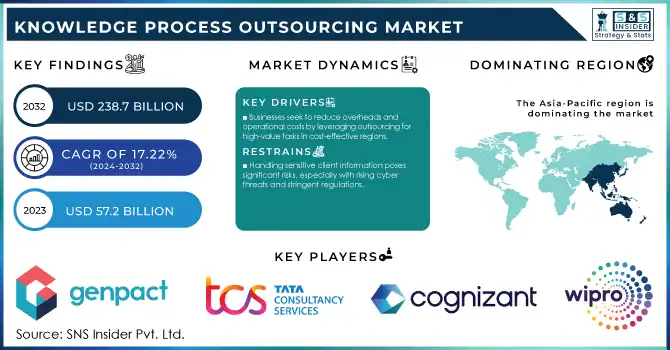

Knowledge Process Outsourcing Market Size & Overview:

The Knowledge Process Outsourcing Market was valued at USD 57.2 billion in 2023 and is expected to reach USD 238.7 billion by 2032, growing at a CAGR of 17.22% over 2024-2032.

The Knowledge Process Outsourcing (KPO) Market has evolved into a critical component of the global outsourcing landscape, providing specialized and analytical services that go beyond routine processes. KPO includes research, data analysis, legal services, engineering, and market intelligence. Its growth is primarily driven by the rising demand for expertise-intensive solutions, cost optimization, and the increasing reliance of organizations on third-party services for advanced knowledge-based activities. For instance, the adoption of outsourced research and development (R&D) services has surged, especially in industries like pharmaceuticals, where global spending on R&D reached approximately USD 238 billion in 2023. Another example is the significant growth in the outsourcing of legal services, with global legal process outsourcing revenue surpassing USD 18 billion in 2023. The proliferation of big data, the growing need for business insights, and the rapid digital transformation across industries are key accelerators for the KPO market. Companies are leveraging artificial intelligence (AI) and machine learning (ML) to enhance the efficiency and accuracy of outsourced analytical services, thus driving further adoption. The availability of a highly skilled talent pool in emerging economies like India and the Philippines has also bolstered the market's growth, with companies outsourcing high-value tasks such as investment research and financial modeling.

Get More Information on Knowledge Process Outsourcing Market - Request Sample Report

Furthermore, the increasing focus on cost efficiency amid economic uncertainties has pushed businesses to seek strategic partnerships through KPO services, ensuring scalability and access to cutting-edge tools. The education and e-learning sector has also contributed significantly to the market's growth, as organizations outsource curriculum design and content development to specialized providers. For example, the rising demand for online learning content led to a 30% year-over-year growth in outsourced e-learning development services in 2023.

The Knowledge Process Outsourcing market is positioned for sustained growth, underpinned by the demand for domain-specific expertise, technological advancements, and the imperative for operational flexibility. As businesses seek to innovate while reducing overheads, the KPO sector will continue to expand, with further integration of AI and analytics reshaping its scope and capabilities.

Knowledge Process Outsourcing Market Dynamics

Drivers

-

Businesses seek to reduce overheads and operational costs by leveraging outsourcing for high-value tasks in cost-effective regions.

-

The need for advanced data analysis and business insights drives the demand for knowledge-driven outsourcing solutions.

-

Integration of AI, ML, and automation enhances the efficiency and scalability of KPO services.

Artificial intelligence (AI), machine learning (ML), and automation are revolutionizing the Knowledge Process Outsourcing market, enabling specialized, knowledge-driven services to perform tasks more efficiently, at a greater scale, and with greater accuracy. KPO providers can manage huge data volumes, extract important information, and work with minimum human involvement. These advanced technologies result in lower operational costs, a shorter processing time, and high accuracy. For instance, AI-based analytics solutions can swiftly analyze large data sets to deliver actionable information in fields like health care and finance. Just like the outsourced services of market analysis and customer behavior, ML models improve predictive accuracy. Automation especially robotic process automation (RPA) reduces the effort involved in repetitive yet high-value processes like financial modeling, legal document reviews, and compliance checks. With work being automated, KPO firms can produce these outputs faster and more consistently, allowing clients to meet strict deadlines without the trade-off of quality. As an example, a legal outsourcing company could employ AI to scan contracts for risks or regulatory compliance in a fraction of the time it takes for manual processes.

Moreover, KPO offers the appealing nature of scaling operations on demand, wherein within a minimal shift in workforce, AI and automation can adjust to the changing magnitude of operation. This scalability is especially useful in sectors such as e-commerce, where the demand for services like customer behavior analysis usually peaks during the holiday seasons. KPO firms using these technologies can handle complex requirements efficiently while ensuring high levels of service quality.

| KPO Service | Role of AI, ML, and Automation | Impact |

|---|---|---|

| Legal Outsourcing | AI-driven contract review and compliance management | Reduced time and increased accuracy |

| Financial Analytics | ML algorithms for predictive modeling and fraud detection | Improved risk management and forecasting |

| Content Development | Automation of e-learning module creation and translation | Enhanced scalability and global reach |

Restraints

-

Handling sensitive client information poses significant risks, especially with rising cyber threats and stringent regulations.

-

The demand for highly skilled professionals in AI, ML, and domain-specific expertise often exceeds supply, limiting growth potential.

-

The slow adoption of advanced technologies in traditional sectors limits the scalability of KPO services.

The slow adoption of advanced technologies in traditional sectors presents a significant obstacle to the scalability and growth of the Knowledge Process Outsourcing market. Industries like manufacturing, agriculture, and certain areas of healthcare and legal services often rely on outdated systems and workflows, lacking the necessary infrastructure and expertise to embrace modern technologies such as artificial intelligence (AI), machine learning (ML), and robotic process automation (RPA). This limits KPO providers from fully delivering their advanced, knowledge-based services to these industries. Traditional sectors that lag in digital transformation frequently struggle with fragmented or unstructured data, hindering the effective application of AI-driven analytics. Without the adoption of digital tools and automation, these businesses miss out on optimizing services such as predictive modeling, financial analysis, or legal process enhancements. This creates a challenge for KPO providers to showcase their value, which depends on leveraging advanced technologies for efficient, high-quality outcomes.

A significant barrier in these industries is resistance to change. Many companies prioritize immediate cost savings over investing in technology upgrades, delaying modernization efforts. Additionally, the scarcity of skilled professionals capable of implementing and managing advanced technologies further slows the adoption process, complicating the integration of innovative outsourcing solutions. Scalability in the KPO sector relies on the ability to manage large-scale, complex projects. However, the technological inertia in traditional industries restricts this potential. For example, a manufacturing firm that has not adopted smart technologies is unable to fully utilize outsourced analytics or R&D services, reducing opportunities for KPO providers to deliver transformative, high-value solutions.

To address these issues, KPO providers must prioritize client education and develop tailored offerings to bridge the technological gaps in traditional industries. By enabling the gradual adoption of modern tools and processes, even the most reluctant sectors can begin to realize the advantages of advanced outsourcing. This approach not only drives the growth of the KPO market but also fosters innovation and efficiency across traditionally resistant industries.

Knowledge Process Outsourcing Market Segment Analysis

By Service

In 2023, the analytics & market research segment captured the largest market share - 37.8% of the total share. Largely due to the high demand for business intelligence and analytical tools that lessen the burden on employees. KPO providers typically have focused expertise in certain industries or domains, such as finance, healthcare, or technology. It facilitates the access of experts with comprehensive knowledge and insights about elaborate industry trends, regulations, and market dynamics which, by offering this kind of specialized knowledge, companies can obtain. KPO services are in demand as firms want to use the skills of specialized experts without hiring full-time resources to do the work.

The legal process outsourcing segment is anticipated to witness the highest CAGR over the forecast period, attributed to reduced cost while providing efficient services. These are very industrious processes — legal research, contract drafting, document review, etc. Outsourcing these jobs to KPO businesses helps save money. In a similar vein, sectors with complex knowledge work gain cost benefits from outsourcing highly specialized and highly trained tasks.

The fastest-growing application in the forecast period is other services (engineering & design, financial processes, and research & development outsourcing). Technological innovations continue to bring new tools for offering knowledge-based services to clients.

By Application

In 2023, the BFSI segment held the largest revenue share in the knowledge process outsourcing market at 33.5%. Sensitive information related to customers and financial databases of many banks are all part of this BFSI segment. As a consequence, businesses get information outsourcing processes like monetary analytics, equity research, and nonefficiency services amongst other things. Financial services companies such as CRISIL Ltd., Credit Suisse Group AG., and WNS (Holdings) Ltd.

IT & telecom is projected to record the highest CAGR during the forecast period. This will be due to the growing fragmented and huge database of the IT and the telecom sector which will drive the growth of the market across the forecast period.

Knowledge Process Outsourcing Market Regional Analysis

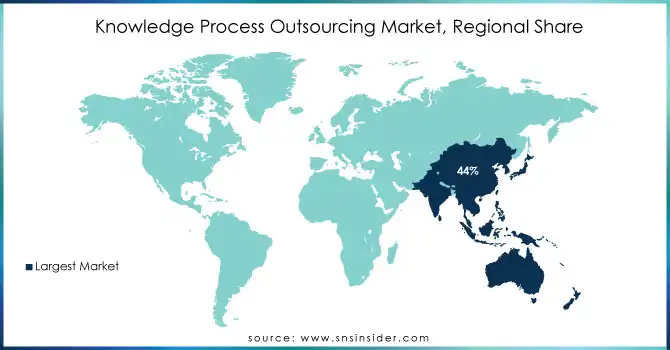

Asia-Pacific region dominated the Knowledge Process Outsourcing Market and represented a significant revenue share of 44.0% in 2023 owing to a large workforce, affordability, and fast-paced technological growth. India and the Philippines have emerged as major centers that outsource services like legal processing, market research, and data analytics. Major companies from healthcare, BFSI, IT, and various other industries are drawn to the region due to its abundant English-speaking, skilled labor and low operational costs. Asia-Pacific also continues to lead in the market because of government support on this, and the presence of startups focusing on AI and automation.

North America is expected to grow fastest with the highest CAGR in the KPO market owing to increased demand for advanced outsourcing solutions in industries like healthcare and finance, and IT. Innovation and early adopters of technology such as AI, ML, and RPA would be one of the major growth drivers for the region. Due to the need for streamlining and cost optimization, high-value functions, such as R&D and business analytics, are being outsourced more frequently by companies in the U.S. and Canada. Additionally, with the increased focus on compliance management and regulatory knowledge, the demand for KPO services in North America is on the rise.

Do You Need any Customization Research on Knowledge Process Outsourcing Market - Enquire Now

Key players

The major key players along with their products are

-

Genpact - Data Analytics Solutions

-

Tata Consultancy Services (TCS) - Business Process Services

-

Cognizant Technology Solutions - Healthcare Analytics

-

Wipro - Finance and Accounting Outsourcing

-

Accenture - IT and Business Consulting

-

Infosys - Knowledge Management Services

-

ExlService - Risk and Compliance Services

-

Sitel Group - Customer Experience Management

-

Teleperformance - Business Process Outsourcing Services

-

HCL Technologies - Digital Transformation Services

-

Capgemini - Cloud and Data Management Solutions

-

IBM Global Services - Artificial Intelligence Consulting

-

Concentrix - IT Outsourcing Services

-

Firstsource Solutions - Customer Interaction Management

-

S&P Global - Data and Analytics Solutions

-

ZS Associates - Sales and Marketing Analytics

-

WNS Global Services - Research and Data Analytics

-

Pitney Bowes - Document Management Solutions

-

Luxoft - Software Engineering Services

-

Cognizant - Digital Engineering Services

Recent Developments in the Knowledge Process Outsourcing Market

-

March 2024: Accenture expanded its KPO services by focusing on artificial intelligence (AI)-driven analytics to enhance operational efficiency for its clients in sectors like healthcare and financial services. This move is aligned with Accenture’s broader strategy to integrate advanced technologies into their service lines to meet growing demands for AI and data-driven decision-making.

-

February 2024: Genpact launched a new R&D outsourcing platform aimed at improving efficiency in the pharmaceutical sector. This platform leverages AI and machine learning for enhanced drug development and clinical trial processes, thus catering to an increasing need for specialized outsourcing services in the healthcare domain.

| Report Attributes | Details |

| Market Size in 2023 | US$ 57.2 Bn |

| Market Size by 2032 | US$ 238.7 Bn |

| CAGR | CAGR of 17.22% from 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Service (Analytics & Market Research, Engineering & Design, Financial Process Outsourcing, Legal Process Outsourcing, Publishing Outsourcing, Research & Development Outsourcing, Others) • By Application (BFSI, Healthcare, IT & Telecom, Manufacturing, Pharmaceutical, Retail, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Genpact, Tata Consultancy Services (TCS), Cognizant Technology Solutions, Wipro, Accenture, Infosys, ExlService, Sitel Group, Teleperformance, HCL Technologies, Capgemini, IBM Global Services |

| Key Drivers |

• Businesses seek to reduce overheads and operational costs by leveraging outsourcing for high-value tasks in cost-effective regions. |

| Market Restraints | • Handling sensitive client information poses significant risks, especially with rising cyber threats and stringent regulations. • The demand for highly skilled professionals in AI, ML, and domain-specific expertise often exceeds supply, limiting growth potential. • The slow adoption of advanced technologies in traditional sectors limits the scalability of KPO services. |