Luxury Electric Vehicle Market Report Scope & Overview

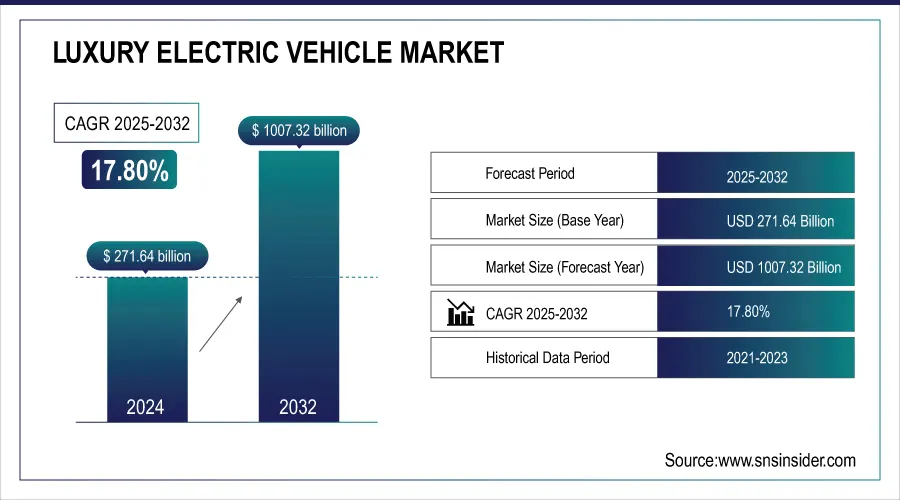

The Luxury Electric Vehicle Market Size was valued at USD 271.64 Bn in 2024 and is expected to reach USD 1007.32 Bn by 2032, the CAGR recorded for the forecasted year 2024-2032 was 17.80%.

Luxury manufacturers have been spending extensively in EV technology. To promote the adoption of EVs, governments in several nations provided incentives and subsidies. These incentives frequently reduced the price and increased the appeal of luxury EVs. As the availability of charging stations increased, concerns about range anxiety subsided, making EVs, including high-end models, more useful for daily use. To draw customers to their EV Propulsion Types, luxury automakers use their strong brand appeal and reputation for quality and craftsmanship. Some high-end EV models, like Tesla's Model 3, offered more cheap options, expanding their appeal beyond usual consumers of high-end vehicles.

Get More Information on Luxury Electric Vehicle Market - Request Sample Report

Due to the instant torque offered by electric motors, luxury EVs often feature quick acceleration. High-end luxury EVs can reach 60 mph in under 3 seconds, approximately 4 seconds, or sometimes even less quickly. Many high-end EVs are built to reach top speeds that frequently exceed 100 mph. For those who value performance and speed, some versions may even reach or exceed 150 mph. Precision and responsive handling are achieved by the luxury EVs' sophisticated suspension systems and low centres of gravity, which are caused by the positioning of the large batteries. While retaining outstanding traction and stability on the road, they provide a comfortable and smooth ride.

Market Size and Forecast:

-

Market Size in 2024: USD 271.64 Billion

-

Market Size by 2032: USD 1007.32 Billion

-

CAGR: 17.80% from 2025 to 2032

-

Base Year: 2024

-

Forecast Period: 2025–2032

-

Historical Data: 2021–2023

Key Luxury Electric Vehicle Market Trends

-

Rising demand for premium and sustainable mobility solutions

-

Advancements in battery technology enabling longer range and faster charging

-

Integration of autonomous driving and connected car features

-

Growing appeal of eco-luxury with sustainable materials and carbon-neutral manufacturing

-

Expansion of ultra-fast charging infrastructure by luxury automakers

-

Strong growth momentum in Asia-Pacific and Middle East luxury EV markets

-

Intensifying competition with new entrants and traditional luxury automakers

-

Increased R&D investments and strategic collaborations for innovation

Luxury Electric Vehicle Market Growth Drivers

-

The rise in demand for the luxury electric vehicles.

Advanced driver assistance systems, such adaptive cruise control, lane-keeping aid, and semi-autonomous driving capabilities, are common in premium EVs because they improve both safety and convenience. Luxury EVs are renowned for having luxurious interiors with high-end materials, cutting-edge entertainment systems, and supportive seats. The tranquil inside environment is also enhanced by the silent electric drivetrains. Luxury automakers frequently provide a wide range of customization possibilities, enabling customers to modify the performance, appearance, and features of their EVs to suit their tastes.

Luxury Electric Vehicle Market Restraints

-

The high maintenance cost and the ongoing economic constrains globally.

Luxury Electric Vehicle Market Opportunities

-

The need of an hour for the climate control.

-

The shift of automotive industry from traditional internal combustion engine (ICE) to electric vehicles.

The full lifecycle, including production, use, and disposal, must be considered in order to effectively calculate the environmental impact of EVs. Due to the construction of the batteries, EVs often have a greater carbon footprint during manufacturing; however, this is balanced by lower emissions during operation. Compared to ICE vehicles, EVs use less energy overall. They lose less energy because a greater proportion of the energy from their power source is converted into forward motion. Overall emissions are reduced as a result of this efficiency. The number of kilometres travelled in EVs as opposed to ICE vehicles will determine the overall reduction in carbon emissions. The number of emissions reduced increases with the number of electric-only kilometres travelled.

Luxury Electric Vehicle Market Segment Analysis

By Propulsion Type

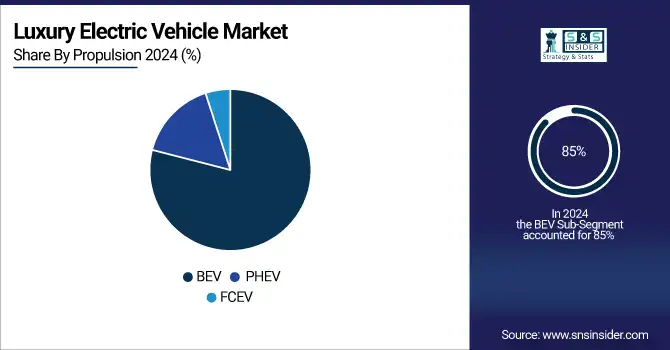

The luxury EV landscape depicts an intricate play of propulsion technologies. BEVs dominate the scene, with an overwhelming market share of 85%. Zero emissions and improved battery capacity make them the unanimous favourite amongst eco-friendly, high-end consumers. PHEVs, while holding only a 12% market share, do represent a highly practical solution for those demanding a middle path between electric and conventional power.

Their flexibility, especially in countries where the charging infrastructure is low, remains on a steady increase. Another 3% comes from the Fuel Cell Electric Vehicles, which offer better range and faster refuelling. Their inability to get more significant share lies in the national lack of hydrogen infrastructure and premium price tag. Still, technological advances being made with this segment will redefine it in years to come.

Luxury Electric Vehicle Market Regional Analysis

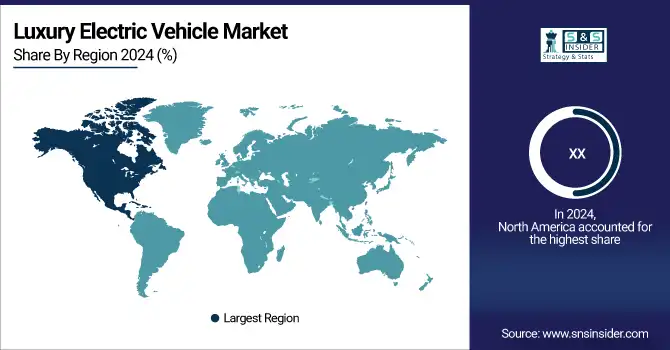

North America Luxury Electric Vehicle Market Insights

North America will be the region which will show good growth during the forecasted period due to reasons like government incentives, growing environmental awareness, and the entry of luxury automakers like Tesla, Audi, and Jaguar with their EV models, the U.S. luxury EV industry has been expanding gradually. Particularly well-liked models in this market included Tesla's Model S, Model X, and Model 3. Much like the US, Canada saw a growth in the adoption of premium EVs. Government incentives and an expanding network of charging infrastructure were key factors in this rise.

Need any customization research on Luxury Electric Vehicle Market - Enquiry Now

Europe Luxury Electric Vehicle Market Insights

Europe will have the second largest share because sales of premium EVs were rising quickly in nations including the Netherlands, Germany, the UK, and France. To compete with Tesla, well-known automakers like BMW, Mercedes-Benz, and Audi were releasing high-end electric versions. Norway showed out as a forerunner in the adoption of luxury EVs. A substantial market share for EVs was achieved thanks to supportive government regulations, generous incentives, and a strong commitment to sustainability.

Asia Pacific Luxury Electric Vehicle Market Insights

APAC will be the dominating region because Luxury EV sales in China were growing quickly, propelled by indigenous automakers like NIO, Xpeng, and Li Auto. For the rich customer base, these businesses were making high-performance electric SUVs and cars. EVs with luxury features were being developed by companies like Toyota, Nissan, and Honda, but the market there was very modest compared to other places.

Latin America (LATAM) Luxury Electric Vehicle Market Insights

Latin America holds 11.4% of the Luxury Electric Vehicle market in 2024, driven by rising consumer awareness, urban mobility initiatives, and infrastructure expansion. Countries such as Brazil and Mexico are witnessing increased adoption of EVs in luxury segments, supported by government subsidies, investments in charging networks, and strategic partnerships with global automakers. While still developing compared to North America and Europe, LATAM is emerging as a promising market for premium EV adoption.

Middle East & Africa (MEA) Luxury Electric Vehicle Market Insights

The Middle East & Africa region is projected to hold 18.5% of the global Luxury Electric Vehicle market in 2024, fueled by investments in clean mobility, renewable energy integration, and sustainable urban transportation. Saudi Arabia, the UAE, and South Africa are leading the way in adopting luxury EVs for both private and commercial applications. Initiatives such as smart city projects, incentives for electric mobility, and collaborations with global EV manufacturers are accelerating market growth, positioning MEA as a high-potential region for luxury EV adoption.

Electric Vehicle Market Competitive Landscape

Tesla

Tesla is a U.S.-based electric vehicle leader, recognized for its innovation in luxury EV design, performance, and cost optimization.

-

In 2024, Tesla achieved a significant milestone by securing the lowest cost differentiation among luxury EV OEMs, strengthening its competitive edge. This development highlights Tesla’s focus on scaling production efficiency, battery technology, and supply chain optimization to maintain leadership in the premium EV market.

Hyundai Motor Company

Hyundai Motor Company, headquartered in South Korea, is an emerging luxury EV player known for its advanced design, battery innovation, and sustainability-driven manufacturing.

-

In 2024, Hyundai announced a major investment in a new U.S.-based EV and battery production facility, aimed at expanding capacity and accelerating its North American growth. The initiative positions Hyundai to boost battery output, reduce dependence on imports, and strengthen its luxury EV offerings in one of the fastest-growing markets.

Luxury Electric Vehicle Market Key Players

- Tesla, Inc.

- BYD

- Volkswagen AG

- BMW AG

- AB Volvo

- Ford Motor Company

- Hyundai Motor

- Toyota Motor Corporation

- Kia Corporation

- Audi AG

- Mercedes-Benz Group AG (Daimler)

- Porsche AG

- Jaguar Land Rover (Tata Motors)

- Lucid Motors

- Rivian Automotive, Inc.

- NIO Inc.

- XPeng Motors

- Fisker Inc.

- Maserati S.p.A. (Stellantis)

- Lexus (Toyota’s luxury brand)

| Report Attributes | Details |

| Market Size in 2024 | US$ 271.64 Billion |

| Market Size by 2032 | US$ 1007.32 Billion |

| CAGR | CAGR of 17.80% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | by Propulsion Type (BEV, PHEV, FCEV), by Vehicle Type (Cars, Vans, Trucks, Buses), |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, France, UK, Italy, Spain, Poland, Russsia, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia,ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, Egypt, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia Rest of Latin America) |

| Company Profiles | Tesla, BYD, Volkswagen, BMW, AB Volvo, Ford Motor, Hyundai Motor, Toyota, Kia Corp, Audi. |