Intelligent Enterprise Data Capture Software Market Report Scope & Overview:

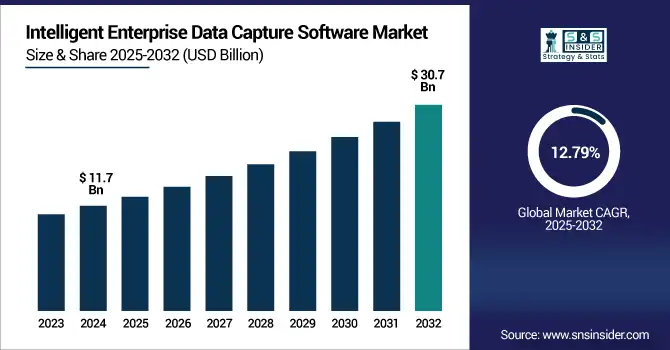

The Intelligent Enterprise Data Capture Software Market size was valued at USD 11.7 billion in 2024 and is expected to reach USD 30.7 billion by 2032, growing at a CAGR of 12.79% during 2025-2032.

To Get more information on Intelligent-Enterprise-Data-Capture-Software-Market - Request Free Sample Report

The intelligent enterprise data capture software market is witnessing robust growth, fueled by increasing digital transformation, the need for automation in data-intensive processes, and the rising volume of unstructured enterprise data. Businesses across industries such as BFSI, healthcare, and retail are adopting these solutions to improve efficiency, ensure compliance, and enable real-time decision-making. Key Intelligent Enterprise Data Capture Software Market trends include the integration of AI and machine learning for smarter data processing, as well as the shift toward cloud-based and RPA-integrated platforms. The market is expected to expand steadily over the coming years, supported by strong demand for scalable, intelligent solutions that reduce manual effort and enhance data accuracy. As enterprises prioritize data-driven operations, intelligent data capture will become a core component of modern business infrastructure.

The U.S. Intelligent Enterprise Data Capture Software Market is growing rapidly due to rising digitalization across industries, demand for real-time analytics, and strict regulatory compliance requirements. Market size is projected to increase from USD 3.3 billion in 2024 to USD 8.5 billion by 2032. This reflects a CAGR of 12.51% over the forecast period.

Market Dynamics:

Drivers:

-

The shift toward automation and real-time analytics is driving enterprises to adopt intelligent data capture software for faster, error-free processing.

Organizations across industries are accelerating digital transformation initiatives to improve operational efficiency, customer experience, and compliance. This shift has significantly boosted the demand for intelligent enterprise data capture software, which leverages AI, ML, and OCR technologies to automate the extraction and classification of unstructured data from documents, emails, and other sources. Enterprises are increasingly deploying these solutions to replace manual data entry, reduce human error, and enable real-time decision-making. Additionally, the integration of these tools with enterprise resource planning (ERP) and customer relationship management (CRM) systems enhances business agility. As businesses continue to digitize, intelligent data capture becomes a critical enabler of scalable, automated workflows.

For Instance, According to IDC (2024), over 70% of global data created in 2024 was unstructured, emphasizing the growing need for intelligent capture and real-time processing tools.

Restraints:

-

The need for substantial initial investment and complex system integration discourages small and mid-sized firms from deploying these solutions.

Despite the advantages, the high upfront cost of implementing intelligent enterprise data capture software poses a barrier for many mid-sized and smaller organizations. These solutions often require investments in advanced infrastructure, staff training, and integration with legacy enterprise systems, which can be technically complex and financially demanding. In addition, companies may face compatibility issues when integrating data capture tools with existing software platforms, creating delays and increasing operational risk. Without proper planning, the deployment may result in underutilized capabilities or inefficient workflows. As a result, some organizations hesitate to adopt these solutions, especially in regions or sectors with limited IT budgets.

For Instance, 61% of small and medium-sized enterprises cited cost as the primary barrier to adopting AI-driven data automation solutions.

Opportunities:

-

The demand for flexible, low-maintenance, and remotely accessible platforms is boosting adoption of SaaS-based intelligent data capture tools.

The growing preference for cloud-based solutions presents a significant opportunity in the intelligent enterprise data capture software market. Cloud platforms offer enhanced scalability, lower upfront investment, and ease of remote access, aligning well with the hybrid and remote work environments becoming prevalent across global enterprises. Businesses are increasingly turning to SaaS-based models that allow for faster deployment, real-time updates, and lower maintenance costs. Moreover, cloud-native platforms enable seamless integration with RPA and analytics tools, further enhancing data processing speed and accuracy. As organizations seek agile and cost-effective digital solutions, cloud-enabled intelligent data capture software is set to gain considerable traction.

Challenges:

-

Handling sensitive data under evolving regulations increases the burden on enterprises to secure and govern information accurately and lawfully.

With the growing use of AI-driven data capture tools, concerns over data security, privacy, and regulatory compliance have intensified. These software solutions often handle sensitive personal and corporate data, making them potential targets for cyberattacks. Furthermore, businesses must navigate complex regulations such as GDPR, HIPAA, and CCPA, which demand strict data handling and storage practices. Failure to comply can result in significant fines and reputational damage. Organizations must invest in secure infrastructure, encryption, and governance frameworks to ensure data captured and processed is protected. Balancing the efficiency of automation with privacy obligations remains a critical challenge for market adoption.

Segmentation Analysis:

By product Type:

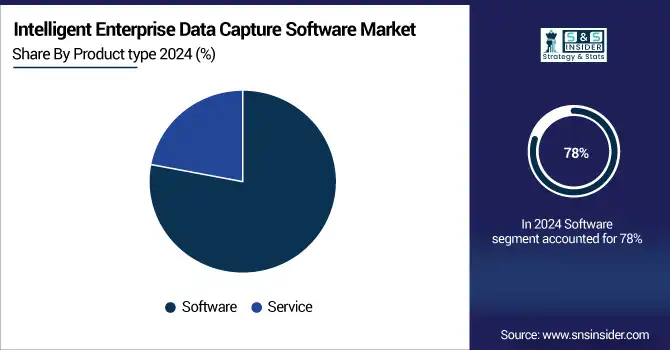

The software segment dominated the market in 2024 and accounted for 78% of intelligent enterprise data capture software market share, due to high enterprise demand for AI-driven document capture, classification, and processing tools. Its scalability, automation features, and compatibility with ERP and CRM systems make it a core enterprise investment. Continued upgrades and AI integration will sustain strong performance through 2032 across BFSI, healthcare, and retail sectors.

In April 2024, Ricoh enhanced its intelligent capture capabilities by acquiring Germany-based Natif.ai, boosting its document data extraction power—particularly for handwritten and paper documents—strengthening its automation portfolio

The services segment is expected to register the fastest CAGR by 2032, driven by rising demand for consulting, deployment, and managed services among enterprises lacking internal expertise. As intelligent capture solutions become more complex, organizations increasingly rely on third-party providers for integration, maintenance, and support—especially in cloud and hybrid environments across developing markets.

By Deployment:

The on-premise segment led the intelligent enterprise data capture software market in 2024 and held the revenue share of more than 54%, driven by large enterprises prioritizing data security, regulatory compliance, and full control over infrastructure. Industries like banking, government, and healthcare prefer on-premise deployment due to sensitive data handling needs. However, its dominance is expected to gradually decline as cloud-based alternatives become more secure, scalable, and cost-efficient.

The SaaS & PaaS segment is expected to register the fastest CAGR through 2032, fueled by the rising need for scalable, flexible, and cost-effective deployment models. Growing adoption among SMEs, demand for remote accessibility, and reduced IT overhead make cloud-based intelligent capture highly attractive. Integration with AI, RPA, and analytics tools further accelerates market growth globally.

By Line of Business:

The finance segment dominated the intelligent enterprise data capture software market in 2024 and accounted for a significant revenue share , driven by high volumes of transactional data, the need for compliance automation, and risk mitigation. Financial departments in BFSI, retail, and enterprise sectors rely on intelligent data capture for invoice processing, audits, and reporting. The demand will remain strong due to strict regulatory environments and digitized financial workflows.

In Feb 2025, Oracle introduced AI-powered pricing features within its NetSuite suite, making complex quote generation more efficient for finance teams. This integration enhances automation across financial workflows, reducing manual workload and improving data capture accuracy

The legal sector is projected to register the fastest CAGR by 2032, fueled by increasing digitalization of case files, contracts, and compliance documentation. Law firms and in-house legal teams are adopting intelligent capture to automate document classification, improve case management efficiency, and ensure regulatory adherence. AI-powered document search and extraction capabilities are further driving legal tech adoption.

Regional Analysis:

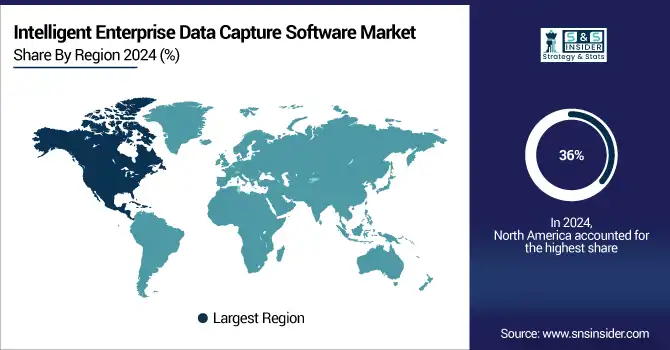

North America dominated the intelligent enterprise data capture software market in 2024 and accounted for 36% of revenue share, due to high enterprise digital maturity, early AI adoption, and strong investment in automation technologies. Major industries like BFSI, healthcare, and legal are driving demand for intelligent capture solutions. The presence of key players and favorable regulatory standards will continue to support steady market expansion across the region.

Asia-Pacific is projected to register the fastest CAGR through 2032, driven by rapid digitization across emerging economies, increasing cloud adoption, and government-backed automation initiatives. SMEs in India, China, and Southeast Asia are adopting intelligent capture tools to streamline workflows and enhance data accuracy, positioning the region as a high-growth opportunity in enterprise automation.

Europe's intelligent enterprise data capture software market growth is driven by strong data protection regulations (GDPR), increasing automation in finance and legal sectors, and growing AI integration in enterprise software. Continued investment in digital transformation will fuel steady demand for intelligent data capture solutions through 2032 across the region.

Germany leads the European intelligent enterprise data capture software market due to its advanced manufacturing base, strong financial sector, and early adoption of AI-driven enterprise software. High regulatory compliance needs and robust IT infrastructure make it a prime environment for intelligent data capture software deployment across industries like banking, logistics, and legal services.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players:

The major key intelligent enterprise data capture software market companies are UiPath, Blue Prism, Hyperscience, OpenText, Nanonets, DataSnipper, AntWorks, Databricks, Qlik, Scandit, Samsung SDS, K2View and others

Recent Developments :

-

In April 2025, UiPath: Introduced GenAI Activities GA in Automation Cloud, including advanced context grounding, web reader, image classification, and semantic similarity tools to enhance intelligent document workflows.

-

In November 2024, Hyperscience: Launched Hypercell R40 with deep-learning enhancements for extracting data from complex, long-form documents, boosting compliance and accuracy in enterprise workflows.

| Report Attributes | Details |

| Market Size in 2024 | US$ 11.7 Billion |

| Market Size by 2032 | US$ 30.7 Billion |

| CAGR | CAGR of 12.79% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Software, Handwriting Recognition, Optical Character Recognition, Intelligent Document Recognition, Services, Consulting, Training, Implementation & Support) • By Deployment (On-premise, SaaS & PaaS, Hybrid) • By Line of Business (Finance, Sales, Human Resource, Marketing, Legal Sector) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | UiPath, Blue Prism, Hyperscience, OpenText, Nanonets, DataSnipper, AntWorks, Databricks, Qlik, Scandit, Samsung SDS, K2View and others in the report |