Urinary Catheters Market Size & Overview:

The Urinary Catheters Market size was USD 5.808 billion in 2023 and is estimated to reach USD 9.502 billion by 2032 with a growing CAGR of 5.68% by 2024-2032.

Get more information on Urinary Catheters Market - Request Sample Report

The urinary catheters market is experiencing significant growth, driven by the increasing prevalence of urinary incontinence and bladder dysfunction, especially among the aging population. Urinary incontinence, a common condition affecting up to 45% of women globally, is a major factor contributing to the rising demand for urinary catheters. Additionally, chronic conditions like spinal cord injuries and neurological diseases are also fueling the need for these devices, as they often result in bladder retention issues.

Technological advancements are reshaping the urinary catheter market, with innovations aimed at improving patient comfort and reducing complications. Hydrophilic-coated catheters, which reduce friction during insertion, have become increasingly popular for minimizing urethral injuries and infections. Studies show that hydrophilic-coated catheters can reduce the risk of urinary tract infections (UTIs) by up to 80% compared to traditional catheters. This reduction in infections is a key driver of the market, as patients and healthcare providers prioritize safer and more comfortable catheter options.

Intermittent catheters are gaining significant market share, particularly due to their lower infection rates. These catheters, designed for single-use and self-administration, are especially favored by patients in home healthcare settings. As healthcare trends continue to shift towards at-home care, intermittent catheters offer a convenient and hygienic solution for individuals managing urinary health. The rise of patient-centered care, alongside advancements in catheter design, further contributes to the market's expansion, as these devices become more accessible and easier to use for patients of all demographics.

With growing awareness of catheter-associated urinary tract infections (CAUTIs) and the importance of reducing healthcare-associated risks, there is an increasing preference for disposable catheters. These single-use products offer a hygienic and cost-effective alternative, reducing the risk of infections and improving patient outcomes. As the demand for safer, more comfortable, and user-friendly urinary catheter solutions rises, the market is expected to continue its upward trajectory, meeting the needs of a diverse patient base worldwide.

Urinary Catheters Market Dynamics

Drivers

-

Increasing Demand for Comfortable, Safe, and Homecare-Friendly Solutions Fuels Market Expansion

The urinary catheters market is experiencing substantial growth due to several critical drivers. One of the major factors is the increasing prevalence of urinary incontinence, particularly among the aging population, where conditions like bladder dysfunction and urinary retention are becoming more widespread. These conditions often require catheterization for effective management. Chronic diseases, such as neurological disorders and spinal cord injuries, which impair bladder function, are also contributing to the rising demand for urinary catheters.

Technological advancements have played a key role in market growth. Innovations like hydrophilic-coated catheters have reduced friction and the risk of injury during insertion, making them more comfortable and safer for patients. These advancements have been instrumental in minimizing complications such as urinary tract infections (UTIs), which are common with traditional catheters. The development of intermittent catheters, which can be self-administered and are designed for single use, is another important driver. These catheters offer a hygienic and convenient solution, particularly for patients in home care settings.

The shift toward home healthcare has significantly influenced the demand for user-friendly and portable catheter solutions. Intermittent catheters, in particular, are favored by patients seeking more independence in managing their condition outside of healthcare facilities. Additionally, growing awareness around catheter-associated urinary tract infections (CAUTIs) has led to a greater preference for disposable catheters, which reduce the risk of infection and offer a more cost-effective solution. These factors combined are fueling the continued expansion of the urinary catheters market.

Restraints

-

High Risk of Complications

Despite advancements, urinary catheters still carry the risk of complications such as urinary tract infections (UTIs), bladder spasms, and tissue injury, which can hinder market growth.

-

Cost and Accessibility Issues

The high cost of advanced catheter products, particularly hydrophilic-coated and intermittent catheters, may limit access for patients in low-income regions or healthcare settings, restricting broader market adoption.

Urinary Catheters Market Segmentation Analysis

By Product

Intermittent catheters dominated the catheter market in 2023, securing a 52% share due to their wide usage in both healthcare facilities and home care settings. These catheters are highly favored for their practical application in managing urinary retention, incontinence, and other urological conditions. Their popularity stems from their ease of use, minimal risk of infection, and affordability compared to indwelling catheters. The global prevalence of conditions such as benign prostatic hyperplasia (BPH), spinal cord injuries, and urinary incontinence has further fueled demand. Moreover, intermittent catheters are preferred for short-term use, reducing the likelihood of complications like catheter-associated urinary tract infections (CAUTIs). With a market share of approximately 45.0% in 2023, intermittent catheters continue to be the most widely adopted option in catheterization therapy, demonstrating their key role in modern urological care.

External catheters emerged as the fastest-growing product segment over the forecast period, driven by the increasing adoption of non-invasive solutions for urinary incontinence. Unlike traditional indwelling catheters, external catheters offer a more comfortable, discreet, and less invasive alternative for both men and women, making them particularly popular among elderly individuals. The rise in home care settings has further accelerated the demand for external catheters, as they provide an easy-to-use option for patients who prefer self-management of their condition. These catheters are also associated with a lower risk of complications, including urinary tract infections, which further contributes to their growing popularity.

By Application

Urinary incontinence was the dominant application for catheters in 2023, capturing a 34% share of the market. The growing aging population, rising rates of obesity, and increasing awareness of urinary health issues contributed to the substantial demand for catheters in the treatment of urinary incontinence. These catheters provide an essential solution for individuals suffering from bladder control issues, offering convenience and improved quality of life. Healthcare improvements and increased accessibility have also led to greater adoption, particularly in home care settings. With a market share of around 40.0%, urinary incontinence continues to be the leading indication for catheter use, reflecting the urgent need for effective and comfortable management solutions for this condition.

The spinal cord injury (SCI) application for catheters witnessed the fastest growth over the forecast period. The increasing number of spinal cord injury cases, coupled with advancements in medical care and rehabilitation, has created a rising demand for catheters to manage these patients' bladder care needs. SCI patients often experience long-term bladder dysfunction, requiring regular catheterization to ensure proper urinary function. The growing global awareness of spinal cord injury and improved healthcare infrastructure has further contributed to the surge in demand for catheterization solutions.

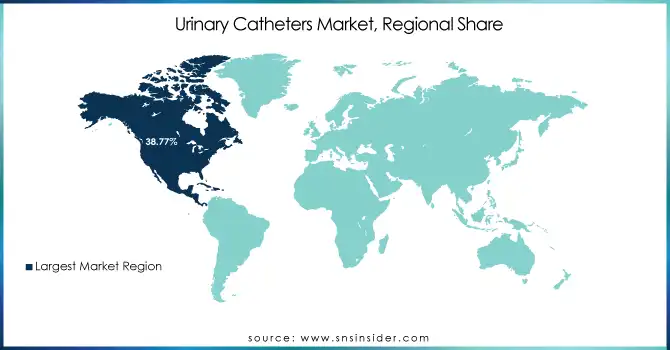

Urinary Catheters Market Regional Outlook

North America led the global market in 2023 with a 38.77% share in 2023, driven by its well-established healthcare infrastructure, high healthcare spending, and increasing demand for advanced catheterization solutions. The region’s dominance is largely due to a high prevalence of chronic diseases such as urinary incontinence, BPH, and spinal cord injuries. Additionally, the adoption of advanced catheter types, including antimicrobial-coated catheters, has bolstered market growth in North America, making it a key hub for innovation and product advancement in the catheter space.

Europe also contributed significantly to the global market, with countries like Germany, France, and the UK leading the way in terms of catheter usage. The demand for catheters in Europe is driven by an aging population and a strong focus on infection control, leading to increased adoption of coated catheters. Furthermore, the growing preference for home care settings, especially in countries with robust healthcare systems, has enhanced the adoption of external catheters, which are considered more patient-friendly and easier to use.

The Asia-Pacific region exhibited the fastest growth over the forecast period, fueled by the expansion of healthcare access, particularly in emerging markets such as India and China. These countries are witnessing a rise in the incidence of chronic diseases and an increasing elderly population, which has led to greater demand for both short- and long-term catheterization solutions. Additionally, the region's growing healthcare investment and the shift toward improving healthcare quality have spurred rapid market development.

Need any customization research on Urinary Catheters Market - Enquiry Now

Key Players in Urinary Catheters Market

-

B. Braun Melsungen AG – Conveen (External catheters), Cystofix (Intermittent catheters), Foley Catheters (Indwelling catheters)

-

Boston Scientific Corp – LoFric Hydro-Kit (Intermittent catheters), Bard Foley Catheters (Indwelling catheters), LoFric Sense (Hydrophilic-coated intermittent catheters)

-

Coloplast Ltd. – SpeediCath Compact (Intermittent catheters), Selena Plus (Foley catheters), Astra (External catheters)

-

ConvaTec Inc. – Foley Catheters (Indwelling catheters), Intermittent Catheters (Hydrophilic catheters)

-

Becton, Dickinson and Company – BD Insyte Autoguard IV Catheter (Intermittent catheter), BD Foley Catheters (Indwelling catheters)

-

Cardinal Health – Intermittent Catheters

-

Hollister Inc – Hollister External Catheters, Hollister Foley Catheters (Indwelling catheters)

-

Medtronic PLC – Medtronic Foley Catheters (Indwelling catheters), Medtronic Intermittent Catheters

-

Cook Medical – Cook Medical Intermittent Catheters, Cook Medical Foley Catheters

-

Teleflex, Inc. – Rüsch Foley Catheters (Indwelling catheters), Rüsch Intermittent Catheters

-

Medline Industries Inc – Medline Foley Catheters (Indwelling catheters), Medline Intermittent Catheters

-

J and M Urinary Catheters LLC – J and M Intermittent Catheters

Recent Development

In Nov 2024, Shockwave Medical's Javelin IVL catheter successfully met its primary trial endpoints, demonstrating promising clinical outcomes. This non-balloon-based intravascular lithotripsy catheter, developed by Johnson & Johnson MedTech, is designed to treat calcium buildup in narrowed vessels of patients with peripheral artery disease, marking a significant advancement in catheter technology.

| Report Attributes | Details |

|---|---|

| Market Size in 2023 | US$ 5.808 billion |

| Market Size by 2032 | US$ 9.502 billion |

| CAGR | CAGR of 5.68% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product (Intermittent Catheters, Foley/ Indwelling Catheters, External Catheters) • By Application (Benign Prostate Hyperplasia & Prostate Surgeries, Urinary Incontinence, Spinal Cord Injury, Others) • By Type (Coated Catheters, Uncoated Catheters) • By End-user (Hospital, Clinics, Long-term Care Facilities, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Eastern Europe [Poland, Romania, Hungary, Turkey, Rest of Eastern Europe] Western Europe] Germany, France, UK, Italy, Spain, Netherlands, Switzerland, Austria, Rest of Western Europe]), Asia Pacific (China, India, Japan, South Korea, Vietnam, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (Middle East [UAE, Egypt, Saudi Arabia, Qatar, Rest of Middle East], Africa [Nigeria, South Africa, Rest of Africa], Latin America (Brazil, Argentina, Colombia, Rest of Latin America) |

| Company Profiles | B. Braun Melsungen AG, Boston Scientific Corporation, Coloplast Ltd., ConvaTec Inc., Becton, Dickinson and Company, Cardinal Health, Hollister, Inc., Medtronic PLC, BD (C.R. Bard, Inc.), Cook Medical, Teleflex, Inc., Medline Industries, Inc., J and M Urinary Catheters LLC |

| Key Drivers | • Increasing Demand for Comfortable, Safe, and Homecare-Friendly Solutions Fuels Market Expansion |

| Restraints | • High Risk of Complications • Cost and Accessibility Issues |