Magnesium Alloys Market Report Scope & Overview:

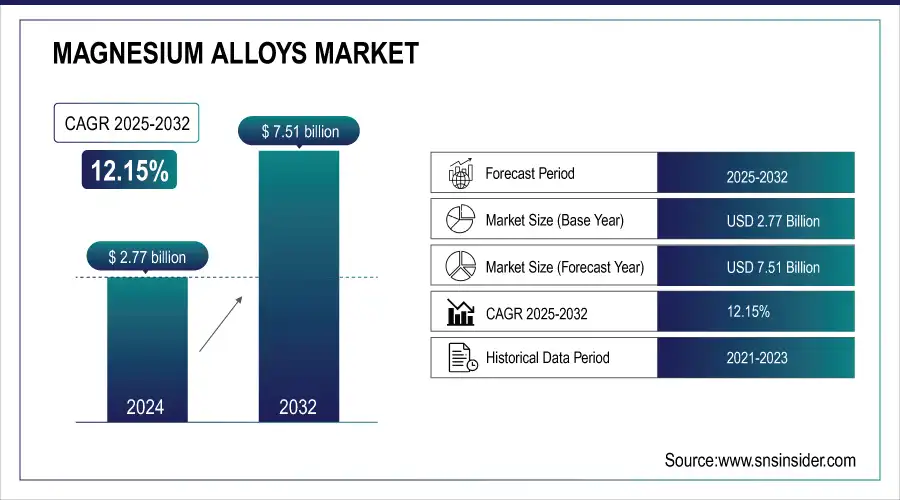

The Magnesium Alloys Market Size was estimated at USD 2.77 billion in 2024 and is expected to arrive at USD 7.51 billion by 2032 with a growing CAGR of 12.15% over the forecast period 2025-2032.

To Get more information on Magnesium Alloys Market - Request Free Sample Report

The Magnesium Alloys Market report uniquely highlights regional disparities in production output, consumption patterns, and capacity utilization rates, offering a comparative analysis of supply-demand dynamics. It delves into technological advancements in alloy processing across key regions, identifying innovations driving efficiency and performance. Additionally, the study explores import/export trends, revealing shifts in trade patterns and regional dependencies. Emerging trends such as the rise of high-performance Mg alloys in aerospace & EV industries, along with sustainability-driven recycling innovations, further distinguish this analysis.

Market Size and Forecast

-

Market Size in 2024: USD 2.77 Billion

-

Market Size by 2032: USD 7.51 Billion

-

CAGR: 12.15% from 2025 to 2032

-

Base Year: 2024

-

Forecast Period: 2025–2032

-

Historical Data: 2021–2023

Magnesium Alloys Market Trends

-

Rising demand for lightweight, high-strength materials in automotive, aerospace, and electronics is driving the magnesium alloys market.

-

Growing focus on fuel efficiency and emission reduction in transportation is boosting adoption.

-

Advancements in corrosion-resistant and high-performance magnesium alloy formulations are enhancing durability.

-

Expansion of automotive EVs, aerospace components, and portable electronics is fueling market growth.

-

Increasing use in biomedical implants and industrial applications is widening the application scope.

-

Development of cost-effective production and recycling technologies is improving feasibility and sustainability.

-

Collaborations between alloy manufacturers, OEMs, and research institutions are accelerating innovation and commercialization.

Magnesium Alloys Market Growth Drivers:

-

The growing demand for magnesium alloys in automotive and aerospace industries is driven by their lightweight properties, enhancing fuel efficiency, performance, and sustainability.

The magnesium alloys market is experiencing significant growth, due to the high strength-to-weight ratio, magnesium alloys are commonly used for vehicle lightweighting, which is closely associated with fuel efficiency and performance. Car manufacturers are using alloys in structural and engine and transmission casing applications to meet stringent emissions regulations and improve electric vehicle (EV) efficiency. Magnesium alloys are making inroads into the aircraft frame, seat, and engine location space to replace heavier aluminum and aluminum-zinc families of metals, saving fuel and improving agility in the aerospace sector. Development in alloy composition and processing is pushing their applications even further. Corrosion-resistant and high-performance alloys continue the tendency to more extensive market uptake. Growing vertical transportation trends in sustainable transport and light-weighting are expected to steadily increase the demand for magnesium alloys, opening promising avenues for suppliers and manufacturers.

Magnesium Alloys Market Restraints:

-

The high cost of energy-intensive extraction, limited supply sources, and additional processing requirements make magnesium alloys less economically viable than aluminum alloys.

The high cost of magnesium extraction and processing remains a significant barrier to its widespread adoption. While aluminum is more abundant and technically easier to refine, which helps explain its relatively low cost, magnesium production requires energy-intensive processes of electrolysis or thermal reduction which leads to higher overall costs. Furthermore, the few nations capable of producing magnesium, China being the primary supplier, means the price of this metal fluctuates and supply chain interruptions are quite possible. Also, specialized refining and alloying techniques to improve the properties of magnesium may be another reason why the cost factor is enhanced during impractical use in the industry. Magnesium alloys are also usually prohibitively corroded against, requiring surface treatments that make them more expensive overall as compared to aluminum alloys. Because of these considerations, magnesium alloys have not been practical for the mass-market with particular reference to the cost-sensitive automotive industry. Apart from the progress in production mechanisms and recyclability, which are still in their early stages to reduce pricing, magnesium has failed to penetrate the market more widely due to its cost in comparison to different materials.

Magnesium Alloys Market Opportunities:

-

The recycling of magnesium alloys is expanding as industries focus on sustainability, cost reduction, and environmental impact through circular economy initiatives.

The recycling of magnesium alloys is gaining traction as industries emphasize sustainability and cost efficiency. To minimise reliance on the energy intensive and expensive extraction of primary magnesium, circular economy initiatives in magnesium include the reprocessing of scrap magnesium by manufacturers. Recycling magnesium alloys can reduce raw material costs and also reduce environmental damage by decreasing carbon releases and resource depletion. The potential for closed-loop recycling systems, in which magnesium is recovered from end-of-life vehicle and aerospace components and used to produce new ones, is being pursued, particularly in relation to the automotive and aerospace sectors, which leads to enhanced overall material efficiency. In addition, there are advancements in refining technologies to demand for better recycled magnesium that is becoming a suitable replacement for virgin materials. Incentives and stricter environmental policy from governments and regulatory bodies are also nudging companies to act more sustainably. Magnesium alloy recycling is predicted to grow as industries focus on environmentally friendly solutions that drive a sustainable and cost-efficient cache of materials.

Magnesium Alloys Market Challenges:

-

Magnesium is highly flammable in powdered form, requiring strict safety measures to prevent fire hazards in manufacturing and handling.

Magnesium is highly flammable, especially in powdered or thinly shaved forms, posing significant fire and explosion hazards in manufacturing and handling. Magnesium is highly flammable, burning at a high temperature and is difficult to put out and may catch fire with high temperatures or gas sparks. A magnesium fire cannot be extinguished by water, since the water reacts violently with magnesium and releases hydrogen gas, which keeps feeding the fire. Class D fire extinguishers or dry sand, instead, are needed to suppress such fires. Because of the hazards, companies handling magnesium alloys must establish rigorous safety measures, which include proper ventilation, dust collection systems, and fireproof storage conditions. In some applications, fire risk is mitigated by use of coating and alloying techniques. Such substantial precautionary measures can be attributed to magnesium being a highly flammable metal. This poses a massive threat in highly regulated industries such as aerospace, automotive, and defense due to strict policies and guidelines on fire safety. Having proper risk management strategies are necessary to ensure magnesium alloys can be handled and processed safely in industrial practice.

Magnesium Alloys Market Segmentation Analysis

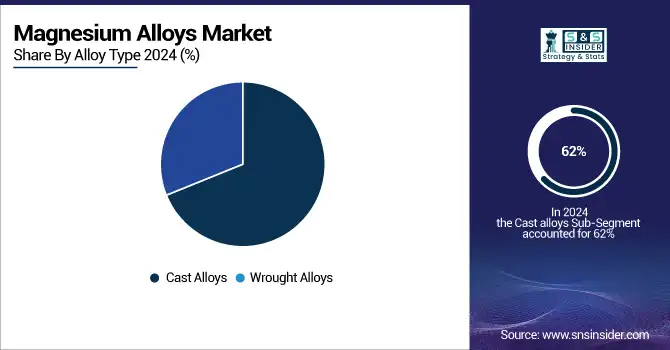

By Alloy Type, Cast alloys dominate with over 62% market share in 2024

Cast alloys segment dominated with a market share of over 62% in 2024, due to their widespread application in automotive, aerospace, and electronics industries. Which all factors makes them super desirable for mass production, Low weight, High strength-to-weight ratio, economic harvest. These alloys are used by automotive manufacturers in engine blocks, transmission cases, and wheels, contributing to mass savings and fuel efficiency. In the aerospace industry, for example, cast magnesium alloys help make aircraft lighter without sacrificing strength which improves overall performance. Their impressive thermal conductivity also benefits the electronics sector, making them ideal materials in laptop casings, mobile devices, and even camera bodies. Cast magnesium alloys are the most dominant segment of the market due to the molding ease of complex shapes and the recyclability of dropped pieces.

By End-use Industry, Aerospace & Defense leads with 38% share in 2024

The Aerospace & Defense segment dominated with a market share of over 38% in 2024, due to the industry's increasing reliance on lightweight materials for enhanced fuel efficiency and superior performance. Magnesium alloys have a superb solid strength-to-weight ratio and are ideal for aircraft structures, missile components, and other defense equipment. They have advantages such as corrosion resistance and ability to work in extreme conditions, further fuelling their increasing deployment in both the military and commercial aviation sectors. With aerospace manufacturers looking for ways to improve fuel economy and achieve sustainability goals, the demand for magnesium alloys is increasing. This is due both to newer alloy compositions as well as specific manufacturing processes that further the applications of magnesium alloys in aircraft and defense components, maintaining the segment in leading position in global magnesium alloys market.

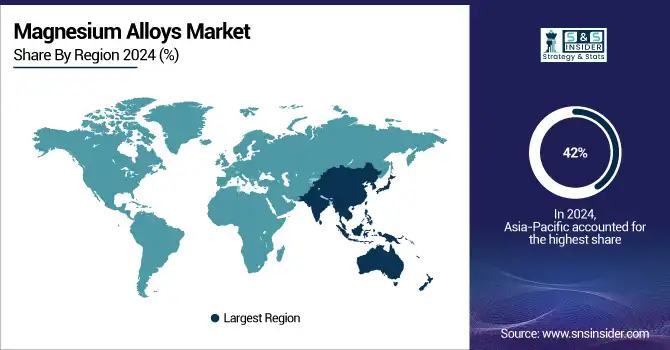

Magnesium Alloys Market Regional Analysis

Asia Pacific Magnesium Alloys Market Insights

Asia-Pacific region dominated with a market share of over 42% in 2024, primarily driven by the strong presence of the automotive, aerospace, and electronics industries in countries such as China, Japan, and South Korea. Availability of raw material in the region helps in driving down the cost of production and assured availability of supply. Its growing acceptance is also buoyed by the increasingly economical manufacturing processes used to produce it and rising demand for lightweight materials in transportation and consumer electronics. In particular, China is leading by the high magnesium production capacity as well as the growing Chinese industrial industry. Furthermore, the increasing production of magnesium alloys for electric vehicles (EVs), aircraft parts, and mobile phones propels the market advance. Supportive government initiatives for sustainable and high-performance materials continues to be one of the factors that is central to Asia-Pacific remaining a key & governing region for this market.

Get Customized Report as per Your Business Requirement - Enquiry Now

North America Magnesium Alloys Market Insights

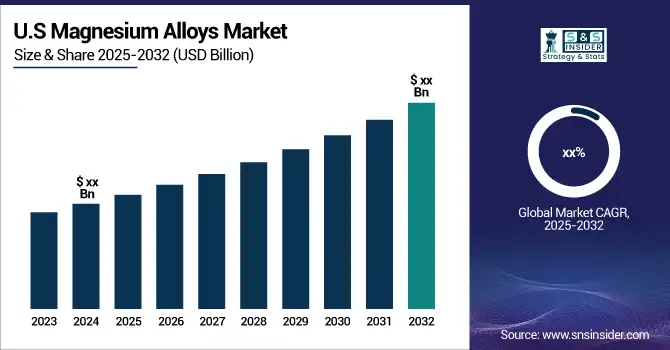

North America is emerging as the fastest-growing region in the Magnesium Alloys Market, driven by the rising adoption of lightweight materials in the automotive and aerospace industries. A major driver for market growth is the growing focus on higher fuel economy and lower emissions, which has resulted in the adoption of magnesium alloys for use in vehicle and aircraft components. This expansion is led in the USA, with plant-based advanced materials being adopted by many manufacturing giants like automotive companies and aerospace manufacturers for improved performance and sustainability. Also, innovation driven technologies along with government initiatives to support the lightweight, high strength materials propels the market growth. North America is forecast to maintain this rapid pace of growth over the coming years, due in part to their strong innovation focus in combination with increasing demand for EVs and next generation aircraft in the region.

Europe Magnesium Alloys Market Insights

The Europe magnesium alloys market is expanding steadily, driven by automotive and aerospace demand for lightweight, high-strength materials. Rising adoption in electric vehicles and industrial applications is boosting growth. Advanced manufacturing processes and recycling initiatives are enhancing sustainability, while government regulations promoting energy-efficient solutions further support market expansion. Key players focus on innovation, alloy development, and partnerships to strengthen regional presence and meet increasing demand for durable, lightweight magnesium solutions.

Middle East & Africa and Latin America Magnesium Alloys Market Insights

The Middle East & Africa and Latin America magnesium alloys market is growing moderately, driven by industrial expansion and automotive lightweighting initiatives. Demand for corrosion-resistant, high-strength alloys in construction, aerospace, and energy sectors is increasing. Limited regional production encourages imports from Europe and Asia. Government initiatives supporting sustainable materials and recycling, coupled with rising awareness of energy-efficient solutions, are further fueling market adoption and investment opportunities in these regions.

Magnesium Alloys Market Competitive Landscape:

Latrobe Magnesium Ltd

Latrobe Magnesium Ltd, listed on ASX (LMG) and OTC (LTRBF), is an Australian company specializing in the production of magnesium and magnesium-based products. The company focuses on sustainable, eco-friendly extraction methods, leveraging innovative technologies to minimize carbon emissions and reduce environmental impact. Latrobe Magnesium develops magnesium from alternative sources such as brown coal fly ash, supplying high-purity Mg and related products for industrial, chemical, and specialty applications while promoting greener manufacturing practices.

-

May 2024: Latrobe Magnesium successfully produced magnesium oxide (MgO) from brown coal fly ash at its 1,000-tonne-per-year Stage 1 Demonstration Plant in Victoria’s Latrobe Valley. This process reduces CO₂ emissions by 60% compared to industry standards.

Western Magnesium Corporation

Western Magnesium Corporation, headquartered in Nevada, USA, develops magnesium and magnesium alloys for industrial and commercial applications. The company focuses on large-scale, high-purity magnesium production, leveraging strategic locations and resources to optimize supply chains. Western Magnesium emphasizes technological innovation, sustainability, and infrastructure efficiency to meet growing demand in automotive, aerospace, and chemical industries, providing high-quality magnesium products while advancing environmentally responsible production methods.

-

March 2023: Western Magnesium announced plans to build a commercial plant and R&D Centre in Nevada, targeting initial production of 25,000 tonnes per year. The West head office will relocate to the new site. Nevada’s dry climate, proximity to the Tami Mosi dolomite source, favorable tax policies, and strong infrastructure support the expansion.

Key Players

Some of the major key players in the Magnesium Alloys Market

-

Magontec (Magnesium Alloy Anodes, Die-Casting Alloys)

-

Meridian Lightweight Technologies (Magnesium Die-Casting Components)

-

Ka Shui International Holdings Ltd. (Magnesium Alloy Casings, Die-Cast Parts)

-

US Magnesium (Primary Magnesium, Magnesium Alloys)

-

Shanghai Regal Magnesium Ltd. Co. (Magnesium Extrusions, Alloy Ingots)

-

Magnesium Elektron (Magnesium Sheet, Rods, and Specialty Alloys)

-

Nanjing Yunhai Special Metals Co. Ltd. (Magnesium Alloy Ingots, Wrought Magnesium)

-

POSCO (Magnesium Sheets, Automotive Components)

-

RIMA Group (Magnesium Alloy Castings, Ingots)

-

Smiths Advanced Metals (Magnesium Alloy Bars, Sheets)

-

Dead Sea Magnesium Ltd. (Magnesium Ingots, Die-Casting Alloys)

-

Wintime Group (Magnesium Alloy Sheets, Extrusions)

-

AMACOR (Magnesium Recycling, Alloy Ingots)

-

Norsk Hydro (Magnesium-Based Lightweight Materials)

-

China Magnesium Corporation (Magnesium Metal, Alloy Products)

-

Luxfer MEL Technologies (Magnesium Casting Alloys, Aerospace Alloys)

-

Qinghai Salt Lake Magnesium Co., Ltd. (Magnesium Ingots, Alloy Billets)

-

Shanxi Yinguang Magnesium Industry (Magnesium Alloy Plates, Wires)

-

Latrobe Magnesium (Eco-Friendly Magnesium Alloys)

-

Western Magnesium Corporation (High-Purity Magnesium Alloys)

Suppliers for (Magnesium alloy plates, sheets, rods, billets, and profiles) on Magnesium Alloys Market

-

Luxfer MEL Technologies

-

MAHLE GmbH

-

Xi'an XYMCO Magnesium Alloy Materials Co., Ltd.

-

Lee Kee Group

-

Luoyang Maige Magnesium Industry Co., Ltd.

-

Nippon Kinzoku Co., Ltd.

-

Mishra Dhatu Nigam Limited (MIDHANI)

-

Magnesium Elektron

-

Dead Sea Magnesium Ltd.

-

US Magnesium LLC

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 2.77 Billion |

| Market Size by 2032 | USD 7.51 Billion |

| CAGR | CAGR of 12.15% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Alloy Type (Cast Alloys, Wrought Alloys) • By End-use Industry (Automotive & Transportation, Electronics, Aerospace & Defense, Power Tools, Others [Medical, Sporting Goods]) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Magontec, Meridian Lightweight Technologies, Ka Shui International Holdings Ltd., US Magnesium, Shanghai Regal Magnesium Ltd. Co., Magnesium Elektron, Nanjing Yunhai Special Metals Co. Ltd., POSCO, RIMA Group, Smiths Advanced Metals, Dead Sea Magnesium Ltd., Wintime Group, AMACOR, Norsk Hydro, China Magnesium Corporation, Luxfer MEL Technologies, Qinghai Salt Lake Magnesium Co., Ltd., Shanxi Yinguang Magnesium Industry, Latrobe Magnesium, Western Magnesium Corporation. |