Smart Hardware ODM Market Size

Get More Information on Smart Hardware ODM Market - Request Sample Report

The smart hardware ODM market is experiencing significant growth as the demand for connected and intelligent devices surges across various sectors. Smart home products, such as voice-activated assistants, intelligent lighting, and automated thermostats, have gained popularity due to their convenience, energy efficiency, and connectivity. ODMs are playing a critical role by providing high-quality, customizable hardware that aligns with the branding and functional requirements of tech giants and startups alike. Through innovative designs, these ODMs help companies create unique, branded devices with faster time-to-market, allowing them to quickly capitalize on emerging consumer trends. Additionally, as consumer electronics incorporate AI for voice recognition, gesture control, and predictive analysis, ODMs are integrating these technologies to offer advanced solutions tailored to brand specifications.

The industrial and automotive sectors also present substantial opportunities for the Smart Hardware ODM Market. For Smart Hardware ODMs, these insights highlight the need for an enhanced online presence and integration with digital platforms, ensuring that consumers can access detailed product information and engage with their offerings remotely. Despite the rise in online research, the preference for in-person experiences, such as testing the products and interacting with knowledgeable sales representatives, indicates that ODMs must also prioritize offline experiences to effectively influence purchase decisions. In industrial settings, ODMs develop smart sensors, IoT-enabled equipment, and robotics hardware that enable manufacturers to create more efficient, data-driven operations. These intelligent devices can communicate with central systems to monitor conditions, track performance, and even predict maintenance needs, minimizing downtime and improving productivity.

Smart Hardware ODM Market Dynamics

Drivers

-

The increasing adoption of Internet of Things (IoT) technology is one of the primary drivers for the Smart Hardware ODM market.

With the rise of consumer electronics and smart home devices, more companies are using ODMs to create and produce them. Specialized hardware is needed to meet consumer expectations for functionality, design, and price due to the increase in connected devices like smart thermostats and wearable fitness trackers. The move towards more advanced technology is driving the demand for ODMs to offer solutions that include connectivity, miniaturization, and integration of multiple functions in small designs. As the demand for intelligent and effective devices rises among consumers, the ODM market gains an advantage from this trend since companies are seeking to delegate hardware design to experts who can provide economical, high-quality products. Moreover, with the quick advancements in technology, particularly in artificial intelligence (AI), machine learning, and 5G connectivity, ODMs have the chance to develop state-of-the-art devices that incorporate these technologies, solidifying their importance in the supply chain.

-

The demand for highly customized and differentiated smart hardware products is driving the growth of the Smart Hardware ODM market.

ODMs provide manufacturers with the freedom to customize designs to fulfill particular consumer preferences or brand demands, whether it's for a ready-made item or a completely personalized solution. This flexibility is essential for businesses wanting to stand out in a competitive market. ODMs offer a variety of services such as engineering, industrial design, software integration, and production, allowing companies to develop products with distinctive traits and aesthetics that reflect their brand's vision. This level of customization also applies to the selection of materials, parts, and features, enabling businesses to innovate without having to spend on internal capabilities. For instance, a business wanting to create a new smartwatch with specific health-monitoring features could partner with an ODM skilled in wearable technology to guarantee the product meets performance and design requirements. This customization feature provides companies with a competitive advantage in a market that is becoming more competitive.

Restraints

-

Intellectual property (IP) theft or misuse is one of the primary concerns for companies outsourcing their hardware design and manufacturing to ODMs.

When a company shares proprietary designs, technology, or know-how with an ODM, there is a risk that the ODM could potentially replicate or misuse that information. This issue is especially noticeable in markets where intellectual property protection laws are weak or where counterfeiting is more common. Businesses might be reluctant to disclose confidential designs or product ideas to ODMs out of concern for safeguarding their intellectual property rights. In addition, even though numerous ODMs adhere to strict confidentiality agreements, the risk of IP leakage or infringement can pose major obstacles for companies seeking to collaborate with ODMs. Therefore, companies might choose to retain their design and manufacturing procedures within their organization, even if it means higher expenses and a longer time before launching, to ensure they have authority over their intellectual property.

Smart Hardware ODM Market Segmentation Outlook

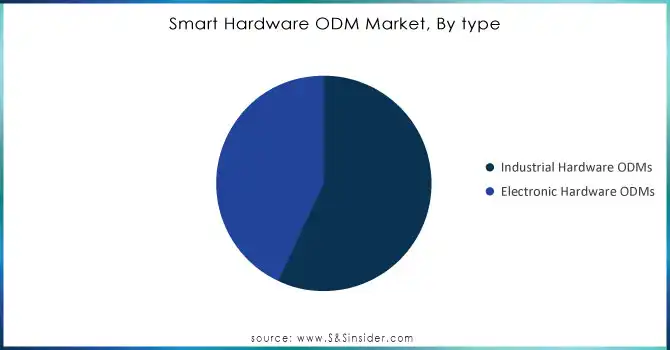

by Type

Industrial Hardware ODMs dominated in 2023 with more than 55% market share due to the increase in industrial digitization, automation, and demand for IoT-enabled devices, this sector is experiencing fast growth as companies can optimize operations and monitor systems in real time. Advantech and AAEON, for instance, create industrial-grade hardware platforms such as ruggedized IoT gateways and edge computing devices specifically designed for sectors like manufacturing and logistics. Industrial Hardware ODMs' ability to customize technology enables businesses to tailor it to their needs, leading to market domination and growth in this sector.

Electronic Hardware ODMs are anticipated to become the fastest-growing segment during 2024-2032. The popularity of smart homes, personal gadgets, and portable devices is causing continuous growth in this sector. Pegatron and Foxconn are crucial in the electronic ODM market as they produce a range of electronic components like smart displays, wearable tech, and IoT-enabled home appliances. Their knowledge assists brands in providing top-notch products customized to meet the needs of consumers, taking advantage of the fast progress in consumer technology.

Get Customized Report as per Your Business Requirement - Request For Customized Report

by Application

The industrial electronics segment dominated the smart hardware ODM market in 2023 due to the surging demand for automated solutions, IoT integration, and machine-to-machine communication within manufacturing and industrial settings. With the increasing adoption of Industry 4.0 and smart manufacturing solutions, ODMs are constantly innovating to provide customized hardware solutions tailored for industrial applications, including control systems, monitoring devices, and automated machinery. Companies like Foxconn and Pegatron are leading providers, offering advanced electronic modules and control units for industrial applications, tailored to meet specific client needs, from robust automation solutions to real-time data analytics integration.

Vehicle electronics are the fastest-growing segment during 2024-2032 in the smart hardware ODM market, primarily driven by the rapid advancements in electric vehicles (EVs), autonomous driving, and connected car technologies. As the Medical Electronics industry shifts toward electrification and smart mobility, there’s an increasing demand for sophisticated electronic hardware that enables vehicle safety, communication, and efficiency. Companies like byD and Bosch collaborate with Medicle Electronics OEMs to supply specialized electronic control units (ECUs) and connectivity modules, enabling seamless vehicle performance and connectivity.

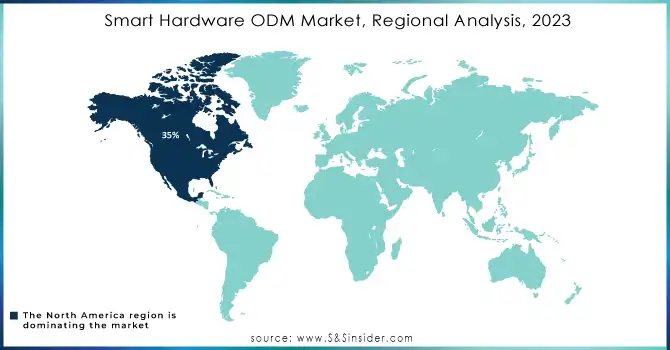

Smart Hardware ODM Market Regional Analysis

North America led the smart hardware ODM market in 2023 with over 35% market share, due to its high rates of connected device adoption, smart home technology, and advanced IoT infrastructure. This area is advantaged by a strong technological environment and substantial consumer expenditure on new gadgets, driving the need for hardware produced by original design manufacturers (ODMs). In North America, corporations such as Flex Ltd. and Jabil Inc. offer cutting-edge smart hardware solutions for various uses, including home automation and wearable health technology, maintaining market dominance with premium, adaptable hardware. Furthermore, partnerships with leading technology companies speed up the advancement and incorporation of state-of-the-art technologies, strengthening North America's leadership in the industry.

Europe is anticipated to have significant growth during 2024-2032 in the smart hardware ODM market, driven by the quick acceptance of IoT technologies and governmental backing for smart city projects. European nations place importance on sustainability, resulting in a rise in the need for energy-saving smart devices. Smartrac N.V. and Harman International provide hardware for Medicle Electronics and home automation industries in Europe, with an emphasis on green technology. Collaborations with telecom companies and the widespread deployment of 5G further support Europe's development, establishing it as a vital market for green and creative hardware solutions.

Key Players

The major key players in the Smart Hardware ODM Market are:

-

Foxconn Technology Group (iPhone, iPad)

-

Quanta Computer (Laptops, Servers)

-

Compal Electronics (Laptops, Tablets)

-

Wistron Corporation (Smartphones, Laptops)

-

Pegatron Corporation (Gaming Consoles, Smartphones)

-

Inventec Corporation (Laptops, Smartphones)

-

Flextronics International (Wearable Devices, Smartphones)

-

Arima Communications (Smartphones, Tablets)

-

Harman International (Car Audio Systems, Wearables)

-

ZTE Corporation (Smartphones, 5G Infrastructure)

-

Huawei Technologies (Smartphones, Wearables)

-

Samsung Electronics (Smartphones, Smartwatches)

-

Lenovo Group (Laptops, Tablets)

-

ASUSTek Computer Inc. (Laptops, Motherboards)

-

Acer Inc. (Laptops, Tablets)

-

TCL Corporation (Smartphones, TVs)

-

LG Electronics (Smartphones, Smart Appliances)

-

Pioneer Corporation (Car Electronics, Home Audio Systems)

-

Jabil Inc. (Smartphones, Wearables)

-

Roku Inc. (Streaming Devices, Smart TVs)

Providers of components to these key players in the Smart Hardware ODM market:

-

TSMC (Taiwan Semiconductor Manufacturing Company)

-

Samsung SDI

-

NXP Semiconductors

-

Qualcomm

-

Intel

-

Broadcom

-

Sony Corporation

-

LG Display

-

SK Hynix

-

Murata Manufacturing

Recent Development

-

October 2024: Vuzix Corporation, a top provider of AI smart glasses and Augmented Reality (AR) technology and products, unveiled its October 2024 Shareholder Letter today, offering an overview of recent achievements, operational enhancements, and the company's optimistic prospects ahead.

-

August 2024: Zetwerk Manufacturing Businesses, a contract manufacturing marketplace, has teamed up with SMILE Electronics, an electronics manufacturing services (EMS) company, to establish three factories for IT hardware production in India.

-

February 2024: Intel India has introduced a diverse range of laptops and IT products made in India at the India Tech Ecosystem Summit in New Delhi. The gathering assembled numerous local manufacturers in one location to exhibit a vast range of locally designed and manufactured devices.

| Report Attributes | Details |

|---|---|

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Electronic Hardware ODM, Industrial Hardware ODM) • By Application (Consumer Electronics, Industrial Electronics, Vehicle Electronics, Medical Electronics, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Foxconn Technology Group, Quanta Computer, Compal Electronics, Wistron Corporation, Pegatron Corporation, Inventec Corporation, Flextronics International, Arima Communications, Harman International, ZTE Corporation, Huawei Technologies, Samsung Electronics, Lenovo Group, ASUSTek Computer Inc., Acer Inc., TCL Corporation, LG Electronics, Pioneer Corporation, Jabil Inc., Roku Inc. |

| Key Drivers | • The increasing adoption of Internet of Things (IoT) technology is one of the primary drivers for the Smart Hardware ODM market. • The demand for highly customized and differentiated smart hardware products is driving the growth of the Smart Hardware ODM market. |

| RESTRAINTS | • Intellectual property (IP) theft or misuse is one of the primary concerns for companies outsourcing their hardware design and manufacturing to ODMs. |