Medium Density Fiberboard (MDF) Market Report Scope & Overview:

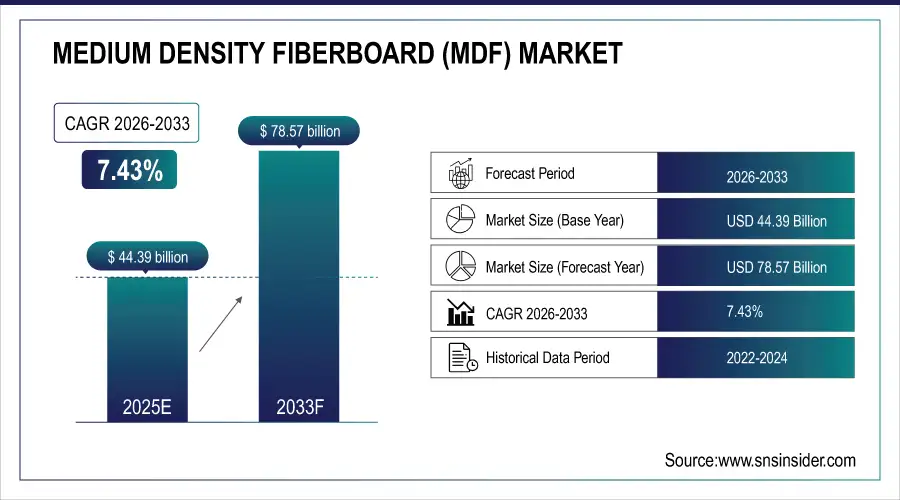

The Medium Density Fiberboard (MDF) Market Size is valued at USD 44.39 Billion in 2025E and is projected to reach USD 78.57 Billion by 2033, growing at a CAGR of 7.43% during the forecast period 2026–2033.

The Medium Density Fiberboard (MDF) Market analysis report offers an inclusive analysis of the business with its methodologies, applications and industry chain structure options. Growing demand for eco-friendly furniture, interior applications, and cost-effective construction materials is anticipated to fuel market growth over the forecast period.

MDF consumption reached 45.6 million cubic meters in 2025, driven by growing furniture demand and rising use of sustainable wood alternatives.

Market Size and Forecast:

-

Market Size in 2025: USD 44.39 Billion

-

Market Size by 2033: USD 78.57 Billion

-

CAGR: 7.43% from 2026 to 2033

-

Base Year: 2025

-

Forecast Period: 2026–2033

-

Historical Data: 2022–2024

To Get more information on Medium Density Fiberboard (MDF) Market - Request Free Sample Report

Medium Density Fiberboard (MDF) Market Trends:

-

Growing use of environmentally friendly and low-emission wood panels is the trend that propels sustainable development of MDF production.

-

Rising applications of MDF in modular furniture and interior decoration is increasing design versatility and affordability.

-

Advances in resin formulation and surface finishing are leading to greater fade-resistance and better aesthetics.

-

Growth of the housing and construction industry in developing countries is driving MDF demand.

-

Digital cutting and automated panel processing are being combined with integration to enhance manufacturing accuracy and material efficiency.

U.S. Medium Density Fiberboard (MDF) Market Insights:

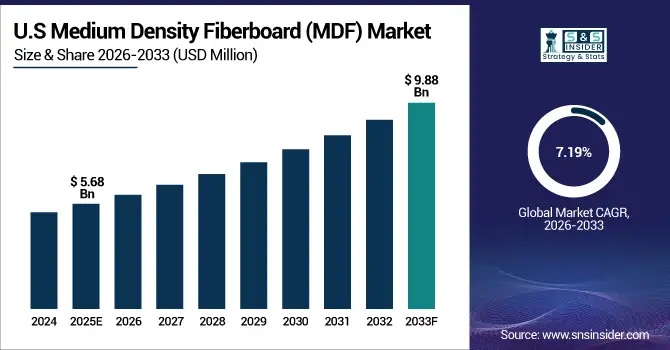

The U.S. Medium Density Fiberboard (MDF) Market is projected to grow from USD 5.68 Billion in 2025E to USD 9.88 Billion by 2033, at a CAGR of 7.19%. Recovery is fueled by robust demand for office systems furniture, environmentally friendly interiors and residential renovation projects and by modern manufacturing and green building practices.

Medium Density Fiberboard (MDF) Market Growth Drivers:

-

Growing adoption of modular furniture and sustainable interior solutions, driving demand for high-quality engineered MDF panels.

Growing adoption of modular furniture and sustainable interior solutions is a key driver of the Medium Density Fiberboard (MDF) Market growth. Due to increasing number of residential and commercial places that are adopting custom fitted, space-saving, environment friendly units around the world, MDF is the finish of preference owing to its... With the improved wood engineering, there's better surface finish quality, moisture resistance and strength which redefines modern standards of interior design with MDF fabrication in furniture and construction industry.

MDF panel sales grew 7.2% in 2025, driven by rising demand for modular furniture and expanding sustainable interior design projects across residential and commercial sectors.

Medium Density Fiberboard (MDF) Market Restraints:

-

Fluctuating raw material prices, formaldehyde emission concerns, and recycling limitations are restraining large-scale growth of the MDF market.

Fluctuating raw material prices, formaldehyde emission concerns, and recycling limitations present major restraints for the Medium Density Fiberboard (MDF) Market. Unstable prices of wood fibres and resins have great influence on production margins, and more stringent regulations for formaldehyde-based adhesives also limit the freedom of operation and production. Furthermore, the lack of recycling and reusing facilities for MDF waste contribute to sustainability issue that impels manufacturers to adopt cleaner technologies based on alternative resins, with an additional effect of increasing production costs and restraining large-scale market expansion.

Medium Density Fiberboard (MDF) Market Opportunities:

-

Growing demand for eco-friendly engineered wood panels offers opportunities for innovation in sustainable MDF manufacturing and design.

Growing demand for eco-friendly engineered wood panels presents a major opportunity for the Medium Density Fiberboard (MDF) Market. With industries moving to sustainable construction and green interior design, the companies are investing in low-emission adhesives, recycled fibers and renewable raw materials. These advancements result in longer part life, better appearance and compliance with the environment. This push toward sustainability will not only reinforce their brand but open up long term opportunities across internationally the furniture, construction and architectural design markets.

Eco-friendly MDF products accounted for 27% of new product launches in 2025, driven by rising demand for sustainable furniture and green building materials.

Medium Density Fiberboard (MDF) Market Segmentation Analysis:

-

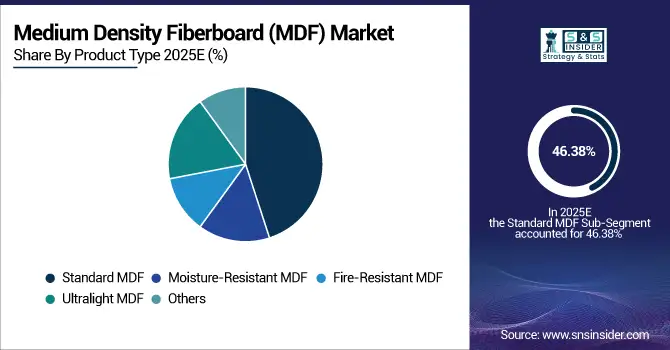

By Product Type, Standard MDF held the largest market share of 46.38% in 2025, while Moisture-Resistant MDF is expected to grow at the fastest CAGR of 8.17% during 2026–2033.

-

By Application, Furniture dominated with a 54.62% share in 2025, while Construction is projected to expand at the fastest CAGR of 8.45% during the forecast period.

-

By Thickness, Standard MDF accounted for the highest market share of 58.73% in 2025, while Thin MDF is anticipated to record the fastest CAGR of 7.96% through 2026–2033.

-

By End-Use Industry, Residential held the largest share of 61.84% in 2025, while Commercial is expected to grow at the fastest CAGR of 7.88% during 2026–2033.

By Product Type, Standard MDF Dominates While Moisture-Resistant MDF Expands Rapidly:

The Standard MDF segment dominated the market in 2025 with its extensive cost effectiveness, even density and versatility in furniture, interior design and cabinetry. Its good machineability and take laminations make it the material of choice with furniture manufacturers. The Moisture-Resistant MDF is the fastest growing segment due to its increased applications in kitchens and baths or any other water prone areas. In 2025, over 35% of modular furniture units incorporated moisture-resistant MDF panels.

By Application, Furniture Dominates While Construction Expands Rapidly:

The Furniture segment dominated the market in 2025, owing to developments in modular, ready-to-assemble and sustainable furniture production. MDF’s flat surface and ease of forming is excellent for the manufacturing of modern furniture. Construction is the fastest growing segment as MDF takes hold in wall cladding, partitions and prefabricated buildings. In 2025, MDF accounted for around 28% of interior panel installations in new residential buildings.

By Thickness, Standard Dominates While Thin Expands Rapidly:

The Standard segment dominated the market in 2025, and is commonly used for cabinet, shelf and decorative panel applications due to its high strength and dimensional stability. It is still in industry use as a general-purpose process. Thin is the fastest growing segment as designers and makers seek lighter weight options for laminates, ceiling panels, ornate interiors. In 2025, thin MDF consumption increased by 24% across furniture backings and decorative elements.

By End-Use Industry, Residential Dominates While Commercial Expands Rapidly:

The Residential segment dominated the market in 2025, propelled by increased home renovation, interior design upgrades, and demand for affordable engineered wood products. MDF’s versatility and smooth finish make it a popular choice for wardrobes, flooring, and decorative panels. The Commercial is the fastest growing segment, supported by demand from offices, retail chains, and hospitality interiors. In 2025, MDF usage in commercial décor projects rose by 21% compared to the previous year.

Medium Density Fiberboard (MDF) Market Regional Analysis:

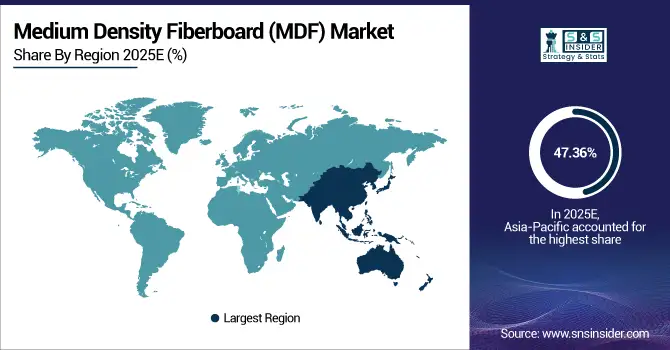

Asia-Pacific Medium Density Fiberboard (MDF) Market Insights:

The Asia-Pacific Medium Density Fiberboard (MDF) Market dominates globally with a 47.36% market share in 2025, driven by furniture manufacturing keeps growing and housing building develops rapidly in China, India and Southeast Asia. Growing consumer inclination toward cost-effective, eco-friendly and tailor-made wood panels is also driving production in the region. Robust export potential, government-backed housing support programs and growing investment toward sustainable construction materials continue to underpin the dominant role of Asia-Pacific in MDF market.

Get Customized Report as per Your Business Requirement - Enquiry Now

China Medium Density Fiberboard (MDF) Market Insights:

China’s Medium Density Fiberboard (MDF) Market is driven by strong furniture manufacturing, rapid urban housing expansion, and rising demand for cost-effective engineered wood. Investments in automated production, sustainable adhesives, and low-emission panels enhance efficiency and compliance. Robust exports and large-scale construction projects position China as the core growth hub of Asia-Pacific’s MDF market.

North America Medium Density Fiberboard (MDF) Market Insights:

North America's Medium Density Fiberboard (MDF) industry has a good market, ranging from modular furniture to interior renovation and sustainable construction materials. Growing home remodels and use of engineered wood in residential and commercial applications will support demand. However, continuing development of panel production technology and increased knowledge about environmental alternatives will drive this market penetration further, cementing North America’s status as an important part of demand for MDF.

U.S. Medium Density Fiberboard (MDF) Market Insights:

U.S. Medium Density Fiberboard (MDF) Market growth is driven by rising residential construction, expanding modular furniture production, and growing preference for eco-friendly, low-emission wood materials. Rising popularity of automated panel processing and new resin technologies are improving quality and productivity, while green initiatives and home remodeling trends underpin demand growth for MDF.

Europe Medium Density Fiberboard (MDF) Market Insights:

The Europe Medium Density Fiberboard (MDF) Market is witnessing steady growth driven by the expanding furniture, construction, and interior design industries. Production trends are environmentally driven with a strong focus on sustainability, low-emissions materials and conformation to environmental standards. Germany, the UK, France and Italy are frontrunners in the markets with the proliferation of the eco label MDF panels, advanced manufacturing automation and increasing demand for aesthetically pleasing customizable wood-based solutions-both residential as well-as commercial spaces.

Germany Medium Density Fiberboard (MDF) Market Insights:

Germany is a significant market for Medium Density Fiberboard (MDF) due to its well-established furniture, construction and interior applications sector. The growth is attributed to environmentally friendly manufacturing methods, new wood processing technologies, and environmental concerns. Germany remains one of the leading countries in Europe regarding innovative and excellent design in engineered wood products.

Middle East and Africa Medium Density Fiberboard (MDF) Market Insights:

The Middle East & Africa Medium Density Fiberboard (MDF) Market is the fastest growing, projected to expand at a CAGR of 9.15% during 2026–2033. The expansion is being fueled by increasing construction, furniture and interior design work, thanks to urbanization and infrastructure programs. Dynamic market growth due to high demand in Saudi Arabia, UAE and South Africa.

Latin America Medium Density Fiberboard (MDF) Market Insights:

The Latin America Medium Density Fiberboard (MDF) Market size is developing on account of growth in furniture, construction and interiors design sector. Factors include growing urbanization, housing projects and local production in Brazil, Mexico and Argentina. Growing adaptation of green material & environment-friendly MDF alternatives spur growth of local market and competitiveness.

Medium Density Fiberboard (MDF) Market Competitive Landscape:

Kronospan, headquartered in Austria, is a leader in wood-based panel manufacturing, including MDF, particleboard, and laminate flooring. With considerable production scale, vertically integrated supply chain and distribution network for over 40 countries, the company is the leading player in MDF industry. Kronospan’s continuing investment in cutting-edge manufacturing technology, sustainability efforts and use of recycled wood enhances its cost base and environmental credentials. The Leadership in the MDF sector is strengthened due to high quality and customizable product such as MDF elements for furniture and interior.

-

In January 2025, Kronospan launched its new Kronobuild acoustic panels series produced using recycled wood and available in 2600 × 600 mm and 17 mm thickness with invisible transitions, offering enhanced sound absorption, thermal insulation, and stain-resistant surfaces.

ARAUCO, based in Chile, is a major force in the MDF market, supported by one of the world’s largest forestry resource bases and a strong commitment to sustainability. The company is able to rule the roost due to its large manufacturing facilities. ARAUCO has vertically integrated its forest management with pulp and panel production, providing certainty of supply and product quality. Its emphasis on sustainable forestry, pioneering MDF offerings and energy efficient manufacturing practices make them a major competitor across additional industries and support its powerful export businesses in North America and Asia.

-

In October 2025, ARAUCO introduced a new generation MDF product from its Portugal plant that integrates recycled fibreboard material into production, part of its circular economy initiative promoting sustainability, resource efficiency, and eco-innovation in modern wood panel manufacturing.

EGGER Group, headquartered in Austria, is one of Europe’s most influential MDF and wood-based panel producers, known for innovation, design variety, and sustainability. The industry’s leading business is built on strong manufacturing assets; sophisticated surface technologies and a diverse product range from furniture to flooring and interior design. With a focus on sustainable raw materials, circular economy concepts and digital production the company EGGER can still be effective and high-quality. Strategic partners from designers to architects around the world ensure that EGGER is one step ahead in MDF product inspiration and market leadership.

-

In October 2025, EGGER launched its latest product innovations at SICAM in Italy, unveiling the new “PerfectSense Ambiance” decorative board line with expressive red-marble aesthetics, enhanced lacquered surfaces, and improved durability, reflecting evolving interior design preferences and sustainable surface material.

Medium Density Fiberboard (MDF)Market Key Players:

Some of the Medium Density Fiberboard (MDF) Market Companies are:

-

Kronospan

-

ARAUCO

-

EGGER Group

-

Kastamonu Entegre

-

Swiss Krono Group

-

Duratex (Dexco)

-

Daiken Corporation

-

Sonae Indústria

-

Finsa

-

Eucatex

-

Masisa

-

Nelson Pine Industries

-

Century Plyboards

-

Greenpanel Industries

-

VRG Dongwha MDF

-

Yonglin Group

-

West Fraser Timber Co.

-

Roseburg Forest Products

-

Georgia-Pacific Wood Products

-

Kaindl KG

| Report Attributes | Details |

|---|---|

| Market Size in 2025E | USD 44.39 Billion |

| Market Size by 2033 | USD 78.57 Billion |

| CAGR | CAGR of 7.43% From 2026 to 2033 |

| Base Year | 2025E |

| Forecast Period | 2026-2033 |

| Historical Data | 2022-2024 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | • By Product Type (Standard MDF, Moisture-Resistant MDF, Fire-Resistant MDF, Ultralight MDF, Others) • By Application (Furniture, Flooring, Interior Decoration, Doors & Mouldings, Packaging, Construction, Others) • By Thickness (Thin, Standard, Thick) • By End-Use Industry (Residential, Commercial, Industrial) |

| Regional Analysis/Coverage | North America (US, Canada), Europe (Germany, UK, France, Italy, Spain, Russia, Poland, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN Countries, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Mexico, Colombia, Rest of Latin America). |

| Company Profiles | Kronospan, ARAUCO, EGGER Group, Swiss Krono Group, Duratex, Greenpanel Industries, Daiken Corporation, West Fraser Timber Co. Ltd., Roseburg Forest Products, Uniboard, Century Plyboards, Georgia-Pacific, Finsa, Weyerhaeuser Company, Kastamonu Entegre, Sierra Pine, Dongwha Enterprise, Robin Resources, Metropolitan Wood Products, and Sahachai Particle Board. |