Kids Smartwatch Market Size & Growth Trends:

The Kids Smartwatch Market size was valued at USD 10.73 billion in 2025 and is expected to reach USD 33.19 billion by 2035 and grow at a CAGR of 11.96% over the forecast period of 2026-2035.

The global market is segmented into type, connectivity, distribution channel, watchband material, and regions. The adoption of these smart wearables has been propelled by the rising concerns over child safety, growing demand for GPS, SOS and fitness tracking features, and preference of smart wearables with interactive learning applications. Kids Smartwatch Market analysis reveals accelerating innovation in child-focused technology. Moreover, increasing trends about digital parenting coupled with favorable government initiatives focused on improving the safety of children is also pushing the growth of global sales of smart wearables for kids.

Kids Smartwatch Market Size and Forecast:

-

Market Size in 2025: USD 10.73 Billion

-

Market Size by 2035: USD 33.19 Billion

-

CAGR: 11.56% from 2026 to 2035

-

Base Year: 2025

-

Forecast Period: 2026–2035

-

Historical Data: 2022–2024

To Get more information on Kids Smartwatch Market - Request Free Sample Report

Key Trends in the Entertainment Robots Market:

-

Rising consumer interest in AI-enabled interactive robots for home, education, and leisure applications.

-

Growing adoption of educational robots in schools and edtech programs to support STEM learning and coding skills.

-

Expansion of humanoid and pet-like robots for entertainment, companionship, and social interaction.

-

Increasing integration of voice recognition, motion sensors, and AI-driven personalization in robots.

-

Growing use of robots in commercial entertainment venues, theme parks, and interactive exhibits.

-

Development of energy-efficient, lightweight, and durable materials for advanced robotic designs.

-

Strategic partnerships between robotics manufacturers, technology providers, and content creators to enhance product capabilities.

The U.S. Kids smartwatch market size was USD 7.09 billion in 2025 and is expected to reach USD 17.38 billion by 2035, growing at a CAGR of 11.90% over the forecast period of 2026–2035.

The U.S. market is segmented by type, connectivity, distribution channel, watchband material and region. A greater focus on child safety and features such as GPS, SOS Alerts and fitness tracking have become some of the leading factors attracting large-scale adoption. Current Kids Smartwatch Market trends highlight rising demand for child-centric tech. Addition of the popularity of tools for interactive learning and communication enhances the attractiveness. In addition to this, the increase in adoption of digital parenting practices and government initiatives towards child security is anticipated to facilitate the market growth of smart wearable devices for kids in the country.

For instance, over 60% of devices in use now support heart rate monitoring and step counting features.

Kids Smartwatch Market Drivers:

-

Expansion of Feature-Rich and Affordable Smartwatches Tailored for Kids by Global Consumer Electronics Brands

Consumer electronics makers are now continuing to bring low-cost, well-equipped smartwatches for kids with health monitoring, fitness, camera, games and even educational tools. Parents and kids love the combination of entertainment and safety features in one device. In addition, economies of scale especially in China and Southeast Asia have lowered the per-unit costs and made kids smartwatches available to a much larger target base. Also, personalized gamifying learning, cartoon interfaces for younger kids make the product more appealing and increase international adoption.

For instance, over 80% of kids’ smartwatches come equipped with fitness tracking, cameras, and educational tools.

Kids Smartwatch Market Restraints:

-

Concerns Related to Children’s Data Privacy and Weak Regulations on Digital Security for Wearable Devices

The increased concern regarding collection, storage, and misuse of personal data of children is one of the significant restraints. As smartwatches continue to collect location, voice, and other usage behavioral data, parents and governments are concerned about cybersecurity and other potential data breaches. Many developing nations have weak regulatory frameworks which cause a barrier for data protection enforcement. Due to a number of high-profile violations with kids smartwatches in history, consumers are skeptical. Keeping up with data privacy with the GDPR, COPPA, and various other standards can also remain a hindrance, particularly for budget manufacturers who specialize in global markets.

Kids Smartwatch Market Opportunities:

-

Rising Integration of AI-Based Learning and Health Monitoring Features to Expand Use-Cases Beyond Communication and Safety

With new emerging AI-powered features such as activity tracking, heart rate monitoring, sleeping patterns analysis, and personalized learning suggestions, kids smartwatches are redefining the boundaries of health and education tools. The expanded functionalities are attractive to parents who also want to manage their child's overall health and development. The Kids Smartwatch Market growth is fueled by smart wellness integrations. As childhood obesity and digital learning are prominent issues, there exists an opening for watches with embedded prompts, physical activity motivation, and interactive quizzes. This will create opportunities for smartwatch manufacturers to venture into the education-tech and wellness space for kid-specific solutions.

For instance, over 45% of households with children under 13 own at least one child-focused wearable device.

Kids Smartwatch Market Challenges:

-

Regulatory Uncertainty and Import Restrictions Pose Challenges for Global Distribution and Market Entry

Smartwatch makers have also found it difficult to traverse complicated regulatory environments between countries. Different regulations on certification, spectrum availability for LTE/GPS modules, automobile customs regulations, etc, exist in different parts of the globe. And some governments even have moved to issue temporary restrictions or bans against particular kids' smartwatch models due to data privacy or radiation concerns. Furthermore, the impositions of tariffs and import duties and the requirement for trade agreements are a cause for price discrepancies and delay in the supply chain. This unpredictability hampers international scalability and deters from entering heavily regulated or politically volatile markets.

Kids Smartwatch Market Segmentation Analysis:

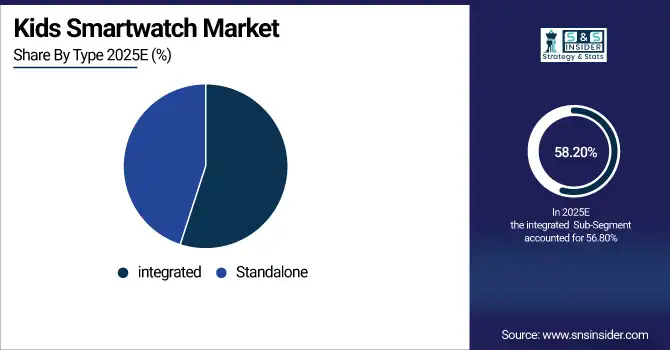

By Type, Integrated Segment Dominates with 58.20% Share in 2025, Also Expected to Record Fastest Growth with 11.79% CAGR

The integrated segment is the largest in the kids smartwatch market, accounting for 58.20% of revenue in 2025. These devices combine multiple features, such as real-time GPS tracking, SOS alerts, and calling via SIM cards, offering convenience for both children and parents. Advanced models include parental controls, secure video calling, and learning applications. Companies like TickTalk Tech LLC lead innovation in this space. The segment’s versatility, safety features, and all-in-one design make it the fastest-growing type, projected to maintain an 11.79% CAGR through 2035.

By Connectivity, Wi-Fi Segment Leads with 30.20% Share in 2025, Expected to Grow Fastest with 13.16% CAGR

Wi-Fi-enabled smartwatches dominate the connectivity segment, capturing 30.20% of the market in 2025. Wi-Fi allows real-time communication, access to educational apps, content streaming, and interactive learning, making it attractive to both children and parents. Companies like VTech Holdings Ltd. provide Wi-Fi-enabled models with kid-friendly apps, video calling, and parental control features. These devices balance safety with digital enrichment. The segment is expected to grow rapidly at a 13.16% CAGR between 2026 To 2035, as parents increasingly prefer connected devices that support learning and communication.

By Distribution Channel, Online Segment Dominates with 57.20% Share in 2025, Growing at 11.88% CAGR

The online distribution channel leads the market, accounting for 57.20% in 2025, driven by convenience, product variety, and competitive pricing. E-commerce platforms enable direct-to-consumer sales, offering seamless ordering, easy comparison, and post-purchase support. Companies like Xplora Technologies AS utilize online channels to enhance customer experience with smooth delivery, digital promotions, and positive reviews. Parents increasingly rely on online shopping for tech products, making it the preferred channel. This segment is expected to grow at an 11.88% CAGR from 2026 to 2035, reflecting the continuing shift toward digital retail.

By Watchband Material, Silicon Segment Dominates with 51.80% Share in 2025, Expected to Grow Fastest with 11.84% CAGR

Silicon watchbands dominate the kid’s smartwatch market with a 51.80% share in 2025 due to their comfort, durability, and child-friendly properties. They are waterproof, hypoallergenic, lightweight, and ideal for daily use, which appeals to both children and parents. Popular products such as Garmin Ltd.’s vívofit jr. range use silicon bands to ensure safety and longevity. This material also supports easy maintenance, flexibility, and vibrant designs, making it highly suitable for active children. The segment is projected to grow at the fastest rate, with an 11.84% CAGR between 2026 to 2035.

Kids Smartwatch Market Regional Overview:

Asia Pacific Holds Largest Share and Expected to Grow Fastest with 12.60% CAGR (2026–2035)

In 2025, Asia Pacific accounted for the largest revenue share of 34.50% in the kids smartwatch market and is projected to grow at the fastest CAGR of 12.60% through 2035. Growth is driven by the large child population in China and India, high local demand, and affordable smartwatches produced by local manufacturers. Increasing awareness of child safety, GPS tracking, and parental control features, combined with well-established distribution networks, further reinforces the region’s market dominance. Companies like Huawei provide competitively priced, feature-rich models catering to school-aged children.

Get Customized Report as per Your Business Requirement - Enquiry Now

China Leads Asia Pacific Market

China dominates the Asia Pacific region due to its vast consumer base, rapid urbanization, and growing adoption of wearable technologies among children. Local companies offer affordable smartwatches with features such as GPS tracking, video calling, and educational apps. Government initiatives promoting child safety and digital learning also drive adoption, encouraging parents to invest in connected devices for monitoring and education. Combined with strong e-commerce and retail infrastructure, China is expected to remain the largest and fastest-growing market in the region over the forecast period.

North America Holds Substantial Market Share with Strong Parental Adoption in 2025

North America accounts for a significant portion of the global kids smartwatch market, supported by robust digital infrastructure, heightened parental awareness, and strong demand for child safety devices. High adoption of GPS-based wearables, advanced parental control functionalities, and tech-savvy families drive growth. Investment by major child-focused technology brands enhances product availability and innovation. The region benefits from extensive retail and e-commerce networks, enabling easy access to smartwatches with safety, educational, and communication features, ensuring North America remains a key revenue contributor.

U.S. Leads North American Market

The United States dominates the North American market due to early adoption of wearable technologies, high consumer spending on child safety devices, and strong brand presence from companies such as Verizon and Apple. GPS tracking, SOS alerts, and interactive educational features are highly valued by parents. Extensive online and offline retail distribution networks, combined with technology-driven marketing and parental awareness campaigns, ensure rapid adoption of kids smartwatches, making the U.S. the largest and most influential market in North America.

Europe Experiences Steady Growth Driven by Child Safety Awareness

Europe’s kids smartwatch market is growing steadily, supported by rising parental concerns over child safety, GPS tracking, and digital health monitoring. Strong smartphone penetration and favorable regulatory frameworks for child safety products further enhance adoption. Parents increasingly invest in wearable devices to track children’s location and ensure safe communication. Countries such as Germany, the UK, and France are leading the market, leveraging both local and international brands that provide feature-rich, secure, and educational smartwatches for school-aged children.

Germany Leads European Market

Germany dominates Europe’s kids smartwatch market due to advanced technological infrastructure, high consumer awareness, and widespread adoption of GPS-enabled devices for children. Parental focus on safety and secure communication drives demand for smartwatches with SOS alerts, real-time location tracking, and educational apps. Supportive regulations and strong retail and online distribution channels allow both domestic and international brands such as Xplora and Vodafone to capture significant market share, making Germany the largest and most influential market in Europe.

Kids Smartwatch Market Companies are:

-

Huawei Technologies Co., Ltd.

-

Xiaomi Corporation

-

Garmin Ltd.

-

VTech Holdings Limited

-

Fitbit (Google LLC)

-

TickTalk Tech LLC

-

imoo (BBK Electronics)

-

Motorola Mobility LLC

-

Oaxis Asia Pte Ltd.

-

Omate (Shenzhen Omate Technology)

-

Xplora (Xplora ASA)

-

360 (Qihoo 360 / 360 Kids)

-

Readboy

-

Spacetalk Ltd.

-

Doki Technologies

-

LG Electronics

-

Precise Innovation

-

Tencent Holdings (Kids wearables)

-

OKII

-

Abardeen

Competitive Landscape of Kids Smartwatch Market:

Huawei Technologies Co., Ltd.

Huawei Technologies Co., Ltd. is a China-based global technology leader, offering a range of smartwatches for children featuring GPS tracking, video calling, SOS alerts, and fitness monitoring. The company emphasizes affordability combined with advanced features such as parental controls and educational apps. Its role in the kids smartwatch market is significant, providing devices that balance safety, connectivity, and interactive learning.

-

In 2025, Huawei introduced a new GPS-enabled smartwatch for children with real-time location tracking, remote communication, and AI-driven learning tools.

Xiaomi Corporation

Xiaomi Corporation, a China-based multinational electronics company, produces affordable and feature-rich kids smartwatches under its Mi Kids series. The company focuses on GPS tracking, voice calling, secure parental controls, and engaging educational content. Xiaomi’s role in the market is vital, enabling mass adoption of wearable devices for children in emerging and developed markets.

-

In 2025, Xiaomi launched updated Mi Kids smartwatches with enhanced durability, water resistance, interactive learning features, and improved connectivity, strengthening its market presence.

Garmin Ltd.

Garmin Ltd., headquartered in Switzerland, is a leading provider of GPS-enabled wearables and fitness devices, including smartwatches for children. The company emphasizes activity tracking, educational features, safety alerts, and durability. Garmin’s role in the kids smartwatch market is significant, offering devices that promote health, learning, and safe digital interaction.

-

In 2025, Garmin expanded its vívofit jr. series with improved GPS functionality, gamified learning activities, and longer battery life, catering to both parents’ safety concerns and children’s engagement.

VTech Holdings Limited

VTech Holdings Limited is a Hong Kong-based global leader in electronic learning products, including Wi-Fi-enabled smartwatches for children. The company specializes in educational apps, video calling, parental controls, and safe browsing features. Its role in the market is crucial, providing secure and educational wearable devices that foster learning while ensuring child safety.

-

In 2025, VTech launched upgraded smartwatches with interactive educational content, video communication capabilities, and advanced parental monitoring tools, reinforcing its leadership in the kids smartwatch segment.

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 10.73 Billion |

| Market Size by 2035 | USD 33.19 Billion |

| CAGR | CAGR of 11.56% From 2026 to 2035 |

| Base Year | 2025 |

| Forecast Period | 2026-2035 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (Integrated and Standalone) • By Connectivity (Bluetooth, Wi-Fi, NFC and Others) • By Distribution Channel (Online and Offline) • By Watchband Material (Silicon, Plastic, Stainless steel and Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia,Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | TickTalk Tech LLC, Xplora Technologies AS, Garmin Ltd., Huawei Technologies Co., Ltd., VTech Holdings Ltd., Jiobit, Verizon Communications Inc., Tencent Holdings Ltd., Oaxis Asia Pte Ltd., Doki Technologies Ltd., Abardeen Technology Co., Ltd., Omate Inc., Angel Watch Company, Alcatel, Kurio, MyKi, LG Electronics Inc., Qihoo 360 Technology Co. Ltd. and Kido. |