Radio Frequency Duplexer Market Size & Growth:

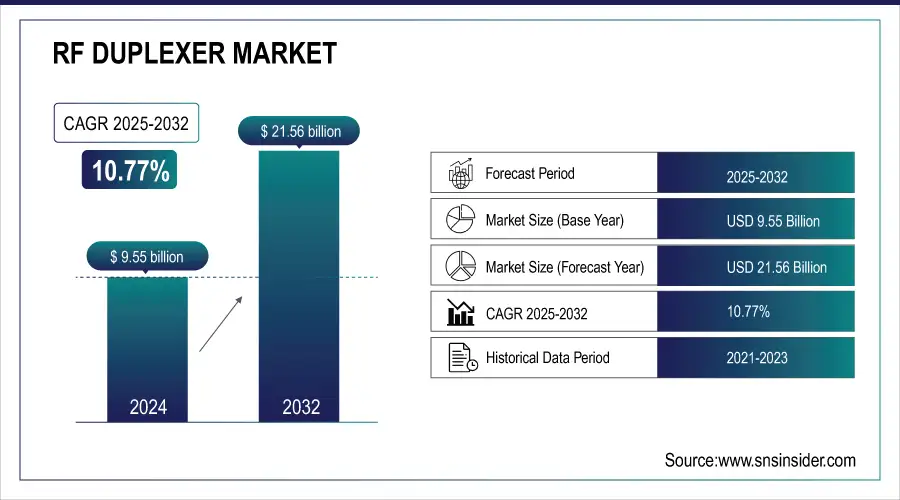

The RF Duplexer Market size was valued at USD 9.55 billion in 2024 and is expected to reach USD 21.56 billion by 2032, growing at a CAGR of 10.77% over the forecast period of 2025-2032.

RF Duplexer Market trends are rapid 5G adoption, miniaturization, advanced acoustic technologies, growing automotive applications, and rising demand for IoT connectivity. The RF Duplexer Market is growing due to the widespread deployment of 5G technology, which demands high-performance, reliable RF components to support faster data speeds and lower latency. Increasing adoption of smartphones, IoT devices, and connected automotive systems is driving demand for efficient duplexers. Advances in acoustic technologies like BAW and SAW enable better performance in compact devices. Additionally, rising investments in telecommunications infrastructure and growing use of wireless communication in industries such as aerospace and healthcare further fuel market growth.

To Get more information on RF Duplexer Market - Request Free Sample Report

Automotive production increasingly integrates advanced communication tech; over 40 million connected cars are expected on the road by 2025.

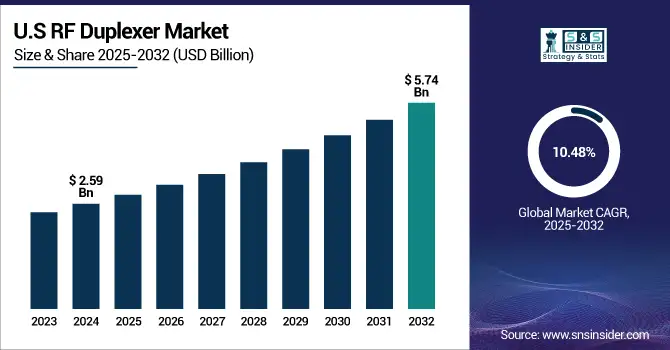

The U.S. RF Duplexer Market size was valued at USD 2.59 billion in 2024 and is expected to reach USD 5.74 billion by 2032, growing at a CAGR of 10.48% over the forecast period of 2025-2032. The U.S. RF Duplexer Market is growing due to rapid 5G network expansion, increasing smartphone adoption, advanced automotive communication systems, rising IoT deployments, and significant investments in telecommunications infrastructure upgrades.

RF Duplexer Market Dynamics:

Drivers:

-

5G expansion and technology advancements accelerate growth in the dynamic global RF duplexer market

Key drivers fueling the global RF Duplexer Market growth include the rapid deployment of 5G networks, which require high-performance duplexers to enable faster data transmission and reduced latency. The surge in smartphone and connected device adoption globally significantly boosts demand for compact and efficient RF components. Additionally, technological advancements in Surface Acoustic Wave (SAW) and Bulk Acoustic Wave (BAW) duplexers improve device performance, driving market growth. Expanding applications in automotive, aerospace, and defense sectors, particularly for vehicle-to-everything (V2X) communication and radar systems, also contribute to increasing market demand.

Automotive industry forecasts predict over 40 million connected vehicles globally by 2025, leveraging V2X communication systems that depend on duplexers.

Restraints:

-

Technical complexity and regulatory challenges hinder growth in the rapidly evolving global RF duplexer market

Key restraints in the RF Duplexer Market include technical challenges related to miniaturization and integration of duplexers into increasingly compact and multifunctional devices. Achieving high performance at higher frequencies, especially in millimeter-wave bands for 5G and beyond, remains complex due to signal loss and interference issues. Additionally, supply chain disruptions and raw material shortages can impact manufacturing timelines and product availability. Strict regulatory standards and certification requirements across different countries also slow down product deployment and increase development complexity.

Opportunities:

-

Expanding wireless infrastructure and IoT adoption drive innovation opportunities in the global RF duplexer market

Opportunities in the global RF Duplexer Market lie in emerging economies where wireless infrastructure is rapidly developing, presenting untapped potential. The growth of Internet of Things (IoT) devices further opens avenues for innovation in duplexer technology to support diverse connectivity needs. Additionally, increasing investments in next-generation telecommunications infrastructure and the evolution of millimeter-wave technologies offer substantial growth prospects for industry players.

The global Internet of Things (IoT) device count is expected to exceed 15 billion units by 2025, creating vast demand for advanced RF components like duplexers.

Challenges:

-

Overcoming competition design complexity and durability demands to advance innovation in the RF duplexer market

Challenges further arise from intense competition among manufacturers pushing rapid innovation cycles, which demand continuous R&D investments and advanced manufacturing capabilities. Compatibility issues with diverse wireless protocols and evolving network architectures require adaptable and customizable duplexer designs, adding to design complexity. Moreover, ensuring durability and reliability in harsh environments, particularly for automotive and aerospace applications, presents ongoing engineering hurdles.

Radio Frequency Duplexer Market Segmentation Insights:

By Frequency Band

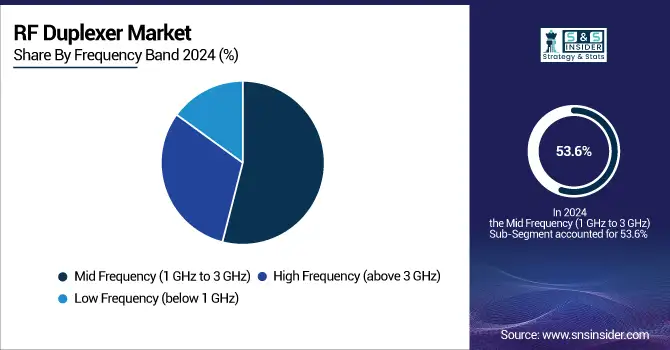

The Mid Frequency band (1 GHz to 3 GHz) dominates the RF Duplexer Market with a 53.6% share in 2024, driven by its widespread use in mobile communications, including 4G LTE and early 5G deployments. This frequency range offers an optimal balance between coverage and data speed, making it the preferred choice for many wireless applications such as smartphones, base stations, and IoT devices. Its established infrastructure and compatibility with existing networks further reinforce its dominant position in the market.

The High Frequency band (above 3 GHz) is expected to register the fastest growth from 2025 to 2032, fueled by the increasing adoption of advanced 5G technologies and upcoming 6G research. Higher frequencies enable ultra-fast data rates and low latency, essential for applications like mmWave communications, augmented reality, and smart cities. This growth is supported by innovations in duplexer technology to overcome challenges like signal attenuation and interference at higher frequencies.

By Application

The Consumer Electronics segment dominates the RF Duplexer Market with a 43.7% share in 2024, driven primarily by the widespread adoption of smartphones, tablets, wearables, and other connected devices. These products require compact, efficient, and high-performance RF duplexers to enable seamless wireless communication and support emerging technologies like 5G. The constant innovation in consumer electronics, along with increasing demand for faster data speeds and improved connectivity, solidifies this segment’s leading position in the market.

The Automotive segment, particularly V2X communication and radar systems, is expected to witness the fastest growth from 2025 to 2032. The rise of connected and autonomous vehicles relies heavily on advanced RF duplexer technology to facilitate vehicle-to-everything communication, enhancing safety and traffic management. Growing investments in smart transportation infrastructure and electric vehicles further fuel this rapid market expansion.

By Technology Type

Surface Acoustic Wave (SAW) Duplexers dominated the RF Duplexer Market in 2024 with a 53.5% share, primarily due to their maturity, cost-effectiveness, and reliable performance in many wireless communication applications. SAW duplexers are widely used in smartphones, tablets, and other consumer electronics because they offer excellent signal filtering at lower to mid-frequency ranges. Their proven technology and established manufacturing processes have made them the preferred choice for numerous devices and infrastructure components.

Bulk Acoustic Wave (BAW) Duplexers, however, are expected to experience the fastest growth from 2025 to 2032. BAW technology supports higher frequency bands, including those used in advanced 5G and emerging 6G networks, enabling better performance at millimeter-wave frequencies. The increasing demand for higher bandwidth, wider channel capacity, and improved signal integrity in next-generation wireless applications is driving rapid adoption of BAW duplexers across telecom and automotive sectors.

By End-User Industry

Mobile & Wireless Communications dominated the RF Duplexer Market with a 57.8% share in 2024 and is expected to grow at the fastest CAGR from 2025 to 2032. This sector drives demand due to the widespread adoption of smartphones, 5G network expansion, and increasing use of wireless technologies in both consumer and enterprise applications. The continuous evolution of mobile connectivity and rising data consumption fuel the need for advanced RF duplexers to support faster, more reliable communication globally.

Radio Frequency (RF) Duplexer Market Regional Analysis:

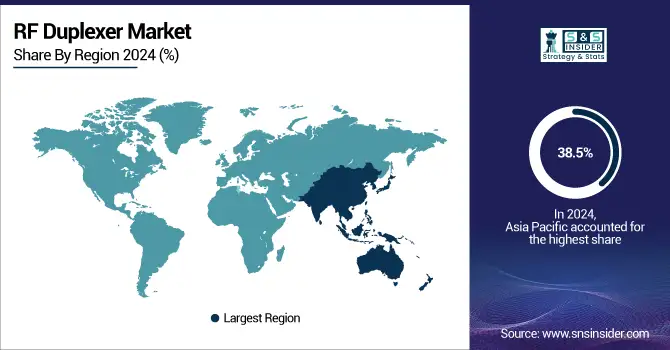

Asia Pacific dominated the RF Duplexer Market with a 38.5% share in 2024 and is expected to grow at the fastest CAGR from 2025 to 2032. Rapid industrialization, expanding 5G networks, and increasing smartphone penetration drive market growth. The region’s focus on technological advancements and large consumer base further fuel demand for high-performance RF duplexers across multiple applications, making Asia Pacific the fastest-growing and largest market globally.

Get Customized Report as per Your Business Requirement - Enquiry Now

China dominates the Asia Pacific region due to its massive telecom infrastructure investments, leading smartphone manufacturing, and aggressive 5G rollout initiatives.

North America is a significant market for RF duplexers, driven by early adoption of advanced communication technologies and substantial investments in 5G infrastructure. The region benefits from the presence of major RF component manufacturers, robust R&D activities, and strong demand from consumer electronics, telecommunications, and defense sectors. The U.S. leads the market, supported by extensive network deployments, a high penetration of connected devices, and continuous technological advancements. Growing demand for IoT applications, automotive connectivity, and next-generation wireless solutions further accelerates market expansion. Favorable regulatory support and high innovation levels position North America as a key contributor to global RF duplexer growth.

Europe’s RF Duplexer Market is driven by strong telecommunications infrastructure, increasing 5G deployments, and rising demand for advanced wireless communication solutions across industries. The region benefits from a well-established electronics manufacturing base, ongoing R&D activities, and growing adoption of IoT devices. Expanding applications in automotive connectivity, industrial automation, and aerospace communication systems further fuel market growth. Additionally, supportive regulatory policies and collaborative initiatives between technology providers and network operators enhance innovation, positioning Europe as a steady-growth market for RF duplexers in the coming years.

Latin America and the Middle East & Africa RF Duplexer Markets are emerging with steady growth potential, driven by expanding telecommunications infrastructure and increasing adoption of mobile and wireless technologies. Rising smartphone penetration, gradual 5G rollouts, and growing IoT applications are fueling demand for advanced RF components in these regions. Investments in smart city projects, transportation connectivity, and industrial automation further support market expansion. Although these regions currently hold smaller shares, ongoing infrastructure development and technology adoption present significant opportunities for future growth in the RF duplexer industry.

RF Duplexer Companies are:

The RF Duplexers companies are Broadcom, Skyworks, Qorvo, Murata, TDK, Taiyo Yuden, STMicroelectronics, Qualcomm, Samsung Electro-Mechanics, Analog Devices, NXP, AVX, TE Connectivity, Texas Instruments, Knowles, Infineon, Vishay, Panasonic, EPCOS, and Ceragon Networks.

Recent Developments:

-

In September 2024, Broadcom and Tower Semiconductor partnered to produce highly integrated Wi-Fi 7 RF front-end modules using Tower’s advanced 300 mm RFSOI technology.

-

In February 2024, Skyworks unveiled its next-generation SkyOne™ platforms, integrating up to seven duplexers in the industry’s smallest footprint. These scalable devices support carrier aggregation and MIPI RFFE-compatible chipsets offering remarkable linearity and power-added efficiency.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 9.55 Billion |

| Market Size by 2032 | USD 21.56 Billion |

| CAGR | CAGR of 10.77% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Frequency Band (New Construction, and Expansion & Renovation) • By Application (Consumer Electronics (smartphones, tablets, wearables), Telecommunications, Automotive, Aerospace & Defense) • By Technology Type (Surface Acoustic Wave (SAW) Duplexers, Bulk Acoustic Wave (BAW) Duplexers, Ceramic Duplexers, and Thin Film Duplexers) • By End-User Industry (Mobile & Wireless Communications, Industrial, Healthcare & Medical Devices, and Defense & Aerospace) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Taiwan, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | Broadcom, Skyworks, Qorvo, Murata, TDK, Taiyo Yuden, STMicroelectronics, Qualcomm, Samsung Electro-Mechanics, Analog Devices, NXP, AVX, TE Connectivity, Texas Instruments, Knowles, Infineon, Vishay, Panasonic, EPCOS, and Ceragon Networks. |