Medical Tubing Market Report Scope & Overview:

Get more information on Medical Tubing Market - Request Sample Report

The Medical Tubing Market Size was valued at USD 10.7 billion in 2023 and is expected to reach USD 21.8 billion by 2032 and grow at a CAGR of 8.3% over the forecast period 2024-2032.

The Medical Tubing market is experiencing a surge in innovation and investment, driven by various factors such as the rising demand for minimally invasive surgeries, the prevalence of chronic illnesses, and advancements in medical device technology. The need for medical tubing is expanding across numerous applications, including catheters, endotracheal tubes, IV tubes, and surgical instruments. Commonly used materials like silicone, polyurethane, and polyethylene are favored for their flexibility, durability, and biocompatibility. To meet the evolving requirements of healthcare, companies are developing advanced materials such as thermoplastic elastomers and fluoropolymers, which address specific challenges in medical procedures. Additionally, the growing trend of outpatient care and home healthcare prompts demand for specialized and cost-effective medical tubing solutions. Regulatory developments and the emphasis on higher safety and performance standards further motivate innovation and the introduction of new products.

Recent advancements highlight the focus on enhancing production capabilities and forming strategic partnerships in the medical tubing sector. For instance, a notable collaboration emerged in November 2024 when a prominent manufacturer announced plans to invest ₹200 crore in a new medical tube manufacturing facility near Chennai, aimed at increasing production capacity to meet the escalating demand in India and neighboring regions. In a related development, a leading medical supplier expanded its biopharma product portfolio in August 2024 by introducing single-use assemblies that incorporate medical tubing components, catering to the rising need for sterile systems in biopharmaceutical applications. Furthermore, another major player announced in February 2023 the expansion of its medical tubing production in Massachusetts, strategically designed to enhance its ability to supply high-quality tubing in response to global healthcare demands. These investments and innovations illustrate the critical role of reliable, high-performance medical tubing in facilitating complex healthcare procedures and treatments, underscoring the industry's commitment to meeting the increasing needs of the medical community.

Medical Tubing Market Dynamics:

Drivers:

-

Rising Demand for Minimally Invasive Surgeries Drives the Need for Advanced Medical Tubing Solutions

The growing preference for minimally invasive surgeries (MIS) is one of the primary drivers for the expansion of the medical tubing market. MIS techniques, such as laparoscopy and endoscopy, have seen a significant rise due to their advantages, including smaller incisions, reduced risk of infection, and shorter recovery times. These procedures require specialized medical tubing, which provides the flexibility, strength, and biocompatibility necessary for these complex operations. Tubing is used in a variety of devices like catheters, endoscopes, and surgical instruments, and the need for reliable and high-performance materials is growing as the volume of such surgeries increases. As healthcare providers aim to reduce patient recovery times and improve surgical outcomes, the demand for advanced medical tubing technologies is expected to continue growing, fueling market expansion.

-

Increasing Incidence of Chronic Diseases and Aging Populations Accelerates Medical Tubing Market Growth

-

Growing Demand for Home Healthcare Solutions Stimulates Medical Tubing Market Expansion

Restraint:

-

Stringent Regulatory Standards for Medical Tubing Production May Hinder Market Growth

Opportunity:

-

Advancements in Biocompatible and Eco-Friendly Medical Tubing Materials Present New Market Opportunities

-

Increasing Demand for Personalized Medicine Fuels Growth in Custom Medical Tubing Solutions

-

Expanding Healthcare Infrastructure in Emerging Markets Opens New Opportunities for Medical Tubing Manufacturers

The rapid expansion of healthcare infrastructure in emerging markets offers new growth opportunities for medical tubing manufacturers. As healthcare access improves in regions such as Asia-Pacific, Latin America, and the Middle East, the demand for medical devices, including those requiring tubing, is increasing. The expansion of healthcare facilities, along with the rising prevalence of chronic diseases and an aging population in these regions, creates a need for high-quality medical tubing solutions. Manufacturers who can establish a presence in these emerging markets and meet the growing demand for medical devices will be well-positioned to capitalize on these new opportunities, driving long-term market growth.

-

Raw Material Price Volatility and Supply Chain Disruptions Pose Challenges to Medical Tubing Manufacturers

Fluctuating prices of raw materials and disruptions in supply chains represent significant challenges for manufacturers in the medical tubing market. The cost of raw materials such as plastics, silicones, and elastomers can be volatile due to factors such as global demand, geopolitical instability, and natural disasters. These price fluctuations can increase production costs, which may affect the pricing of final medical tubing products. Additionally, disruptions in supply chains, such as delays in material delivery or manufacturing capacity constraints, can lead to production delays and unmet demand. Manufacturers must navigate these challenges while maintaining product quality and competitive pricing, which can be particularly difficult during periods of economic instability or global supply chain interruptions.

Consumer Trends in the Medical Tubing Market

| Consumer Trend | Explanation |

|---|---|

| Increased demand for biocompatible materials | Consumers are increasingly opting for biocompatible materials that minimize adverse reactions in patients, especially in critical applications like catheters and infusion tubing. |

| Growing preference for custom medical tubing solutions | With personalized healthcare rising, there is a demand for custom-sized and tailor-made medical tubing solutions to fit specific medical applications. |

| Focus on safety and reliability | Safety and reliability are key factors driving purchasing decisions, particularly for high-risk applications where tube failure could lead to serious consequences. |

| Shift towards eco-friendly and sustainable products | Environmental concerns are pushing for products made from recyclable or biodegradable materials, with companies focusing on reducing waste and improving sustainability. |

| Rising demand for minimally invasive medical devices | There is a growing preference for minimally invasive techniques in healthcare, which require smaller, more flexible medical tubing that supports precise and less invasive treatments. |

The medical tubing market has seen several consumer-driven trends that shape product development and purchasing decisions. One significant trend is the increased demand for biocompatible materials, which are essential in critical applications where patient safety is a priority. Another important factor is the growing preference for custom solutions, driven by personalized healthcare needs. Safety and reliability are consistently prioritized, particularly in high-risk applications. Along with this, there is a clear shift towards eco-friendly products, as consumers and healthcare providers alike seek sustainable options that reduce environmental impact. Additionally, the rising demand for minimally invasive devices is pushing for smaller and more flexible medical tubing, supporting the trend toward less invasive medical procedures and precision treatments. These trends highlight the growing demand for more specialized, safe, and environmentally conscious products in the medical tubing market.

Medical Tubing Market Segments

By Product Type

In 2023, silicone-based medical dominated the product type segment in the medical tubing market, holding a market share of 30%. This prominence can be attributed to silicone's unique properties that make it particularly well-suited for medical applications. Silicone is renowned for its excellent biocompatibility, which is crucial in applications involving direct contact with body tissues and fluids. Additionally, silicone exhibits high flexibility, allowing for easier maneuverability in various medical devices, including catheters and surgical drains. Its thermal stability ensures that it can withstand sterilization processes, maintaining integrity and performance in critical settings. For example, silicone tubing is widely used in neonatal and pediatric care, where patient safety and comfort are paramount. Furthermore, silicone's ability to resist degradation from various chemicals and its non-reactive nature make it an ideal choice for applications involving sensitive medications. As healthcare providers increasingly prioritize patient safety and comfort, the preference for silicone in high-precision medical devices continues to drive its demand, solidifying its position as the leading product type in the medical tubing market.

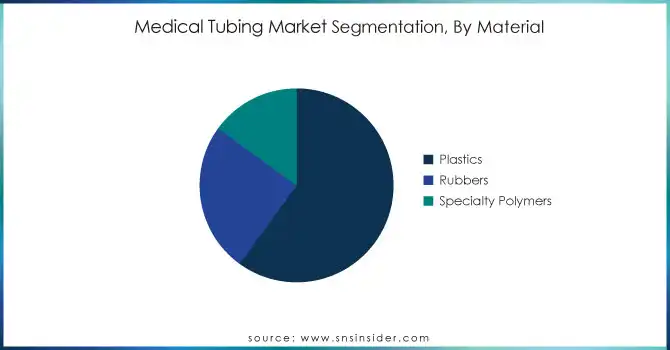

By Material

In 2023, the plastics segment dominated the material segment of the medical tubing market, with a market share of 60%. The extensive use of plastics in medical tubing can be attributed to their versatility, cost-effectiveness, and favorable mechanical properties. Key plastics such as polyolefins (including polyethylene and polypropylene) and polyvinyl chloride (PVC) are commonly employed due to their excellent flexibility, durability, and ease of manufacturing. PVC, in particular, is widely used in intravenous (IV) tubing and blood bags, as it offers clarity and strength, ensuring safe and effective fluid transfer. The ability to customize plastics for specific applications further enhances their appeal; they can be produced in various sizes, shapes, and colors, accommodating a wide range of medical devices. Moreover, the growing focus on cost-effective healthcare solutions drives the demand for plastic tubing, especially in settings where disposable options are preferred. As the healthcare industry continues to expand and evolve, the reliance on plastics in medical tubing applications is expected to remain strong, reinforcing their leading position in the market.

By Structure

In 2023, single-lumen structures dominated the medical tubing market, capturing a market share of 40%. Single-lumen tubing is characterized by its straightforward design, featuring a single channel through which fluids or medications can be delivered. This simplicity makes it an ideal choice for various medical applications, including catheters used for urinary drainage, intravenous (IV) access, and fluid administration. The ease of use associated with single-lumen tubing contributes significantly to its popularity among healthcare professionals, as it simplifies procedures and reduces the risk of complications associated with more complex tubing structures. Additionally, single-lumen tubing is generally more cost-effective than multi-lumen or co-extruded options, making it accessible for a wide range of medical settings. As healthcare facilities seek to optimize efficiency while ensuring patient safety, the demand for reliable and easy-to-handle single-lumen tubing continues to grow. Moreover, the increasing emphasis on minimally invasive procedures further supports the expansion of this segment, as single-lumen tubes are often preferred for their straightforward application in various surgical and diagnostic interventions.

By Application

In 2023, the catheters and cannulas segment dominated the medical tubing market, holding a market share of 35%. The widespread use of catheters and cannulas in various medical procedures drives the demand for high-quality medical tubing. Catheters are essential in numerous applications, including cardiovascular interventions, dialysis, and drug administration, where precise fluid management is crucial. The increasing prevalence of chronic diseases, such as diabetes and heart conditions, has further accelerated the demand for catheters, as many patients require ongoing management and treatment. Additionally, the growing trend toward minimally invasive surgeries has heightened the reliance on catheters, which are often used to facilitate procedures with reduced patient recovery times and lower risks of infection. Innovations in catheter design and materials, aimed at enhancing patient comfort and safety, also contribute to the segment's growth. As healthcare providers continue to seek effective solutions for patient care, the catheters and cannulas segment is expected to maintain its leading position in the medical tubing market, reflecting the critical role these devices play in modern healthcare.

By End-User

In 2023, hospitals and clinics dominated the medical tubing market, with a market share of 50%. This dominance is primarily driven by the high volume of medical procedures performed in these settings, which necessitates a wide range of medical tubing applications. Hospitals and clinics are the frontlines of patient care, where various medical devices, such as infusion systems, catheters, and respiratory support equipment, are utilized extensively. The increasing number of surgical procedures, diagnostic tests, and emergency care situations underscores the ongoing demand for reliable medical tubing solutions in these environments. Furthermore, the trend toward outpatient care and the rising prevalence of chronic diseases that require regular treatment have also contributed to the growing utilization of medical tubing in hospitals and clinics. The continuous focus on enhancing patient outcomes and safety leads healthcare providers to invest in high-quality medical tubing products that ensure efficacy and reliability. As healthcare infrastructure expands globally, hospitals and clinics are expected to maintain their dominant position in the medical tubing market, reflecting the critical role they play in delivering comprehensive patient care.

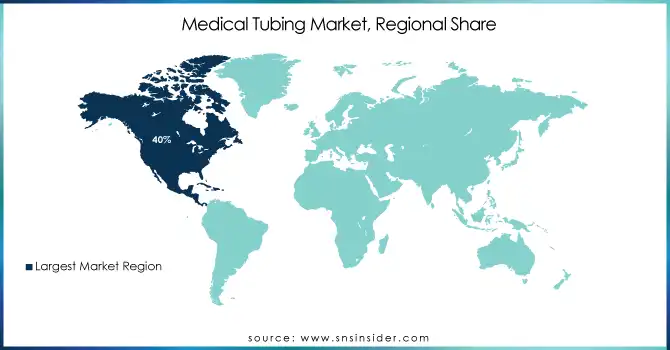

Medical Tubing Market Regional Analysis

In 2023, North America dominated the medical tubing market, capturing a market share of 40%. The region's leadership can be attributed to its advanced healthcare infrastructure, high demand for medical devices, and increasing investment in medical technologies. The U.S., in particular, is a key player in this region, with a significant portion of the market share. The country’s well-established healthcare system and a strong focus on innovative medical solutions contribute to the large-scale consumption of medical tubing. The prevalence of chronic diseases, such as heart disease, diabetes, and cancer, has significantly increased the demand for medical devices like catheters, dialysis tubing, and infusion lines, all of which rely on medical tubing. Additionally, the presence of leading medical device manufacturers, including Medtronic and Boston Scientific, further drives the demand for high-quality medical tubing products. Moreover, the continuous advancements in minimally invasive surgeries and diagnostic techniques in North America also contribute to the growing demand for medical tubing. This demand is bolstered by regulatory support, such as the FDA’s approval of advanced medical devices, ensuring that the region maintains its position as the market leader in the medical tubing sector.

Moreover, in 2023, the Asia Pacific region emerged as the fastest-growing market for medical tubing, with a CAGR of 8.5%. The rapid growth of this region can be attributed to the expansion of the healthcare infrastructure, increasing healthcare expenditures, and a rising population in countries such as China and India. The growing prevalence of chronic diseases, coupled with an aging population, has led to an increase in demand for medical devices, including catheters, infusion sets, and diagnostic tubes. For instance, the Chinese healthcare market is expected to see rapid growth due to the country's aging population and a surge in healthcare investments. In India, rising awareness about healthcare and the improvement of medical services are expected to contribute to the strong demand for medical tubing products. Furthermore, the expanding medical device manufacturing sector in countries like Japan, South Korea, and Singapore is fueling the demand for high-quality medical tubing materials, particularly in the fields of oncology and cardiac treatments. As the demand for advanced medical treatments continues to rise in these countries, the medical tubing market in Asia Pacific is expected to maintain its rapid growth trajectory, driven by both domestic consumption and export opportunities.

Get Customized Report as per your Business Requirement - Request For Customized Report

Recent Developments

-

November 2024: Lubrizol partnered with Polyhose to open a medical tubing production facility in India, addressing the growing demand for high-performance tubing in critical healthcare applications.

-

February 2023: Freudenberg Medical expanded its production capabilities with a new facility in Massachusetts to meet rising demand for custom medical tubing in biopharma and diagnostics.

Key Players:

-

AP Technologies Group Pte. Ltd. (Custom medical tubing, Multi-lumen tubing)

-

Davis Standard (Medical extrusion systems, Tubing extrusion machinery)

-

Fine Tubes Ltd. (Medical-grade stainless steel tubing, Catheter shafts)

-

Lubrizol Corporation (Thermoplastic elastomers, Crosslinked PE tubing)

-

Nordson Corporation (Hot melt adhesive equipment, Medical tube bonding systems)

-

Optinova (PVC medical tubing, Multi-lumen medical tubing)

-

Putnam Plastics (PTFE tubing, Multi-lumen catheter tubing)

-

RAUMEDIC AG (Silicone tubing, Micro tubing for medical applications)

-

Saint-Gobain Performance Plastics (Tygon medical tubing, Platinum-cured silicone tubing)

-

Teleflex Incorporated (Endotracheal tubes, Catheter tubing)

-

Zeus Industrial Products, Inc. (PTFE medical tubing, FEP and PEEK tubing)

-

Abbott Laboratories (Diagnostic tubing, Catheters)

-

B Braun Melsungen AG (IV tubing, Catheter tubing)

-

Conmed Corporation (Laparoscopic tubing, Electrosurgical tubing)

-

DSM Biomedical (Polymer medical tubing, Polycarbonate tubing)

-

Freudenberg Medical (Silicone rubber tubing, Tubing for medical devices)

-

Heraeus Medical Components (Silicone tubing, Catheter shafts)

-

Johnson & Johnson (Catheter tubing, Surgical instrument tubing)

-

Medtronic (Catheters, Infusion tubing)

-

TE Connectivity (Medical-grade connectors, Custom tubing for medical devices)

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | USD 10.7 Billion |

| Market Size by 2032 | USD 21.8 Billion |

| CAGR | CAGR of 8.3% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Product Type (Silicone, Polyolefins, Polyimide, Polyvinyl Chloride, Polycarbonates, Fluoropolymers, Others) •By Material (Plastics, Rubbers, Specialty Polymers) •By Structure (Single-lumen, Co-extruded, Multi-lumen, Tapered or Bump tubing,, Braided tubing) •By Application (Bulk disposable tubing, Catheters & cannulas, Drug delivery system, Biopharmaceutical laboratory equipment, Others) •By End-User (Hospitals and Clinics, Medical Device Manufacturers, Ambulatory Surgical Centers (ASCs), Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | BASF SE, Bayer AG, Lonza Group AG, Azelis, Huntsman Corporation, Evonik Industries AG, Syngenta AG, Wacker Chemie AG, Albemarle Corporation, Taj Pharmaceuticals Ltd. and other key players |

| Key Drivers | •Increasing Incidence of Chronic Diseases and Aging Populations Accelerates Medical Tubing Market Growth •Growing Demand for Home Healthcare Solutions Stimulates Medical Tubing Market Expansion |

| Restraints | •Stringent Regulatory Standards for Medical Tubing Production May Hinder Market Growth |