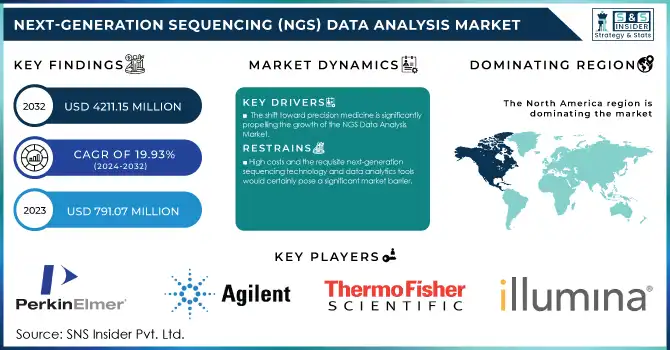

Next-generation Sequencing (NGS) Data Analysis Market Size:

The Next-generation Sequencing (NGS) Data Analysis Market was valued at USD 791.07 million in 2023 and is expected to reach USD 4211.15 million by 2032, growing at a CAGR of 19.93% from 2024-2032. The Next-Generation Sequencing (NGS) Data Analysis Market is witnessing notable expansion, fueled by the rising need for sophisticated genomic data analysis tools across multiple sectors including oncology, genetics, and drug development. NGS technology provides high-throughput sequencing abilities that allow scientists to examine DNA and RNA with exceptional speed and precision, transforming areas such as personalized medicine, diagnostics, and molecular biology. With the growth of NGS usage, the demand for strong, scalable, and effective data analysis tools is increasingly essential.

To get more information on Next-generation Sequencing (NGS) Data Analysis Market - Request Free Sample Report

Recent advancements have been crucial in speeding up the growth of this market. For example, in May 2023, Pfizer partnered with Thermo Fisher Scientific to enhance access to NGS-based cancer testing for patients throughout Latin America, Africa, the Middle East, and Asia. This partnership seeks to enhance cancer diagnostics by offering advanced genomic testing in areas where it was once restricted, addressing the increasing need for NGS data analysis solutions. Moreover, the launch of the Ion Torrent Genexus System by Thermo Fisher in May 2024 has transformed companion diagnostics, providing rapid turnaround times of only 24 hours for oncology tests, thereby increasing market demand.

Another important advancement is the introduction of QIAGEN’s QCI Secondary Analysis cloud solution, enabling smooth integration with clinical variant interpretation tools, thereby improving workflows in cancer and hereditary disease research. This advancement highlights the necessity for cohesive solutions in the NGS data analysis procedure.

The growing use of NGS in clinical diagnostics, combined with improvements in cloud-driven data analysis and automation technologies, is anticipated to keep driving market expansion. Additionally, the increasing emphasis on precision medicine and tailored healthcare bolsters the NGS data analysis market, facilitating more precise and targeted therapies. These trends suggest that the NGS data analysis market will keep growing, fueled by technological advancements and a rising need for precision diagnostics.

Next-generation Sequencing Data Analysis Market Dynamics

Drivers

- The shift toward precision medicine is significantly propelling the growth of the NGS Data Analysis Market.

As healthcare providers move toward more individualized treatments, the need for precise genomic data analysis is paramount. NGS enables healthcare professionals to analyze a patient's genetic makeup and identify specific mutations or abnormalities that can influence treatment options. This is particularly crucial in fields such as oncology, cardiology, and rare genetic diseases. According to the Precision Medicine Initiative, more than 1,000 new cancer therapies are in the pipeline, many of which are reliant on genomic data provided by NGS technologies. This surge in precision medicine adoption is driving demand for NGS-based solutions that enable clinicians and researchers to make more informed decisions, further boosting the market for NGS data analysis.

- NGS technology has become a cornerstone in cancer research, as it provides deep insights into genetic variations, mutations, and the molecular underpinnings of various cancers.

The role of NGS in cancer genomics is expanding as more studies uncover critical genetic alterations linked to tumor growth, progression, and treatment resistance. This is driving the growing adoption of NGS-based tools in cancer diagnostics and research. The rapid growth in NGS applications for oncology is driven by the increasing adoption of companion diagnostics, the rising number of clinical trials focused on genetic profiling, and the need for more accurate, targeted therapies. Additionally, advancements in NGS platforms, such as the Ion Torrent Genexus System and Illumina’s NextSeq, have further enhanced the speed and accuracy of genomic analysis in cancer research. The proliferation of NGS technologies in cancer diagnostics and drug discovery is contributing to the rising demand for data analysis solutions capable of handling complex datasets, ensuring a continuous growth trajectory for the NGS data analysis market.

According to NCBI, Sanger et al. developed DNA sequencing using electrophoresis, but its limitations in throughput and cost hindered large-scale sequencing. NGS overcomes these obstacles by sequencing thousands of DNA molecules in parallel, enabling high speed, and high throughput, and generating comprehensive data in a short time, similar to the Human Genome Project's data within two weeks. NGS platforms like Illumina Hiseq, Miseq, Roche 454 GS, Ion Torrent, and Life Technologies SOLiD are commercially available, with some offering better flexibility and shorter turnaround times for clinical use.

It further explores various NGS applications, including whole-genome sequencing, which covers the entire genome and is used for identifying rare mutations. Whole-exome sequencing focuses on exons of known genes, offering a more cost-effective option with significant cancer-related applications. Transcriptome sequencing allows researchers to analyze RNA expression and splicing profiles, while epigenetic analysis is emerging as an important tool in cancer research, particularly through profiling methylation and protein-DNA interactions.

Restraint

- High costs and the requisite next-generation sequencing technology and data analytics tools would certainly pose a significant market barrier.

NGS requires specialized instruments, trained professionals, and significant computational power to process and interpret the volumes of data generated, which can be a high-cost burden, especially for smaller research institutions or labs in low-resource settings. While NGS has revolutionized genomics, the cost can limit adoption in certain regions or sectors. This restricts the widespread use of NGS in clinical diagnostics, personalized medicine, and other research areas where financial constraints may preclude its use, particularly in developing nations.

- Data Management and Storage Issues restraining the NGS data analysis market.

NGS produces massive amounts of complex data that need to be stored and managed with high-performance solutions. Storing, sharing, and managing large datasets while complying with regulatory standards are two sides of the same coin. Poor storage infrastructure and the complexity of managing and interpreting vast amounts of data may slow down the analysis and overall affect the efficiency of research and clinical applications based on NGS.

NGS Data Analysis Market Segmentation Insigts

By Product

In 2023, the services segment dominated the market with the highest market share in the Next-Generation Sequencing (NGS) market. The growing demand for cost-effective NGS data analysis services is driving adoption, particularly among companies lacking the infrastructure for data management and interpretation. For instance, ArrayGen Technologies Pvt. Ltd. offers a wide range of NGS analysis services across various fields such as cancer genomics, disease studies, agricultural biotechnology, and personalized medicine. Similarly, Thermo Fisher Scientific provides a variety of NGS data analysis solutions.

The commercial NGS software segment is expected to experience the fastest growth due to the increasing demand and awareness surrounding sequencing techniques. The vast amount of data generated by NGS has led to a high demand for specialized algorithms. Companies are developing advanced tools to streamline data interpretation, such as QIAGEN's CLC Genomics Workbench, an all-in-one solution for metagenomics, transcriptomics, epigenomics, and genomics.

By Read Length

In 2023, the short-read sequencing segment dominated the market with a 70% market share in the NGS data analysis market. This dominance is attributed to its high accuracy, cost-efficiency, and capability to rapidly generate large amounts of data. Short-read sequencing is extensively used in applications such as genome sequencing and disease research, making it the preferred option for numerous organizations. Furthermore, the mature technology and well-established workflows of short-read sequencing contribute to its widespread adoption, solidifying its leading position in the market.

The very long-read sequencing segment is expected to grow at the fastest rate of 26% during the forecast period. This rapid growth is driven by advancements in sequencing technologies that enable more precise and detailed genomic analysis, particularly in complex genomic regions. The increasing demand for high-resolution data in fields such as cancer research, rare disease diagnostics, and personalized medicine is further fueling the growth of this segment.

By End-use

In 2023, the academic research segment dominated the market, with a market share of 52%. This dominance is driven by the rising demand for advanced genomic tools in research, the growing number of academic studies in fields such as genetics, oncology, and microbiology, as well as the availability of funding for academic institutions to invest in NGS technologies for pioneering discoveries.

The pharmaceutical and biotechnology segment is projected to experience the fastest growth during the forecast period. This growth is propelled by the increasing application of NGS in drug discovery, personalized medicine, and biomarker identification. As pharmaceutical and biotech companies focus on developing targeted therapies and enhancing clinical outcomes, the demand for sophisticated genomic analysis tools is escalating, driving rapid market expansion in this segment.

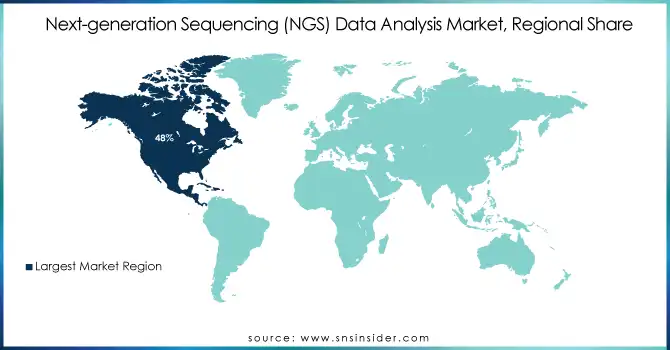

Regional Analysis

In 2023, North America dominated the next-generation sequencing (NGS) data analysis market with a share of 48%. This dominance is due to substantial investments in the healthcare and biotechnology sectors, a high concentration of key market players, and significant government funding for research initiatives. The region also benefits from advanced infrastructure, widespread adoption of cutting-edge technologies, and a robust regulatory environment, making it a major hub for NGS-related research and development.

The Asia Pacific region is expected to witness the fastest growth in the NGS data analysis market, with a projected CAGR of 22.22% over the forecast period. Key drivers of this growth include increasing investments in healthcare and biotechnology, rapid advancements in genomic research, and rising demand for personalized medicine. The region’s expanding healthcare infrastructure, growing adoption of NGS technologies, and the increasing prevalence of chronic diseases, such as cancer, are contributing significantly to market expansion. In particular, China and Japan are anticipated to play major roles in driving this growth, with rising demand for NGS applications in cancer research, genetic testing, and personalized medicine.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Market Players

-

Illumina, Inc. (BaseSpace Sequence Hub, DRAGEN Bio-IT Platform)

-

Thermo Fisher Scientific, Inc. (Ion Reporter Software, Oncomine Reporter)

-

Qiagen N.V. (CLC Genomics Workbench, Ingenuity Pathway Analysis (IPA))

-

Agilent Technologies (Alissa Interpret, GeneSpring GX

-

F. Hoffmann-La Roche Ltd. (AVENIO Oncology Analysis Software, SeqCap EZ Analysis Software)

-

10x Genomics, Inc. (Cell Ranger, Loupe Browser)

-

PacBio (Pacific Biosciences of California, Inc.) (SMRT Link, Circular Consensus Sequencing (CCS) Analysis)

-

Oxford Nanopore Technologies (Epi2Me Analysis Platform, MinKNOW Software)

-

Bio-Rad Laboratories, Inc. (QX Manager Software, CFX Maestro Software)

-

PerkinElmer, Inc. (NEXTFLEX Data Analysis Tools, Signals Notebook

-

Becton, Dickinson, and Company (BD Biosciences) (FlowJo Analysis Software, FACSDiva Software)

-

DNAnexus, Inc. (DNAnexus Apollo, Platform for Precision Health)

-

Partek Incorporated (Partek Flow, Partek Genomics Suite)

-

Seven Bridges Genomics (Seven Bridges Platform, SB Cloud)

-

GeneDx (Variant Analysis Suite, Rare Disease Analysis Tools)

-

Strand Life Sciences (Strand NGS, StrandOmics)

-

BlueBee (Illumina subsidiary) (BlueBee Platform, BlueBase Analytics)

-

Genialis (Expressions Analysis Suite, Smart RNA-Seq Analysis)

-

Deep Genomics (AI-Driven NGS Data Analysis Platform, Genome Annotation Tools)

-

Illumina-owned Edico Genome (DRAGEN Variant Caller, DRAGEN RNA Pipeline)

Key suppliers

These suppliers are critical in ensuring the smooth operation of NGS workflows and the functionality of the data analysis platforms provided by the listed companies.

- Agilent Technologies

- Integrated DNA Technologies (IDT)

- Thermo Fisher Scientific

- New England Biolabs (NEB)

- Beckman Coulter Life Sciences

- Sigma-Aldrich (a Merck subsidiary)

- PerkinElmer, Inc.

- Illumina, Inc

- Pacific Biosciences (PacBio)

- Qiagen N.V.

Recent Developments

-

In May 2024, Thermo Fisher Scientific highlighted the increasing adoption of Next-Generation Sequencing (NGS)-based companion diagnostics (CDx) in oncology. Their Ion Torrent Genexus System provides faster turnaround times, offering results in just 24 hours compared to the traditional 2-3 week wait, showcasing the industry's shift toward quicker and more efficient NGS-based testing.

- In May 2024, QIAGEN launched QCI Secondary Analysis, a cloud-based Software-as-a-Service (SaaS) solution designed for high-throughput secondary analysis of clinical NGS data. The solution seamlessly integrates with QIAGEN’s clinical variant interpretation software, streamlining workflows for oncology and inherited disease applications, further advancing the clinical utility of NGS data analysis.

- In July 2024, Thermo Fisher Scientific announced a partnership focused on advancing clinical research and treatment for myeloid cancers using Next-Generation Sequencing (NGS) technology. The collaboration is expected to leverage NGS to deepen the understanding of myeloid cancer genetics, enabling more precise diagnostics and targeted therapies. This initiative underscores the growing role of NGS technology in cancer research and highlights its increasing demand for advanced data analysis solutions, thereby contributing to the overall growth of the NGS data analysis market.

- In May 2023, Pfizer and Thermo Fisher Scientific formed a partnership aimed at expanding access to Next-Generation Sequencing (NGS)-based testing for lung and breast cancer patients across over 30 countries in Latin America, Africa, the Middle East, and Asia. This collaboration seeks to bring advanced genomic testing to regions where such services have been previously scarce, contributing to the growth of the NGS data analysis market by driving demand for more accessible and accurate cancer diagnostics.

|

Report Attributes |

Details |

|

Market Size in 2023 |

US$ 791.07 million |

|

Market Size by 2032 |

US$ 4211.15 million |

|

CAGR |

CAGR of 19.93% From 2024 to 2032 |

|

Base Year |

2023 |

|

Forecast Period |

2024-2032 |

|

Historical Data |

2020-2022 |

|

Report Scope & Coverage |

Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

|

Key Segments |

• By Product (Services, NGS Commercial Software) |

|

Regional Analysis/Coverage |

North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

|

Company Profiles |

Illumina, Inc., Thermo Fisher Scientific, Inc., Qiagen N.V., Agilent Technologies, F. Hoffmann-La Roche Ltd., 10x Genomics, Inc., PacBio (Pacific Biosciences of California, Inc.), Oxford Nanopore Technologies, Bio-Rad Laboratories, Inc., PerkinElmer, Inc., Becton, Dickinson, and Company (BD Biosciences), DNAnexus, Inc., Partek Incorporated, Seven Bridges Genomics, GeneDx, Strand Life Sciences, BlueBee (Illumina subsidiary), Genialis, Deep Genomics, Illumina-owned Edico Genome, and other players. |

|

Key Drivers |

•The shift toward precision medicine is significantly propelling the growth of the NGS Data Analysis Market. |

|

Restraints |

•High costs and the requisite next-generation sequencing technology and data analytics tools would certainly po |