LIB Cathode Conductive Auxiliary Agents Market Report Scope & Overview:

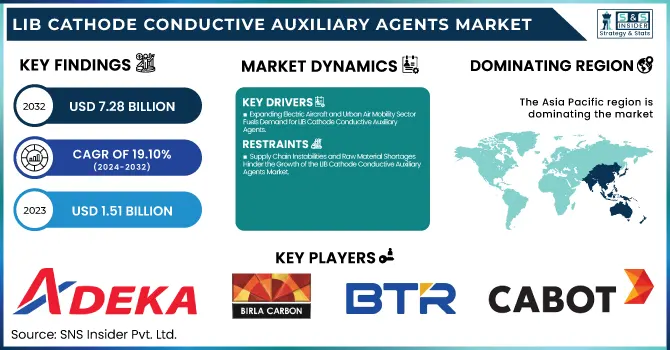

The LIB Cathode Conductive Auxiliary Agents Market Size was valued at USD 1.51 Billion in 2023 and is expected to reach USD 7.28 Billion by 2032, growing at a CAGR of 19.10% over the forecast period of 2024-2032.

To Get more information on LIB Cathode Conductive Auxiliary Agents Market - Request Free Sample Report

The LIB Cathode Conductive Auxiliary Agents Market is evolving rapidly, driven by advancements in energy storage and electric mobility. Our report explores the impact of environmental and safety standards, shaping material compliance in battery manufacturing. A thorough pricing analysis of raw materials uncovers cost dynamics influencing production. With rising investments, the report highlights funding trends accelerating innovations in conductive auxiliary agents. As performance demands grow, customization trends and product innovations redefine battery efficiency. Beyond industry shifts, a detailed economic impact assessment evaluates this sector’s role in global markets. This comprehensive analysis equips stakeholders with strategic insights to navigate the evolving landscape of LIB cathode conductive auxiliary agents.

LIB Cathode Conductive Auxiliary Agents Market Dynamics

Drivers

-

Expanding Electric Aircraft and Urban Air Mobility Sector Fuels Demand for LIB Cathode Conductive Auxiliary Agents

The LIB cathode conductive auxiliary agents market is witnessing growth due to the increasing adoption of electric aircraft and urban air mobility solutions. As the aviation industry shifts toward electrification to reduce carbon emissions, there is a growing demand for high-performance batteries with enhanced conductivity and energy storage capabilities. Conductive auxiliary agents, such as advanced carbon black and carbon nanotubes, are essential in optimizing cathode materials to improve battery efficiency and power output for electric aircraft. The urban air mobility sector, including electric vertical takeoff and landing (eVTOL) aircraft, requires lightweight yet high-capacity batteries, which depend on superior conductive agents to ensure optimal performance. Several aerospace companies and startups are investing in battery innovations tailored for electric aviation applications, driving demand for specialized conductive additives. Government initiatives promoting clean energy solutions in aviation further support this trend. With continued advancements in battery technology, the demand for high-quality conductive auxiliary agents will continue to rise, making them a crucial component in the next generation of electric aircraft and air mobility solutions.

Restraints

-

Supply Chain Instabilities and Raw Material Shortages Hinder the Growth of the LIB Cathode Conductive Auxiliary Agents Market

The LIB cathode conductive auxiliary agents market is facing significant challenges due to supply chain disruptions and raw material shortages. Conductive auxiliary agents, such as carbon nanotubes, carbon black, and graphene, require high-purity precursors, the availability of which is affected by geopolitical tensions, trade restrictions, and environmental regulations. The production of these materials often involves complex processing techniques, making it susceptible to price fluctuations and supply bottlenecks. Additionally, disruptions in the supply of key raw materials like graphite and synthetic carbon compounds further increase production costs. Battery manufacturers are actively seeking alternative suppliers and localized production strategies to mitigate these risks. However, establishing stable supply chains requires substantial investment and long-term planning. The unpredictability of raw material costs affects pricing strategies, limiting the affordability of conductive auxiliary agents. As demand for batteries rises, ensuring a stable supply of high-quality conductive agents remains a challenge. Unless supply chain resilience is improved through diversified sourcing and sustainable production practices, market growth will continue to be constrained by these instabilities.

Opportunities

-

Growing Investments in Smart Manufacturing and Industry 4.0 Technologies Enhance the Demand for Intelligent Grinding Fluid Management Systems

The rapid advancements in solid-state battery technology present significant opportunities for the LIB cathode conductive auxiliary agents market. Solid-state batteries offer advantages such as higher energy density, improved safety, and longer lifespan compared to conventional batteries. Conductive auxiliary agents play a crucial role in optimizing the interface between solid electrolytes and cathode materials, ensuring efficient charge transfer and battery performance. Companies developing solid-state batteries are increasingly focusing on advanced conductive agents, including high-purity carbon nanotubes and graphene-based additives, to enhance conductivity. Governments and private investors are allocating substantial funds for solid-state battery research, accelerating the demand for specialized conductive materials. As solid-state battery commercialization progresses, the market for conductive auxiliary agents is expected to grow significantly. This trend provides lucrative opportunities for manufacturers to develop high-performance conductive additives tailored for solid-state battery applications, expanding their market presence in the next generation of energy storage technologies.

Challenge

-

Stringent Environmental Regulations on Carbon-Based Materials Pose Challenges for the LIB Cathode Conductive Auxiliary Agents Market

The LIB cathode conductive auxiliary agents market faces increasing regulatory challenges due to stringent environmental policies on carbon-based materials. The production of conductive agents, such as carbon black and carbon nanotubes, involves processes that generate emissions and hazardous byproducts. Governments worldwide are tightening restrictions on carbon-intensive manufacturing, pushing companies to adopt greener production methods. Compliance with evolving environmental standards increases production costs and complicates material sourcing. Manufacturers must invest in sustainable alternatives to meet regulatory requirements while maintaining product performance. Unless the industry successfully transitions to eco-friendly conductive agents, market growth may be limited by stringent environmental policies.

LIB Cathode Conductive Auxiliary Agents Market Segmental Analysis

By Product Type

Carbon Nanotubes (CNTs) dominated the LIB Cathode Conductive Auxiliary Agents market in 2023 with a 45.6% share. CNTs are preferred due to their exceptional electrical conductivity, high surface area, and superior mechanical strength, making them ideal for enhancing lithium-ion battery (LIB) performance. Leading battery manufacturers, including Tesla, CATL, and LG Energy Solution, have integrated CNTs into their battery formulations to improve energy density and longevity. In 2023, the U.S. Department of Energy (DOE) and Japan’s New Energy and Industrial Technology Development Organization (NEDO) funded research initiatives to advance CNT applications in battery technology. Additionally, the European Union’s Horizon Europe program invested in CNT-based innovations to enhance battery efficiency in electric vehicles (EVs). The growing emphasis on EVs and renewable energy storage has further fueled CNT adoption, as they offer better percolation networks and superior lithium-ion mobility than traditional carbon black.

By Chemistry

Lithium Nickel Manganese Cobalt Oxide (NMC) dominated the LIB Cathode Conductive Auxiliary Agents market in 2023 with a 47.6% share. NMC is widely used due to its balanced energy density, thermal stability, and long cycle life, making it ideal for electric vehicles (EVs), consumer electronics, and grid storage applications. Major automakers like Tesla, Volkswagen, and Ford increasingly rely on NMC batteries to optimize range and performance. In 2023, China’s Ministry of Industry and Information Technology (MIIT) promoted NMC-based batteries in its EV subsidy policies, further accelerating their adoption. Additionally, South Korea’s Ministry of Trade, Industry, and Energy collaborated with key industry players like LG Energy Solution and SK Innovation to enhance NMC battery technology. Government investments in battery gigafactories and supply chain resilience have further cemented NMC’s dominance in the LIB market.

By Application

Automotive dominated the LIB Cathode Conductive Auxiliary Agents market in 2023 with a 52.8% share. The rising adoption of electric vehicles (EVs) and supportive government policies have driven demand for high-performance LIBs in the automotive sector. Automakers like Tesla, BYD, and General Motors have heavily invested in advanced battery technologies to improve vehicle range and charging efficiency. In 2023, the U.S. Inflation Reduction Act (IRA) and the European Union’s Green Deal accelerated EV adoption by offering tax incentives for lithium-ion battery production and EV purchases. Additionally, China’s New Energy Vehicle (NEV) program provided subsidies for EV manufacturers using high-efficiency LIBs. The rapid expansion of EV charging infrastructure, battery-swapping stations, and battery recycling initiatives has further solidified the dominance of LIBs in the automotive sector.

LIB Cathode Conductive Auxiliary Agents Market Regional Outlook

Asia Pacific dominated the LIB Cathode Conductive Auxiliary Agents Market in 2023 with a significant share of 41.2%, driven by the region’s strong focus on electric vehicle (EV) production and renewable energy storage solutions. Countries like China, Japan, and South Korea are at the forefront of the battery manufacturing industry. In 2023, China led with robust government incentives and subsidies for electric vehicle manufacturers, including giants like BYD, NIO, and CATL. The Chinese government’s support for energy storage systems (ESS) and electric buses has increased the demand for advanced lithium-ion batteries. Japan's technological advancements, particularly by Panasonic and Toyota, and South Korea's LG Energy Solution and SK Innovation continue to drive demand for high-performance cathode conductive auxiliary agents in battery applications. The Asia Pacific market benefits from low-cost manufacturing, abundant raw materials, and well-established supply chains, allowing these nations to dominate the global market. India’s growing EV market, bolstered by government policies like the Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) scheme, is also contributing significantly to the market growth.

The North America region is the second-largest region in the LIB Cathode Conductive Auxiliary Agents Market with a significant market share during the forecast period. The United States has emerged as a major player due to its ambitious goals for electric vehicle adoption and clean energy transition. The U.S. Inflation Reduction Act and other initiatives have created a favorable environment for electric vehicle (EV) manufacturers like Tesla and General Motors to boost domestic production of lithium-ion batteries. Canada is also making strides in EV production, with increasing investments in the battery supply chain and electric vehicle infrastructure. The United States Department of Energy (DOE) has been instrumental in fostering partnerships with battery manufacturers, such as Envision AESC and Ionic Materials, to enhance the performance and cost-efficiency of lithium-ion batteries. As North America moves towards sustainability goals, the market for cathode conductive auxiliary agents will continue to rise. The U.S. government’s increased funding for EV technology research will support the adoption of advanced materials in lithium-ion batteries, positioning North America as a fast-growing region in the market.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

Adeka Corporation (ADEKA Carbon Nanotube Dispersions, ADEKA Conductive Carbon Black)

-

Beilum Carbon Chemical Limited (Beilum Conductive Carbon Black, Beilum Super Conductive Carbon Black)

-

Birla Carbon (Conductex, Raven Conductive Carbon Black)

-

BTR New Material Group Co., Ltd. (BTR Carbon Nanotubes, BTR Conductive Carbon Black, BTR Graphene)

-

Cabot Corporation (LITX 200, LITX 50, Cabot Conductive Carbon Black)

-

Cheap Tubes (Multi-Walled Carbon Nanotubes, Single-Walled Carbon Nanotubes)

-

Denka Company Limited (Denka Acetylene Black, Denka Conductive Carbon Black)

-

Dongheng New Energy Technology Co., Ltd. (Dongheng Carbon Nanotubes, Dongheng Conductive Additives)

-

Jiaozuo Hexing Chemical Industry Co., Ltd. (Super P Conductive Carbon Black, Hexing Conductive Carbon Black)

-

Jiangsu Cnano Technology Co., Ltd. (Cnano Carbon Nanotubes, Cnano CNT Dispersions)

-

Lion Specialty Chemicals Co., Ltd. (Lion Conductive Carbon Black, Lion Acetylene Black)

-

Nanjing Xfnano Materials Tech Co., Ltd. (Xfnano Graphene Powder, Xfnano Carbon Nanotubes)

-

Nanorh (Nanorh Graphene-Based Conductive Additives, Nanorh Carbon Nanotube Dispersions)

-

Northern Graphite (Northern Graphene, Northern Conductive Graphite Powder)

-

OCSiAl (TUBALL Single-Walled Carbon Nanotubes, OCSiAl CNT Dispersions)

-

Orion S.A. (PRINTEX Conductive Carbon Black, XPB 545 Conductive Additive)

-

Resonac Holdings Corporation (Ketjen Black, Super P Conductive Carbon Black)

-

Shenzhen Dynanonic Co., Ltd. (Dynanonic Nano Carbon Materials, Dynanonic Carbon Black)

-

Wuxi Dongheng New Energy Technology Co., Ltd. (Dongheng Carbon Nanotubes, Dongheng CNT Conductive Additives)

-

Zeon Corporation (ZEOCOAT Conductive Polymer, Zeon CNT Dispersions)

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 1.51 Billion |

| Market Size by 2032 | USD 7.28 Billion |

| CAGR | CAGR of 19.10% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Product Type (Carbon Black, Carbon Nanotubes (CNTs), Graphene, Others) •By Chemistry (Lithium Nickel Manganese Cobalt Oxide (NMC), Lithium Nickel Cobalt Aluminum Oxide (NCA), Lithium Iron Phosphate (LFP), Lithium Manganese Oxide (LMO), Lithium Cobalt Oxide (LCO)) •By Application (Automotive, Consumer Electronics, Energy Storage Systems, Industrial, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | BTR New Material Group Co., Ltd., Cabot Corporation, Orion S.A., Birla Carbon, Zeon Corporation, Denka Company Limited, Resonac Holdings Corporation, Jiangsu Cnano Technology Co., Ltd., Shenzhen Dynanonic Co., Ltd., Adeka Corporation and other key players |