Portable Printer Market Size & Trends:

The Portable Printer Market Size was valued at USD 12.24 billion in 2024 and is expected to reach USD 21.30 billion by 2032 and grow at a CAGR of 7.28% over the forecast period 2025-2032.

To Get more information on Portable Printer Market - Request Free Sample Report

The global portable printer market is witnessing a robust growth driven led the surging growing need for wireless and mobile printing solutions among industries including logistics, retail, healthcare, and e-commerce. Technological advances in connectivity, smaller size, and battery performance are increasing convenience for users. Rising use in developing economies and integration with smart devices also support further market growth in the forecast period.

The U.S. Portable Printer Market size was USD 2.56 billion in 2024 and is expected to reach USD 4.59 billion by 2032, growing at a CAGR of 7.67% over the forecast period of 2025–2032.

The portable printer market in U.S. is continuously witnessing demand from various applications including mobile and compact printing solutions, and is growing rapidly. Improvements in wireless connection, connection with smart devices and the surging remote work are driving the acceptation. The growing upgradations in battery life and print quality have also supported the market expansion, with portable printers that are user friendly and reliable.

According to research, over 75% portable printers sold in the U.S. in recent years feature wireless connectivity including Wi-Fi or Bluetooth, and Mobile professionals and field service industries contribute to over 50% of portable printer sales in the U.S.

Portable Printer Market Dynamics:

Key Drivers:

-

Increasing Adoption of Mobile Workforces and On-the-Go Business Operations Drives Portable Printer Market Growth

The surging remote work settings and mobile workspaces are largely augmenting the demand for portable printers. Professionals in different industries including logistics, retail, healthcare, and field services highly require on-the-go printing functionality to achieve operational efficiency. Portable printers support instant documentation, label printing, and receipt printing, which increases productivity and service delivery. As more and more companies implement mobile-first policies and become accustomed to more fluid working environments, the demand for portable, wireless and hassle-free printing solutions is becoming increasingly necessary, contributing to the growth of U.S. portable printer market.

According to research, more than 65% of logistics and field service companies have integrated portable printing solutions into their operations, and On-the-go printing has been shown to improve operational efficiency by up to 25% in mobile workforce environments.

Restrain:

-

Limited Battery Life and Printing Capacity Restrict the Widespread Adoption of Portable Printers

Lack of battery capacity and low print volume are the crucial bottlenecks for the promotion of portable printer. Most models are not capable of high-volume printing and prolonged use without recharging, and many are less appropriate for heavy duty use and long days in the field. Such factors can inhibit productivity and user satisfaction, especially where stringent industries are involved. Until advances are achieved in battery efficiency and total device ruggedness, these problems will continue to impede broader adoption of portable printers among professionals seeking dependable, continuous printing capability.

Opportunities:

-

Growing Integration of Portable Printers with Smartphones and Cloud Services Presents Lucrative Market Opportunities

Integration of mobile printers with smart phones, tablets, and cloud technologies is one of the significant opportunities that would help to stimulate the mobile printer market. With the widespread use of smartphones in the workspace, there is growing demand for computers and peripheral devices that can be used easily with such smartphones. Cloud printing provides instant access to documents and makes it possible to print from anywhere, making it more convenient for mobile professionals. Particularly, this development has been a boon for small business enterprises and service professionals that require efficient printing and lower-footprint solutions. The trend promises to create new opportunities for growth and innovation in the market over the upcoming years.

Challenges:

-

Technical Limitations in Print Quality and Speed Pose Operational Challenges in Critical Use Cases

While there is convenience through portable printers, technical constraints through print quality and speed pose shortcomings in industries involving high precision and speedy output. For instance, in legal, medical, or government use where document clarity and speed are imperative, portable printers could be inferior. Print resolution tends to be behind desktop printers, and slower speed can interfere with time-critical operations. These limitations can detract from their attractiveness for some business applications, and therefore manufacturers need to spend money improving the basic performance characteristics of portable devices to keep pace with increasing market demands.

Portable Printer Market Segment Analysis:

By Connectivity

The wireless segment dominated the market with a revenue share of 38.98% in 2024 due to its popularity across industries, including retail, logistics, and field services. Portable printer companies including Epson and Brother have introduced wireless-enabled portable printers, such as the Epson WorkForce WF-110 and Brother PocketJet 773, which feature Wi-Fi connectivity and cloud support. These technologies address mobile workforce requirements, increase print flexibility, and reduce cable dependence, greatly driving segment expansion in the changing portable printing market.

The Bluetooth segment is expected to have the fastest CAGR of 8.41% during the forecast period of 2025-2032, attributed to low power usage and easy integration with mobile devices. Manufacturers, such as Canon and Zebra Technologies have come up with Bluetooth-supporting models including the Canon PIXMA TR150 and Zebra ZQ220, especially suited for small and real-time printing in mobile applications. The growing demand for affordable, wireless, and portable solutions in retail, transport, and healthcare is fueling widespread adoption of Bluetooth-based portable printers.

By Technology

The inkjet segment dominated the portable printer market share with a 52.66% in 2024 due to its better print quality and adaptability to different types of media. HP and Canon are among the companies that have driven the segment forward with small, high-resolution portable inkjet printers including the HP OfficeJet 250 and Canon PIXMA TR150. They enable wireless and mobile printing, perfect for business users and design professionals, solidifying inkjet's stronghold on providing versatile, high-quality printing in mobile formats.

The thermal segment is expected to have the fastest CAGR of 8.56% over 2025-2032 due to increased demand for effective, low-maintenance printing in logistics, healthcare, and retail. Companies, such as Zebra Technologies and Brother, have launched mobile thermal printers such as the Zebra ZQ630 and Brother RJ-4250WB, designed for quick, robust, and inkless printing of labels and receipts. Their mobility and ruggedness make thermal printers perfect for heavy-duty field operations, propelling this segment's high growth.

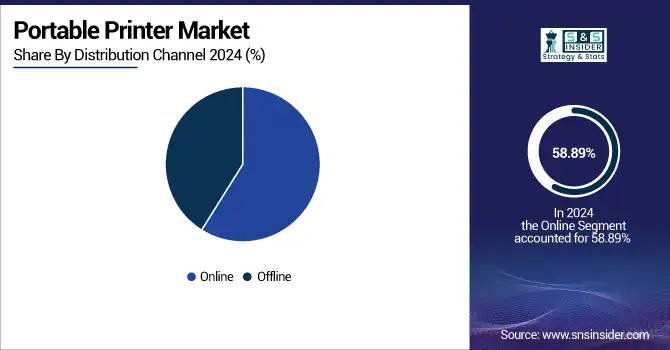

By Distribution Channel

The online segment held highest revenue share of 58.89% in 2024 in the portable printer industry, driven by the growth in direct-to-consumer and e-commerce sales channels. Players such as Canon, Epson, and HP have increased their product availability through channels such as Amazon and official websites, introducing products, such as the Canon PIXMA TR150 and HP Tango X. These products, combined with online marketing and rapid delivery, increase customer convenience and reach, leading to control in the online distribution market.

Offline segment is expected to have the fastest CAGR of 8.43% during 2025-2032, with users looking for hands-on experience and post-sales support for mobile printers. Retailers and technology chains such as Best Buy and Staples are collaborating with brands such as Brother and Zebra Technologies to feature models, such as the Brother PocketJet 773 and Zebra ZQ220. Demonstrations, packaged promotions, and tailored consultations in physical stores are inducing customer participation and supporting growth through this channel.

By Industry Vertical

The retail segment dominated the market with a 34.90% revenue contribution in 2024, owing to the need for shelf labeling and mobile checkout. Companies, such as Bixolon and Seiko Instruments have come up with compact, high-speed portable printers including the Bixolon SPP-R310 and Seiko MP-B20, increasing mobility for retail workers and cutting customer waiting times. These innovations maximize store efficiency, making portable printers crucial tools in contemporary retailing and further entrenching this market segment as market leader.

Transport and logistics segment expected fastest growth of 8.34% CAGR between 2025 and 2032, spurred by growing demand for print-on-site within warehouses and shipping. TSC Auto ID and Dymo have introduced models,s such as the TSC TTP-225 and Dymo LabelWriter 4XL, geared for rapid and rugged label printing in the field. These developments in handheld printing technology are essential to boost real-time tracking, increase shipment precision, and simplify logistics operations.

Portable Printer Market Regional Analysis:

Asia Pacific region dominated the market a 37.82% of the revenue in the Portable Printer market in 2024, led by industrial development and growing demand for portable solutions across retail, healthcare, and logistics. Portable Printer companies such as Bixolon and TSC Auto ID have introduced portable printers, such as the Bixolon SPP-R310 and TSC TTP-225, fulfilling the region's requirement for portable, rugged, and efficient printing. The strong growth of e-commerce and mobile services in nations, such as China and India is driving the demand for these printers.

-

China dominates the Asia Pacific region in the market with respect to its massive manufacturing capability, high rate of technology adoption, and rapidly growing e-commerce sector. Industrialization rate of the nation, increasing logistics infrastructure, and mobile population growth support strong demand for portable printing products.

The North America region is expected to have a CAGR of 8.21% during the forecast period of 2025-2032, following increasing demand in retail, logistics, and healthcare industries. Companies including Zebra Technologies and Seiko Instruments have introduced products like the Zebra ZQ510 and Seiko MP-B30, which have enhanced mobile printing options for companies requiring high-speed, on-the-go printing.

-

The U.S. leads the North American market owing to its sophisticated technology infrastructure, elevated usage of mobile printing solutions among industries, and high demand by retail, logistics, and healthcare industries, supporting constant innovation and market expansion.

The European portable printer market for portable printers is growing steadily, driven by increasing adoption of mobile printing solutions across retail, logistics, and healthcare industries. Increasing mobile workforces, IoT connectivity, and the requirement for cost-efficient, on-the-move printing solutions are driving the growth. Germany, the UK, and France are the leaders in the market, with innovations leading the technological landscape in the region.

-

Germany leads with the European market owing to its robust industrial sector, high demand in retail, logistics, and healthcare industries, and high levels of technological adoption. The U.K. and France rank next with high market presence fueled by mobile and IoT integrations.

In the Middle East and Africa, the demand for portable printers is enriched due to technological advancement and industrialization in the UAE and Saudi Arabia, and South Africa has also have emerged as a lucrative market for portable printers during the forecast period, owing to the growth of logistics. In Latin America, Brazil was the leader, with Argentina trailing, as mobile printing finds application in retail and logistics.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players:

Major Key Players in Portable Printer Market are HP Inc., Seiko Epson Corporation, Canon Inc., Brother Industries, Ltd., Zebra Technologies Corporation, Polaroid Corporation, Fujifilm Holdings Corporation, Bixolon Co., Ltd., Toshiba TEC Corporation, and Honeywell International Inc and others.

Recent Development:

-

In January 2025, HP Inc. released the HP Sprocket Photo Booth Printer. This portable photo printer is designed for events and gatherings, offering customizable photo prints with a 10.1-inch touchscreen and built-in LED ring light.

-

In August 2024, Fujifilm Holdings Corporation introduced the INSTAX MINI LINK 3 Smartphone Printer. This smartphone printer features augmented reality effects and collage options, allowing users to customize images before printing.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 12.24 Billion |

| Market Size by 2032 | USD 21.30 Billion |

| CAGR | CAGR of 7.28% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Connectivity (Wireless, USB, Bluetooth, Ethernet) • By Technology (Inkjet, Thermal, Impact) • By Distribution Channel (Online, Offline) • By Industry Vertical (Healthcare, Retail, Telecom, Transportation and Logistics, Others) Service Providers, Healthcare Equipment Manufacturers, Industrial Control System Providers) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia,Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | HP Inc., Seiko Epson Corporation, Canon Inc., Brother Industries, Ltd., Zebra Technologies Corporation, Polaroid Corporation, Fujifilm Holdings Corporation, Bixolon Co., Ltd., Toshiba TEC Corporation, Honeywell International Inc. |