Medical Reference Apps Market Report Scope & Overview:

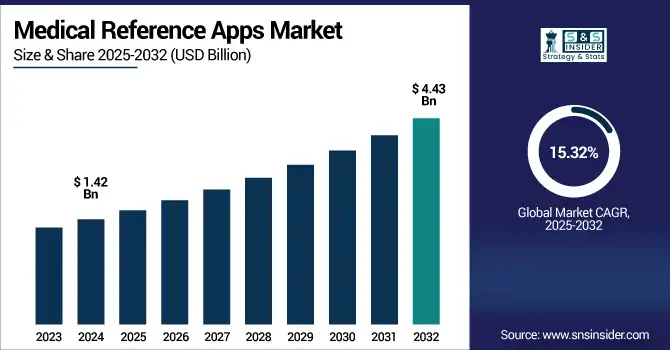

The medical reference apps market size was valued at USD 1.42 billion in 2024 and is expected to reach USD 4.43 billion by 2032, growing at a CAGR of 15.32% over the forecast period of 2025-2032.

To Get more information on Medical Reference Apps Market - Request Free Sample Report

The global medical reference apps market is growing rapidly, driven by expanding smartphone penetration, increased demand for point-of-care clinical decision tools, and growing popularity among healthcare professionals and medical students. High usability, real-time updates, and exhaustive EHR integration have driven adoption. Moreover, AI-driven diagnostics and customized medical content have expanded app functionality. As global healthcare trends toward digitalization, the market will grow exponentially and is expected to reach exceptional levels by 2032 in developed and emerging regions.

The U.S. medical reference apps market size was valued at USD 0.41 billion in 2024 and is expected to reach USD 1.25 billion by 2032, growing at a CAGR of 14.84% over the forecast period of 2025-2032.

The North American medical reference apps market is dominated by the United States, as the country is the undisputed smartphone use among healthcare professionals. EHR-integrated clinical apps are standard, with such popular providers as Epocrates and Medscape dominating the industry. The U.S. boasts an advanced healthcare IT infrastructure and legislation favorable to digital health.

Market Dynamics:

Drivers:

-

Rising Prevalence of Smartphones and mHealth Technology is Leading the Market Growth

The global spread of smartphones, which is on the rise all over the globe, has revolutionized the way doctors consult medical information. For reason of rapid internet and mobile expansion, Clinicians presently display a greater tendency to use smartphones as a quick and reliable reference during routine work. Finding what you need to help make a patient care decision has never been easier. Stay current on the latest oncology and medical news, including new drug approvals and label changes, on our apps. This movement to mobile health (mHealth) is particularly pronounced among urban-based hospitals and clinics as doctors want tools that enable them to move faster and not rely on desktops or printed manuals.

The widespread proliferation of mobile health tools is evident in that the number of health-related applications on the Apple and Google app stores exceeded 100,000 in 2022, as reported in Digital Health Interventions through Science Direct.

In an alum study (ScienceDirect, 2024), Saudi Arabian doctors revealed ease of access, clinical relevance, and workflow compatibility as significant enabling factors behind their uptake of mHealth applications.

A Nature study of European general practitioners who used digital health reported that it results in better care and more job satisfaction; perceived barriers were the cost, technical literacy, and reimbursement schemes.

-

Rising Demand for Point-of-Care Clinical Decision Support is Escalating the Growth of the Market

Health professionals are increasingly expected to deliver timely, accurate, and evidence-based care, nowhere more so than in high-pressure settings, such as emergency rooms and ICUs. Medical reference apps address this by providing clinical decision support in real time at the bedside. Such applications help to confirm the identity of a drug, assist in diagnosing conditions, plan treatment, and assess risks, all in seconds. This not only increases clinical workflow efficiency, but it also contributes to minimizing human error and promoting patient safety. Therefore, these tools have become a critical need for clinicians who make critical decisions in keeping with evidence-based trends in medical knowledge.

DynaMed received the Best in KLAS award for clinical decision support in mid-2025, demonstrating that the industry continues to prioritize fast, reliable access to the latest medical knowledge for clinicians.

Restraint

-

Limited Clinical Validation and Regulatory Safeguards are Restraining the Market from Growing

A lot of medical reference apps do not undergo the rigours of clinical trials and aren’t validated by medical bodies, as they are developed by private companies or third-party developers. Unlike pharmaceuticals or medical devices that must undergo rigorous regulatory scrutiny, these apps can hit the market with little oversight. This raises important questions about their accuracy, reliability, and safety, especially if used for clinical interventions or drug interaction screening.

Healthcare providers are naturally cautious of using non-peer-reviewed, non-certified apps from organizations, such as the US FDA and European Medicines Agency (EMA). Without this validation, any subsequent medical advice or references given may be stale, incorrect, or inconsistent, jeopardizing patient safety and disrupting clinical workflow. This persistence of distrust severely hampers the adoption of the technology into hospitals, clinics, or schools.

Segmentation Analysis:

By Application

The drug information segment dominated the medical reference apps market share in 2024 with 32.64%, as there is an urgent requirement for authentic, current drug information at the point of care. The drug interaction and dosing safety message sourcing metrics are for an App that is continually used by healthcare professionals to find drug interactions, dosage information, contraindications, and adverse effect profiles, necessary for safe prescribing and patient care. Furthermore, the development of extensive drug databases within mobile platforms by major industry participants, such as Epocrates and IBM Micromedex has made it part of the daily routine of a clinician and pharmacist globally.

The fastest growth during the forecast period is anticipated for the medical condition & symptoms management segment, which continues to be driven by the growing use of apps for initial diagnosis, triage, and monitoring of diseases. These are becoming increasingly popular among healthcare providers and patients, particularly in resource-poor and remote environments, where quick access to medical expertise may be limited. Improvements in AI and machine learning have also improved the accuracy and individualization of symptom-checking apps, which have become a useful tool in current patient-centered care delivery.

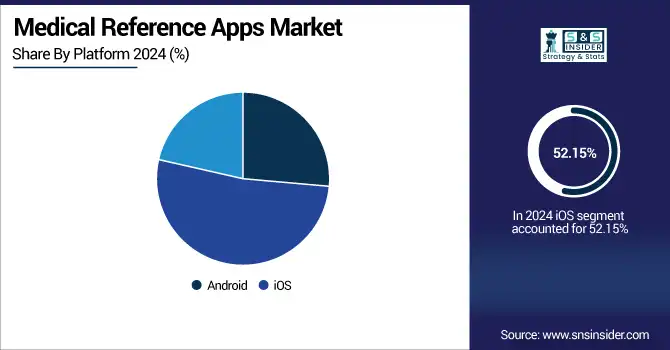

By Platform

The iOS segment held the largest share of the medical reference apps market in 2024 with a 52.15% market share, primarily due to the majority of clinicians prefer iOS platforms compared to Android platforms, especially in developed countries, such as North America and Europe. iOS stands for stable operating environment, predictable performance, and high standards in the quality of Apps suited for the clinical environment.

The android segment is expected to exhibit the fastest growth over the forecast period, as android is available at large and affordable rates, and its increasing adoption in the developing countries, including Asia Pacific, Latin America, and Africa. The open-source availability of Android facilitates customization and local app development, which accounts for its popularity in regions with diverse healthcare requirements. With the increased penetration of smartphones and the internet in developing nations, there is great potential for the growth of Android-based medical reference applications.

By Apps

The smartphones segment held the largest share of the medical reference apps market growth in 2024 as they are readily available, can be easily carried, and are connected constantly to the internet, thus are efficient in providing instant information at the point of care. Smartphones are generally used by most healthcare workers due to their convenience, speed, and availability of numerous medical reference applications. Meanwhile, ongoing app updates, easy-to-use interfaces, and compatibility with other mobile tools have cemented smartphones as the dominant platform for how medical reference content.

The tablet segment is anticipated to grow significantly over the forecast period as the greater screen size and superior display quality of Tablets, facilitating optimal perception of complicated medical images, anatomical models, and interactive content. Tablets are being used more at clinical rounds, telemedicine visits, and in educational scenarios that require detailed information and multitasking. With more hospitals and schools issuing tablets to their staff, the market for tablet-based medical reference apps is poised for significant growth.

By End-Use

The healthcare Providers segment held the largest share of the medical reference apps market in 2024, with a 54.09% market share. The segment’s growth is rising as these applications have been adopted by the majority of physicians, nurses, and pharmacists in the form of drug databases, treatment guidelines, and a diagnostic aid tool for clinical help in medical practices and thus saving time and avoiding errors. Their deep integration into EHRs and hospital information systems helped cement their widespread use in day-to-day clinical practice, both in hospital and outpatient settings.

The others segment (medical students, academic researchers, public health workers, and policy makers) will likely expand at the highest CAGR during the forecast period. This is being shaped by a growing emphasis on digital learning, remote education, and data-centric healthcare provision. Medical students are becoming increasingly dependent on apps for anatomy, diagnostics, and exam revision, and public health workers and policymakers are using the apps to gain access to real-time data and clinical guidelines. The proliferation of open-access medical education and research platforms is also expediting adoption among this heterogeneous base of users.

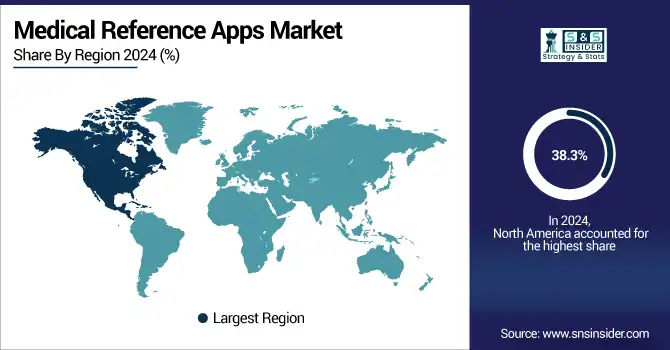

Regional Analysis:

North America dominated the medical reference apps market analysis with a 38.3% market share in 2024, due to the highly developed healthcare sector, high digital penetration among healthcare professionals, and penetration of EHRs. There are a considerable number of top medical app developers based in the region, such as Epocrates, Medscape, and IBM Micromedex, who regularly update and improve clinical decision-support tools. Moreover, a conducive regulatory environment, high per capita healthcare expenditure, and early uptake of technology in healthcare facilitate easy assimilation of medical apps in clinical processes, especially in the U.S. and Canada.

Asia Pacific is the fastest-growing region in the medical reference apps market with a 15.90% CAGR over the forecast period due to fast smartphone adoption, rising internet access owing to advanced technologies, and a rising number of tech-savvy healthcare professionals. Digital health programs are coming up in many countries, including India, China, and Southeast Asian nations are being driven by government initiatives to push telemedicine, geo-tagging, and mobile health that is growing in double digits. Also, the lack of health workers in rural areas is driving clinicians to depend more on mobile-based reference tools, which is further pushing app adoption across the region.

The medical reference apps market in Europe is growing due to the increasing acceptance of digital health in public and private healthcare organizations. The market is driven by the rising investment in healthcare IT infrastructure, focus on clinical accuracy and compliance, and the increasing demand for point-of-care decision support tools. Adoption is highest in Germany, the U.K., and France, with app integration into hospital networks being particularly strong in these countries, helped by supportive regulation, such as the EU medical device regulation (MDR), which guarantees the safety and standardization of medical software apps.

The medical reference apps market trend in Latin America and MEA is expected to witness moderate growth as it is still in its nascent stage. This trend is underpinned by better healthcare infrastructure, growing mobile and internet penetration, and the general rise in the sense of digital health tools among medical practitioners. Some Latin American countries are seeing increased proliferation of medical apps, especially in cities where digital health projects are more widely developed.

MEA region is growing substantially in the medical reference apps market due to the government’s initiatives to digitize health in the region and enhance demand for mobile health solutions to serve the scarcity of medical resources, especially in remote areas. Yet barriers, including lack of interoperability, slower spending on healthcare IT, and disparate regulations, still inhibit more rapid market growth in both markets.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players:

The medical reference apps market companies are Epocrates Inc., Wolters Kluwer Health, Medscape (WebMD LLC), Isabel Healthcare, BMJ Publishing Group Ltd, VisualDx, DynaMed (EBSCO Information Services), QxMD Software Inc., Skyscape Inc., Unbound Medicine Inc., PEPID LLC, Omnio by Physicians Interactive, MDCalc, IBM Micromedex (Merative), 3D4Medical (Elsevier), Kenhub GmbH, Elsevier Health, MIMS Group, Ziff Davis, American Academy of Pediatrics (AAP), and other players.

Recent Developments:

-

March 2023 – Epocrates, athenahealth, Inc.'s subsidiary and a well-known digital clinical decision support provider for healthcare prescribers, reported notable success for the year 2022. Some of its major milestones included launching a new mobile app intended to improve the clinician experience. The new app simplifies access to key resources that healthcare professionals need at the point of care and beyond, further solidifying Epocrates' stronghold in the healthcare and pharmaceutical industries.

-

October 2022 – EBSCO Information Services (EBSCO) and Merative announced a rebranded and expanded version of their integrated clinical decision support solution. Renamed DynaMedex, formerly sold as DynaMed and Micromedex with Watson, the solution continues to enhance clinical decision-making and operational effectiveness for healthcare professionals and health systems.

Medical Reference Apps Market Report Scope:

Report Attributes Details Market Size in 2024 USD 1.42 Billion Market Size by 2032 USD 4.43 Billion CAGR CAGR of 15.32% From 2025 to 2032 Base Year 2024 Forecast Period 2025-2032 Historical Data 2021-2023 Report Scope & Coverage Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook Key Segments • By Application (Drug Information, Medical Condition & Symptoms Management, Medical Calculators, Clinical Guidelines, Others)

• By Platform (Android, iOS, Others)

• By Apps (Smartphones, Tablets)

• By End Use (Healthcare Providers, Patients, Others)Regional Analysis/Coverage North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) Company Profiles The medical reference apps market companies are Epocrates Inc., Wolters Kluwer Health, Medscape (WebMD LLC), Isabel Healthcare, BMJ Publishing Group Ltd, VisualDx, DynaMed (EBSCO Information Services), QxMD Software Inc., Skyscape Inc., Unbound Medicine Inc., PEPID LLC, Omnio by Physicians Interactive, MDCalc, IBM Micromedex (Merative), 3D4Medical (Elsevier), Kenhub GmbH, Elsevier Health, MIMS Group, Ziff Davis, American Academy of Pediatrics (AAP), and other players.