Virtual Data Room Market Report Scope & Overview:

The Virtual Data Room Market Size was valued at USD 2.16 Billion in 2023 and is expected to reach USD 11.37 Billion by 2032 and grow at a CAGR of 20.3% over the forecast period 2024-2032.

Get more information on Virtual Data Room Market - Request Sample Report

The Virtual Data Room Market has experienced substantial growth in recent years, driven by the increasing need for secure digital data storage and exchange in business transactions. A Virtual Data Room is a secure online repository companies, legal teams, and financial professionals use to store, share, and manage confidential information, particularly during mergers and acquisitions (M&A), fundraising, due diligence, and other sensitive business processes.

A major driver is the rise in Mergers and Acquisitions (M&A), which necessitate secure, efficient platforms for due diligence. Additionally, cloud-based VDRs are gaining traction due to their cost-effectiveness, scalability, and the growing need for remote collaboration, especially as businesses shift towards digital-first operations. According to a U.S. Government report from the Small Business Administration (SBA), the rise in digital adoption by small businesses has contributed to the increasing demand for VDR solutions, with small businesses now accounting for a significant portion of cloud-based solution adoption. This trend is further supported by heightened cybersecurity concerns and the need for compliance with regulations such as GDPR and HIPAA, particularly in industries like healthcare and finance.

Additionally, VDRs are pivotal in industries like real estate, where secure document sharing and transaction management are essential. The U.S. Government's Cybersecurity & Infrastructure Security Agency (CISA) also highlights the increasing need for secure cloud solutions to protect against rising cyber threats, further propelling the VDR market's growth.

Virtual Data Room Market Dynamics

Key Drivers:

-

Increasing Adoption of Cloud-Based Solutions Drives Virtual Data Room Market Expansion Across Multiple Industries

As businesses increasingly migrate to the cloud for improved scalability, accessibility, and cost-efficiency, cloud-based VDRs have become the go-to solution for managing and securing sensitive data. VDRs offer organizations the ability to store, share, and collaborate on confidential documents securely from anywhere in the world, an essential feature for businesses dealing with M&A, fundraising, or legal due diligence. The cloud infrastructure enables real-time access to data, secure document sharing, and instant collaboration among stakeholders without the need for on-premise IT resources.

Additionally, cloud-based solutions support automatic updates and backups, reducing IT overhead. The demand for cloud solutions is particularly high in sectors such as real estate, healthcare, legal, and financial services, where sensitive data protection is crucial. With more businesses shifting to the cloud for day-to-day operations, the growth of VDR adoption is set to continue, offering companies the ability to conduct high-value transactions and manage compliance more effectively. The move towards cloud-based services also aligns with the need for better data protection, especially with increasing cyber threats.

-

Surge in Mergers and Acquisitions (M&A) Activity Drives Demand for Virtual Data Room Solutions

M&A transactions typically involve vast amounts of sensitive and confidential documents that need to be exchanged securely among multiple parties, such as buyers, sellers, advisors, and legal teams. Traditional data rooms have been replaced by VDRs due to their enhanced security features, real-time collaboration tools, and ability to provide comprehensive audit trails. VDRs streamline the due diligence process, allowing companies to efficiently manage and monitor the flow of documents and sensitive data during the transaction lifecycle.

The increasing number of cross-border M&A deals, as well as the growing involvement of private equity firms, is further accelerating the demand for VDRs. Additionally, the rise of digital transactions has made it easier for companies to explore new acquisition opportunities across borders, with VDRs playing a key role in ensuring smooth, secure, and legally compliant deal-making. The market sees consistent growth as companies in industries such as technology, healthcare, and finance depend on VDR solutions to safeguard their confidential data and enhance their M&A processes.

Restrain:

-

High Costs and Complex Implementation of Virtual Data Room Solutions May Hinder Market Growth

Despite the increasing adoption of Virtual Data Room solutions, the high costs and complexity in the implementation of these platforms pose a significant restraint to the market’s growth. VDRs, especially those with advanced features such as AI integration, customizable access controls, and real-time analytics, can come with a hefty price tag. For smaller companies or startups, the initial setup fees, subscription costs, and additional fees for premium features may deter them from investing in VDR solutions.

Moreover, while VDRs are designed to be user-friendly, the integration with existing IT infrastructures and the need for employee training to fully utilize the platform can be challenging. These issues can lead to longer implementation timelines and disrupt business operations, particularly for smaller enterprises without dedicated IT teams. The complexity of data migration and the need to ensure data security and compliance during the transition to a VDR platform further add to the burden. As a result, while larger corporations may have the resources to absorb these costs and challenges, smaller organizations may hesitate to adopt VDR solutions, limiting overall market penetration.

Virtual Data Room Market Segments Analysis

By Component

The Solution segment of the Virtual Data Room (VDR) Market is projected to hold the largest revenue share, accounting for 73% in 2023. This dominance is driven by the increasing demand for AI-powered VDR solutions that enhance security, automate document management, and enable real-time collaboration across industries. The integration of advanced technologies such as machine learning, automated indexing, and document categorization is reshaping the landscape of VDR solutions.

For instance, Datasite recently launched Datasite Diligence, an AI-driven platform that streamlines due diligence by automating the organization and analysis of deal documents. Similarly, Intralinks introduced Intralinks Dealspace, which combines VDR functionality with AI-based tools for improved data insights and quicker deal closure.

The Services segment in the Virtual Data Room Market is experiencing the largest CAGR of 21.80% during the forecasted period, highlighting a growing demand for consulting, integration, training, and support services in addition to core VDR solutions. Companies are increasingly seeking tailored VDR consulting services to address specific needs, such as regulatory compliance and secure document management. The rise in complex VDR implementations and the need for ongoing support has driven t

Additionally, training and maintenance services are gaining prominence as businesses aim to improve their employees’ ability to manage VDR platforms efficiently. As businesses scale up their adoption of VDRs, particularly in M&A and due diligence processes, the requirement for integration and ongoing support services has increased. These services are essential for ensuring that VDR solutions remain compliant, secure, and functional, fueling the rapid growth of the Services segment in the Virtual Data Room Market.

By Vertical

The Banking, Financial Services, and Insurance (BFSI) sector is poised to dominate the Virtual Data Room (VDR) Market, accounting for 34% of the market share in 2023. This dominance is largely attributed to the critical need for secure data management during sensitive financial transactions, including M&A, IPOs, asset management, and regulatory reporting. VDR solutions are essential in this sector for securely managing vast volumes of financial data, ensuring confidentiality, and streamlining due diligence processes.

Similarly, Datasite offers solutions for financial professionals, providing a platform for managing and securely sharing documents during high-stakes deals. The increasing complexity of financial regulations, the growing frequency of cross-border deals, and heightened concerns over cybersecurity are driving financial institutions to adopt VDRs.

The Corporate vertical is experiencing the highest CAGR of 21.90% in the Virtual Data Room Market, reflecting the increasing adoption of VDRs by companies across industries to streamline secure data sharing and collaboration. As businesses expand globally and undergo digital transformations, the need for secure platforms to manage internal communications, mergers, and collaborations has become critical.

As corporate governance becomes increasingly complex and the volume of digital transactions grows, companies require secure and efficient solutions to handle sensitive data. The demand for cloud-based and AI-powered VDR solutions in the corporate sector is fueling this growth, with companies focusing on enhanced automation and analytics to streamline their deal processes. As a result, the corporate segment is set to be a key driver of VDR market growth in the coming years.

Regional Analysis

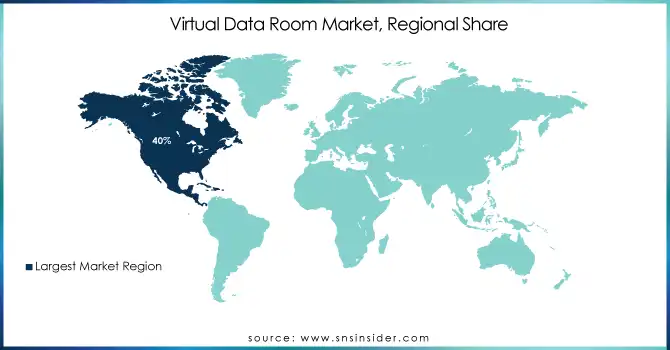

In 2023, North America is the dominant region in the Virtual Data Room (VDR) Market, accounting for an estimated 40% of the global market share. This dominance can be attributed to several factors, including the high adoption of cloud-based solutions, robust digital infrastructure, and the growing number of M&A activities in the region. North America is home to many leading VDR solution providers such as Datasite, iDeals Solutions, and Intralinks, whose products are widely used across industries like banking, financial services, insurance (BFSI), and legal sectors.

For example, Intralinks Dealspace is a widely adopted platform that caters to North American clients, particularly in financial and legal sectors. Furthermore, the region's strong regulatory environment and focus on data protection and compliance drive the demand for secure VDR solutions.

The Asia Pacific region is the fastest-growing market for Virtual Data Rooms (VDRs) in 2023, with an estimated CAGR of 22.20% during the forecasted period. The rapid growth in this region is driven by an increasing focus on digitalization, growing business transactions, and the rise in cross-border M&A activities. Countries like China, India, and Japan are witnessing a surge in demand for VDRs as they experience expansion in the technology, real estate, and finance sectors.

For example, iDeals Solutions and Ansarada have expanded their footprints in the Asia Pacific, catering to growing demand from corporate enterprises and law firms. The region's emerging economies are also witnessing an increase in small and medium enterprises (SMEs) adopting VDR solutions to streamline business operations and improve data security.

Need any customization research on Virtual Data Room Market - Enquire Now

Key Players

Some of the major players in the Virtual Data Room Market are:

-

iDeals Solutions (iDeals Virtual Data Room, iDeals Board)

-

Diligent Corporation (Diligent Boards, Diligent ESG)

-

SS&C Intralinks (Intralinks VDR, Intralinks Dealspace)

-

Thomson Reuters (Thomson Reuters Data Room, Thomson Reuters HighQ)

-

FORDATA (FORDATA Virtual Data Room, FORDATA Secure Collaboration)

-

Axway (Axway SecureTransport, Axway AMPLIFY Managed File Transfer)

-

Citrix Systems (Citrix ShareFile VDR, Citrix Content Collaboration)

-

Donnelley Financial Solutions (Venue Virtual Data Room, ActiveDisclosure)

-

Vault Rooms (Vault Rooms VDR, Vault Rooms Secure File Sharing)

-

Datasite (Datasite Diligence, Datasite Prepare)

-

Drooms (Drooms NXG, Drooms TRANSACTION)

-

FirmsData (FirmsData Virtual Data Room, FirmsData Secure Document Sharing)

-

SecureDocs (SecureDocs Virtual Data Room, SecureDocs eSignature)

-

Ansarada (Ansarada Deals, Ansarada Data Room)

-

CapLinked (CapLinked Virtual Data Room, CapLinked FileProtect)

-

Vitrium Systems (Vitrium Security, Vitrium Protected Documents)

-

SmartRoom (SmartRoom VDR, SmartRoom Deal Management)

-

Onehub (Onehub Virtual Data Room, Onehub Secure Sharing)

-

ShareVault (ShareVault Virtual Data Room, ShareVault Deal Room)

-

Confiex Data Room (Confiex Virtual Data Room, Confiex Secure File Exchange)

Recent Trends

-

August 2023: Datasite, a global leader in SaaS-based technology for M&A professionals, acquired MergerLinks, a London-based financial data platform. MergerLinks provided finance professionals access to deal information, credential promotion, and investor engagement for capital transactions.

-

September 2023: Intralinks, Inc. introduced DealVault, an enhanced cloud-based archive storage solution that enables secure access and sharing of deal archives, eliminating reliance on physical USB drives. The solution also allows users to unarchive deals, accelerating the initiation of new transactions quickly.

-

October 2023: Diligent and DFIN announced a partnership to enhance SEC compliance and ESG reporting through an integrated solution. This collaboration combines Diligent’s ESG data management tools with DFIN’s ActiveDisclosure SEC filing software, facilitating real-time collaboration and audit-ready reporting.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 2.16 Billion |

| Market Size by 2032 | US$ 11.37 Billion |

| CAGR | CAGR of 20.3 % From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component (Solution [AI-Powered, Non-AI-Powered], Services [Consulting, Implementation & Integration, Training and Support & Maintenance]) • By Deployment (Cloud-Based, On-Premise) • By Enterprise Size (Large Enterprises, SMEs) • By Vertical (Banking, Financial Services, and Insurance (BFSI), Corporates, Healthcare and Life Sciences, Government and Legal & Compliance Agencies, Real Estate, Industrial, Energy & Utility, Others) • By Function (Marketing and Sales, Legal and Compliance, Finance, Workforce Management) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | iDeals Solutions, Diligent Corporation, SS&C Intralinks, Thomson Reuters, FORDATA, Axway, Citrix Systems, Donnelley Financial Solutions, Vault Rooms, Datasite, Drooms, FirmsData, SecureDocs, Ansarada, CapLinked, Vitrium Systems, SmartRoom, Onehub, ShareVault, Confiex Data Room |

| Key Drivers | • Increasing Adoption of Cloud-Based Solutions Drives Virtual Data Room Market Expansion Across Multiple Industries • Surge in Mergers and Acquisitions (M&A) Activity Drives Demand for Virtual Data Room Solutions |

| Restraints | • High Costs and Complex Implementation of Virtual Data Room Solutions May Hinder Market Growth |