Lithium Iron Phosphate Batteries Market Size & Analysis:

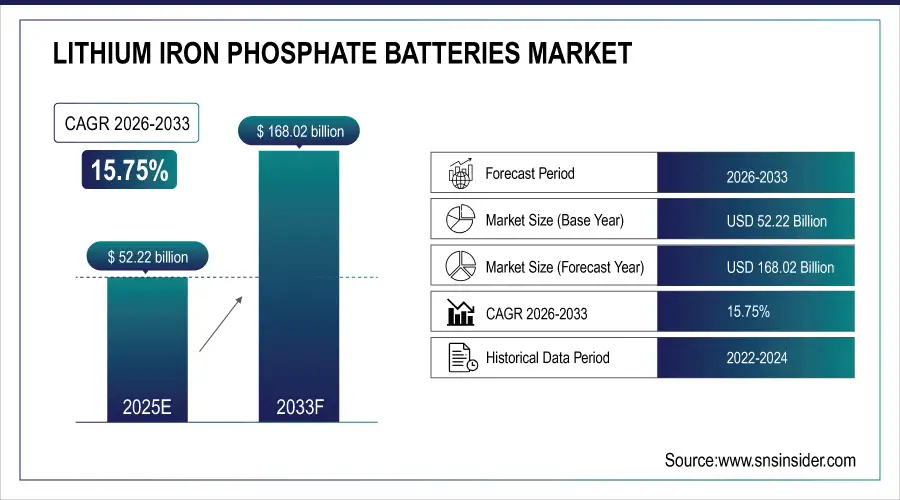

The Lithium Iron Phosphate Batteries Market size was valued at USD 52.22 Billion in 2025E and is projected to reach USD 168.02 Billion by 2033, growing at a CAGR of 15.75% during 2026-2033.

The Lithium Iron Phosphate Batteries Market analysis highlights the rapid adoption of LiFePO₄ technology in electric vehicles, energy storage systems and industrial applications due to its high-energy density and long cycle life. Growing need for low cost and environment friendly batteries.

In 2025, over 40% of new electric vehicles in China and 25% globally used LiFePO₄ batteries, driven by their lower cost, thermal stability, and suitability for standard-range models.

Market Size and Forecast:

-

Market Size in 2025E: USD 52.22 Billion

-

Market Size by 2033: USD 168.02 Billion

-

CAGR: 15.75% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information on Lithium Iron Phosphate Batteries Market - Request Free Sample Report

Lithium Iron Phosphate Batteries Market Trends

-

Increasing sale of electric vehicles globally is boosting the demand for safe long cycle life and cost effective LiFePO₄ batteries.

-

Growing utilization of grid and residential ESS drives the global LiFePO₄ battery market.

-

Advancements in high energy density, quick charging and battery management systems boost performance and acceptance throughout the applications.

-

Attention to batteries that are green, recyclable and harmless is pushing markets as well as the use of batteries in different industries.

-

Policies, tax breaks, and support programmes for clean power speed up LiFePO₄ battery manufacture and end use.

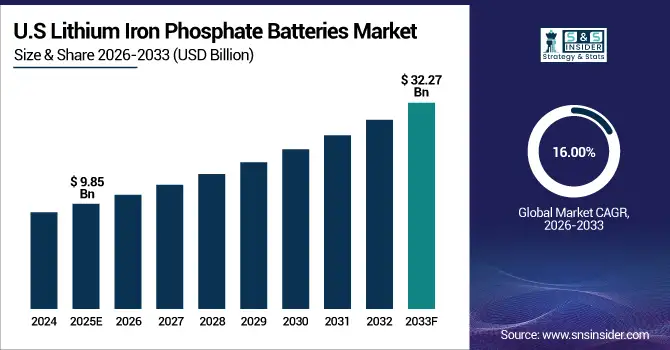

The U.S. Lithium Iron Phosphate Batteries Market size was valued at USD 9.85 Billion in 2025E and is projected to reach USD 32.27 Billion by 2033, growing at a CAGR of 16.00% during 2026-2033. Lithium Iron Phosphate Batteries Market growth is driven by stronger demands for clean transportation and renewable energy are driving the U.S. lithium iron phosphate (LiFePO₄) batteries market. There are many technically superior high energy density and fast charging batteries. Government subsidies and encouragement for clean energy are driving the market.

Lithium Iron Phosphate Batteries Market Growth Drivers:

-

Rising Electric Vehicle Adoption and Demand for Efficient, Safe, Long-Lasting Lithium Iron Phosphate Batteries

The Electric Vehicles (EV) including renewable energy storage systems market is witnessing the increased need for LiFePO₄ batteries. With their safety, thermal stability, long cycle life and cost effectiveness they present advantages when compared to other chemistries. Increasing industrial and consumer applications, in addition to favorable government policies and incentives for clean energy continue to drive market growth. Ongoing technological development such as fast charging and greater energy density of batteries improve battery performance, driving adoption across automotive, energy storage and other industrial sectors globally.

In 2025, over 70% of energy storage system integrators and EV manufacturers prioritized LiFePO₄ for its non-flammable chemistry and stable performance at high temperatures, reducing thermal runaway risks.

Lithium Iron Phosphate Batteries Market Restraints:

-

Limited Energy Density and High Initial Manufacturing Costs Hindering Lithium Iron Phosphate Battery Adoption

Although, the energy density of LiFePO₄ batteries is relatively low as a lithium-ion chemical, and thus their application to high-performance EVs remains constrained. Manufacturers are also faced with the high cost of production and raw materials. Furthermore, a scarce recycling network and reliance on lithium and phosphate reserves may cause supply chain limitations. These aspects can delay penetrations in the market that require light weight, compact and higher energy batteries. These are issues that must be resolved by the manufacturers, especially if Near-Infrared is to gain wider acceptance in competitive applications and remain profitable.

Lithium Iron Phosphate Batteries Market Opportunities:

-

Expansion in Renewable Energy Storage and Industrial Applications Driving LiFePO₄ Battery Market Growth

With the growing installation of renewable energy resources, microgrids, and utility-scale batteries on a large scale, LiFePO₄ batteries have high potential. Increasing demand for ecofriendly, safe and long-life batteries in industrial, automotive as well as consumer electronics applications helps manufacturers to develop new products and product portfolios. On the other hand, growing interest towards fast-charging solutions, second-life battery applications and smart grid integration also helps in boosting the growth of the market. Emerging markets such as the EV adoption and renewable energy initiatives in these countries are a long-term investment opportunity expanding the market for LiFePO₄ batteries.

In 2025, over 65% of new utility-scale and microgrid battery installations globally used LiFePO₄ chemistry, valued for its durability, safety, and compatibility with solar and wind intermittency management.

Lithium Iron Phosphate Batteries Market Segment Analysis

-

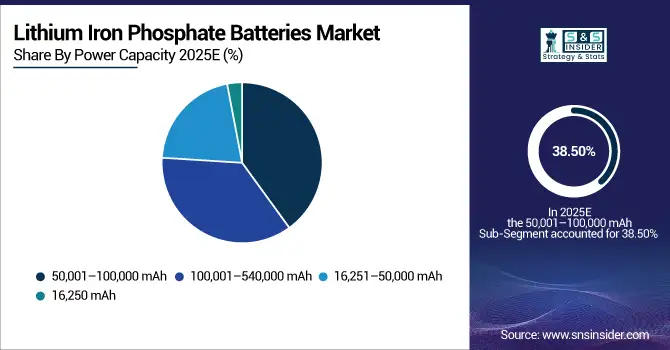

By Power Capacity, the 50,001–100,000 mAh segment led the market with a 38.50% share, while the 100,001–540,000 mAh segment registered the fastest growth, with a CAGR of 11.80%.

-

By application, stationary batteries dominated the market with a 46.20% share in 2025, whereas portable batteries were the fastest growing segment, recording a CAGR of 12.40%.

-

By voltage, the 3.2–12 KV segment led with a 42.70% share, while the 12–20 KV segment grew fastest at a CAGR of 10.90%.

-

By end-use industry, the automotive sector held 21.60% of the market in 2025, whereas the power segment registered the fastest growth with a CAGR of 11.60%.

By Power Capacity, 50,001–100,000 mAh Leads Market While 100,001–540,000 mAh Registers Fastest Growth

The 50,001–100,000 mAh segment accounted for largest share of the market owing to such features as an optimum combination of capacity and reliability and easy use in a EVs and industrial purposes. While, 100,001–540,000 mAh category is growing more quickly as need increases for utility energy storage systems, grid support and commercial applications. Growing demand for high-capacity batteries for integration of renewable energy sources and backup power solutions propel the manufacturers to upscale production and develop new products as per their increasing application globally.

By Application, Stationary Dominate While Portable Shows Rapid Growth

In this market, stationary applications segment dominated due to grid and commercial energy storage system have been predominant now and their long cycle life and stable performance. Meanwhile, portable devices like consumer electronics, small EVs and UPS are expanding stably. Growth prospects for the portable segment are being influenced by increasing need of mobile power systems, smaller battery packages and high energy batteries in lighter weight devices. The miniaturizing of LiFePO4 cells additionally drives rapid adoption in portable applications within residential, industrial and transportation.

By Voltage, 3.2–12 KV Lead While 12–20 KV Registers Fastest Growth

3.2–12 KV has the most substantial share in this market, which are popularly used for normal EVs, ESS and industry. Increasing needs for EVs batteries in both emerging and developed markets. While, 12–20 KV segment has the highest growth rate as it is more and more used in high-power industrial applications, utility-scale energy storage systems, as well as heavy-duty EVs. Demand has been driven by technology advancements enabling higher voltage operation and safety improvement, and increasingly being produced across various crops of manufacturers that are expanding production capacity to meet.

By End-Use Industry, Automotive Lead While Power Grow Fastest

Automotive is the largest segment by application type, which is attributed to growing adoption of EVs, penetration of hybrid vehicles and fleet electrification. LiFePO₄ batteries increases efficiency, safety, and reliability, pushing the adoption in electric mobility worldwide. While, power applications, from grid-scale storage to integrating renewable energy to backup, is the fastest-growing. The increasing attention toward sustainable energy solutions, government incentives for the adoption of renewable energy generation in developing economies, and rising demand for industrial electricity storage contribute to the growth of this segment. Constant technological evolution of high energy and fast-charging.

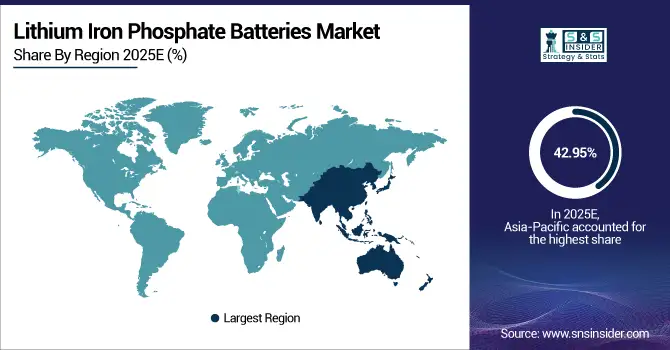

Asia-pacific Lithium Iron Phosphate Batteries Market Insights

In 2025 Asia-Pacific dominated the Lithium Iron Phosphate Batteries Market and accounted for 42.95% of revenue share, this leadership is due to increasing EV penetration and rising renewable energy initiatives. Demand is being fueled by growing industrial and consumer uses. Market growth is also fuelled by technological developments in high energy density and fast charging batteries. Government support for environmentally-friendly energy adoption and encouraging policies help drive the regional growth.

Get Customized Report as per Your Business Requirement - Enquiry Now

China Lithium Iron Phosphate Batteries Market Insights

China is the leading country of the world in terms of both extensive volume production and domestic application of the LiFePO₄ battery for electricity vehicles (EVs) [5–7] and energy storage systems. Government incentives and policy support promote local production and technology R & D.

North America Lithium Iron Phosphate Batteries Market Insights

North America is expected to witness the fastest growth in the Lithium Iron Phosphate Batteries Market over 2026-2033, with a projected CAGR of 16.43% due to increase in EV production, renewable energy storage and industrial applications. Improvements in technology such as better cycle life and safety are contributing to adoption. US and Canada are putting money in home production to reduce imports. The state also provides incentives for the deployment of clean energy. Increasing commercial and utility applications also continue to support regional growth factors.

U.S. Lithium Iron Phosphate Batteries Market Insights

The U.S. market is expanding more EV penetration, grid-scale energy storage and industrial electrification. Federal and state-level incentives support clean energy and battery production. But it is a booming demand for safe, durable and fast-charging LiFePO₄ batteries which is behind the new development.

Europe Lithium Iron Phosphate Batteries Market Insights

In 2025, Europe emerged as a promising region in the Lithium Iron Phosphate Batteries Market, due to seeing gradual development with the transformation into electricity utilization and renewable energy application. EVs and clean energy storage are being encouraged by governments with incentives and regulations. Demand is also being propped up by industrial, commercial and residential applications.

Germany Lithium Iron Phosphate Batteries Market Insights

Germany leads Europe in its usage of LiFePO₄ batteries thanks to high EV penetration as well as renewable projects in line. Industrial and automotive applications are some of the key drivers for safe, long-lasting batteries. The government supports domestic manufacturing and innovation through its policies and subsidies.

Latin America (LATAM) and Middle East & Africa (MEA) Lithium Iron Phosphate Batteries Market Insights

The Lithium Iron Phosphate Batteries Market is experiencing moderate growth in the Latin America (LATAM) and Middle East & Africa (MEA) regions, due to the increasing EV penetration, renewable projects and industrial uses. Among the leading players in emerging countries, Brazil, Mexico, South Africa and United Arab Amirates lead with market growth. Growing need for safe, reliable, and affordable batteries is contributing toward regional growth. Production facilities and distribution networks are opening up, thanks to investment from manufacturers.

Lithium Iron Phosphate Batteries Market Competitive Landscape:

BYD Company Ltd. is a global leader in LiFePO₄ battery production, supplying electric vehicles, energy storage systems, and industrial applications. The company focuses on high-performance, safe, and sustainable battery technologies. Strategic investments in R&D, manufacturing capacity, and global expansion strengthen BYD’s position in the rapidly growing LiFePO₄ market.

-

In April 2025, BYD and Saudi Aramco signed a Joint Development Agreement to collaborate on new energy vehicle technologies, aiming to enhance efficiency and environmental performance in the automotive sector. The partnership also focuses on advanced battery integration, sustainable materials, and future mobility solutions across global markets.

A123 Systems LLC specializes in advanced lithium-ion and LiFePO₄ batteries for automotive, grid, and commercial applications. The company emphasizes high power density, long cycle life, and safety. Its innovative battery management systems and collaborations with EV and industrial clients reinforce its competitive position in the global LiFePO₄ battery market.

-

In September 2025, A123 Systems introduced its next-generation energy storage portfolio at RE+ 2025, featuring the AEnergy™ 5000 and AEnergy™ 850 platforms designed for utility, commercial, and microgrid applications in North America. These platforms provide improved safety, faster charging, longer lifecycle, and higher energy density, supporting renewable energy adoption and grid stability initiatives.

K2 Energy manufactures LiFePO₄ batteries for electric vehicles, energy storage, and industrial applications. Known for reliability, durability, and high safety standards, K2 Energy invests in advanced cell technology and scalable production. The company’s focus on custom solutions and sustainable practices strengthens its growth and market share in the LiFePO₄ sector.

-

In October 2025, K2 Energy announced the expansion of its manufacturing facility in Nevada to increase production capacity for its lithium iron phosphate batteries. This expansion aims to meet the growing demand for energy storage solutions and electric vehicle applications. The company plans to hire additional staff and invest in advanced manufacturing technologies to enhance efficiency and product quality.

Electric Vehicle Power System Technology Co. Ltd. produces LiFePO₄ batteries for EVs, commercial vehicles, and energy storage systems. The company emphasizes high energy density, thermal stability, and long cycle life. Continuous technological innovation and strategic partnerships enable it to expand its presence in the global LiFePO₄ battery market.

-

In September 2025, Electric Vehicle Power System Technology Co. Ltd. unveiled a new line of high-performance lithium iron phosphate batteries designed for commercial electric vehicles. These batteries feature enhanced energy density and fast-charging capabilities, aiming to improve the operational efficiency of electric buses and trucks.

Lithium Iron Phosphate Batteries Companies are:

-

A123 Systems LLC

-

K2 Energy

-

Electric Vehicle Power System Technology Co. Ltd.

-

Bharat Power Solutions

-

OptimumNano Energy Co. Ltd.

-

k2battery

-

LiFeBATT Inc.

-

LITHIUMWERKS

-

CENS Energy Tech Co. Ltd.

-

RELiON Batteries

-

Contemporary Amperex Technology Co. Limited (CATL)

-

Gotion High-Tech

-

CALB (China Aviation Lithium Battery Co. Ltd.)

-

LG Energy Solution

-

Panasonic Corporation

-

Samsung SDI

-

Sunwoda

-

BSLBATT

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 52.22 Billion |

| Market Size by 2033 | USD 168.02 Billion |

| CAGR | CAGR of 15.75% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Power Capacity (16,250 mAh, 16,251–50,000 mAh, 50,001–100,000 mAh, and 100,001–540,000 mAh), • By Application (Portable, Stationary, and Others) • By Voltage (Up to 3.2 KV, 3.2–12 KV, 12–20 KV, and Above 20 KV) • By End-Use Industry (Automotive, Power, Industrial, and Others) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | BYD Company Ltd., A123 Systems LLC, K2 Energy, Electric Vehicle Power System Technology Co., Ltd., Bharat Power Solutions, OptimumNano Energy Co., Ltd., k2battery, LiFeBATT, Inc., LITHIUMWERKS, CENS Energy Tech Co., Ltd., RELiON Batteries, Contemporary Amperex Technology Co., Limited (CATL), Gotion High-Tech, CALB (China Aviation Lithium Battery Co. Ltd.), EVE Energy Co. Ltd., LG Energy Solution, Panasonic Corporation, Samsung SDI, Sunwoda, and BSLBATT |