Metal Cleaning Chemicals Market Report Scope & Overview:

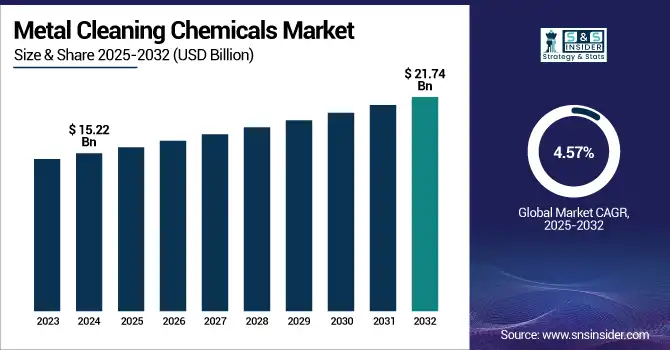

The Metal Cleaning Chemicals Market size was valued at USD 15.22 billion in 2024 and is expected to reach USD 21.74 billion by 2032, growing at a CAGR of 4.57% over the forecast period of 2025-2032.

To Get more information on Metal Cleaning Chemicals Market - Request Free Sample Report

Factors, such as stringent environmental regulations, the increasing demand for sustainable industrial metal cleaning chemicals, and automation are contributing to the metal cleaning chemicals market growth. Water-based formulations, digitalized monitoring, and advanced metal surface treatment chemicals for precision cleaning are among other important in the metal cleaning chemicals market trends. The ongoing development of heavy metal cleaners, such as the Nalmet produced by Ecolab, is a good example of this trend.

According to Ecolab’s 2024 Growth & Impact Report, the company saved 226 billion gallons of water and protected 1.7 billion people through its cleaning solutions, according to Ecolab’s 2024 Growth & Impact Report. New EPA legislation on discharge limits will continue to drive market growth. Metal cleaning chemicals companies are stepping up their offerings and research efforts on green chemistry. These factors validate the Asia Pacific metal cleaning chemical market share expansion. Metal cleaning chemicals market analysis of metal cleaning chemicals service providers should highlight resource efficiency.

Metal Cleaning Chemicals Market Dynamics:

Drivers:

-

Escalating Industrial Water Stress Drives Demand for Water-Efficient Cleaning Solutions

According to the 2024 United Nations World Water Development Report, Industry uses almost 20% of the planet’s freshwater supply, while half the planet’s populations live in places with seasonal water scarcity. This increasing water stress is expected to drive the growth of the metal cleaning chemicals industry by encouraging the use of eco-friendly industrial metal cleaning chemicals, such as biodegradable, water-based, and concentrated formulations. Leading manufacturers of metal cleaning chemicals are developing products that aid end users in cutting down on water usage and treatment expenditure. These developments in eco-friendly metal surface treatment chemicals for water-efficient applications echo key trends prevalent in metal cleaning chemicals market with respect to sustainability and eco-accountability in the industrial setting.

-

Rising Adoption of Antimicrobial Chemistries Enhances Equipment Hygiene and Uptime

The American Chemistry Council promotes the use of antimicrobial agents in industrial water systems to minimize biofouling and extend equipment life. In the metal cleaning chemicals industry, antimicrobial features are more and more incorporated into heavy metal cleaner formulations to promote cleanliness and to inhibit microbes on metal surfaces. This development reduces the following maintenance cycle, prolongs lifetime for the cleaning systems, and increases safety in operation. Although it is still an emerging technology, the incorporation of antimicrobial chemistries into metal surface treatment chemicals is a significant innovation that helps contribute to the growth of the market for metal cleaning chemicals. It further fortifies the metal cleaning chemicals market size prospects for those who have introduced more functional, value-added lines of products.

Restraints:

-

Elevated Liability Risks Increase Compliance Costs for Solvent-based Cleaners

According to the U.S. Chemical Safety Board, complex chemical incident investigations can run more than USD 10 million in direct expenses. Chemical cleaning companies that use reactive or flammable solvents are subject to stringent safety regulations and high insurance premiums. These compliance demands add up to operational costs and investment in management of risks. Smaller manufacturers are hit hardest since they usually don't have the systems in place to absorb those costs without them being reflected in their pricing. Accordingly, the increased liability and reporting requirements restrict the competitive flexibility of the industry, decreasing the rate at which the market share for metal cleaning chemicals will expand with little EU presence for emerging and regional solvent-based cleaner manufacturers.

Metal Cleaning Chemicals Market Segmentation Analysis:

By Cleaner Type

Aqueous segment dominated the metal cleaning chemicals market in 2024 and accounted for 64.3% in 2024 due to high demand for alkaline aqueous solutions. Their supremacy is due to being eco-compliant, safe, and effective on steel and aluminum substrates in automotive and heavy equipment. The U.S. Environmental Protection Agency has enforced continued setbacks in using aqueous systems compared with high-VOC-containing systems in the Clean Air Act, bringing it into the mainstream in industry. This has the effect that aqueous cleaners continue to be the benchmark for ecologically friendly concepts in the sector of chemicals for metal treatment.

The solvent segment is projected to be the fastest growing, registering a CAGR of 5.0% during the forecast period on account of the growing demand for precision, high-performance cleaning mostly in aerospace and electronics. Solvent-based heavy metal cleaners play a critical role where aqueous systems prove deficient, especially in clean environments. According to norms published by the U.S. Occupational Safety and Health Administration, safer solvent-based technologies are becoming increasingly popular, which, in turn, is stimulating the demand and spurring innovation among the manufacturers of metal cleaning chemicals in response to tightening regulatory and industrial cleaning efficiency requirements.

By Ingredient Type

The surfactants segment dominated the metal cleaning chemicals market in 2024, accounting for a share of over 31.4%, due to its characteristics of easy degreasing and surface wetting. Non-ionic and amphoteric surfactants are commonly used in industrial metal cleaners, particularly in the manufacturing and transportation industries. The move toward biodegradable surfactants is also supported by the American Cleaning Institute, creating additional demand from the environmentally conscious operations. This confirms the necessity of surfactants as useful components in effective and non-hazardous metal surface treatment agents.

The solvents ingredient emerged as the fastest growing segment with the highest CAGR of 5.32% in 2024 due to the growing demand for environmentally friendly solvents, which are less toxic and enable improved cleaning. The U.S. Department of Energy also supports the use of bio-based solvents within its Better Plants Program in order to increase the sustainability of industrial processes. This reflects wider trends in the metal cleaning chemicals market, where both regulation and performance-led improvements are driving the adoption of high-purity, non-VOC products throughout a range of end-use markets.

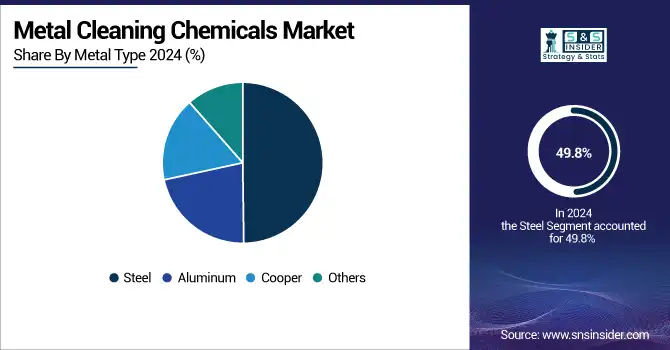

By Metal Type

Steel segment dominated the metal cleaning chemicals market with 49.8% share in 2024, and its use was dominated by carbon steel. With high usage of steel in construction, manufacturing, and transportation, the demand for a reliable and cost-efficient heavy metal cleaner has soared. Growing steel production in APAC and North America has been boosting demand for industrial metal cleaning that efficiently complies with quality and corrosion standards, notes the American Iron and Steel Institute.

The copper segment reported the largest CAGR of 5.32% in 2024 due to the rising use of copper in electronics, renewable energy, and precision components. The U.S. Geological Survey projected copper use will continue on the steady upward trend in 2023, supported by grid modernization and electric vehicle infrastructure. This expansion, in turn, drives demand for copper-compatible metal cleaning solutions, which promote conductivity and corrosion inhibition, thus increasing segment stake and underpinning new development in metal cleaning chemicals manufacturers.

By End-Use Industry

In 2024, the manufacturing sector dominated and had the largest market share in the metal cleaning chemicals market, with a 34.7% share, on account of increasing requirements from machines, tool & die, and the fabrication industry. The U.S. Manufacturing Extension Partnership also emphasizes the importance of effective cleaning on the packaging line to extend product life and ensure regulatory compliance. The efficiency, reliability, and automation prioritized by manufacturers are driving them towards sustainable metal surface treatment chemicals, further maintaining the lead sales of this segment.

Healthcare is projected to be the fastest-growing application with a CAGR of 5.38% by 2024, owing to the strict sanitation requirements for surgical instruments and medical devices. The Centers for Disease Control and Prevention singles out sterilization-grade cleaners to comply with mandated hygiene regulations. It has created the development of non-residue heavy metal and antimicrobial cleaners for healthcare, and healthcare has made the metal cleaning chemicals market more attractive.

Metal Cleaning Chemicals Market Regional Outlook:

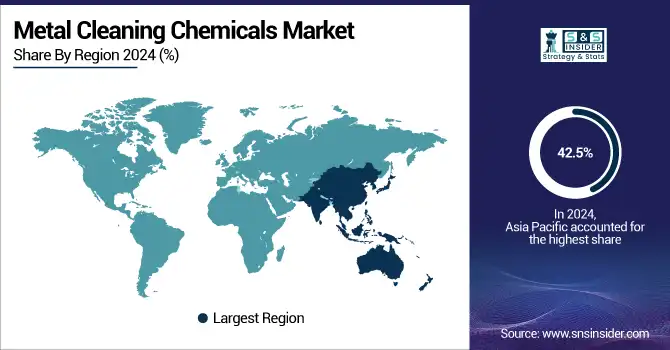

Asia Pacific dominated and is projected to be the fastest-growing in 2024, with around 42.5% market share on account of the rapid industrialization, infrastructure investment, and stringent environmental regulations toward the adoption of advanced metal surface treatment chemicals. Asia Pacific accounts for around 45% of growth in global manufacturing value added by 2020, facts that highlight the region’s dependence on industrial metal cleaning chemicals, according to UNIDO. In China, government incentives to encourage the preferential adoption of clean technology also provided impetus to cleaner heavy metals in the automotive, electronics, and construction industries.

The Chinese market will be the largest in the region and will account for a major share of the metal cleaning chemicals market in the region in 2024. Its Ministry of Industry and Information Technology is pushing petrochemical-based cleaner makers in their 2023 circular economy guidelines to move to biodegradable, water-based formulations. The policies have led to over USD 1.2 billion in new investments in local heavy metal cleaner research and development, cementing China’s position at the forefront of sustainable metal cleaning technologies.

North America emerged as the fastest-growing region at a CAGR of 3.57% of the global demand for industrial metal cleaning chemicals in 2024, supported by the significant demand for industrial metal cleaning chemicals in the U.S and Canada. The U.S. leads the market with a valuation of USD 2.18 billon with a market share of 59% in 2024. In 2022, the U.S. shipments of chemicals approached USD 639 billion, benefiting from the strong downward momentum of metal surface treatment chemicals. The use of low-toxicity, water-soluble detergents was initiated by Canadian federal effluent standards under the Fisheries Act. These forces will continue to drive the overall metal cleaning chemicals market size over the forecast timeframe by being regulation compliant and by product innovation.

North America was led by the U.S., which held a market share of 59% in North America’s market for metal cleaning chemical market and generated a market size of USD 2.18 billion in 2024. Due to the EPA’s National Pretreatment Program and Clean Water Act revisions, U.S. manufacturers spent USD 450 million on more sustainable heavy-duty metal cleaners. That investment resulted in a 15% improvement in facility discharge toxicity and a 12% lift in the water recycled by key automotive and aerospace factories.

Europe is the third-largest region with a market size of over 19.8% in 2024, spurred massive chemical clusters in Germany, and France and stringent EU REACH regulations. According to Cefic, the European chemical industry is worth more than €640 billion and provides stable employment to 1.2 million people, just one reason why metal cleaning chemicals play an essential role in manufacturing output. Rising energy prices and changing policies, such as the Green Deal, have further driven the adoption of environment-friendly metal surface treatment chemicals in the auto and heavy machinery industries.

Germany had significantly dominated the metal cleaning chemicals market in Europe in 2024. Some German producers spent €300 million on low-VOC and solvent-free heavy metal cleaners to meet the EU VOC Directive limits, according to the Verband der Chemischen Industrie (VCI). These resulted in a 20% reduction in on-site emissions and a 10% improvement in cleaning cycle efficiency at significant steel and automotive facilities.

Get Customized Report as per Your Business Requirement - Enquiry Now

Key Players:

The major metal cleaning chemicals market competitors include BASF SE, Evonik Industries AG, Eastman Chemical Company, Quaker Houghton, Stepan Company, The Dow Chemical Company, The Chemours Company, Hubbard-Hall Inc., KYZEN Corporation, and Nouryon.

Recent Developments:

-

In April 2025, BASF launched Trilon G, a next-generation GLDA-based chelating agent for eco-friendly metal cleaning formulations, addressing the growing demand for bio-based, biodegradable ingredients.

-

In March 2025, Evonik entered an exclusive U.S. distribution agreement with Sea-Land Chemical Company to broaden the reach of its metal cleaning and surface treatment solutions.

-

In March 2025, Quaker Houghton expanded its industrial metal cleaning chemicals portfolio through the acquisition of Dipsol Chemicals, adding specialty solvent and surfactant lines to its offerings.

| Report Attributes | Details |

|---|---|

| Market Size in 2024 | USD 15.22 billion |

| Market Size by 2032 | USD 21.74 billion |

| CAGR | CAGR of 4.57% From 2025 to 2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Historical Data | 2021-2023 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | •By Cleaner Type (Aqueous, Solvent) •By Ingredient Type (Chelating Agent, Surfactants, Solvents, Solubilizer, ph Regulator, Others) •By Metal Type (Steel, Aluminum, Cooper, Others) •By End-use Industry (Manufacturing, Healthcare, Automotive & Aerospace, Others) |

| Regional Analysis/Coverage | North America (US, Canada, Mexico), Europe (Germany, France, UK, Italy, Spain, Poland, Turkey, Rest of Europe), Asia Pacific (China, India, Japan, South Korea, Singapore, Australia, Rest of Asia Pacific), Middle East & Africa (UAE, Saudi Arabia, Qatar, South Africa, Rest of Middle East & Africa), Latin America (Brazil, Argentina, Rest of Latin America) |

| Company Profiles | BASF SE, Evonik Industries AG, Eastman Chemical Company, Quaker Houghton, Stepan Company, The Dow Chemical Company, The Chemours Company, Hubbard-Hall Inc., KYZEN Corporation, and Nouryon |