Massive Open Online Course Market Report Scope & Overview:

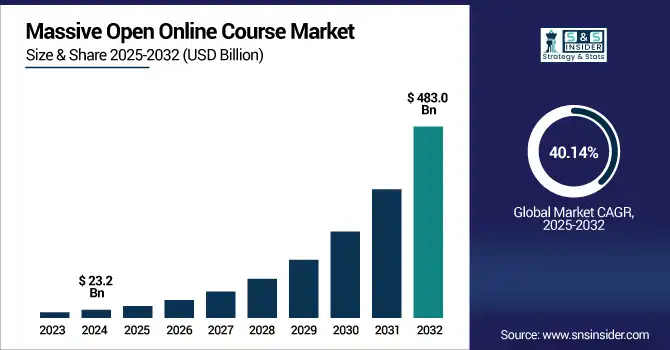

The Massive Open Online Course Market was valued at USD 23.2 billion in 2023 and is expected to reach USD 483.0 billion by 2032, growing at a CAGR of 40.14% from 2024-2032.

To Get more information on Massive-Open-Online-Course-Market - Request Free Sample Report

The report highlights rising enrollment rates in MOOCs for technology and business subjects, dominating other categories in 2024. Coursera and Udemy hold the largest platform market share, driven by diverse course offerings and corporate partnerships. North America and Asia Pacific lead in active learner penetration, with significant growth in emerging markets. Interestingly, completion rates for paid courses remain consistently higher than free courses across regions. Additionally, the report notes a growing trend of MOOC integration into formal university curriculums and enterprise upskilling programs, expanding the market’s institutional adoption footprint.

The U.S. Massive Open Online Course (MOOC) market was valued at USD 6.5 billion in 2023 and is projected to reach USD 132.8 billion by 2032, growing at a CAGR of 39.79%. Growth is driven by increasing demand for affordable, flexible, and skill-based learning, accelerated by corporate upskilling initiatives and university partnerships. The rise of AI-powered adaptive learning, credential-based programs, and industry-focused content will further fuel market expansion over the next decade.

Massive Open Online Course Market Dynamics

Driver

-

The rising demand for flexible, affordable, and on-demand learning solutions is fueling MOOC market growth.

The MOOC market is primarily driven by the rising demand for affordable, on-demand, and flexible education options that fit around personal and professional schedules. With a surge in upskilling needs, especially in fast-evolving domains like data science, AI, and digital marketing, MOOCs offer a scalable, accessible alternative to traditional education. Additionally, collaborations between MOOC platforms and top universities or industry partners enhance the credibility of online certifications, attracting working professionals and students alike. The increasing internet penetration, smartphone adoption, and digital payment options further streamline access, accelerating enrollment growth in the U.S. and globally.

Restraint

-

Low course completion rates and learner engagement challenges hinder the long-term impact of MOOCs.

Despite high enrollment, MOOCs often face low course completion rates, particularly for free courses, limiting their long-term impact. Many learners register out of curiosity or with informal goals, leading to disengagement midway. The lack of peer interaction, one-on-one mentorship, and academic pressure found in traditional setups affects learner motivation. Additionally, complex or overly theoretical course content without practical applications can discourage continued participation. Platforms are attempting to address this via gamification, personalized learning paths, and graded assignments, but the challenge of sustaining learner interest and ensuring knowledge retention remains a significant market restraint.

Opportunity

-

Industry-endorsed micro-credentials and professional certifications are creating new revenue streams for MOOC providers.

A major opportunity lies in the rapid growth of industry-recognized micro-credentials, digital badges, and professional certificates offered through MOOCs. Companies increasingly value skills-based hiring over traditional degrees, leading to collaborations with MOOC platforms for role-specific programs in AI, cybersecurity, cloud computing, and business management. Learners can now stack these credentials towards larger qualifications, improving career prospects without committing to long, expensive degrees. This trend not only boosts platform monetization via paid course enrollments but also fosters continuous, lifelong learning, opening lucrative revenue channels for both corporate and academic MOOC providers.

Challenge

-

Ensuring consistent course quality, content relevance, and global recognition remains a major obstacle for the market.

Maintaining consistent course quality, content relevance, and academic rigor across thousands of MOOCs and instructors poses a critical challenge. With varying instructor expertise and frequent content updates needed in dynamic subjects like AI or digital marketing, ensuring learners receive accurate, current, and applicable knowledge is complex. Moreover, without global accreditation standards for MOOC certifications, employer recognition can be inconsistent. Addressing this requires platforms to invest in expert curation, AI-based content validation tools, and strategic alliances with accredited institutions to enhance course credibility and learner outcomes.

Massive Open Online Course Market Segmentation Analysis

By Type

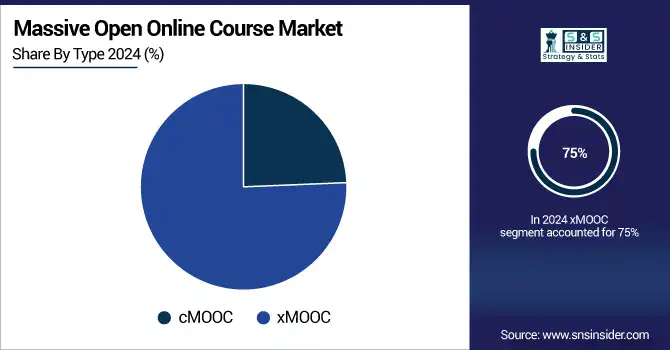

xMOOCs dominated the market in 2023 and accounted for 75% of revenue share, due to their structured, instructor-led format and partnerships with reputed universities and corporations offering recognized certificates. Their compatibility with professional upskilling programs and integration with enterprise learning platforms has fueled adoption across business, technology, and healthcare domains. Looking ahead to 2032, the segment is expected to maintain strong growth driven by demand for credential-based learning, executive education, and workforce development, especially in North America and Europe, with increasing emphasis on hybrid education models.

cMOOCs are expected to register the fastest CAGR through 2032, fueled by a growing demand for collaborative, community-driven, and peer-based learning models. The rise of decentralized education ecosystems, online study groups, and social learning communities has boosted interest in cMOOCs, particularly for creative, interdisciplinary, and lifelong learning topics.

By Subject Type

The Technology segment led the MOOC market and accounted for 38% of revenue share in 2023, driven by surging demand for digital skills, coding, AI, cloud computing, and cybersecurity courses. The proliferation of tech jobs, accelerated digital transformation, and the rise of remote work environments have significantly boosted enrollments in this subject area. With ongoing talent shortages in tech sectors globally and the push for upskilling and reskilling initiatives by both enterprises and governments, this segment is expected to retain its leadership through 2032, sustaining steady growth as emerging technologies like AI, blockchain, and IoT reshape job market demands.

The Business segment is anticipated to record the fastest CAGR through 2032, supported by growing interest in leadership, management, digital marketing, finance, and entrepreneurship courses. As start-ups multiply and enterprises restructure for digital-first operations, there's increasing demand for strategic, operational, and financial skills across industries. MOOCs providing executive certifications, MBA alternatives, and corporate-sponsored programs have seen rising enrollments. This growth will be further fueled by SME sector expansion, cross-disciplinary skill requirements, and higher adoption of MOOC-based corporate training programs, particularly in the U.S., Europe, and emerging Asia-Pacific markets.

Regional Landscape

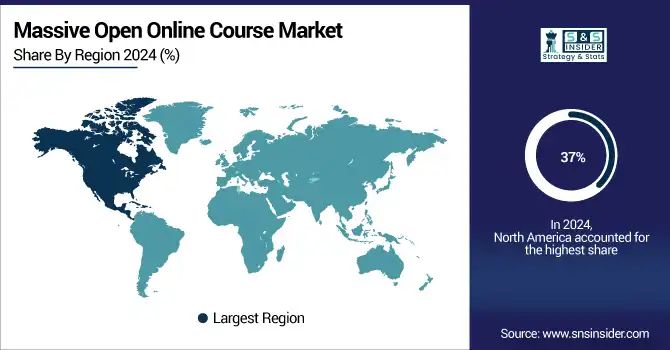

North America dominated the MOOC market in 2023 and represented 37% of revenue share, fueled by the early adoption of online learning platforms, the presence of major providers like Coursera, edX, and Udemy, and a strong emphasis on digital skills development. The region benefits from advanced internet infrastructure, a high proportion of working professionals pursuing upskilling programs, and academic collaborations with top universities. Government-backed workforce development initiatives and enterprise training programs continue to support market expansion. North America is expected to maintain its lead through 2032, driven by continuous innovation and corporate e-learning investments.

Asia Pacific is projected to register the fastest CAGR in the MOOC market through 2032, owing to increasing internet penetration, a rapidly expanding young population, and growing demand for affordable, accessible education. Countries like India, China, and Southeast Asian nations are witnessing surging enrollments in technology and business-focused MOOCs, driven by employment-oriented learning and government digital literacy programs. Corporate adoption for workforce upskilling and partnerships between universities and MOOC providers are further fueling growth. The region’s rising middle class and mobile-first learners will continue to power market momentum in the coming years.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players

-

Coursera – Coursera Plus

-

edX – MicroMasters Programs

-

Udemy – Udemy Business

-

FutureLearn – Microcredentials

-

Khan Academy – Khan Academy Courses

-

Udacity – Nanodegree Programs

-

Skillshare – Skillshare Classes

-

LinkedIn Learning – LinkedIn Learning Courses

-

Alison – Diploma Courses

-

OpenSAP – openSAP Courses

-

Swayam – Swayam Courses

-

Canvas Network – Canvas Network Courses

-

D2L (Desire2Learn) – Open Courses

-

Edraak – Edraak Courses

-

Pluralsight – Pluralsight Skills

Recent Developments

-

February 2024: Expanded its course offerings to approximately 7,000, collaborating with over 300 universities and companies.

-

February 2024: Entered into a partnership with the University of Surrey to support the delivery of online master’s degrees and professional certificate programs.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 23.2 Billion |

| Market Size by 2032 | US$ 483.0 Billion |

| CAGR | CAGR of 40.14% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Type (cMOOC, xMOOC) • By Subject Type (Technology, Business, Science, Other) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | Coursera, edX, Udemy, FutureLearn, Khan Academy, Udacity, Skillshare, LinkedIn Learning, Alison, OpenSAP, Swayam, Canvas Network, D2L (Desire2Learn), Edraak, Pluralsight |