Location-Based Entertainment Market Report Scope & Overview:

To get more information on Location-Based Entertainment Market - Request Free Sample Report

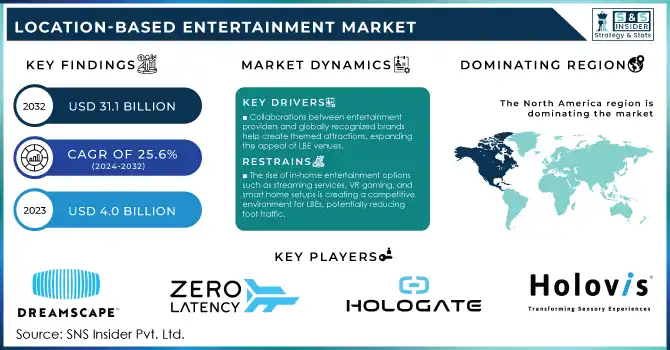

The Location-Based Entertainment Market Size was valued at USD 4.0 Billion in 2023 and is expected to reach USD 31.1 Billion by 2032, growing at a CAGR of 25.6 % over the forecast period 2024-2032.

The global location-based entertainment (LBE) market is experiencing significant growth due to several factors, such as government support, and technological development. U.S. Department of Commerce states the global entertainment and media market grew 6% per year in 2023, affecting the LBE greatly. The demand for immersive attractions, such as augmented reality and virtual reality, stimulates the growth of LBE in amusement parks, arcades, and gaming centers. Moreover, the government’s efforts to develop tourism also stimulate the growth of LBE. For example, the World Tourism Organization reports that international tourists increased by 4% in 2023, making the LBE more attractive for consumers who are looking for unique entertainment experiences. Other factors that also stimulate the growth of the market would be the increasing popularity of themed attractions and interactive exhibits. The technology is also moving forward with advanced technologies, such as 5G, that facilitate the influence of faster data on LBEs. Thanks to modern technologies, LBE can offer its guests high-quality entertainment experiences. The industry also attracts more investments from governments and companies who are creating infrastructure for LBE. The activity is particularly important for development in Asia-Pacific. Consumer spending on recreational leisure is rising, prompting the LBE industry’s growth.

The gaming industry is transforming with more LBE technology-driven initiatives. Consumers are involved more in VR, especially in the multiplayer form. Smaller firms are investing in LBEs as a result of the trend, while the big wigs invest and develop various technologies to make the consumer’s experience more enjoyable, such as AR, VR, MR, IDD, and 3DPM. For example, Apple and Disney communicated their plans for a platform of VR content in 2023. The LBE becomes attractive for consumers since it does not require them any personal simulation gadgets, and on the other hand, provides them with an immersive environment. The LBE also changes consumers’ perception of malls, turning them into social hubs of entertainment and shopping.

Location-Based Entertainment Market Dynamics

Drivers

-

The integration of advanced virtual and augmented reality experiences into location-based entertainment is driving consumer interest and enhancing immersive experiences, fuelling market growth.

-

Theme parks, interactive experiences, and immersive installations are gaining popularity as people seek more personalized and engaging entertainment options.

-

Growing disposable incomes, particularly among younger audiences, are boosting demand for unique, experience-driven entertainment, contributing to the expansion of LBE.

-

Collaborations between entertainment providers and globally recognized brands help create themed attractions, expanding the appeal of LBE venues.

The location-based entertainment market is primarily driven by extensive developments in virtual reality and augmented reality technologies leading to enhanced immersive entertainment. VR and AR as technologies have been witnessing rapid advancements, and development and location-based entertainment venues, thereby going beyond the traditional amusement parks or cinemas, have become highly interactive and immersive. For example, VR attractions in places like the VOID and Dreamscape have become increasingly popular because they allow users to enter entirely new, virtual worlds while still engaging with real space. Such a development has increased the immersive character of location-based entertainment by several notches. Investing in VR-based entertainment is particularly likely to appeal to Millennials and Gen Z, who tend to value experiences enabled by new, immersive technologies.

According to a recent survey, 65% of consumers are more likely to use entertainment applications or platforms that include VR and AR. The global user base of VR/AR technologies is also growing, and more and more LBEs focusing on immersive entertainment products and services are expected to experience more “foot traffic”. Similarly, theme parks are coming up with high-quality VR rides, such as the VR-based Mario Kart ride at Universal Studios Japan, where riders wear VR glasses and “race” using physical mobility on a track that employs cutting-edge VR technology. Such high-tech experiences that include the perfect combination of physical and digital reality are known to keep driving users back and further engaging with them.

Restraints:

-

The high cost of developing and maintaining state-of-the-art immersive entertainment environments, including equipment, technology, and venues, limits the entry of smaller players into the market.

-

The rise of in-home entertainment options such as streaming services, VR gaming, and smart home setups is creating a competitive environment for LBEs, potentially reducing foot traffic.

One of the critical challenges for the location-based entertainment market is the high costs associated with the initial setup. The market is built around a variety of technologies, ensuring immersive experiences and utilizing either virtual reality or augmented reality approaches. Importing these technologies implies investing in a variety of equipment and its extensive reach to the venue, which has to be designed with respective technological support. Some of the equipment includes VR headsets, motion capture systems, high-end projectors, and custom-designed spaces for interactions. Additionally, ongoing maintenance costs and regular technology upgrades are necessary to keep the experience fresh and competitive. This high initial investment may be limiting for emerging market players. These high costs can be prohibitive, especially for smaller players, limiting market entry and innovation. Large entertainment companies and established venues may have the financial capacity to absorb these costs, but newer entrants face challenges in securing the required capital. The need for substantial investment also makes it difficult to offer frequent upgrades or adaptations, potentially limiting the variety and appeal of the entertainment offerings over time.

Location-Based Entertainment Market Segmentation Overview

By Component Type

The hardware segment contributed to around 64% of the total revenue in the location-based entertainment market in 2023. This is due to the high demand for innovative, high-tech equipment that is required to provide a high level of immersion in LBE venues. The growth of smart city projects that is observed in the U.S., China, and other countries in Europe, the Middle East, and Africa, supports the rapid development of the hardware market. VR headsets, motion tracking devices, and other innovative solutions are becoming an integral part of LBE centers. According to the U.S. Bureau of Economic Analysis, the consumption of hardware and equipment in the entertainment domain has already increased by 5% in 2023. It is expected that the ongoing development and popularization of 5G technologies will further support the growth of the hardware domain. Mobile apps and VR glasses utilizing this technology are often used in LBE centers, which stimulates the demand for new devices. The global rise in demand for interactive and immersive experiences, especially among millennials and Gen Z, has also led to an increased focus on upgrading LBE venues with cutting-edge hardware solution

By Technology

In 2023, the 3-Dimensional technology segment was the largest and accounted for over 41% of the market revenue share. The contribution is expected to remain substantial in the future due to the high demand for 3D immersive experiences in various entertainment venues, such as cinemas, museums, and theme parks. Moreover, government-based incentives and programs aimed at promoting technological innovation, such as the Horizon Europe mission of the European Commission, supported the adoption of 3D technology across various LBE locations. The program focused on research in digital technologies and allocated over €10 billion to support innovation. Furthermore, consumer demand for lifelike and immersive experiences propelled entertainment providers to implement 3D technology, increasingly using it in the gaming and movie industries. According to the U.S. National Endowment for the Arts, in 2023, 3D cinema revenue grew by 8%, which reflects the rising public interest in the technology. It is expected that the trend will remain in the future, notwithstanding the fast-paced technological advancement in the field of holography and projection that contributes to the improvement of the quality of 3D experiences.

By End-Use

In 2023, the amusement parks segment accounted for a significant market share of about 40%. This is primarily because of the high demand for outdoor, family-friendly experiences, which offer attraction for tourists. Amusement parks have acquired a central role in the LBE market, as they can provide a wealth of entertainment opportunities, including not only various themed coasters and rides but also AR and VR experiences that fully immerse the customer. This trend is attributable to the worldwide drive towards increasing tourism. According to the United Nations World Tourism Organization, international tourist arrivals have reached 1.4 billion by the year 2023, and as a result, today, amusement parks are more visited than ever both in developed and developing countries. An additional factor that has contributed to the increasing dominance of this market segment is governments’ interest in encouraging the development of new parks and other entertainment centers as a part of broader economic policy that aims to boost the local economy and increase employment. For example, China’s Ministry of Culture and Tourism announced the construction of several large-scale amusement parks, contributing to the segment’s growth.

Location-Based Entertainment Market Regional Analysis

North America region dominated and accounted for 33% revenue share in the LBE market in 2023. The region’s dominance is attributed to its superior technological infrastructure and the high inclination toward immersive entertainment such as virtual reality and augmented reality. The U.S. Department of Commerce reports that consumer expenditure on recreational and entertainment services in the U.S. increased by 7% in 2023, an indication that the demand for entertainment alternatives is high. The increased coverage of 5G in North America is instrumental in the growth of the LBE market. 5G facilitates high-quality interaction during real-time applications at amusement parks, cinemas, and gaming centers. The growth of North America’s LBE market is attributable to the robust tourism industry. The U.S. Travel Association reports that there was a 9% hike in domestic travel in 2023, translating to increased visits to the LBEs, such as theme parks and interactive museums, in the U.S. Notably, North America is home to some of the leading entertainment conglomerates, including Disney and Universal Studios. The corporations are constantly upgrading and innovating to become more interactive and engaging. The recent progressions have been instrumental in consolidating North America’s dominance in the LBE in the worldwide market.

On the other hand, the Asia Pacific LBE industry is growing at a significant growth rate due to the increased consumer demand and government investment in entertainment infrastructure. The fast growth rate is linked to the increased levels of disposable income and the demand for novel entertainment experiences in countries such as China, Japan, and South Korea. The governments in the region have intensified their spending toward the development of their entertainment infrastructure. China’s 14th Five-Year Plan emphasizes the growth of the cultural and entertainment industries. Notably, the country reported a 6% growth in the cultural and entertainment sectors in 2023, according to the National Bureau of Statistics of China. The Asia Pacific region also has a large middle-class population that is inclined towards the consumption of entertainment services.

Get Customized Report as per Your Business Requirement - Enquiry Now

Recent News and Developments

-

March 2023, Merlin Entertainments posted the announcement of its plans to open a second Peppa Pig Theme Park in North Texas with the expected opening date in 2024. This UK-based company is a global leader in location-based entertainment.

-

In January 2023, Walt Disney and Apple, Inc. joined their efforts to create a VR content platform for Apple’s headsets. The hardware would be developed with a collaborative establishment, Sony Group Corporation.

-

July 2023, the U.S. Department of Commerce announced a USD 500 million expenditure on boosting technological development in the LBE sphere. The investment is released to develop next-generation VR and AR technologies to establish a more immersive experience in entertainment places throughout the state.

Key Players in Location-Based Entertainment Market

Key Service Providers/Manufacturers:

-

The VOID – [Hyper-Reality Experience, Star Wars: Secrets of the Empire]

-

Dreamscape Immersive – [Alien Zoo, The Blu: Deep Rescue]

-

Spaces, Inc. – [Terminator Salvation: Fight for the Future, Virtual Reality Arena]

-

Zero Latency – [Undead Arena, Singularity]

-

Tyffon Inc. – [Tyffonium Shibuya, Corridor of the Mirror]

-

Hologate – [Simurai, Cold Clash]

-

Illuminarium Experiences – [WILD Safari Experience, SPACE: A Journey to the Moon]

-

Nomadic – [Arizona Sunshine, The House of the Dead]

-

Holovis International Ltd. – [Immersive Theaters, DomeVR]

-

VRstudios – [VRcade Arena, PowerPlay]

Key Users of Services/Products:

-

Disney Parks, Experiences and Products

-

Universal Parks & Resorts

-

Merlin Entertainments

-

Cinemark Theatres

-

AMC Theatres

-

Madame Tussauds

-

IMAX Corporation

-

SeaWorld Entertainment

-

Cedar Fair Entertainment Company

-

Parques Reunidos

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 4.0 Billion |

| Market Size by 2032 | USD 31.1 Billion |

| CAGR | CAGR of 25.6% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Component Type (Hardware, Software) • By Technology (2 Dimensional (2D), 3 Dimensional (3D), Cloud Merged Reality) • By End-use (Amusement Parks, Arcade Studios, 4D films) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe [Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | The VOID, Dreamscape Immersive, Spaces, Inc., Zero Latency, Tyffon Inc., Hologate, Illuminarium Experiences, Nomadic, Holovis International Ltd., VRstudios. |

| Key Drivers | • The integration of advanced virtual and augmented reality experiences into location-based entertainment is driving consumer interest and enhancing immersive experiences, fuelling market growth. • Theme parks, interactive experiences, and immersive installations are gaining popularity as people seek more personalized and engaging entertainment options. |

| RESTRAINTS | • The high cost of developing and maintaining state-of-the-art immersive entertainment environments, including equipment, technology, and venues, limits the entry of smaller players into the market. |