Shinko Tires, CST Tires, ITP Tires, Interco Tire Corporation, Vee Rubber Group, Hoosier Racing Tire, Avon Tyres, and Trelleborg AB,MRFare key players in the Power Sport Vehicle Tire Market. |

| Key Drivers | • The Power Sport Vehicle Tire Market thrives on the growing demand for high-performance, durable tires that enhance vehicle traction and handling. |

| Restraints | • Environmental Challenges and Sustainability Concerns in the Power Sport Vehicle Tire Market |