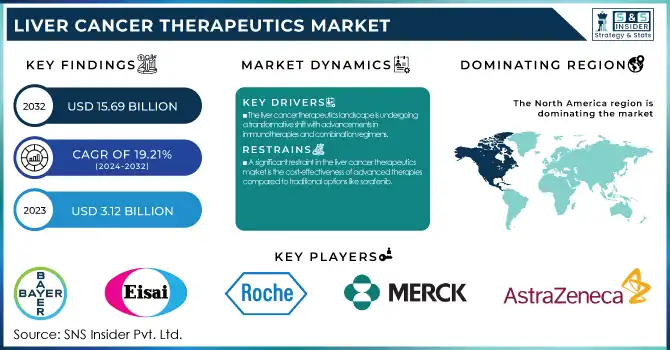

Liver Cancer Therapeutics Market Size & Overview:

The Liver Cancer Therapeutics Market was valued at USD 3.12 billion in 2023 and is expected to reach USD 15.69 billion by 2032, growing at a CAGR of 19.21% from 2024-2032.

To get more information on Liver Cancer Therapeutics Market - Request Free Sample Report

The liver cancer therapeutics market is expected to drive in upcoming years, which will support the growth of the industry in the long run. According to NCBI, Liver cancer is still one of the most common malignancies in the world, accounting for an estimated 905,677 incident cases and 830,180 deaths globally in 2023 (Global Cancer Observatory). For liver cancer, chronic hepatitis B and C infections as well as alcohol and non-alcoholic fatty liver disease are emerging to be the burden of disease. Liver cancer is the sixth-commonest cancer worldwide. The number of newly diagnosed primary liver cancer cases from 2020-2040 is anticipated to rise sharply; an estimated 1.4 million new diagnoses are projected by 2040.

There have been significant advances in therapeutic approaches for liver cancer in recent years. Conversely, targeted therapies, including sorafenib and lenvatinib, remain important in the management of advanced HCC. First-line treatment has been transformed with the advent of immune checkpoint inhibitors such as mepolizumab-bevacizumab (Tecentriq), which provide superior survival relative to conventional therapies. Combination strategies combining targeted and immune-based therapies are entering popular use supported by clinical benefits and improved patient outcomes.

Moreover, 2023 saw the FDA’s accelerated approvals of agents like durvalumab and tremelimumab (Imjudo), which have both increased the resources available for unresectable liver cancer, mirroring a trend toward tailored medicine. Molecular diagnostics innovation allows better patient stratification identification and actionable biomarker discovery, which increases treatment precision.

The market is primed for transformational growth as current clinical trials investigating next-generation therapies such as CAR-T cells and bispecific antibodies are slated to reshape the treatment landscape for liver cancer.

Liver Cancer Therapeutics Market Dynamics

Drivers

-

The liver cancer therapeutics landscape is undergoing a transformative shift with advancements in immunotherapies and combination regimens.

Immunotherapies and combination regimens are redefining the liver cancer therapeutics landscape. Combined immune checkpoint inhibitors, including atezolizumab and nivolumab, have led to considerable improvements in survival, with studies demonstrating a median overall survival of 19.2 months in patients receiving the atezolizumab-bevacizumab combination versus 13.4 months in traditional sorafenib therapy. These therapies are now the standard first-line therapies for advanced hepatocellular carcinoma (HCC). 2023 brought the FDA approval of durvalumab and tremelimumab (Imjudo) another milestone was reached in the treatment of unresectable liver cancer.

Additionally, combination therapies combining immunotherapies with tyrosine kinase inhibitors (TKIs) such as lenvatinib or monoclonal antibodies such as bevacizumab have shown better efficacy, overcoming obstacles of resistance and disease progression. The expanding pipeline of clinical trials—including well-studied candidates for CAR-T cell therapies and bispecific antibodies—reflects the biopharmaceutical industry’s desire to use next-generation technologies to elicit responses in more patients and build longer-term survival.

-

The growing number of regulatory approvals and the launch of innovative therapies are propelling the liver cancer therapeutics market forward.

Key factors propelling growth of the liver cancer therapeutics market include an increase in the number of regulatory approvals and launches of innovative therapies in the last few years, several new drugs have been approved for the disease, expanding treatment options for patients with hepatocellular carcinoma (HCC). Pivotal shifts such as the FDA approval of atezolizumab-bevacizumab (Tecentriq) — which significantly outperformed the standard of care in advanced liver cancer laps 10 years after sorafenib that required months of careful communication and consultation.

More recently, the approval of durvalumab-tremelimumab (Imjudo) for unresectable HCC in 2023 demonstrates that combination therapies are playing a vital approach targeting multiple pathways to improve outcomes in patients. That industry commitment to advancing therapy is reflected in the recent rapid expansion of the therapeutic pipeline, with promising candidates such as cabozantinib, tislelizumab, and next-generation CAR-T therapies.

Combined with accelerated approval pathways, particularly in the United States, Europe, and Japan, these advancements have shortened the time-to-market for life-saving drugs. These developments are fulfilling the increasing need for advanced therapy and wider access to new treatments across the globe, catering to market expansion.

Restraint

-

A significant restraint in the liver cancer therapeutics market is the cost-effectiveness of advanced therapies compared to traditional options like sorafenib.

High cost of novel therapies vs competitors (sorafenib), ex: entrectinib and ibrutinib. Recent studies have shown that therapies, such as lenvatinib, sintilimab plus bevacizumab, and atezolizumab plus bevacizumab, are associated with high incremental cost-effectiveness ratios (ICERs) per quality-adjusted life years (QALYs) gained. In the case of example, the ICER for lenvatinib is USD 188,625.25 per QALY gained and for atezolizumab in combination with bevacizumab is USD144,513.71 in QALY gained, both well above the commonly held threshold for cost-effectiveness of US$36,600/QALY.

Healthcare Economic Model: This evidence suggests that while advanced therapies offer clinical advantages, their high costs may result in reduced access and overall unsustainability within most healthcare systems. The results indicate that sorafenib is more cost-effective than ramucirumab, with a cost-effectiveness probability of 100% at the threshold; thus, sorafenib is a more reasonable choice in terms of expenditure, especially in areas with few medical resources.

Moreover, cost-effectiveness results are highly sensitive to variables such as medical insurance reimbursement ratios and medicine pricing (even within a brand). Areas where drug prices are high or insurance coverage is low have even greater challenges adopting these advanced therapies, resulting in growing disparities in access to optimal care.

Liver Cancer Therapeutics Market Segmentation Insights

By Therapy

The targeted therapy segment dominated the market with a market share of 56% in 2023, owing to targeted therapy's ability to haven't targeted molecule or pathway responsible for tumor growth and spread. This strategy has less impact on normal cells, thereby minimizing side effects and improving patient outcomes. Targeted therapies, for example, have had promising results in maintaining controlled tumor size and increasing survival rates in liver cancer.

The immunotherapy segment is expected to grow at the fastest CAGR of 21.68% from 2024 to 2032. The immune system to target and kill cancer cells via immunotherapy has heralded a paradigm shift in liver cancer treatment, as the effect has provided significant hope resulting in increased uptake of this treatment modality with greater investment into furthering such treatment options.

Drug Type

The Hepatocellular Carcinoma (HCC) segment dominated the market and accounted for the highest market share of 38% in the liver cancer drug market in 2023. HCC is the most frequent type of primary liver cancer and has a high prevalence and mortality rates, thus off for many research and development efforts to identify effective treatments. HCC is hard to treat, and available treatment options are limited, so companies are investing sizeable resources in the development of new and better drugs. Moreover, rising awareness and early diagnosis of liver cancer facilitate timely treatment, thereby contributing to the growth of the HCC treatment market.

The Hepatoblastoma segment is projected to grow at the fastest rate in the liver cancer therapeutics market owing to the rising incidence of the disease and advancements in treatment options. Hepatoblastoma is a rare, aggressive liver cancer that occurs in patients predominantly in the pediatric population; as awareness of hepatoblastoma has increased over the years, early diagnosis has allowed for improved treatment and outcomes for affected children. Cancer survivability has improved with developments in chemotherapy, surgery, and liver transplantation, leading to an increasingly urgent need for these specialty agents. In addition, constant studies on new targeted therapies and immunotherapy against hepatoblastoma are driving the segment's growth. Additionally, the Hepatoblastoma segment is growing very rapidly and is one of the fast-growing segments in the liver cancer therapeutics market, supported by the rise in the awareness level on the individual stage, growing diagnostic tools that help in its early diagnosis, treatment options, such as surgery and chemotherapy.

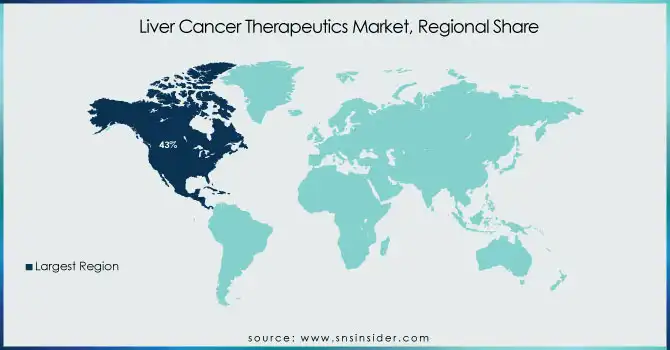

Liver Cancer Therapeutics Market Regional Analysis

North America dominated the market with a market share of 43%. The growth of the liver cancer therapeutics market in North America can be attributed to several factors. With state-of-the-art healthcare infrastructure, such as specialized health facilities, and the availability of qualified personnel, the area is equipped to carry out the rapid development, approval, and distribution of these liver cancer treatments. North America also has the largest number of leading pharmaceutical and biotech companies including Bayer, Merck, and Bristol-Myers Squibb actively working on liver cancer therapies and innovation and clinical research. Also, a high prevalence of liver cancer due to risk factors such as hepatitis and obesity further supports the need for effective treatments. Owing to early detection and insurance of good healthcare systems, the accessibility of treatment is easier. The well-established research and development platform in North America, backed by government funding, facilitates the development of new therapies and confirms the region’s dominance in the global liver cancer therapeutics market

Asia-Pacific is experiencing the fastest growth with a CAGR of 22.73% in the liver cancer therapeutics market. The region is a high-endemicity area for liver cancer with high-risk factors facing countries (e.g., chronic hepatitis B and hepatitis C infection, high alcohol consumption, and dietary habits), especially in China and Japan. When early detection and diagnosis become available, the need for effective treatments will increase as healthcare infrastructure continues to develop. The region is also observing vast investments in pharmaceutical R&D, where global players and local companies are developing liver cancer therapies targeting the needs of the Asian populations. The growing healthcare spending, increasing access to treatments, and awareness about liver cancer and its treatment in the Asia Pacific region propel the market's rapid growth.

Need any customization research on Liver Cancer Therapeutics Market - Enquiry Now

Key Players

-

Bayer AG (Nexavar (sorafenib), Stivarga (regorafenib))

-

Eisai Co., Ltd. (Lenvima (lenvatinib), Halaven (eribulin))

-

Roche Holding AG (Tecentriq (atezolizumab), Avastin (bevacizumab))

-

Merck & Co., Inc. (Keytruda (pembrolizumab), Lenvima (lenvatinib))

-

AstraZeneca (Imfinzi (durvalumab), Tremelimumab)

-

Bristol-Myers Squibb (Opdivo (nivolumab), Yervoy (ipilimumab))

-

Pfizer Inc. (Inlyta (axitinib), Sutent (sunitinib))

-

Exelixis, Inc. (Cabometyx (cabozantinib), Cometriq (cabozantinib))

-

Eli Lilly and Company (Cyramza (ramucirumab), Verzenio (abemaciclib))

-

Novartis AG (Afinitor (everolimus), Zykadia (ceritinib))

-

Sanofi (Zaltrap (ziv-aflibercept), Thymoglobulin)

-

Gilead Sciences, Inc. (Hepcludex (bulevirtide), GS-5745)

-

BeiGene, Ltd. (Tislelizumab, Pamiparib)

-

Regeneron Pharmaceuticals, Inc. (Libtayo (cemiplimab), REGN4659)

-

Amgen Inc. (Blincyto (blinatumomab), AMG 510 (sotorasib))

-

F. Hoffmann-La Roche Ltd. (Erivedge (vismodegib), Kadcyla (trastuzumab emtansine))

-

Ipsen (Onivyde (irinotecan liposome injection), Somatuline Depot (lanreotide)

-

Hutchmed (Surufatinib, Fruquintinib)

-

Can-Fite BioPharma (Namodenoson (CF102), CF602)

-

Zymeworks Inc. (ZW25 (zanidatamab), ZW49)

Recent Developments

-

August 2024 – Bristol Myers Squibb announced that the U.S. Food and Drug Administration (FDA) has accepted a supplemental Biologics License Application (sBLA) for Opdivo (nivolumab) in combination with Yervoy (ipilimumab) as a potential first-line treatment for adults with unresectable hepatocellular carcinoma (HCC). This decision is based on findings from the Phase 3 CheckMate -9DW trial. The FDA has set a Prescription Drug User Fee Act (PDUFA) target date of April 21, 2025.

-

April 2023 – Roche reported new data from the Phase III IMbrave050 study. Results show that Tecentriq (atezolizumab) combined with Avastin (bevacizumab) significantly improved recurrence-free survival (RFS) in patients with hepatocellular carcinoma (HCC) at high risk of recurrence following liver resection or ablation with curative intent.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 3.12 Billion |

| Market Size by 2032 | US$ 15.69 Billion |

| CAGR | CAGR of 19.21% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Therapy (Targeted Therapy, Immunotherapy, Chemotherapy) • By Type (Hepatocellular Carcinoma, Cholangio Carcinoma, Hepatoblastoma, Others) • By Distribution Channel (Hospital Pharmacy, Retail Pharmacy, Online Pharmacy) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Bayer AG, Eisai Co., Ltd., Roche Holding AG, Merck & Co., Inc., AstraZeneca, Bristol-Myers Squibb, Pfizer Inc., Exelixis, Inc., Eli Lilly and Company, Novartis AG, Sanofi, Gilead Sciences, Inc., BeiGene, Ltd., Regeneron Pharmaceuticals, Inc., Amgen Inc., F. Hoffmann-La Roche Ltd., Ipsen, Hutchmed, Can-Fite BioPharma, Zymeworks Inc., and other player |

| Key Drivers | •The liver cancer therapeutics landscape is undergoing a transformative shift with advancements in immunotherapies and combination regimens. •The growing number of regulatory approvals and the launch of innovative therapies are propelling the liver cancer therapeutics market forward. |

| Restraints | •A significant restraint in the liver cancer therapeutics market is the cost-effectiveness of advanced therapies compared to traditional options like sorafenib. |