Low Dropout Voltage Regulators (LDO) Market Report Scope & Overview:

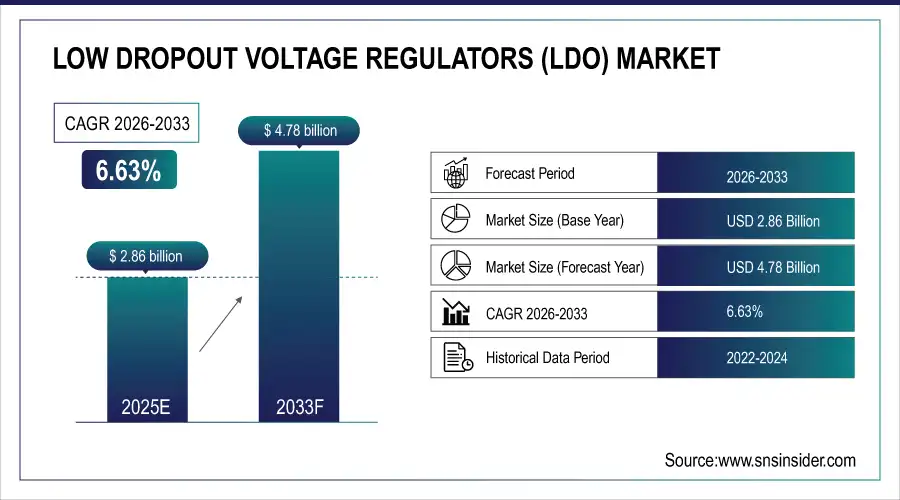

The Low Dropout Voltage Regulators (LDO) Market size was valued at USD 2.86 Billion in 2025E and is projected to reach USD 4.78 Billion by 2033, growing at a CAGR of 6.63% during 2026–2033.

The Low Dropout Voltage Regulators (LDO) Market is experiencing robust growth due to increasing demand for efficient power management across automotive, industrial, and consumer electronics sectors. Advancements in ultra-low quiescent current, high input voltage handling, and compact packaging are enhancing energy efficiency and reliability. LDOs are increasingly integrated into electric vehicles, ADAS, IoT devices, and battery-powered systems, driving widespread adoption. Continuous innovation from leading semiconductor manufacturers is enabling higher performance, reduced power losses, and improved system stability, positioning LDO regulators as vital components in next-generation electronic and power management architectures.

In April 2024, STMicroelectronics launched the LDH40 and LDQ40 LDO regulators for automotive and industrial applications, featuring up to 40V input, ultra-low quiescent current, and AEC-Q100 qualification, ensuring efficient, reliable power management for infotainment, ADAS, and electric vehicle systems.

Low Dropout Voltage Regulators (LDO) Market Size and Forecast:

-

Market Size in 2025: USD 2.86 Billion

-

Market Size by 2033: USD 4.78 Billion

-

CAGR: 6.63% (from 2026 to 2033)

-

Base Year: 2025E

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information On Low Dropout Voltage Regulators (LDO) Market - Request Free Sample Report

Low Dropout Voltage Regulators (LDO) Market Highlights:

-

Rising demand for low-noise power solutions in high-fidelity audio systems is driving LDO market growth, with advanced regulators like the MUSES100 ensuring stable, noise-free performance in consumer and professional audio equipment.

-

Increasing adoption of compact, energy-efficient, and high-performance devices is encouraging manufacturers to integrate low-noise LDOs, enhancing user experience across home and portable audio segments.

-

High design complexity, efficiency limitations, and thermal management challenges are restraining LDO market growth, as higher power dissipation and limited current handling reduce suitability for high-power applications.

-

Integrating protection features such as thermal shutdown and overcurrent control increases production cost and design time, limiting broader adoption of LDOs in advanced electronics.

-

Rising opportunities exist in compact and energy-efficient LDO solutions for miniaturized, battery-powered, and IoT-enabled devices, supporting longer battery life, improved efficiency, and enhanced thermal reliability.

-

New product introductions like Toshiba’s TCR3DMxxA and TCR3EMxxA series demonstrate innovation in ultra-low dropout, low-noise, and high-efficiency LDOs for industrial and battery-powered systems, boosting reliable power management.

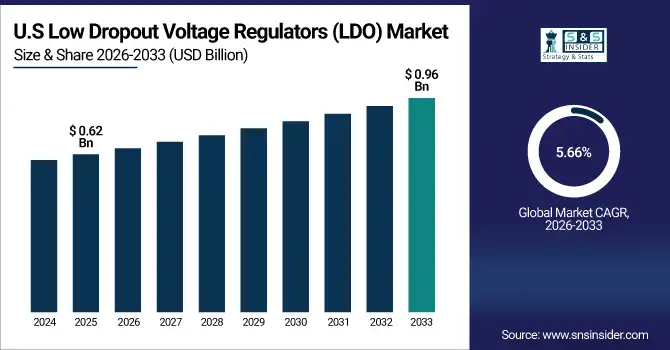

The U.S. Low Dropout Voltage Regulators (LDO) Market size was valued at USD 0.62 Billion in 2025E and is projected to reach USD 0.96 Billion by 2033, growing at a CAGR of 5.66% during 2026–2033. driven by the increasing demand for efficient power management solutions across automotive, industrial, and consumer electronics sectors. The growing adoption of electric vehicles, advanced driver-assistance systems (ADAS), and IoT-enabled devices fuels the need for compact, energy-efficient LDOs. Additionally, advancements in low quiescent current and high PSRR designs enhance reliability and performance, supporting widespread integration in battery-powered and high-precision applications.

Low Dropout Voltage Regulators (LDO) Market Drivers:

-

Rising Demand for Low-Noise Power Solutions in High-Fidelity Audio Systems Driving LDO Market Growth

The increasing adoption of high-fidelity audio equipment across consumer and professional applications is a major driver for the Low Dropout Voltage Regulators (LDO) market. Advanced LDOs, such as the MUSES100 by Nisshinbo Micro Devices, offer superior noise suppression, high ripple rejection, and stable voltage output essential for premium sound quality. As the audio industry shifts toward more compact, energy-efficient, and high-performance devices, manufacturers are integrating low-noise LDO regulators to ensure clean power delivery, enhancing the overall user experience and fueling steady market expansion across home and portable audio segments.

September 2024 — Nisshinbo Micro Devices introduced the MUSES100 CMOS low-noise, low-dropout (LDO) voltage regulator designed for high-quality audio systems, offering a ripple rejection ratio of up to 90 dB and low output noise of 3.0 μVrms to ensure stable, noise-free audio performance across professional and consumer audio equipment.

Low Dropout Voltage Regulators (LDO) Market Restraints:

-

High Design Complexity and Thermal Limitations Restraining LDO Market Growth

The growth of the Low Dropout Voltage Regulators (LDO) market is constrained by increasing design complexity, efficiency limitations, and thermal management challenges. LDOs, while ideal for noise-sensitive applications, often suffer from higher power dissipation and limited current handling compared to switching regulators. These inefficiencies make them less suitable for high-power or battery-operated systems demanding longer runtime. Additionally, integrating protection features such as thermal shutdown and overcurrent control increases production cost and design time. As a result, balancing performance, size, and power efficiency remains a key restraint hindering broader adoption of LDOs in advanced electronic applications.

Low Dropout Voltage Regulators (LDO) Market Opportunities:

-

Rising Opportunities in Compact and Energy-Efficient LDO Solutions for Next-Generation Electronics

The market for compact and energy-efficient low dropout (LDO) regulators is expanding rapidly, driven by rising adoption in miniaturized, battery-powered, and IoT-enabled devices. Growing demand for longer battery life, improved power efficiency, and enhanced thermal reliability is fostering innovation in ultra-small, low-noise, and high-performance LDO solutions across consumer, industrial, and automotive applications, positioning them as critical components in next-generation electronics.

On September 2024, Toshiba Electronics Europe introduced its TCR3DMxxA and TCR3EMxxA series of 300mA LDO voltage regulators, featuring ultra-low dropout voltage, low noise, and high efficiency for compact industrial and battery-powered systems, enhancing battery life with minimal quiescent current and advanced protection features for reliable power management.

Low Dropout Voltage Regulators (LDO) Market Segment Highlights:

-

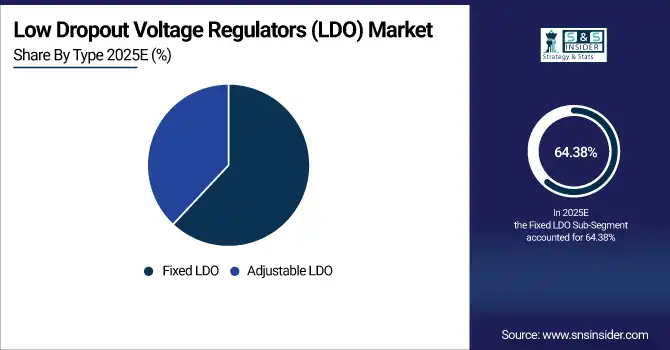

By Type: Dominant – Fixed LDO (64.38% in 2025 → 60.63% in 2033); Fastest-Growing – Adjustable LDO (CAGR 7.96%).

-

By Output Current: Dominant – Low Current LDO (39.38% in 2025 → 35.63% in 2033); Fastest-Growing – High Current LDO (CAGR 9.09%).

-

By Application: Dominant – Consumer Electronics (29.63% in 2025 → 27.38% in 2033); Fastest-Growing – Automotive (CAGR 8.86%).

-

By Technology: Dominant – CMOS LDO (55.38% in 2025 → 57.63% in 2033); Fastest-Growing – Other Technologies (CAGR 8.45%).

Low Dropout Voltage Regulators (LDO) Market Segment Analysis:

By Type, Fixed LDO is Dominating and Adjustable LDO is Fastest-Growing.

Fixed LDOs hold market dominance owing to their simplicity, low cost, and stable voltage output, making them ideal for consumer electronics, industrial systems, and battery-powered devices. In contrast, Adjustable LDOs are emerging as the fastest-growing segment, driven by their voltage flexibility, improved efficiency, and expanding adoption in automotive, IoT, and communication applications requiring precise power regulation.

By Output Current, Low Current LDO is Dominating and High Current LDO is Fastest-Growing.

Low Current LDOs dominate the market due to their widespread use in portable and battery-powered devices that require efficient power conversion with minimal heat generation. In contrast, High Current LDOs are the fastest-growing segment, driven by their expanding role in high-performance systems, automotive electronics, and industrial applications demanding stable voltage under heavy loads.

By Application, Consumer Electronics is Dominating and Automotive is Fastest-Growing.

Consumer electronics lead the market owing to the extensive use of LDOs in smartphones, wearables, and IoT devices requiring low noise and compact designs. Meanwhile, the automotive segment is witnessing rapid growth, fueled by the electrification of vehicles and increased demand for efficient voltage regulation in advanced driver-assistance systems (ADAS) and infotainment units.

By Technology, CMOS LDO is Dominating and Other Technologies are Fastest-Growing.

CMOS LDOs dominate due to their low power consumption, high integration capability, and suitability for portable devices. However, other emerging technologies are growing fastest, supported by innovations that combine superior performance, enhanced thermal stability, and compatibility with next-generation high-frequency and low-voltage applications.

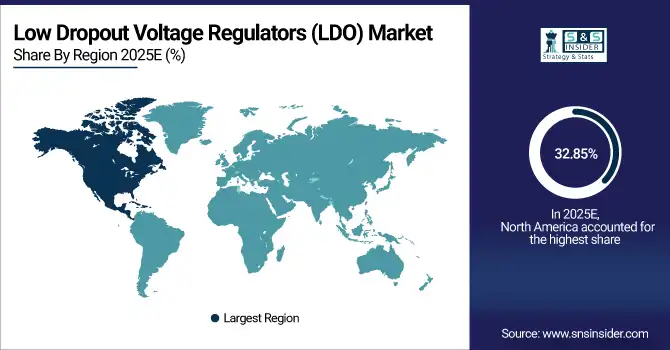

Low Dropout Voltage Regulators (LDO) Market Regional Highlights:

-

North America (Dominant – 32.85% in 2025 → 30.97% in 2033, CAGR 5.85%)

-

Asia-Pacific (Fastest Growing – 31.82% in 2025 → 34.54% in 2033, CAGR 7.72%)

-

Europe (22.54% → 22.73%, CAGR 6.74%)

-

Latin America (7.39% → 6.95%, CAGR 5.81%)

-

Middle East & Africa (5.40% → 4.81%, CAGR 5.09%)

Low Dropout Voltage Regulators (LDO) Market Regional Analysis:

North America Low Dropout Voltage Regulators (LDO) Market Insights:

North America leads the Low Dropout Voltage Regulators (LDO) Market, driven by strong demand across automotive, industrial, and consumer electronics sectors. The region benefits from advanced semiconductor manufacturing, rapid adoption of IoT devices, and increasing investment in power-efficient technologies, fostering innovation and steady growth in high-performance LDO applications.

Get Customized Report as per Your Business Requirement - Enquiry Now

U.S. Low Dropout Voltage Regulators (LDO) Market Insights:

The U.S. leads the Low Dropout Voltage Regulators (LDO) Market, driven by growing adoption in automotive, industrial, and consumer electronics applications, emphasizing energy efficiency, miniaturization, and advanced power management technologies.

Asia-Pacific Low Dropout Voltage Regulators (LDO) Market Insights:

Asia-Pacific is the fastest-growing region in the Low Dropout Voltage Regulators (LDO) market, fueled by rapid expansion of consumer electronics, IoT devices, and automotive industries. Increasing investments in semiconductor manufacturing, coupled with rising demand for compact, energy-efficient components across China, Japan, South Korea, and India, are accelerating regional market growth.

China Low Dropout Voltage Regulators (LDO) Market Insights:

China is the dominant country in the Low Dropout Voltage Regulators (LDO) market, driven by its strong semiconductor manufacturing base, large electronics production capacity, and growing adoption of power-efficient technologies across industries.

Europe Low Dropout Voltage Regulators (LDO) Market Insights:

The Europe Low Dropout Voltage Regulators (LDO) market is witnessing emerging trends driven by increasing demand for energy-efficient and compact power management solutions across automotive, industrial, and consumer electronics sectors. Growing emphasis on sustainability, electrification, and advanced semiconductor design is fostering innovation and supporting steady market expansion across the region.

Germany Low Dropout Voltage Regulators (LDO) Market Insights:

Germany is the dominant country in the Europe Low Dropout Voltage Regulators (LDO) market, driven by its strong electrical manufacturing base, advanced automotive industry, and growing adoption of energy-efficient semiconductor technologies.

Latin America Low Dropout Voltage Regulators (LDO) Market Insights:

The Latin America Low Dropout Voltage Regulators (LDO) market is steadily expanding, fueled by increasing adoption of power-efficient components in consumer electronics, automotive systems, and industrial automation. Growing investments in semiconductor manufacturing, renewable energy integration, and smart infrastructure development are further supporting market growth across countries like Brazil, Mexico, and Argentina.

Brazil Low Dropout Voltage Regulators (LDO) Market Insights:

Brazil is the dominant country in the Latin America Low Dropout Voltage Regulators (LDO) market, accounting for the largest share due to its expanding electronics manufacturing base and growing demand for energy-efficient power solutions.

Middle East & Africa Low Dropout Voltage Regulators (LDO) Market Insights:

The Middle East and Africa Low Dropout Voltage Regulators (LDO) market is witnessing moderate growth, driven by increasing adoption of power-efficient components in industrial automation, telecommunications, and consumer electronics. Ongoing infrastructure development and rising investment in smart technologies further support the region’s demand for reliable, low-noise power management solutions.

Saudi Arabia Low Dropout Voltage Regulators (LDO) Market Insights:

Saudi Arabia is the dominant country in the Middle East and Africa Low Dropout Voltage Regulators (LDO) market, supported by its growing electronics manufacturing, renewable energy projects, and increasing adoption of power-efficient semiconductor solutions.

Low Dropout Voltage Regulators (LDO) Market Competitive Landscape:

Texas Instruments Incorporated (TI) is a global leader Founded in 1930 and headquartered in Dallas, Texas in analog and embedded processing semiconductors. With around 34,000 employees, TI designs high-performance solutions like the TPS7N53 LDO Regulator (launched in December 2024), advancing efficient power management across automotive and industrial applications.

-

In December 2024, Texas Instruments introduced the TPS7N53 LDO Regulator, a 3 A device featuring low input voltage, ultra-low noise, high PSRR, and compact 3×3 mm packaging, aimed at enhancing power efficiency in automotive and industrial applications.

onsemi Founded in 1999 and headquartered in Scottsdale, Arizona is a global semiconductor leader specializing in power management, analog, and sensor solutions. In March 2024, the company established the Analog and Mixed-Signal Group (AMG) to expand its LDO regulator and power management portfolio, targeting automotive, industrial, and cloud markets.

-

In March 2024, onsemi formed its Analog and Mixed-Signal Group (AMG) led by Sudhir Gopalswamy to expand its power management and sensor interface portfolio, unlocking a USD 19.3 billion market opportunity and strengthening its presence in automotive, industrial, and cloud power solutions.

Low Dropout Voltage Regulators (LDO) Market Key Players:

-

Texas Instruments Inc. (TI)

-

STMicroelectronics N.V.

-

Analog Devices, Inc.

-

Linear Technology (now part of Analog Devices)

-

ON Semiconductor Corporation

-

Intersil Corporation (Renesas Electronics Corporation)

-

Maxim Integrated (Analog Devices)

-

Microchip Technology Inc.

-

Toshiba Corporation

-

NXP Semiconductors N.V.

-

Skyworks Solutions, Inc.

-

Richtek Technology Corporation

-

Fairchild Semiconductor (ON Semiconductor)

-

Semtech Corporation

-

Daily Silver Imp Microelectronics Co., Ltd.

-

Avnet Israel Ltd.

-

ROHM Semiconductor

-

Infineon Technologies AG

-

Diodes Incorporated

-

Renesas Electronics Corporation

-

Power Integrations, Inc.

| Report Attributes | Details |

|---|---|

| Market Size in 2025 | USD 2.86 Billion |

| Market Size by 2033 | USD 4.78 Billion |

| CAGR | CAGR of 6.63% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type(Fixed LDO and Adjustable LDO) • By Output Current(Low Current LDO, Medium Current LDO and High Current LDO) • By Application(Consumer Electronics, Automotive, Telecommunications, Industrial and Healthcare) • By Technology(CMOS LDO, Bipolar LDO, BiCMOS LDO And Other Technologies) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Texas Instruments Inc. (TI), STMicroelectronics N.V., Analog Devices, Inc., Linear Technology (now part of Analog Devices), ON Semiconductor Corporation, Intersil Corporation (Renesas Electronics), Maxim Integrated (Analog Devices), Microchip Technology Inc., Toshiba Corporation, NXP Semiconductors N.V., Skyworks Solutions, Inc., Richtek Technology Corporation, Fairchild Semiconductor (ON Semiconductor), Semtech Corporation, Daily Silver Imp Microelectronics Co., Ltd., Avnet Israel Ltd., ROHM Semiconductor, Infineon Technologies AG, Diodes Incorporated, Renesas Electronics Corporation, and Power Integrations, Inc. |