Lithium Hydroxide Market Report Scope & Overview:

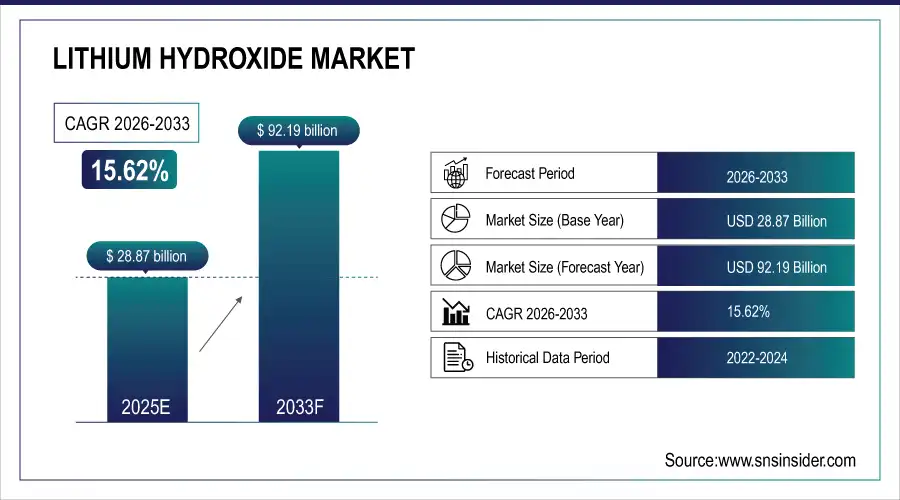

The Lithium Hydroxide Market Size is valued at USD 28.87 Billion in 2025E and is projected to reach USD 92.19 Billion by 2033, growing at a CAGR of 15.62% during the forecast period 2026–2033.

The Lithium Hydroxide Market analysis report delivers an in-depth overview of the market landscape, highlighting evolving applications, supply dynamics, and technological progress shaping demand. Progressing demand for electric vehicles and energy storage solutions are expected to increase lithium hydroxide intake, powered by technical developments and investments in a climate-friendly battery production plant.

Lithium Hydroxide demand reached 1.2 million tons in 2025, driven by surging electric vehicle production and expanding battery manufacturing capacity.

Market Size and Forecast:

-

Market Size in 2025: USD 28.87 Billion

-

Market Size by 2033: USD 92.19 Billion

-

CAGR: 15.62% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information On Lithium Hydroxide Market - Request Free Sample Report

Lithium Hydroxide Market Trends:

-

World’s lithium supply chain would be disrupted by the increasing demand for high-purity lithium hydroxide for EV battery manufacture.

-

Lithium recovery from used batteries rises due to growing recycling and processing technologies consistent with the circular economy purpose.

-

To safeguard the cost of the raw material, many of the world’s biggest car manufacturers have entered into long-term lithium supply agreements.

-

Increased investment in green extraction methods such as direct lithium extraction increases production efficiency.

-

Lithium hydroxide business is advancing in energy storage systems due to state funding for electric car development.

-

Lithium hydroxide consumption is expected to skyrocket in the next generation of solid-state batteries, as research and development acquires popularity.

U.S. Lithium Hydroxide Market Insights:

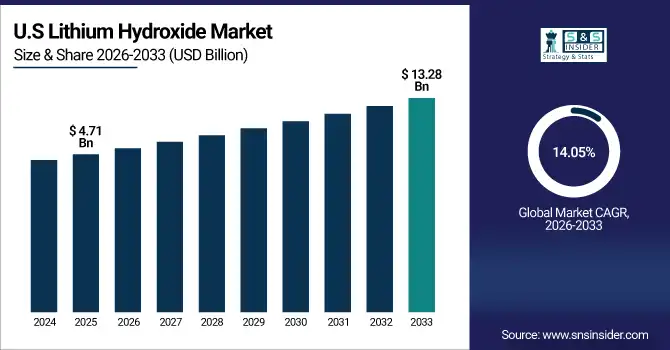

The U.S. Lithium Hydroxide Market is projected to grow from USD 4.71 Billion in 2025E to USD 13.28 Billion by 2033, at a CAGR of 14.05%. Such growth is supported by the expanding electric vehicle manufacturing, increasing battery production capacity, and the government’s initiative to promote clean energy and establish the domestic lithium supply chain.

Lithium Hydroxide Market Growth Drivers:

-

Rapid expansion of electric vehicle production, driving surging demand for high-purity lithium hydroxide in advanced battery manufacturing.

The rapid expansion of electric vehicle production is a key driver of Lithium Hydroxide Market growth. The scenario of electrification, including the high-purity lithium hydroxide for the lithium-ion battery, has been observed. The need for new energy at the governmental level and the provision of a broader scope for battery technology promote market growth. Increased investment in gigafactories fuels grow, as does new supply chains. Hence, Lithium hydroxide serves as a keystone for the clean energy transformation encouraged by the market.

Lithium Hydroxide Production increased by 11.5% in 2025, fueled by surging EV battery demand and expanding gigafactory capacities across China, Europe, and North America.

Lithium Hydroxide Market Restraints:

-

Limited lithium reserves, high extraction costs, and supply chain disruptions are constraining consistent growth of the Lithium Hydroxide Market.

Limited lithium reserves, high extraction costs, and supply chain disruptions pose significant restraints to the Lithium Hydroxide Market. Subject to practical use evolution due to scarce access to high-quality lithium. Demand that outpaces the battery-grade lithium hydroxide supply due to unstable raw materials pricing and energy expenditures hikes. The inability to develop a predictive strategy that safeguards against the legislative and geopolitically disruptive environment. Manufacturers’ inability to develop a pricing model that sustains predictable investments and situational evolution.

Lithium Hydroxide Market Opportunities:

-

Rising electric mobility and renewable energy adoption create vast opportunities for innovation in lithium hydroxide production and supply.

Rising electric mobility and renewable energy adoption present a major opportunity for the Lithium Hydroxide Market. As nations switch to clean transportation and power systems, there is a high requirement for high-performance lithium-ion batteries. In response, the manufacturer of all sizes is upping its use of the most up-to-date refining technologies and environmentally friendly extraction methods. In addition, lithium hydroxide is being used in a groundbreaking partnership between leading automakers and battery manufacturers.

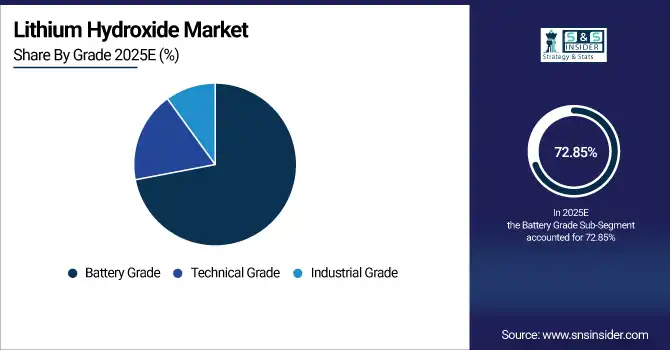

Battery-grade lithium hydroxide accounted for 68% of total output in 2025, driven by rising demand from electric vehicle manufacturers and large-scale energy storage projects.

Lithium Hydroxide Market Segmentation Analysis:

-

By Source, Hard Rock held the largest market share of 54.37% in 2025, while Recycled Lithium is expected to grow at the fastest CAGR of 18.46% during 2026–2033.

-

By Grade, Battery Grade dominated with a 72.85% share in 2025, while Technical Grade is projected to expand at the fastest CAGR of 14.29% over the forecast period.

-

By Application, Electric Vehicles accounted for the highest market share of 61.24% in 2025, while Energy Storage Systems are anticipated to record the fastest CAGR of 17.63% through 2026–2033.

-

By End Use Industry, Automotive captured the largest share of 64.58% in 2025, while the Energy segment is expected to grow at the fastest CAGR of 16.72% during 2026–2033.

By Source, Hard Rock Dominates While Recycled Lithium Expands Rapidly:

The Hard Rock segment dominated the market due to the extensive mining in Australia and Canada, which provided high quality lithium feedstock and stable supply. The refining infrastructure is well developed, which ensures a stable output for battery producers. The Recycled Lithium is the fastest growing segment as a result of sustainability programs, battery recycling improvements, and government backing for closed-loop supplies. In 2025, over 720,000 tons of lithium hydroxide originated from hard rock sources globally.

By Grade, Battery Grade Dominates While Technical Grade Expands Rapidly:

The Battery Grade segment dominated the market due to its indispensable function in electric vehicle batteries and lithium producers’ drive toward high-nickel cathode chemistries. Such a growing market for long-range EVs and energy storage opportunities strengthens the segment’s demand. The Technical Grade is the fastest growing segment due to a surge in lubricants and greases and special chemicals. In 2025, Battery Grade lithium hydroxide accounted for nearly 73% of total consumption.

By Application, Electric Vehicles Dominate While Energy Storage Systems Expand Rapidly:

The Electric Vehicles segment dominated the market due to the car manufacturers’ growing adoption of electric vehicles and lithium-ion batteries capacity uplifts. In addition, the growing affordability and regulations demands in the direction of electromobility make this sector the leading one. Energy Storage Systems is the fastest growing segment due to renewable integration and power grid balancing. In 2025, EV-related lithium hydroxide demand surpassed 800,000 tons, underscoring its leadership in application share.

By End Use Industry, Automotive Dominates While Energy Expands Rapidly:

The Automotive segment dominated the market, accounting for the majority share on account of increasing EV production and stringent sustainability laws. Automakers’ long-term contracts with lithium producers have helped to safeguard their supply chains and stabilize demand levels. The Energy segment is the fastest growing segment due to the expansion of renewable power sources and the development of utility-scale storage operations to satisfy decarbonization targets. In 2025, automotive-related lithium hydroxide consumption surpassed 410,000 tons globally, reaffirming its dominant position.

Lithium Hydroxide Market Regional Analysis:

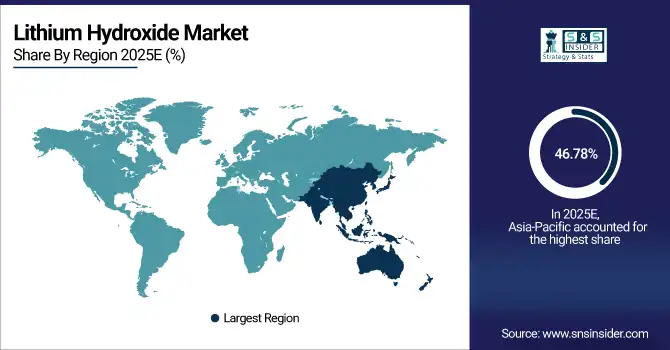

Asia-Pacific Lithium Hydroxide Market Insights:

The Asia-Pacific Lithium Hydroxide Market dominated globally with a 46.78% share in 2025. China’s large-scale EV production and a huge number of lithium refining facilities with additional plants in countries such as Japan, and South Korea have empowered Asia-Pacific. Being significantly supported by the government and characterized by rapid industrialization and sturdy regional supply chains, the region continues to dominate. With Gigafactory expansions, lucrative prospects for renewable energy, and innovations if the sector continues to grow, Asia-Pacific’s standing will only harden.

Get Customized Report as per Your Business Requirement - Enquiry Now

China Lithium Hydroxide Market Insights:

China Lithium Hydroxide Market is fueled by the growth of EV manufacturing, the robust production capability of the battery, and positive government policies toward clean energy. Additionally, increasing investments in refining infrastructure and technology make China a dominant market player. The nation is a key principle in lithium activity throughout the Asia-Pacific, with significant exports and development partnerships.

Europe Lithium Hydroxide Market Insights:

The Europe Lithium Hydroxide Market is the fastest-growing region, projected to expand at a CAGR of 18.72% during 2026–2033. Growing on the back of accelerating EV adoption, ambitious carbon neutrality plans, and expansion of gigafactory developments in Germany, France, and the UK, in-market investment and innovation will continue to increase. Rising investments in local lithium refining and recycling infrastructure coupled with multiplier partnerships with car manufacturers will reinforce Europe’s standing as a critical center for producing and developing sustainable battery materials.

Germany Lithium Hydroxide Market Insights:

The Germany Lithium Hydroxide Market is developing into an important node in Europe’s EV and battery landscape. Together, automotive manufacturing, increasing investment in gigafactories, and government-backed eco-friendly policies are propelling the growth. In addition, growing emphasis on sustainable energy storage and cutting-edge refining technologies enhance Germany’s standing in Europe’s lithium supply chain.

North America Lithium Hydroxide Market Insights:

The North America Lithium Hydroxide Market is expanding steadily, driven by increasing EV adoption and strong government incentives supporting clean energy transition. The U.S. and Canada are experiencing sizable investments in domestic lithium extraction, refining, and battery manufacturing. Platform collaborations across global carmakers, technology providers, and mining companies regarding North American supply chain consolidation and storage systems innovation and sustainability projects, are also adding to North America’s increasing influence in the world’s lithium hydroxide sector.

U.S. Lithium Hydroxide Market Insights:

The U.S. Lithium Hydroxide Market is supported by the spike in the consumption of automotive manufacturers, battery producers, and green projects’ market champions. Companies could furthermore benefit from a strong national supply chain value, thanks to strategic investments in local lithium refining, recycling expansions, and automaker collaborations.

Latin America Lithium Hydroxide Market Insights:

The Latin America Lithium Hydroxide Market is expanding due to the rising demand for EVs, the adoption of favorable policies on mining, and the large lithium reserves in Chile, Argentina, and Brazil. Furthermore, the substantial investments in extraction-related capital, facilities, and partnerships with top international energy companies and the construction of regional battery plants, have made Latin America an essential lithium production center.

Middle East and Africa Lithium Hydroxide Market Insights:

The Middle East & Africa Lithium Hydroxide Market will grow on account of rising EV initiatives, renewable energy investments, and industrial diversification. The implementation of robust government sustainability policies in Saudi Arabia, the UAE, and South Africa, along with the burgeoning number of battery production projects, will boost regional demandite and enhance MEA’s presence in the lithium value chain.

Lithium Hydroxide Market Competitive Landscape:

Albemarle Corporation, headquartered in Charlotte, North Carolina, is a leader in specialty chemicals and one of the largest lithium producers. The Company leads the Lithium Hydroxide Market courtesy of the wide geography of operations, vertically-integrated supply chain, and leading-edge extraction technologies. Albemarle maintains strategic leadership due to a resilient focus on sustainable lithium production for EV batteries and energy storage and long-standing partnerships with biggest automakers. Continuous investment into R&D and strategic resource acquisition bolster its market authority.

-

In June 2025, Albemarle launched its advanced battery-grade lithium hydroxide product line in the U.S., featuring enhanced purity and performance to support next-generation electric vehicle batteries and sustainable energy storage applications.

Ganfeng Lithium Co., Ltd., based in Jiangxi, China, is one of the world’s largest and most diversified lithium producers, covering the full value chain from extraction to recycling. Using innovative technology and partnerships with EV manufacturers such as Tesla and BMW, the company dominates the Lithium Hydroxide Market. In addition, management strategy involves significant investments in new, sustainable Lithium extraction and recycling technologies, which further enhances the reliability of supply sources. Ganfeng’s large resource basis along with vertical integration guarantees constant growth and market dominance.

-

In February 2025, Ganfeng Lithium launched its new high-efficiency lithium hydroxide series designed for next-generation EV batteries, offering improved purity, enhanced thermal stability, and better energy density to meet rising global demand for advanced energy storage solutions.

SQM S.A., headquartered in Santiago, Chile, is a key supplier of lithium and lithium derivatives, known for its vast brine resources in the Atacama Desert. Primary dominance of the company over the Lithium Hydroxide Market occurs due to high-volume production capability and the efficiency of brine-based extraction. Strategic geographical superiority, sustainability strategies, and commitment to high-quality lithium hydroxide for electric vehicles and energy accumulation have reinforced its presence. Furthermore, SQM’s extended-term contracts and supply chain reliability ensure its sector prominence.

-

In July 2025, SQM launched its next-generation high-purity lithium hydroxide product optimized for solid-state batteries. The launch enhances battery performance, supports faster charging, and aligns with the company’s strategy to serve advanced EV and energy storage markets.

Lithium Hydroxide Market Key Players:

-

Ganfeng Lithium Co., Ltd.

-

SQM S.A. (Sociedad Química y Minera de Chile)

-

Tianqi Lithium Corporation

-

Livent Corporation

-

Allkem Limited

-

Sichuan Yahua Industrial Group Co., Ltd.

-

AMG Advanced Metallurgical Group N.V.

-

BYD Company Limited

-

Nemaska Lithium Inc.

-

Lithium Americas Corp.

-

Jiangxi Ganfeng Lithium Industrial Co., Ltd.

-

European Lithium Ltd.

-

Piedmont Lithium Inc.

-

Sayona Mining Limited

-

Avalon Advanced Materials Inc.

-

Sigma Lithium Corporation

-

Pilbara Minerals Limited

-

Galaxy Resources Limited

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 28.87 Billion |

| Market Size by 2033 | USD 92.19 Billion |

| CAGR | CAGR of 15.62% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Source (Brine, Hard Rock, Recycled Lithium, Others) • By Grade (Battery Grade, Technical Grade, Industrial Grade) • By Application (Electric Vehicles, Energy Storage Systems, Ceramics & Glass, Lubricants, Polymers, Others) • By End Use Industry (Automotive, Electronics, Industrial, Energy, Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Albemarle Corporation, Ganfeng Lithium Co., Ltd., SQM S.A. (Sociedad Química y Minera de Chile), Tianqi Lithium Corporation, Livent Corporation, Mineral Resources Limited, Sichuan Yahua Industrial Group Co., Ltd., Allkem Limited, Lithium Americas Corp., Piedmont Lithium Inc., Nemaska Lithium, Sigma Lithium Corporation, Avalon Advanced Materials Inc., European Lithium Ltd., Jiangxi Special Electric Motor Co., Ltd., AMG Advanced Metallurgical Group N.V., Keliber Oy, Shandong Ruifu Lithium Industry Co., Ltd., Chengxin Lithium Group Co., Ltd., Galaxy Resources Limited. |