Medical Carts Market Size & Trends

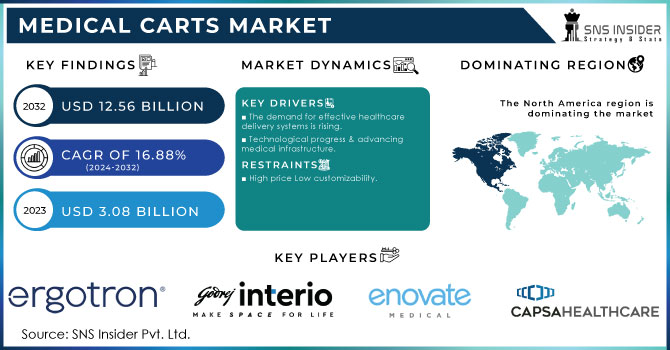

The Medical Carts Market Size was valued at USD 3.08 billion in 2023 and is expected to reach USD 12.56 billion by 2032 and grow at a CAGR of 16.88% over the forecast period 2024-2032.

To Get More Information on Medical Carts Market - Request Sample Report

Market development is being driven by the rising incidence of musculoskeletal injuries (MSI) and the expanding use of electronic medical records (EMR) in hospitals. For instance, 1.71 billion individuals worldwide would be affected by musculoskeletal problems in February 2021. Furthermore, due to population expansion and ageing, the number of people with musculoskeletal issues is rapidly rising. The need for medical carts will thus rise in the near future as a result of these considerations. The use of mobile carts is expanding as a result of constantly improving technology that provides better layout, construction, alternatives, and features that satisfy consumer needs. For instance, in December 2021, Advantech, a well-known supplier of medical computer systems and services, added the AMiS-30EP pole cart to its AMiS product range. This product may be equipped with a range of monitors and devices, depending on the application. These technological advancements will probably cause the industry to grow soon. In addition, Capsa Healthcare debuted its brand-new Trio mobile computing workstation in August 2021. Electronic health records are mobilised by Capsa's Trio point-of-care platform, which also provides effective and accurate medication management. Due to these advancements, the market is probably going to grow soon One of the major drivers of the medical cart market's expansion is the emergence of telemedicine and telehealth, as well as technological developments in medical carts. The need for medical carts is anticipated to increase in the coming years since these carts boost nurse productivity and enable better patient care. Medical cart innovations, including the availability of light items with better mobility and ergonomics, are anticipated to improve the usage of these devices. The safety of nursing personnel is increased by the availability of handle and wheel mounts with the proper and appropriate sizes of batteries.

The market for medical carts is being driven by an increase in awareness among healthcare professionals and the use of patient engagement solutions globally. Approximately USD 1.0 trillion is spent on healthcare delivery in the US healthcare system, according to data from the Harvard Business Review. These statistics show that medical mistakes are the third-most common cause of mortality in the United States. These systemic mistakes can be fixed with the aid of electronic medical records (EMRs).

Medical Carts Market Dynamics

DRIVERS

-

The demand for effective healthcare delivery systems is rising.

-

Technological progress & advancing medical infrastructure.

The demand for fast and effective healthcare procedures is what drives the medical care industry. In order to optimize workflow and patient care, medical carts assist in the organization, storage, and transportation of medical supplies, equipment, and patient information. The creation of smart, creative medical carts with EMR integration, barcode scanning, medicine dispensing systems, and remote monitoring capabilities is a result of technological advancements. These technological trends increase the usefulness and effectiveness of medical carts, increasing demand. Medical carts are in high demand because of the expanding healthcare infrastructure, which includes hospitals, clinics, and ambulatory care facilities.

RESTRAIN

-

High price Low customizability.

Medical carts can be pricey, particularly if they include cutting-edge features and technology. Adoption may be hampered by the expensive price, especially in smaller healthcare institutions with tighter resources. There may be restrictions on modification since certain medical carts may not fully satisfy the unique demands of healthcare institutions or professionals. For certain specialized healthcare settings, a lack of customization choices might be a constraint.

OPPORTUNITY

-

Expansion of home healthcare and telehealth.

-

Developing nations.

The market for medical carts is growing as telemedicine services are being used more widely and home healthcare is becoming more popular. Remote consultations and in-home patient care can be facilitated by mobile medical carts with telemedicine features and remote monitoring devices. Due to expanding healthcare infrastructure and rising healthcare costs, medical cart demand is rising in emerging nations. Medical Cart providers and manufacturers have several opportunities to expand in these sectors.

CHALLENGES

-

Controlling infections Ergonomics and usability.

In healthcare facilities, infection control is crucial. Medical carts present a difficulty in maintaining good cleanliness and minimizing cross-contamination since they are constantly used and transferred between patient rooms. Manufacturers should concentrate on creating carts that are simple to clean and sanitize. Throughout their shifts, healthcare workers use medical carts for a variety of duties. To reduce strain and exhaustion on the part of healthcare personnel, ergonomic design and simplicity of use are essential. User-friendly features and ergonomic concerns should be given top priority by manufacturers.

Medical Carts Market Segmentation Analysis

By Product

The mobile computing carts segment emerged as the leading force in the medical carts market, capturing a substantial 73.2% revenue share in 2023. Their versatility, compact design, and ability to provide comprehensive clinical solutions made them indispensable for point-of-care facilities. While initially employed primarily for computer documentation, the expanding applications of these carts, including telemedicine and patient education, are poised to further fuel their adoption. Telemedicine, in particular, is gaining traction as mobile carts enable remote consultations, bridging the gap between patients and specialists, even in geographically remote areas.

The wall-mounted workstations segment is poised for rapid growth, projected to expand at a remarkable 18.4% CAGR during the forecast period. Their ability to maximize space and minimize the spread of infections has garnered significant attention. As healthcare professionals and patients become increasingly aware of the importance of computer technology in healthcare, ergonomic solutions like wall-mounted workstations are gaining traction. The limited workspace available in many healthcare facilities, coupled with the growing adoption of computers and cart systems, is expected to drive demand for these solutions. Wall mounts offer a static location for monitors or TVs, meeting patient needs and contributing to a more organized and efficient healthcare environment. Innovative advancements, such as holographic inserts designed to reduce surface contact and prevent the spread of infections, further highlight the potential of wall-mounted workstations to enhance patient safety and improve overall healthcare outcomes.

By Type

Emergency carts dominated the medical carts market, commanding a substantial 40.6% revenue share in 2023. Their vital role in emergency rooms, where the risk of infectious diseases is heightened, is a primary driver of their demand. These carts, equipped with essential drugs and medical equipment, are indispensable for responding to medical emergencies like cardiac arrest. Moreover, advancements in emergency cart design, such as improved mobility, lighter weight, and enhanced ergonomics, are expected to boost their adoption. These features not only enhance efficiency but also prioritize the safety of healthcare professionals.

The procedure carts segment is poised for rapid growth, projected to expand at a remarkable 17.3% CAGR during the forecast period. Their versatility and utility across various healthcare settings make them a valuable asset. Procedure carts are essential for a wide range of surgical procedures, including cardiology, endoscopy, and more, providing easy access to necessary therapeutics. Their sanitary design and mobility contribute to a safer and more efficient surgical environment. By minimizing the risk of cross-contamination and ensuring a well-organized workspace, procedure carts play a crucial role in supporting successful surgical outcomes.

By End-Use

Hospitals remain the dominant segment in the medical carts market, holding a significant 36.2% revenue share in 2023. Technological advancements within medical mobile workstations, such as advanced medication delivery systems, have been instrumental in driving adoption. Additionally, a growing emphasis on patient engagement, coupled with EHR incentive programs, has contributed to the segment's expansion. Other factors fueling growth include the adoption of barcode-labeled medication distribution (BCMA), the rise of telehealth, and the need to improve nursing efficiency and reduce operational costs.

The physician offices or clinics segment is experiencing rapid growth, projected to expand at a CAGR of 17.4% during the forecast period. The increasing awareness and demand for all-in-one solutions that are compact and versatile have driven this growth. These carts, equipped with medicine, medical equipment, computers, and storage, offer a comprehensive solution for clinics. The rising adoption of mobile workstations by clinics is a key factor contributing to the segment's expansion.

Medical Carts Market Regional Insights

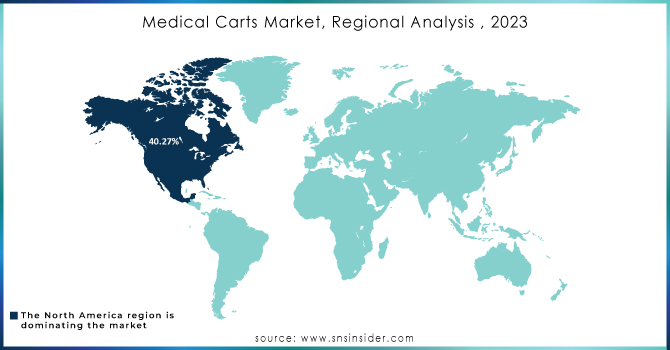

With the greatest revenue share of more than 40.27% in 2023, North America led the market. The presence of prominent players, significant government investments in the development of cutting-edge medical equipment, and a favourable reimbursement environment are all contributing factors to the market's expansion in the area.

The need for home dialysis is expanding as the prevalence of chronic kidney disease (CKD) rises. The largest revenue share held by this region can be attributed to the presence of streamlined processes, such as hospital admissions and reimbursement claims, as well as the availability of integrated healthcare IT products to maintain Electronic Health Records (EHRs). Strategies used by businesses to market their products are expected to raise the level of market competitiveness.

During the projection period, the Asia-Pacific region is anticipated to have the greatest CAGR. The increasing demand for medical carts and the firms' increased focus on developing their presence in this area are the two main factors predicted to propel market expansion. Additionally, expanding R&D efforts, rising healthcare costs, and the accessibility of affordable healthcare IT solutions are all predicted to fuel market expansion.

The market is expected to see considerable expansion over the course of the forecast period as a result of manufacturers in the Asia-Pacific region concentrating on the development of low-cost products with improved efficiency. Additionally, because labour and raw materials are more affordable in Asia-Pacific countries, multinational corporations are investing in local businesses.

Do You Need any Customization Research on Medical Carts Market - Enquire Now

Key Players in the Medical Carts Market

The major Players Ergotron, Inc, ITD GmbH, Godrej Interior Healthcare, Capsa Healthcare, Enovate Medical, Touch Point Medical, JACO Inc, Advantech Co., Ltd, Harloff Manufacturing Co, Medline Industries Inc, Holo Industries LLC , Armstrong Medical Inc, McKesson Medical-Surgical Inc, Omni cell Inc, Altus Health Systems, Compu Caddy, and others.

Recent Developments in the Medical Carts Market

-

2024: InterMetro Industries Announced a partnership with a leading technology company to integrate AI-powered features into their medical carts, enhancing efficiency and patient care.

-

2024: Harloff Manufacturing introduced a customizable medical cart platform that allows healthcare facilities to tailor their carts to specific needs and preferences.

-

2024: Omnicell announced a strategic partnership with a major healthcare provider to develop innovative medical cart solutions for medication management and dispensing.

| Report Attributes | Details |

| Market Size in 2023 | US$ 3.08 Bn |

| Market Size by 2032 | US$ 12.56 Bn |

| CAGR | CAGR of 16.88% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Mobile Computing Carts, Wall-mounted Workstations, Medication, Medical Storage Columns, Cabinets, & Accessories, Others) • By Type (Anaesthesia, Emergency, Procedure, Others) • By End-Use (Hospitals, Ambulatory Surgical Centers, Physician Offices or Clinics, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]). Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia Rest of Latin America) |

| Company Profiles | Ergotron, Inc, ITD GmbH, Godrej Interior Healthcare, Capsa Healthcare, Enovate Medical, Touch Point Medical, JACO Inc, Advantech Co., Ltd, Harloff Manufacturing Co, Medline Industries Inc, Holo Industries LLC, Armstrong Medical Inc, McKesson Medical-Surgical Inc, Omni cell Inc, Altus Health Systems, Compu Caddy |

| Key Drivers | • The demand for effective healthcare delivery systems is rising. • Technological progress & advancing medical infrastructure. |

| Market Restraints | • High price Low customizability. |