Laser Printer Market Size & Growth Trends:

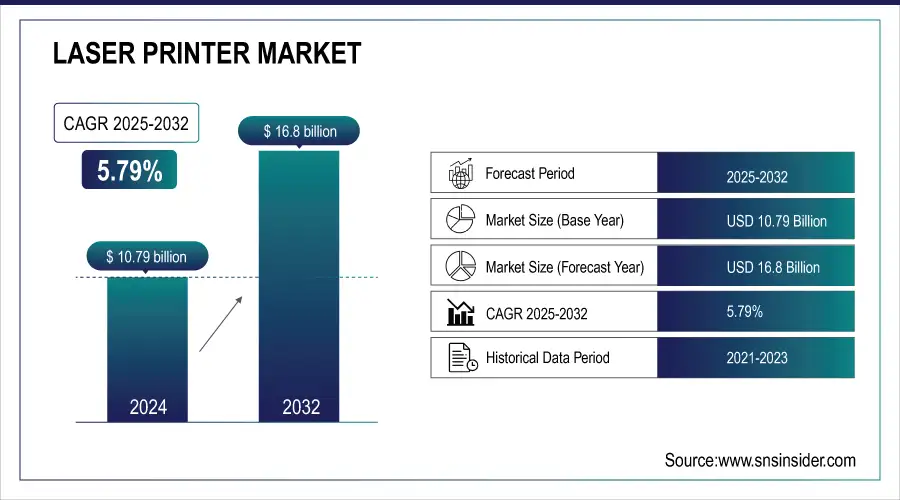

The Laser Printer Market Size was valued at USD 10.79 Billion in 2025E and It is expected to grow at a CAGR of 5.79% to reach USD 16.8 Billion by 2033.

In the Laser Printer Market, global shipments by region provide insights into the distribution of laser printer demand across key markets such as North America, Europe, and Asia-Pacific. Manufacturing capacity utilization (2023) reflects the efficiency of production facilities and supply chain stability, indicating potential constraints or surpluses. Market share of leading vendors highlights the competitive landscape, showcasing the dominance of major players like HP, Canon, Brother, and Xerox. Lastly, print technology adoption trends (historic and future) track the transition from monochrome to color laser printers and the growing preference for multifunction printers (MFPs), driven by evolving business and consumer needs.

Laser Printer Market Size and Forecast:

-

Market Size in 2025E USD 10.79 Billion

-

Market Size by 2033 USD 16.8 Billion

-

CAGR of 5.79% From 2026 to 2033

-

Base Year 2025

-

Forecast Period 2026-2033

-

Historical Data 2022-2024

To Get more information on Laser Printer Market - Request Free Sample Report

Laser Printer Market Trends:

• Growing adoption of multifunction laser printers (MFPs) due to space efficiency and cost-effectiveness.

• Increased demand for cloud printing, mobile integration, and remote printing solutions.

• Rise of AI-driven print management software and predictive maintenance for reduced downtime.

• Integration of IoT-enabled and smart printers enhancing connectivity and operational efficiency.

• Focus on energy-efficient, voice-activated, and automated printing solutions supporting digital transformation.

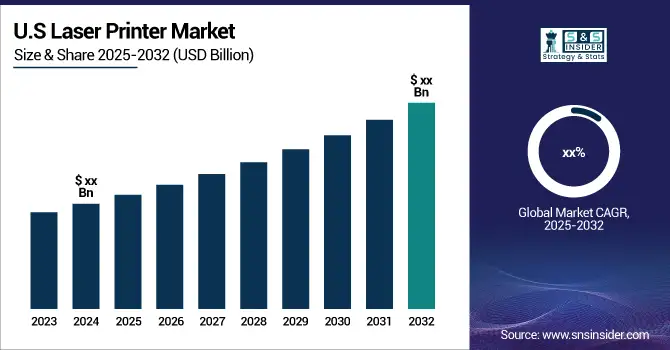

The U.S. Laser Printer market size was valued at an estimated USD 4.05 billion in 2025 and is projected to reach USD 6.30 billion by 2033, growing at a CAGR of 4.9% over the forecast period 2026–2033. Market growth is driven by steady demand from corporate offices, educational institutions, and government organizations for high-speed, reliable, and cost-efficient printing solutions. Increasing adoption of multifunction laser printers for printing, scanning, and copying, along with rising focus on workflow efficiency and document security, is supporting market expansion. Additionally, advancements in energy-efficient printing technologies, improved toner formulations, and continued demand for on-premise printing in regulated environments further contribute to the stable growth outlook of the U.S. laser printer market during the forecast period.

Laser Printer Market Growth Drivers:

-

The increasing preference for space-saving, cost-effective multifunction laser printers (MFPs) is driving market growth across businesses and home users.

The rapid adoption of multifunction laser printers, which combine printing, scanning, copying, and faxing in one unit, is an important factor influencing the market growth. Due to less space and cheaper solutions than standalone devices, businesses, and consumers prefer MFPs (Multi-Function Printers). Moreover, remote work and hybrid office models have also contributed to the need for an efficient printing solution. Enhanced usability of MFP or above with, connectivity advancements like Wi-Fi, Cloud Printing Mobile Integration, and other enhancements led to the preference towards MFP. MFPs have been widely adopted in corporate offices, healthcare, education & government organizations globally owing to their capability of simplifying document management and minimizing operational costs.

Laser Printer Market Restraints:

-

The high upfront cost and expensive toner replacements make laser printers less accessible for budget-conscious consumers and small businesses.

Laser printers do have some benefits as well, but the high initial costs associated with these printers (especially color or high-speed models) mean it is extremely difficult for budget-conscious consumers and small businesses to obtain these devices. replacement toners, drums, and maintenance can greatly increase the overall total cost of ownership. Compared to inkjet printers, which pose a lesser threat due to their low initial price, the high-cost consumables and periodic servicing needed make laser printers cost prohibitive which raises buyer hesitance. Moreover, small and medium business enterprises prefer economical choices such as inkjet & digital documentation solutions through the cloud, thereby limiting the expansion of the total market for laser printers in some market sections.

Laser Printer Market Opportunities:

-

The adoption of cloud printing, IoT-enabled printers, and AI-driven print management is creating new growth opportunities for the laser printer market.

As such, areas like cloud printing could present a major opportunity for the laser printer market, as well as IoT-enabled printers and AI-driven print management software. With an inclination of businesses and enterprises towards on-cloud document management and wireless printing which ensures remote print features along with added security elements. AI-powered predictive maintenance employed by smart printers can minimize downtime and make better use of available resources. Moreover, innovations are fuelled by newer and better features such as voice-activated printing, mobile printing, and energy-efficient designs. With the increasing number of organizations adopting digital transformation strategies, laser printer manufacturers are well-positioned to leverage this opportunity by providing connected and automated printing solutions that are better suited to the needs of modern business environments.

Laser Printer Market Segment Analysis:

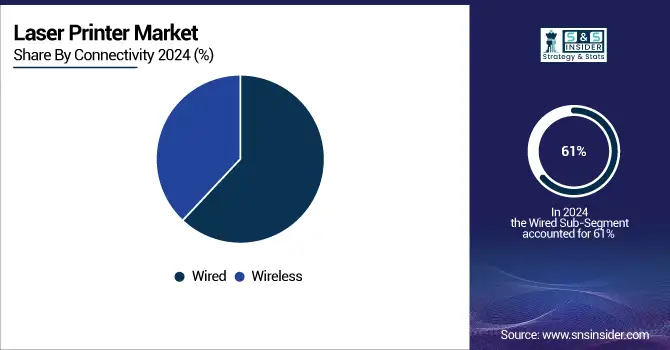

By Connectivity

In 2025, the wired segment dominated the market and accounted for a significant revenue share of 61%. Growth In Wired Laser Printers Segment; Stable & Reliable Performance Wired connections like Ethernet and Universal Serial Bus offer stable and reliable data transfers with low risk of interference or signal loss, which translates to consistent print quality and performance. In addition, wired connectivity is where it is more secure than a wi-fi net because nobody wants to get into it and access the information. This becomes especially critical for companies and organizations that deal with sensitive or confidential information.

The wireless segment is anticipated to manifest the fastest CAGR during the forecast period, 2026 to 2033. This growth in the segment is mainly driven by laser printers that provide a lot of mobility and flexibility. Wireless printing enables users to print from a range of devices, like smartphones, tablets, and laptops, without requiring physical connections.

By Printer Type

The multifunction laser printers segment dominated the market and accounted for a significant revenue share in 2025. The segment is expected to grow significantly due to the personalization and versatility offered by multifunction laser printers empowered by laser technology. A wide range of features and configuration options means many businesses can configure their multifunction laser printer according to their exact requirements.

The single-function laser printers segment is expected to register the fastest CAGR during the forecast period 2026-2033. Cost-effective, straightforward, and dependable, single-function laser printers helped bolster this segment's growth. In general, single-function laser printers will have a cheaper purchase price than any multifunction device. So businesses or individuals that are on a budget but need to print, but not do anything else, are very much interested in this and find it an attraction.

By Output

The monochrome segment dominated the market and represented a significant revenue share in 2025. Growth of the segment during an estimated period can be credited to economic factors, which fulfill the purpose of volume printing requirement. Monochrome laser printers typically have a lower cost per page than color printers So they become an affordable option for organizations and businesses that only require black-and-white document printing.

The color segment is expected to be the fastest-growing segment from 2026 to 2033. Growth in the segment is due to a rise in the demand for color printing of professional & marketing materials. Companies need good-quality color printing to prepare professional papers, marketing communication documents, and presentations. Color laser printers are ideal for creating marketing collateral and documents that are visually appealing in color since they offer vibrant and accurate color reproduction.

By End-Use

In 2025, the commercial segment dominated the market and accounted for a significant revenue share. Robust business activity and the globalization of businesses contribute to the growth of the segment. In this context, enterprises continue to grow present in more competitive related to pragmatic and reliable printing solution trusted. Laser printers provide the quickness, output quality, and durability suitable for commercial bulk printing.

The industrial segment is expected to register the fastest CAGR during the forecast period 2026 to 2033, The growth of the segment is because of the demand from industrial applications which have higher volume printing. Industrial environments, including manufacturing plants, warehouses, and logistics centers, need a durable printing solution that can handle a large volume of print jobs. Laser printers are preferred for high to medium-volume printing which are quick and reliable, making industrial applications.

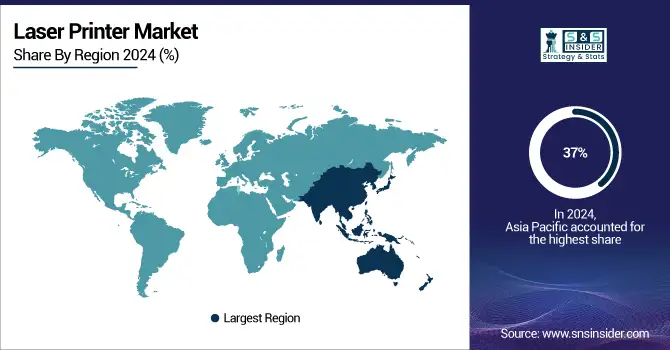

Laser Printer Market Regional Analysis:

Asia Pacific Laser Printer Market Insights

In 2025, the Asia Pacific held the majority share in the global laser printer market with a revenue share of over 37%. Driven by rapid economic growth and growth in e-commerce in the region. High demand for printed materials, shipping labels, invoices, marketing materials, etc. in the booming e-commerce sector in Asia Pacific. This is why laser printers, which are meant for high-volume printing, play an important role in assisting e-commerce operations.

Get Customized Report as per Your Business Requirement - Enquiry Now

North America Laser Printer Market Insights

North America is expected to register the fastest CAGR during the forecast period 2026-2033. Technological advancement in the region is driving the growth of the market in the region. Home to some of the most innovative technology, North America delivers quality laser printing technology for years to come. Things like wireless connectivity, mobile printing, cloud integration, and energy efficiency, are drawing business and consumers and reprising the laser printer.

Europe Laser Printer Market Insights

Europe’s laser printer market is driven by the strong presence of corporate offices, educational institutions, and government organizations adopting multifunction printers for efficient document management. High demand for cloud-based printing, mobile integration, and energy-efficient devices supports market growth. Enterprises are increasingly leveraging AI-powered print management and predictive maintenance solutions. Environmental regulations and sustainability initiatives are encouraging manufacturers to produce eco-friendly, low-energy models. The market also benefits from technological advancements, seamless connectivity, and rising digital transformation initiatives across businesses.

Latin America (LATAM) and Middle East & Africa (MEA) Laser Printer Market Insights

The LATAM and MEA laser printer markets are expanding due to growing business adoption of multifunction printers for cost-effective and efficient operations. Rising digitalization, remote work adoption, and government initiatives for modern office infrastructure are boosting demand. Increased focus on wireless printing, cloud integration, and AI-driven print management solutions supports market growth. Key sectors such as banking, healthcare, and education are driving investments in connected, energy-efficient, and multifunctional laser printers across these regions.

Laser Printer Companies are:

-

HP Inc. – HP LaserJet Pro MFP M428fdw

-

Canon Inc. – Canon imageCLASS MF445dw

-

Brother Industries, Ltd. – Brother HL-L8360CDW

-

Xerox Corporation – Xerox VersaLink C405

-

Epson Corporation – Epson WorkForce AL-M320DN

-

Lexmark International, Inc. – Lexmark MS431dw

-

Ricoh Company, Ltd. – Ricoh SP 5300DN

-

Kyocera Corporation – Kyocera ECOSYS P2040dw

-

Konica Minolta, Inc. – Konica Minolta bizhub 4700i

-

Panasonic Corporation – Panasonic KX-MB2235

-

Sharp Corporation – Sharp MX-B455W

-

Dell Technologies Inc. – Dell Smart Printer S2830dn

-

Toshiba Corporation – Toshiba e-STUDIO 408P

-

Samsung Electronics Co., Ltd. – Samsung ProXpress M4560FX

-

Oki Electric Industry Co., Ltd. – OKI C332dn

Competitive Landscape for Laser Printer Market:

Xerox Corporation is a key player in the laser printer market, offering a wide range of multifunction and single-function printers for corporate, education, and government sectors. The company focuses on advanced connectivity, cloud integration, and AI-driven print management solutions, enhancing efficiency, productivity, and sustainable printing practices globally.

-

In December 2024, Xerox announced its agreement to acquire Lexmark International for USD 1.5 billion, aiming to enhance its core print offerings and expand its global presence, particularly in the Asia-Pacific region.

Ricoh Company, Ltd. is a prominent player in the laser printer market, providing multifunction and high-performance printers for enterprises, healthcare, and education sectors. The company emphasizes cloud-enabled printing, mobile integration, and AI-driven print management, delivering efficient, secure, and sustainable document solutions that support digital transformation and operational productivity worldwide.

-

In October 2024, Ricoh established a new industrial printing company in Europe, focusing on expanding its industrial printing solutions to meet diverse market needs.

| Report Attributes | Details |

|---|---|

| Market Size in 2025e | USD 10.79 Billion |

| Market Size by 2033 | USD 16.8 Billion |

| CAGR | CAGR of 5.79% From 2026 to 2033 |

| Base Year | 2025 |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Printer Type (Single-Function Laser Printers, Multifunction Laser Printers) • By Connectivity (Wired, Wireless) • By Output (Monochrome, Color) • By End-Use (Industrial, Residential, Commercial) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | HP Inc., Canon Inc., Brother Industries Ltd., Xerox Corporation, Epson Corporation, Lexmark International Inc., Ricoh Company Ltd., Kyocera Corporation, Konica Minolta Inc., Panasonic Corporation, Sharp Corporation, Dell Technologies Inc., Toshiba Corporation, Samsung Electronics Co. Ltd., Oki Electric Industry Co. Ltd. |