Logistics and Supply Chain Market Report Scope & Overview:

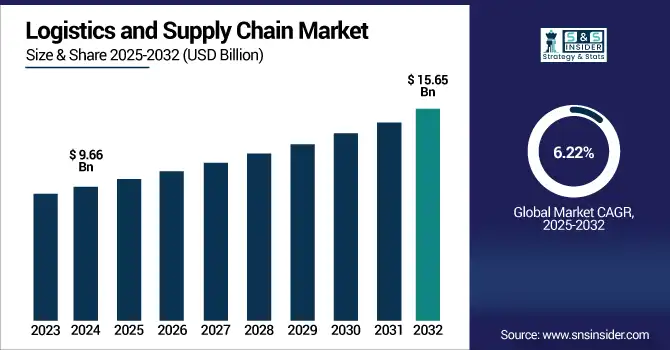

The logistics and supply chain market size was valued at USD 9.66 billion in 2024 and is expected to reach USD 15.65 billion by 2032, expanding at a CAGR of 6.22% over the forecast period of 2025-2032.

To Get more information on Logistics and supply chain market - Request Free Sample Report

The logistics and supply chain industry are critical to the effective transport and management of products in global and local economies. Mirroring the trend in almost every other industry, the parking and mobility sector is increasingly digitizing operations with e-commerce-fueled globalization and real-time visibility demands spurring rapid deployments of the likes of AI, IoT, and automation. In North America, the U.S. continues to dominate with its robust retail sector, as Canada and Mexico gain ground in freight and manufacturing logistics, respectively. Key trends are last-mile delivery, cold chain logistics and cross-border trade." Companies are doing it by leveraging digital technologies and sustainability to optimize efficiency, resiliency, and relationships with customers to better guide their way through what have become more complicated supply chains.

Automated warehouses boost order fulfillment speed by up to 60% and cut labor costs by 30%. Meanwhile, e-commerce returns logistics account for 20%-30% of supply chain costs, driving innovations including smart routing that reduce fuel use by 15% and drone deliveries cutting urban delivery times by 50%.

The U.S. logistics and supply chain market size reached USD 1.19 billion in 2024 and is expected to reach USD 1.82 billion in 2032 at a CAGR of 5.49% over 2025-2032.

The North American market is led by the U.S. as a result of early technology adoption, substantial development in e-commerce volume, and significant presence of retail and manufacturing. Key market drivers are increased consumer need for same-day delivery, technological innovations involving AI and IoT for real-time tracking, and capital investment in automation and warehouse management. In addition, the country benefits due to the existence of global logistics leaders and interstate transport lines providing the country with strong support. The increasing need for cold chain logistics and last-mile delivery services is also supporting the logistics and supply chain market growth among major industry verticals.

Logistics and Supply Chain Market Dynamics:

Drivers:

-

Growing Demand for Real-Time Visibility and Automation in Logistics Operations Boosts Logistics and Supply Chain Market Growth

Amplifying demand for real-time tracking, predictive analytics, and operational transparency are the factors that boost the demand for logistics and supply chain market. Companies concentrate on increasing customer satisfaction by reducing time and errors in delivery. New and leading-edge technologies including IoT, artificial intelligence, and the cloud are increasingly being integrated into supply chain operations to enhance inventory control, cut costs, and improve efficiency. By providing real-time information, companies can quickly react to disruptions and make adjustments to their logistics plans. This need for smart, adaptive supply chains is especially prevalent in industries, such as retail, manufacturing, and healthcare, where accuracy and swiftness are essential.

Restraints:

-

High Implementation and Maintenance Costs of Advanced Logistics Technologies Restrain Logistics and Supply Chain Market Growth

Transformative changes are happening across the logistics industry, so it stands to reason that when it comes to warehouses, these are not immune to what is increasingly being called digital transformation, and where warehouse robotics and automation are increasingly becoming a part of the furniture. In particular, capital investment and maintenance costs are a burden for small and medium-sized companies. Moreover, building new technologies into old systems can become a highly complicated and time-consuming process, which disrupts the context you use. Such financial and technical limitations restrict the widespread use of such an invention, especially for regions and industries that are sensitive to cost, and the industry.

Opportunities:

-

Expansion of E-Commerce and Omnichannel Retailing Creates Lucrative Opportunities in the Logistics and Supply Chain Market

The proliferation of e-commerce and the logistics and supply chain market trend toward omnichannel commerce have put significant upward pressure on the need for truly flexible and responsive logistics solutions. Consumers now expect faster, and often same-day, deliveries, forcing companies to spend heavily on state-of-the-art fulfillment centers, last-mile delivery services, and distributed warehousing. This shift presents a significant growth opportunity for logistics providers that are able to help support real-time order fulfillment across an ever-changing inventory.

In addition, the globalization of online shopping is pushing cross-border logistics activity. The organizations that are best equipped to handle multi-channel supply chains and provide a united customer experience may very well find themselves on the path to domination in this changing retail world.

Challenges:

-

Supply Chain Disruptions Due to Geopolitical Tensions and Natural Disasters Challenge Market Stability and Continuity

Variables, such as protectionism, political instability, and natural disasters have brought great threats to the smooth operation of the supply chain, which places high requirements on logistics companies. All of these can result in port shutdowns, transport disruptions, raw material shortages, and higher costs, rendering supply chains more fragile. Businesses frequently have to redesign logistics and rely on alternative suppliers, which introduce complexity and risk. Risk mitigation tactics like diversity and nearshoring have certainly offset the tumult, but this unexpected nature of these disruptions has not let up on the pressure for the logistics industry.

Logistics and Supply Chain Market Segmentation Analysis:

By Transportation Mode

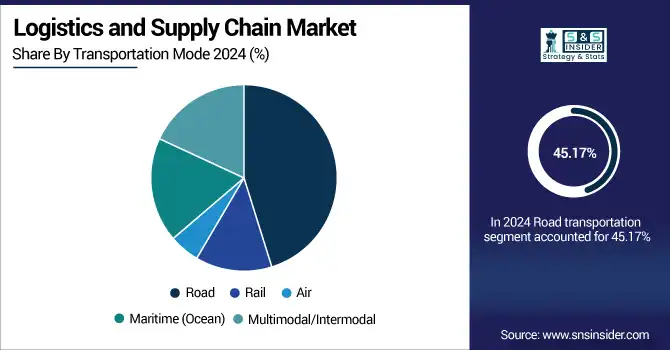

The road transportation segment leads the logistics and supply chain market, holding a dominant 45.17% revenue share in 2023 due to its extensive network and flexibility for last-mile delivery. The major logistics and supply chain market companies, including FedEx and the long-haul delivery company UPS, unveil electric and autonomous trucks, and nations have focused on sustainability and efficiency. For instance, UPS has recently started rolling out electric delivery vans to help cut down on carbon emissions. Where domestic supply is concerned, road transport is still key, particularly for time-critical and e-commerce loads. This segment's leadership position is reinforced by ongoing investments in smart traffic management and fleet tracking via the Internet of Things (IoT) for operational efficiency and improved customer experience.

The maritime segment is experiencing the fastest growth at a CAGR of 7.63%, with the rise of global trade and the cost-effectiveness of maritime transportation. Maersk and COSCO are among the leading companies to have introduced digital platforms that improve the tracking of ships and the management of cargo, thereby making the industry more transparent and more efficient, in the process reducing delays. AI and predictive analytics have just been adopted by Maersk to optimize routes and save fuel. Expansion of maritime logistics is compatible with growing global logistics and the increasing size of cargo batches.

By Service Type

The transportation service segment commands the largest revenue share of 46.52% in 2023, due to its core function of transporting goods efficiently over distance. Companies including DHL and XPO Logistics have been leading the charge, adding electric vehicles and AI-based route optimization tools to their service offerings. DHL’s announcement of its “Green Fleet” initiative is a good example of the industry’s focus on sustainability. Transportation services are critical in linking suppliers, producers, and consumers together, and thus is the center of the logistics and supply chain industry. Innovation continues, resulting in faster implementations and lowering of operational costs, adding to the competitiveness of this segment.

The freight forwarding segment is the fastest-growing service type, with a CAGR of 7.67%, driven by globalization and the growing complexity of cross-border trade. Companies including Kuehne + Nagel and Expeditors International have introduced digital platforms that integrate customs clearance, documentation, and cargo tracking. The new blockchain-enabled freight forwarding solution from Kuehne + Nagel improves visibility and reliability. The expansion of freight forwarding is evidence of this increasingly favorable climate, and also the need for courier services that can successfully navigate cross-border regulatory environments and multi-modal logistics.

By Industry (End-Use)

The retail and e-commerce segment leads the logistics and supply chain market share of 27.18%, propelled by explosive gains in online shopping. Companies, such as Amazon and Walmart have introduced state-of-the-art fulfilment centers with the help of robotics and artificial intelligence to fast-track order processing. Amazon’s recent launch of automated warehouses that include robotic picking is just one manifestation of this trend. The sector is being revolutionized by consumer demand for fast and slick delivery, and that needs the quickest and super slick of logistics chains.

The healthcare and pharmaceuticals segment is growing at the fastest CAGR of 6.79%, fueled by growing demand for cold chain logistics and safe supply chains. Entities, such as UPS Healthcare and DHL Life Sciences have also introduced dedicated cold-chain solutions and vaccine distribution networks. The news, namely DHL, which just unveiled its new real-time temperature monitoring for pharmaceutical shipments, yet again confirms the significance of product integrity. Growth in the segment is driven by increasing healthcare requirements, strict regulatory requirements, and globalization of pharmaceutical distribution. Sophisticated logistics services also provide for secure and accurate delivery, especially for life-saving drugs and medical instruments, thereby driving the logistics market.

Logistics and Supply Chain Market Regional Outlook:

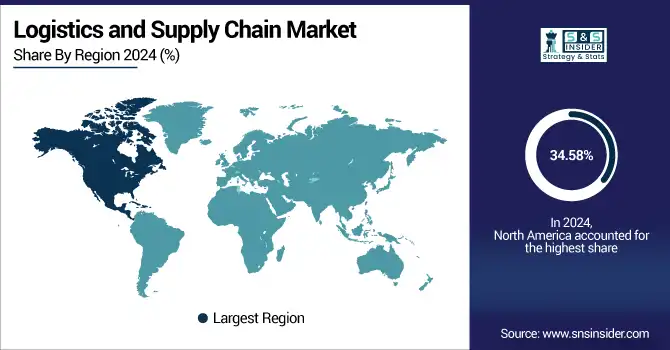

North America is a dominant region with the largest share of 34.58%, as a result of mature infrastructure and technology, and the established manufacturing sectors. Abundant road, rail, and air networks (serving both domestic and cross-border transportation) support e-commerce and retail in the region.

North America’s logistics industry is led by the U.S., which is also the destination with the largest retail market and is the global leader in technology applications for supply chain management.

Europe’s logistics sector thrives on well-established multimodal transportation routes and strict regulation. Adoption of green logistics and automation in various industry verticals, such as the manufacturing and retail sectors, has led to the growth of this market.

Germany is the dominant country in Europe due to its central location, strong manufacturing base, leadership in automotive and manufacturing exports, which combined create significant logistics and supply chain activity.

The Asia Pacific is the fastest-growing region, at a CAGR of 6.90%, due to fast industrialization, urbanization, and flourishing e-commerce. The area is also making substantial investments into expanding its ports, creating smart logistics hubs, and developing digital solutions to help manage the growing volumes of trade and complex supply chains.

China led the Asia Pacific region due to its large manufacturing market, a large number of ports, and government-led campaigns aimed at supply chain modernization and Belt and Road connectivity.

The Middle East & Africa, and Latin America logistics markets are becoming advanced with developing infrastructure, growing trade routes and increasing demand of e-commerce. The UAE heads the latter, courtesy of its strategic ports, and Brazil leads Latin America, as it has a big economy and is a key regional trading partner.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players:

The major key players of the logistics and supply chain market are DHL Supply Chain & Global Forwarding, Kuehne + Nagel International AG, DB Schenker, C.H. Robinson Worldwide, Inc., DSV A/S, FedEx Corporation, United Parcel Service (UPS), XPO Logistics, Inc., Nippon Express Holdings, Maersk Logistics & Service, and others.

Key Developments:

-

In March 2025, DHL purchased U.S.-based pharmaceutical logistics firm Cryopdp, bolstering its healthcare and life sciences logistics strength in international markets to support its specialized supply chain services.

-

In April 2025, FedEx partnered with Amazon to handle parts of its package delivery system, including large-item shipments, after UPS cut back on its logistics arrangements with Amazon.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 9.66 Billion |

| Market Size by 2032 | USD 15.65 Billion |

| CAGR | CAGR of 6.22% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Transportation Mode (Road, Rail, Air, Maritime (Ocean), Multimodal/Intermodal) • By Service Type (Transportation, Warehousing, Inventory Management, Customs Brokerage, Freight Forwarding, Packaging and Handling, Value-Added Services) • By Industry (End-Use) (Retail & E-commerce, Manufacturing, Automotive, Food & Beverage, Healthcare & Pharmaceuticals, Technology & Electronics, Energy & Utilities, Construction, Defense & Aerospace) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | DHL Supply Chain & Global Forwarding, Kuehne + Nagel International AG, DB Schenker, C.H. Robinson Worldwide, Inc., DSV A/S, FedEx Corporation, United Parcel Service (UPS), XPO Logistics, Inc., Nippon Express Holdings, Maersk Logistics & Service |