Loyalty Management Market Size Analysis:

The Loyalty Management Market was valued at USD 10.8 billion in 2023 and is expected to reach to USD 34.6 billion by 2032 and grow at a CAGR of 13.8% from 2024-2032.

Get More Information on loyalty Management Market - Request Sample Report

The loyalty management market is seeing significant growth owing to digital transformation in industries such as retail, in which companies are adopting more advanced loyalty solutions to increase customer engagement. Loyalty management platforms supply businesses with essential tools for creating and managing loyalty programs, utilizing mobile apps, social media platforms, and digital wallets. Recent data suggests that 88% of consumers are more likely to engage with brands that provide personalized rewards. Rewards are provided in the form of personalized offers, digital loyalty cards, and the integration of mobile wallets, all assisting companies in retaining customers and enhancing brand loyalty.

Significant industry leaders are using AI (artificial intelligence), machine learning, and data analytics to analyze consumer behaviour and improve customer experience. In August 2023, Valuedynamx Ltd. introduced the Pay with Points solution, enabling banks and airlines to provide consumers with more dynamic reward options. It accomplishes this by curating miles-based loyalty programs tailored to its bank and airline merchant partner network. Additionally, market growth is also influenced by the shift towards automated solutions. Reportedly, 58% of businesses prefer automated loyalty management systems over manual systems for reduced manual errors and increased efficiency. The shift towards mobile deployment and digital wallets also preserves the decrease in manual loyalty systems, replacing traditional punch cards by providing businesses with more visibility by 34% over customer behaviours and streamlining consumer journeys. Moreover, government regulations such as the GDPR and CCPA have also been partially responsible for greater growth, as firms must carefully guarantee data privacy in loyalty programs and enhance consumers’ trust.

Drivers

-

Companies are increasingly prioritizing customer retention through loyalty programs, as retaining customers is more cost-effective than acquiring new ones.

-

The use of AI and machine learning in loyalty programs enables businesses to personalize rewards, leading to enhanced customer engagement and improved program effectiveness.

-

Growing digitalization, especially mobile apps, and online platforms, allows for seamless and efficient loyalty management, boosting user participation and customer satisfaction.

-

Businesses are adopting omnichannel approaches to integrate loyalty programs across physical stores, online platforms, and mobile applications, driving customer interaction across multiple touchpoints.

One of the major driving factors of the loyalty management market is the growing focus on customer retention. It is becoming more and more apparent that keeping an existing client is more cost-effective than acquiring a new one. The emergence and growing popularity of loyalty programs are largely due to businesses realizing and capitalizing on this approach. According to recent data, the cost of attracting a new customer can be up to five times higher than retaining an existing one. Furthermore, even a modest 5% increase in customer retention rate can lead to a profit growth of 25% to 95%. Thus, the development of loyalization strategies is becoming a more holistic trend engaging a variety of sectors in rental growth.

loyalty programs also increase customer lifetime value. A 2023 report by Bond Brand Loyalty suggested that 79% of consumers are more likely to return and continue purchasing goods in the company’s operating their respective loyalty programs. In addition, 65% of customers claim to change their plan and purchase either more often or in larger quantities, striving to maximize their advantages from the program. Furthermore, businesses increasingly focus on providing personalized rewards or rewards that each customer can select for themselves.

Restraints

-

Developing and maintaining a comprehensive loyalty management system can be expensive, particularly for small and medium enterprises.

-

Managing a variety of rewards, customer segments, and multi-channel integrations can lead to operational complexities and inefficiencies.

-

With loyalty programs involving the collection of sensitive customer data, rising concerns over data breaches and privacy regulations (such as GDPR) may hinder market growth.

Data privacy and security concerns present one of the crucial restraints to the growth of the loyalty management market. The majority of loyalty programs are inclined toward collecting extensive customer data, including personal information, purchase history, and preferred brands. Having access to this information allows businesses to develop a high level of customer personalization, create engaging rewards, and extend targeted advertising efforts. However, this data is also extremely sensitive data and is regulated by strict privacy laws in Europe and the U.S. In accordance with this, companies need to ensure that they securely store, process, and handle customer data and that they compensate for data breaches and cyberattacks. Failure to comply with these laws may result in substantial penalties, lawsuits, and damage to the company's reputation and customer trust. As such, although the overall trust in data and the minimum level of loyalty system adoption are well-ensconced across industries, the high limitation in the implementation and expansion of loyalty management systems is posed by concerns related to data privacy and security.

Segment Analysis

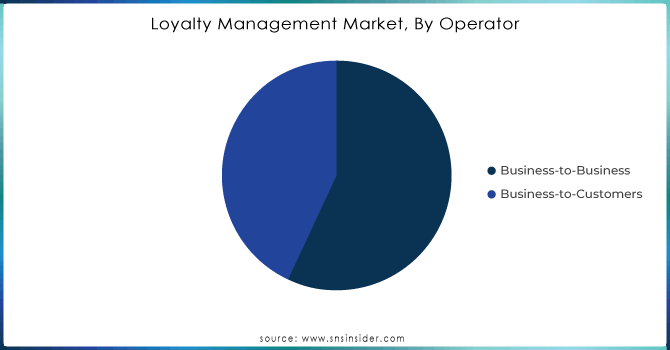

By Operator

B2B held over 56% share of the market. These loyalty programs are focused on devising strategies that would provide solutions to specific needs required in the B2B relationships, hence assisting companies in building long-term, mutually beneficial relationships with other companies. The services often include loyalty program design and implementation that would consolidate relationships, build trust, and foster collaboration over time.

In the B2C segment, loyalty management solutions are an important part in building up strong relations with each and every end customer. These solutions focus on the consumer behaviours, preferences, and buying habits to design personalized loyalty initiatives. In other words, through analysis of customer data, businesses come up with targeted rewards and offers that align with consumer interests and thereby help in building their loyalty over a period of time. Such initiatives also help in motivating repeat purchases and hence brand loyalty, with the ultimate objective of customer retention. Through such kinds of initiatives, businesses can make value endorsements to consumers who are likely to be more connected with continuing their choices of products or services.

Need any customization research on Loyalty Management Market - Enquiry Now

By Organization Size

The large enterprises segment accounted for over 63% share of the market in 2023, owing to their drive to up customer retention rates via incentives and rewards. In addition, these companies are investing heavily in loyalty solutions and taking up advanced customized loyalty solutions to remain competitive. In terms of implementing these solutions, simple framework coordination, adaptability to new technologies, as well as data protection are at the foremost of their priorities. Their financial strength enables them to adopt advanced loyalty management solutions, contributing to the segment's continued expansion.

Small and Medium Enterprises segment is anticipated to grow at a significant CAGR of 14.2% from 2024 to 2032. SMEs play a vital role in national employment and economic growth, making loyalty solutions important for their success. The cloud-based deployments that enable reductions in costs and an integration of these solutions with CRM systems are particularly popular with SMEs. An example of this is the fact that in April 2022, Virgin Australia launched the Business Flyer Loyalty Program in order to retain its existing customers who are incurring expenses as SMEs and to attract new SME clients. These earn Velocity Points for every dollar’s worth of flight expenses on specific flights and these points can be used for free hotel stays, car rentals, or attraction expenses.

By Vertical

In 2023, the retail and consumer goods segment accounted for the largest market share, with over 20%. This is because of the increase in the number of internet users and the use of mobile apps to purchase products and make decisions. Companies in the retail and consumer goods sector are leveraging loyalty programs that run on websites and e-commerce sites to keep existing customers and attract new ones. Many brands launching loyalty initiatives to stay competitive and attract more customers. For example, in September 2023, children’s clothing company Hanna Andersson unveiled “Hanna Rewards.” Customers earn one point for every dollar they spend. After collecting 125 points, they are awarded a $10 reward. In addition, customers are updated on new products, sales, and special offers.

In the forecast period, the hospitality sector growing with fastest CAGR 14.3%. This is mainly because the restaurant, hotel, and resort owners are introducing loyalty management solutions to increase the loyalty of customers and offer better services. Hospitality loyalty programs are personalized and customers are rewarded using points or through partnerships. However, the guests also benefit from guest service-based incentives such as free Wi-fi, discount on stay on the best available suites in future stays, instant redemption on food and beverage, and no blackout dates in the hospitality sector.

Regional analysis

In 2023, over 35% of the loyalty management market was held by North America, because of the wide adoption of loyalty solutions and tough competition in several industries. Such a highly populated and economically developed region as North America hosts major providers such as Aimia, Inc., Bond Brand Loyalty, Inc., ICF International Inc., Kobie Marketing, and TIBCO Software. These can also be defined as principal rivals because of their emphasis on investing significant sums in the development of products and customer bases. For example, the U.S. market is greatly supported by consumers who generally utilize debit and credit cards to access different monetary benefits and the use of diverse programs that allow to retrieving a range of corresponding products, for example, discounts, rebates, and cashback.

In the Asia Pacific region, the loyalty management market is anticipated to expand at a CAGR of 14.4% from 2024 to 2032. This growth is facilitated by fast-growing internet alternatives and the widening retail and consumer goods and e-commerce sectors across China, Japan, and India. Industries such as travel, hospitality, retail, and consumer goods are increasingly in need of an array of improved and user-friendly loyalty solutions that are affordable. Ways this market is also concerning China, because its loyalty management market demonstrates a significant CAGR from 2024 to 2032.

Key Players:

The major players in the market are Brierley+Partners, Capillary Technologies, Gift Management, Apex Loyalty, Epsilon, Oracle, Preferred Patron, SailPlay, Bond Brand Loyalty, Merkle, Capillary, Punchh, Comarch, ICF Next, Maritz Motivation, Kobie, Cheetah Digital, ProKarma, Annex Cloud, Sumup, Kangaroo, LoyaltyLion, Smile.io, Ebbo, Jakala, Yotpo, Zinrelo, Loopy Loyalty, Paystone, SessionM, and others in final report.

Recent development

-

In April 2024, Visa a digital payment company introduced the Visa Web3 Loyalty Engagement Solution which empowers the brands to deliver immersive digital experiences and gamified rewards to their consumers.

-

In January 2023, IBM Corporation has launched IBM Partner Plus which is a program reimagining how IBM interacts with the IBM business partners. It provides unprecedented access to the IBM resources and the incentives of the partnership are empowered which helps the earning potential available for new and existing partners i.e. technology providers, resellers, business partners, independent software vendors in the IBM Partner plus.

-

In 2023, a collaboration was announced between the Salesforce, Inc. and Polygon a blockchain platform which supports non-fungible token -based (NFT-based) loyalty using Salesforce. By using these systems, the client can move their business to Polygon using the Salesforce platform to create and manage token-based loyalty.

-

In 2023, Cerillion a provider of BSS/OSS as a service announced the launch of Cerillion 23.1. This new version includes the loyalty management within the core BSS/OSS to build customer engagement.

| Report Attributes | Details |

| Market Size in 2023 | USD 10.8 Bn |

| Market Size by 2032 | USD 34.6 Bn |

| CAGR | CAGR of 13.8% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Offering (Solution, {Channel Loyalty, Customer Loyalty, Customer Retention}, Services {Professional, Managed}) • By Operator (Business-to-Business, Business-to-Customers) • By Deployment (On-premise, Cloud) • By Organization Size (Small & Medium Enterprise (SME), Large Enterprise) • By Vertical (Transportation, IT & Telecommunication, BFSI, Media & Entertainment, Retail & Consumer Goods, Hospitality, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Brierley+Partners, Capillary Technologies, Gift Management, Apex Loyalty, Epsilon, Oracle, Preferred Patron, SailPlay, Bond Brand Loyalty, Merkle, Capillary, Punchh, Comarch, ICF Next, Maritz Motivation, Kobie, Cheetah Digital, ProKarma, Annex Cloud, Sumup, Kangaroo, LoyaltyLion, Smile.io, Ebbo, Jakala, Yotpo, Zinrelo, Loopy Loyalty, Paystone, SessionM |

| Key Drivers | • The use of AI and machine learning in loyalty programs enables businesses to personalize rewards, leading to enhanced customer engagement and improved program effectiveness. |

| Market Opportunities | • Developing and maintaining a comprehensive loyalty management system can be expensive, particularly for small and medium enterprises. |