Wearable Sensors Market Size & Overview:

Get More Information on Wearable Sensors Market - Request Sample Report

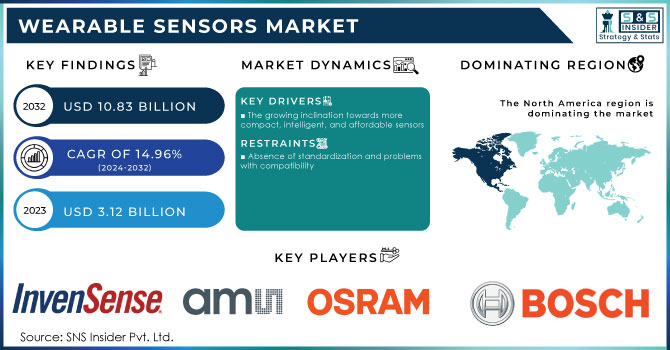

The Wearable Sensors Market Size was valued at USD 3.12 Billion in 2023 and is expected to reach USD 10.83 Billion by 2032 and grow at a CAGR of 14.96% over the forecast period 2024-2032.

Wearable sensors are booming rapidly in the market based on the technology and its adoption of smart gadgets in developing countries. By 2025, close to 1.1 billion wearable devices will be in use worldwide, and most of these will be connected to healthcare and fitness platforms. The current market leaders in wearable technology are smartwatches and fitness bands, with a market share estimated at 45% by 2026, mainly because they collect health data from people between 0-9 years and 60+.

Wearable sensors are also to be integrated into health systems. With the number of chronic diseases on the rise, wearable sensors for diabetic, hypertensive, and cardiac conditions are becoming extremely indispensable. Over 60% of the global population will be suffering from at least one chronic condition by 2030, which will escalate the demand for wearable sensors. After traditional devices like smartwatches, nearly 30% will be captured by upcoming innovations such as smart shoes, clothing, and implantable sensors by 2032.

Wearable sensors also have immense applications in sports and fitness. These devices are increasingly being used for athlete performance monitoring, injury prevention, and optimal programs for training, with the smart wearables in the sports industry expected to attain nearly 20 million units by 2026. In general, advancements in power technology, wireless communication, and sensor technologies are envisioned to sustain continuous market growth which calls for wearable sensors in consumer health and sports technology ecosystems.

Wearable Sensors Market Dynamics

KEY DRIVERS:

-

The growing inclination towards more compact, intelligent, and affordable sensors

The wearable Sensors Market is expected to grow during this period as a direct function of the increasing trend toward smaller, smarter, and more cost-effective sensors. This growth is driven by increased demand for smart platforms like the Internet of Things (IoT). There are also Emerging technologies that enhance the adoption of wearable sensors for plants. The U.N. Food and Agriculture Organization further states that the world has to produce 70% more food by 2050. Agricultural innovation will have to be met with the role of technology in achieving this.

Recent developments in crop monitoring, including sensor-enabled drones and tractors in tandem with low-resolution satellite imagery, have helped farmers scale up crop monitoring. Plant sensors-worn-on body parts take it up to a level higher than this, and it is such innovation that has been underpinned in the 2023 report of the World Economic Forum on emerging technologies.

Besides this, it also appears that with the advancement of smart mobile devices like smartphones and tablets, the costs of sensors have decreased as compared to the past. According to the group specifically to the southeastern US and to their desire to share data captured by the smart devices. We conducted an electronic survey of respondents from the online patient advisory group about smart device ownership, usage, and data sharing. Of the 3021 members of the online patient advisory group, 1368 (45%) completed the survey, including 871 female (64%), 826 and 390 White (60%) and Black (29%) participants, respectively, and a slight majority (52%) age 58 and older. Most of the respondents (98%) owned a smartphone and the majority (59%) owned a wearable. In this population, the most likely to possess a wearable device were those who identify as female, Hispanic and belong to Generation Z (age 18-25), and those with higher education completion levels, who are fully employed. 50 percent of smart device owners would share and 32 percent would consider the sharing of smart device data for research purposes.

RESTRAIN:

-

Absence of standardization and problems with compatibility

Even though wearable sensors are developing at a very fast rate, some very significant restraints limit them, mostly due to common standards and interoperability issues. Interoperability, which is projected to grow with a strong CAGR between 2024 and 2032, has been an immense challenge that so far hinders the full potential of this market.

Therefore, the lack of universal standards for sensor communications currently restricts market growth. That not only leads to integration problems but also frustrates users whose belongings from multiple brands do not communicate efficiently with each other. The wearable sensors market is likely to boom with the ever-escalating demand for consumers and development in IoT. However, the lack of such standardized solutions has led to fragmentation across platforms.

In addition, the crucial requirement of ensuring safe communication between devices creates another important layer of difficulty in driving further adoption. The long work needed to be done to solve these issues such as security standard definition and implementation will be important in the long term. It is therefore expected that the lack of an overall framework will constrain this projected growth of the wearable sensors market between forecasts since technical limitations will still pose significant challenges against widespread integration and functionality. This shows that collaboration between the enterprises and the developers will be necessary in the setting up of a standard communication protocol and inter-device compatibility.

Wearable Sensors Market Segmentation Overview

By Sensor Type

Accelerometer held the largest share at 30% in the wearable sensor market in 2023. The growth in the segment is supported by the increasing inclination of the populace towards the usage of wearable devices in the market. The output of motion sensing with accelerometer sensors is enhanced and gives higher accuracy in tracking and monitoring user activities. The fitness and wellness-related series delivered through the usage of accelerometers in wrist-worn devices serve as a key source of market traction. Further, its ability to separate the step and not to mistake the shaking of just the wrist can be a potential factor in segment growth.

The optical segment is expected to grow at the highest CAGR of 17.81% during the forecasted period 2024-2032. Optical sensors have been linked with growth in wearable devices primarily owing to their application. They are integrated into smart wearables, and they play an essential role by providing accurate electrocardiogram readings with maximum precision. Such factors enable highly sensitive measurement of health parameters and the surrounding environment, hence boosting demand during the forecast period.

By Device type

Smartwatches accounted for the largest share of 39% of wearable sensors in the year 2023 and would expand at the fastest rate of 16.79% over the forecasted period. primarily boosted by advanced sensors including GPS, accelerometers, and heart rate, creating more health and fitness monitoring. Its evolution, ranging from simple fitness bands to feature-packed wearable technologies supporting mobile payments and notification systems along with controls for media, allows the market further to expand in its appeal. Style and personalization appeal to diverse consumers and hence allow expansion in the market.

Smart glasses are the second largest market with a share of 11% in 2023 wearable sensors, which also have increasing adoption due to applications in augmented reality, healthcare, and industrial fields. The glasses come with sensors that will offer real-time data, thus making operations a hands-free affair. Growth in smart glasses would be on an uptrend as more and more industries would embrace AR for training remote assistants and interactive experiences.

BY END USER

The consumer segment holds 50% of the market share in 2023 and is estimated to grow at the highest CAGR of 16.18% during the forecast period. The need for sensor-fused devices is growing as the awareness of remote monitoring of wellness and fitness is becoming quite popular among users. There is a wide variety of factors based on which demand is placed, such as the availability of numerous wearables, technological advancement in sensors, and vendors' ability to provide differentiated products.

Areas of adoption among consumers will continue dominating the market over the forecast period. Critical drivers pushing the shipments of wearables in recent times are increased demand for devices that track fitness, wellness, and lifestyle. Consumers are increasingly preferring wrist-worn, VR headsets, and smart clothing; this is positively impacting the market, and vendors are looking to innovate and provide optimum solutions to users.

Further, the segment is also expected to grow rapidly with increasing consumer spending power, particularly in electronics. Larger companies seem to be coming up with their version of wearables more focused on fusing fashion along with utility. Constant innovation will also be a boon in helping the consumer segment grow further.

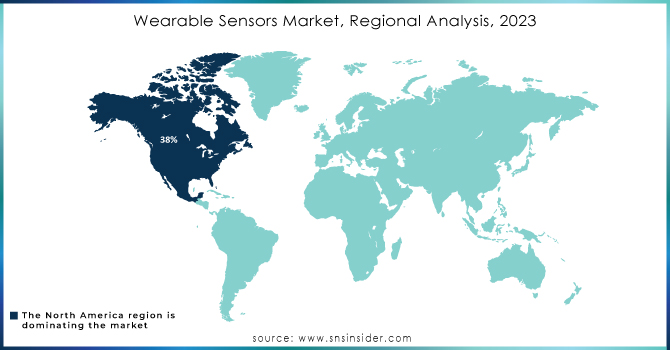

Wearable Sensors Market Regional Analysis

The North American region dominated the wearable sensors market with a revenue share of 38% in 2023. This dominance is due to rapidly increasing awareness of health and fitness. Moreover, the area where wearables can be extremely important lies in the growth of digital technology in the U.S. Apart from this, the region's healthcare industry is doing well, and this will start using wearable sensor-based products more and more throughout the forecast period. The increasing U.S. population with massive health issues among youths coupled with an aging portion is fueling demand for healthcare activity monitoring devices. A wearable sensor is a module in any wearable device. It gives the right and reliable information about the activities and behavioral patterns of a user. A wearable sensor detects activities by monitoring physical and physiological parameters along with other symptoms.

The Asia Pacific wearable sensors market will be seen to grow with a high CAGR of 17.81% during the forecast period 2024-2032. Countries like Japan, South Korea, and China are considered among the top technology hubs in the Asia Pacific region. These OEMs play a significant role in the development of IMUs, MEMS technology, and others, and can promise accuracy while also making it possible to keep the price relatively lower for products developed through them. Many of the enterprises within China have evolved to develop wearables at lower costs, which is attributed to the growing number of users within the market. The growing demand for home healthcare monitoring shall continue to fuel the growth of this market across China for the foreseeable future.

Need Any Customization Research On Wearable Sensors Market - Inquiry Now

Key Players

Some of the major players in the Wearable Sensors Market are:

-

InvenSense Inc. (Gyroscopes, accelerometers)

-

AMS OSRAM AG (Optical sensors, including heart rate sensors)

-

Bosch Sensortec GmbH (Accelerometers, gyroscopes)

-

STMicroelectronics (Inertial measurement units (IMUs), pressure sensors)

-

Infineon Technologies (Power management ICs, microcontrollers)

-

Knowles Electronics (MEMS microphones and pressure sensors)

-

NXP Semiconductors (Microcontrollers, NFC chips)

-

Texas Instruments (Microcontrollers, analog-to-digital converters)

-

TE Connectivity (Connectors, antennas, and sensors for wearable devices)

-

Broadcom (Wireless connectivity chips (Bluetooth, Wi-Fi) and NFC)

-

Analog Devices (ADCs, digital-to-analog converters)

-

Panasonic (Batteries, sensors, and modules for wearable devices)

-

Asahi Kasei (Materials for wearable devices, including flexible displays)

-

Maxim Integrated (Analog ICs, including ADCs)

-

Renesas Electronics (Microcontrollers, analog ICs)

-

ON Semiconductor (Power management ICs, analog ICs)

-

Vishay Intertechnology (Resistors, capacitors)

-

TDK Corporation (Electronic components, including capacitors)

-

AVX Corporation (Capacitors and filters)

-

Honeywell International (Pressure and Humidity sensors)

RECENT TRENDS

-

In May 2024, Sensirion announced its SLD3x series of miniature liquid flow sensor platforms for subcutaneous drug delivery. The product's customizable solutions, according to the company, help to provide precise flow control and contribute to maintaining patient safety for therapies requiring the subcutaneous delivery of medication.

-

In May 2023, engineers at the University of California, San Diego achieved their first breakthroughs in designing the world's first wearable ultrasound that is fully integrated into the body for deep tissue monitoring. This innovation is a transformative leap in cardiovascular monitoring and lays out life-saving potential ahead of one of the world's leading wearable ultrasound labs.

-

In May 2023, STMicroelectronics of Switzerland launched a first generation of MEMS pressure sensors said to yield outstanding accuracy and environmental hardness. Gas and water metering, weather monitoring, air conditioning systems, and home appliances are but some applications of the sensors.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 3.12 Billion |

| Market Size by 2032 | US$ 10.83 Billion |

| CAGR | CAGR of 14.96% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Sensor (Accelerometer, Gyroscope, Optical, Force & Pressure, Inertial Sensor, Temperature, Magnetometers, Medical Based Sensors, Others) • By Device type Smartwatch, Fitness Band, Smart Glasses, Smart Fabric, Smart Footwear, Other Wearables) • By End-use (Consumer, Defense, Healthcare, Industrial, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | InvenSense Inc., AMS OSRAM AG, Bosch Sensortec GmbH, STMicroelectronics, Infineon Technologies, Knowles Electronics, NXP Semiconductors, Texas Instruments, TE Connectivity, Broadcom , Analog Devices, Panasonic, Asahi Kasei, Maxim Integrated, Renesas Electronics, ON Semiconductor, Vishay Intertechnology, TDK Corporation AVX Corporation, Honeywell International |

| Key Drivers | • The growing inclination towards more compact, intelligent, and affordable sensors |

| Restraints | • Absence of standardization and problems with compatibility |